What are economic indicators?

Economic indicators are the key to understanding the behaviour of financial markets. Economic data released about the wider economy is endlessly analysed for clues about what happens next and what it means for the prices and value of the assets and investments that are the results of this economic activity.

From bond investors, to equity investors to commodity traders, private equity, and hedge fund activities, their success is ultimately determined by how well the economy performs. The economic data looked at by investors ranges from output, price inflation, wage inflation, the labour market, surveys or fiscal trends.

What does GDP growth, equity prices and corporate profits mean for a company?

Ultimately, growth of company profits at the aggregate levels cannot be greater than the rate of growth in the economy, in nominal terms, as a whole. But of more importance than simply looking at company balance sheets, is looking at what is happening in the economy for a guide as to how the company will perform in the future.

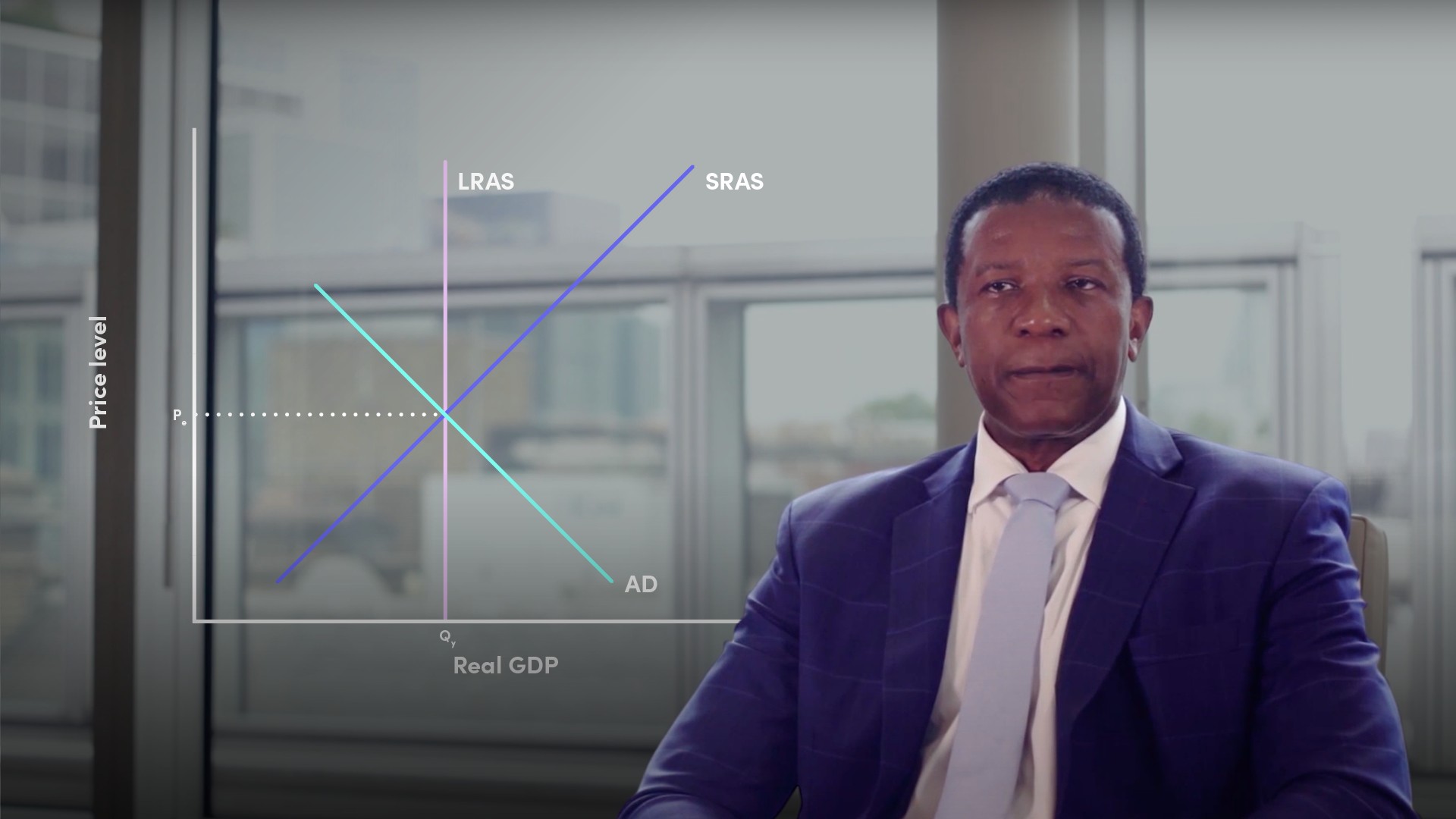

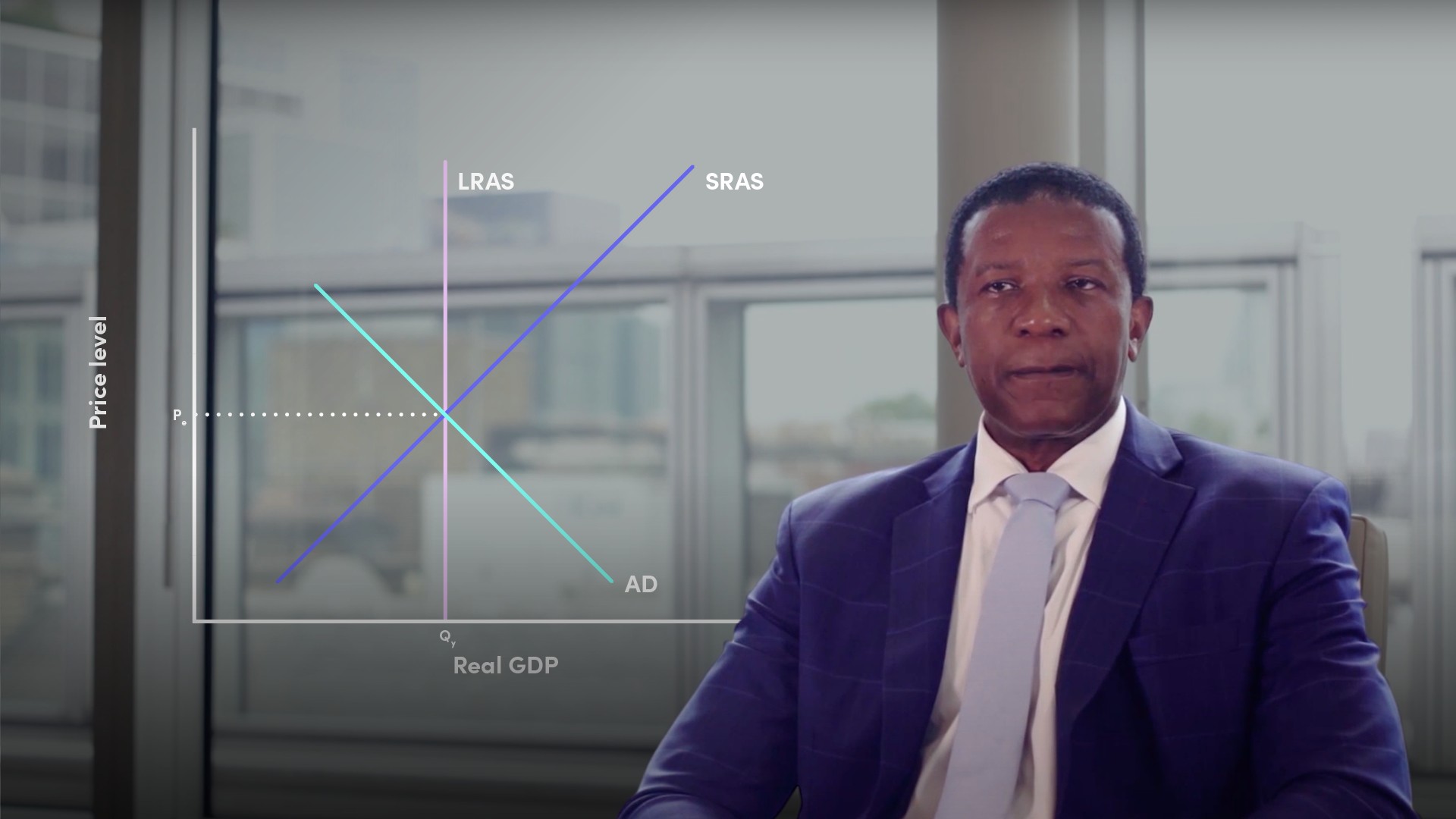

Why does GDP matter for financial markets?

The total net value added, produced by the economy over time can be measured in terms of the gross domestic product. GDP and corporate profits are linked. Faster growth in GDP provides the cash to drive company profits and dividends.

Growth and inflation are also linked. The faster the rate of growth of GDP, the higher the rate increases in inflation and wage inflation.

What is inflation?

Inflation is linked to bond markets as inflation erodes the real return from fixed income securities. Fast rising inflation means higher short term interest rates counter it. This may lead to a steeper yield curve, slowing the economy.

How does monetary policy impact the economy?

Higher interest rates slow down the economy because of the higher cost of borrowing to investors. Higher rates also raise the cost of borrowing to households and businesses.

Lower interest rates speed up the rate of the growth of the economy because they make it easier for firms and households to borrow and spend.

Why does fiscal policy matters for the economy?

Fiscal policy matters because too much government debt means that they borrow money and pay interest from funds that could be used by the private sector for profitable investment.

This ‘crowds out’ higher productivity activity by the private sector of the economy. High debt levels also drive up long interest term rates, imply higher future taxes and can cause inflation.