Economics and Accounting of Securities Loans

Richard Comotto

30 years: Money markets

In this video, Richard explains the economics of a securities loan and how payments between parties are made, he also outlines how to account for a securities lending transaction.

In this video, Richard explains the economics of a securities loan and how payments between parties are made, he also outlines how to account for a securities lending transaction.

Economics and Accounting of Securities Loans

6 mins 3 secs

Key learning objectives:

Understand the economics of a securities lending transaction and how payments between parties are made

Understand how to account for a securities lending transaction

Overview:

As the quantities being exchanged and then re-exchanged in a securities loan are fixed, the lender is committing to take back the loan at its original value, retaining the risk on the loaned securities even though they have been given to the borrower. The borrower, on the other hand, keeps the risk on non-cash collateral. If parties continue to take on the risk of securities, they will want to continue to receive the returns. As the returns stay with the respective party, we need to account for the transaction in a way that reflects its economic substance rather than its legal form.

What are the economics of a securities loan?

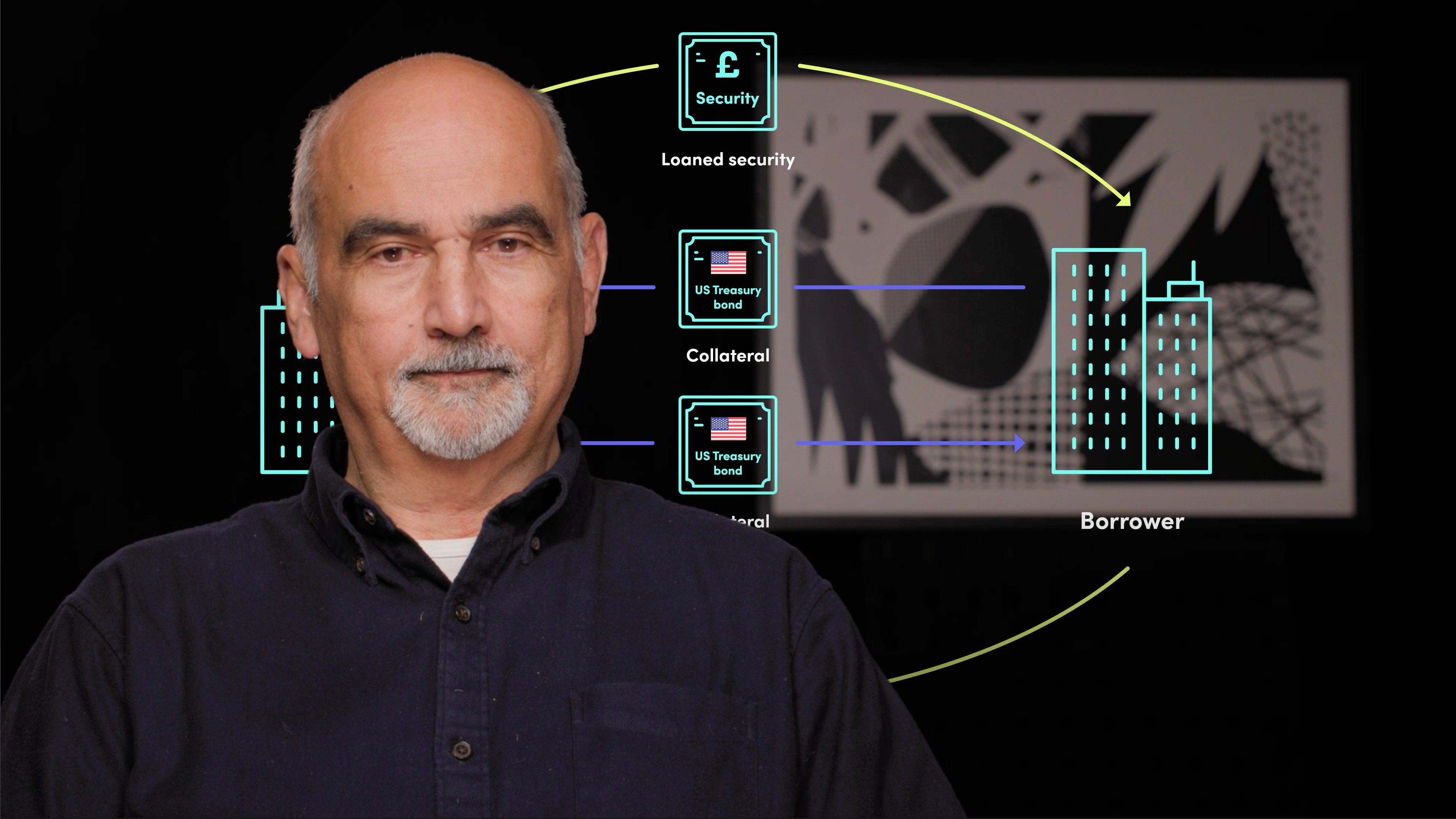

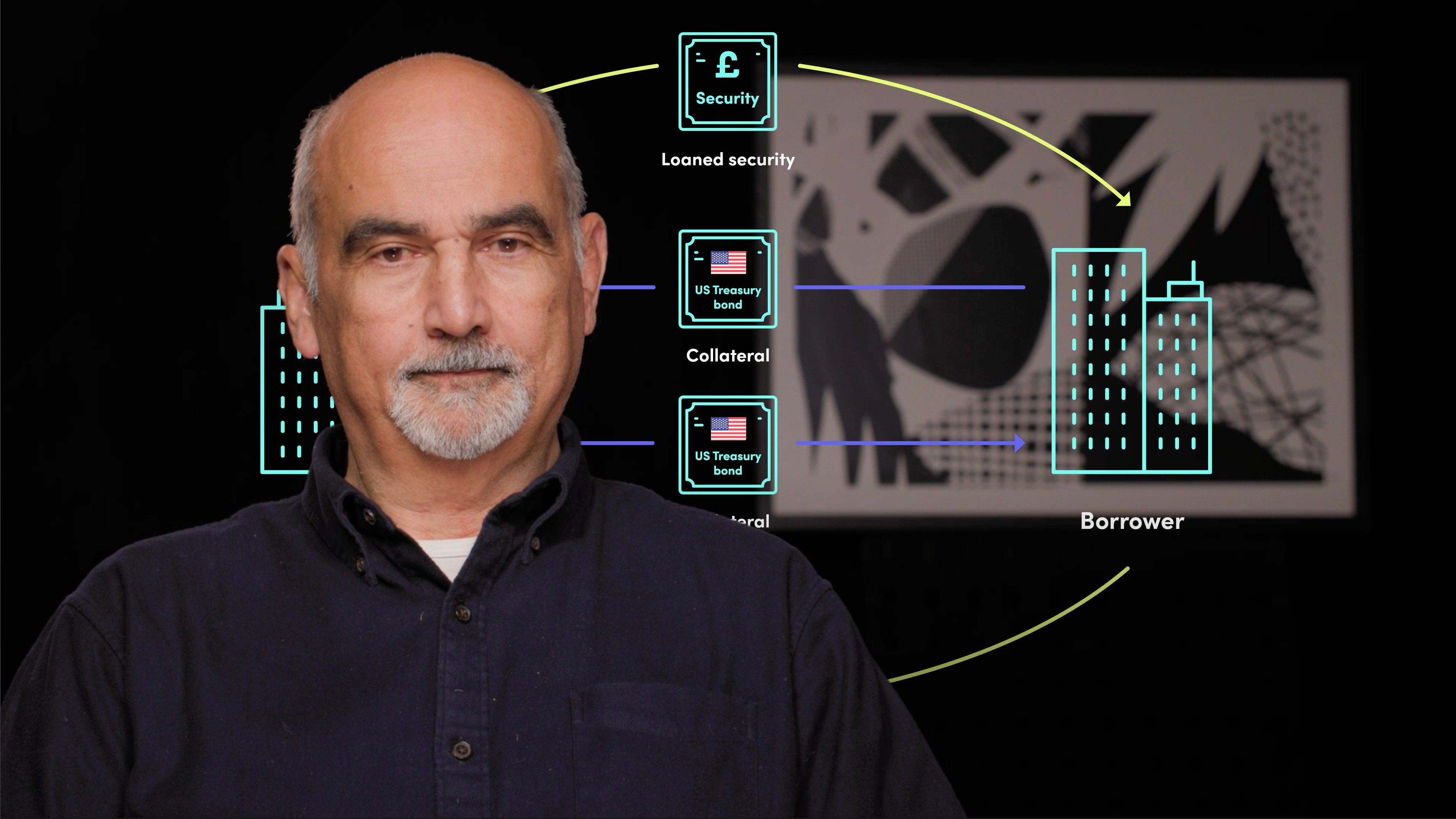

In a securities loan, the lender agrees to lend a certain quantity of a security in exchange for an agreed amount of collateral. The quantities are nominal values in the case of fixed-income securities and numbers of shares in the case of equity, but because the quantities being exchanged are fixed, the lender is committing to take back the loan at its original value, meaning that the lender retains the risk on the loaned securities, even though the borrower has been given the legal title to them. The borrower also keeps the risk on the collateral (securities or cash) when collateral has been given by title transfer.

In the case of fixed-income securities, returns come in three forms:

- Capital gains if the clean price of a security rises

- The additional accrued interest added to the market value of a security over the loan period

- Any income that is actually paid on security during the loan in the form of coupons or dividend

Any income is paid to the legal owner, which is the borrower in the case of securities loans. The lender, therefore, needs compensating, as they are the ones holding the risk. This is done in the form of so-called manufactured payments by one party to the other.

Equity loans will receive different types of income, but the concept remains the same.

How should a securities loan be accounted for?

In order to understand the accounting treatment for a securities loan, we need to understand its economic substance. This is because financial accounts should reflect the economic substance of a transaction rather than its legal form.

In a securities loan against non-cash collateral, the risk and return on the loaned securities remains with the lender and the risk and return on the collateral remains with the borrower. This means that there should be no change in the balance sheet entries of the two parties, and for this reason, securities lending is sometimes described as off-balance sheet.

In a securities loan against cash collateral, the cash is recognized on the balance sheet of the lender as a new asset, offset by an increase in its debt. On the borrower's balance sheet, the holding of cash is reduced and replaced by a claim for repayment by the securities lender. The accounting treatment of a securities loan against cash collateral is the same as for an unsecured deposit.

Richard Comotto

There are no available Videos from "Richard Comotto"