Introduction to International Electronic Payments

Ritu Sehgal

20 years: Corporate banking

The main purpose of the second video on this series is to provide a step by step information on the International Payment methods.

The main purpose of the second video on this series is to provide a step by step information on the International Payment methods.

Introduction to International Electronic Payments

4 mins 26 secs

Key learning objectives:

Understand how banks choose their correspondent bank in other countries

Outline the steps for an international payment

Overview:

The text below gives an overview of how the International payment system works.

What is a Correspondent Bank?

A correspondent bank is a financial institution that provides services to another, usually in a different country.

For example, The best way for Lloyds to gain access to the US payment network is to form relationships with US banks that are already members of the US domestic payment schemes, this US bank is known as a "correspondent bank."

How do banks choose their correspondent bank in other countries?

Banks choose their correspondent banks based on

- The strength of their position in the domestic US market

- The number of schemes they can provide access to

- The cost and quality of payments service they can provide

- Aftercare provision

What is SWIFT?

SWIFT is a secure communication system that allows over 10,000 financial institutions in over 200 countries to send and receive messages to each other relating to financial transactions.

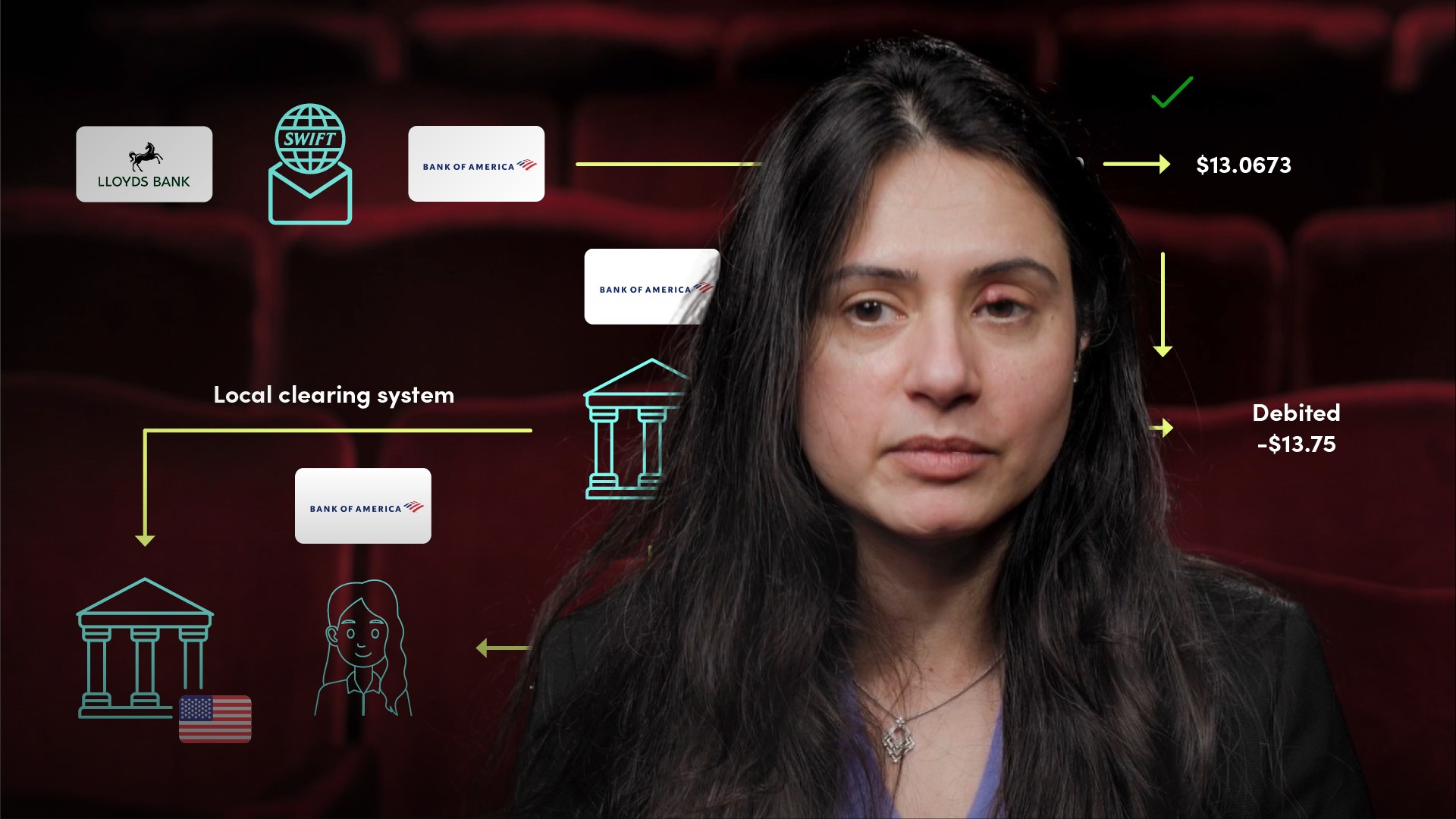

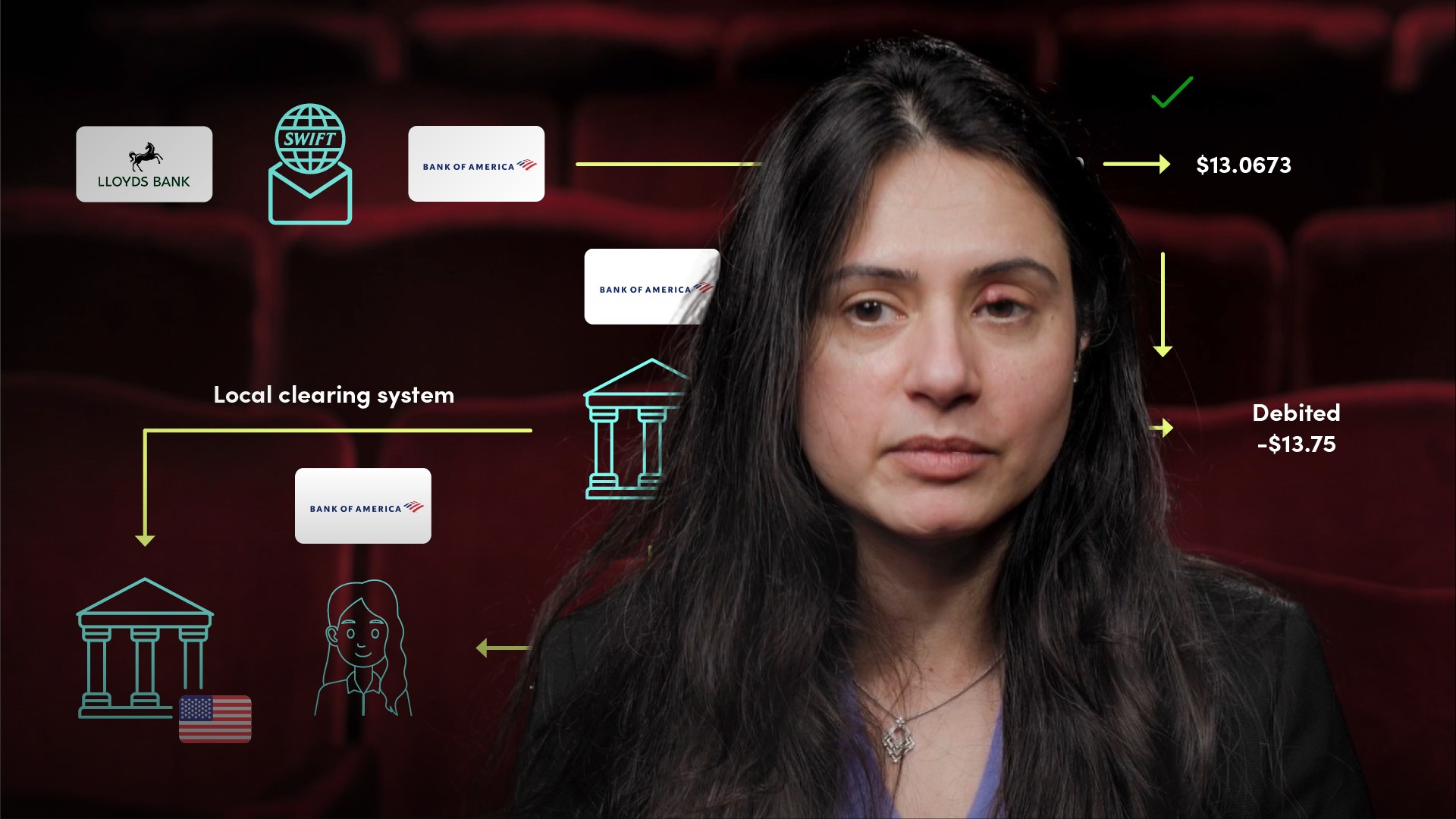

What are the steps for an international payment?

- Once the instruction is received to make a payment, the bank will send a message to the correspondent bank initiating the payment, using SWIFT.

- The instruction will include permission from your bank to the correspondent bank to take the money for the payment.

- On receipt of the instruction, the correspondent bank will debit your bank account for the value of the payment stated in the SWIFT message and effect the payment.

- Finally, the correspondent bank will credit the payee’s account on their own system.

Ritu Sehgal

There are no available Videos from "Ritu Sehgal"