Equity Options Greeks

Imran Lakha

20 years: Equity derivatives trading

In this video, Imran explains the main options Greek in detail. He further explains the concept of gamma trading and how volatility traders delta hedge their options positions to trade volatility agnostic to market direction. He also gives us an overview of how the greek profile of a vanilla option changes as we move through strike price and also as we pass through time.

In this video, Imran explains the main options Greek in detail. He further explains the concept of gamma trading and how volatility traders delta hedge their options positions to trade volatility agnostic to market direction. He also gives us an overview of how the greek profile of a vanilla option changes as we move through strike price and also as we pass through time.

Equity Options Greeks

18 mins 33 secs

Key learning objectives:

Identify the different Option Greeks

Understand the concept of Gamma Trading

Understand how volatility traders delta hedge their options positions to trade volatility agnostic to market direction

Overview:

The three main options Greeks are Delta, Gamma and Theta.

What is the Delta of an option?

The change in the option value with respect to a change in spot price.

DELTA = Change in option value / Change in stock price

What is the GAMMA of an option?

The change in the option delta for a given change in the spot price. It is the change in DELTA for a 1% change in the Spot price.

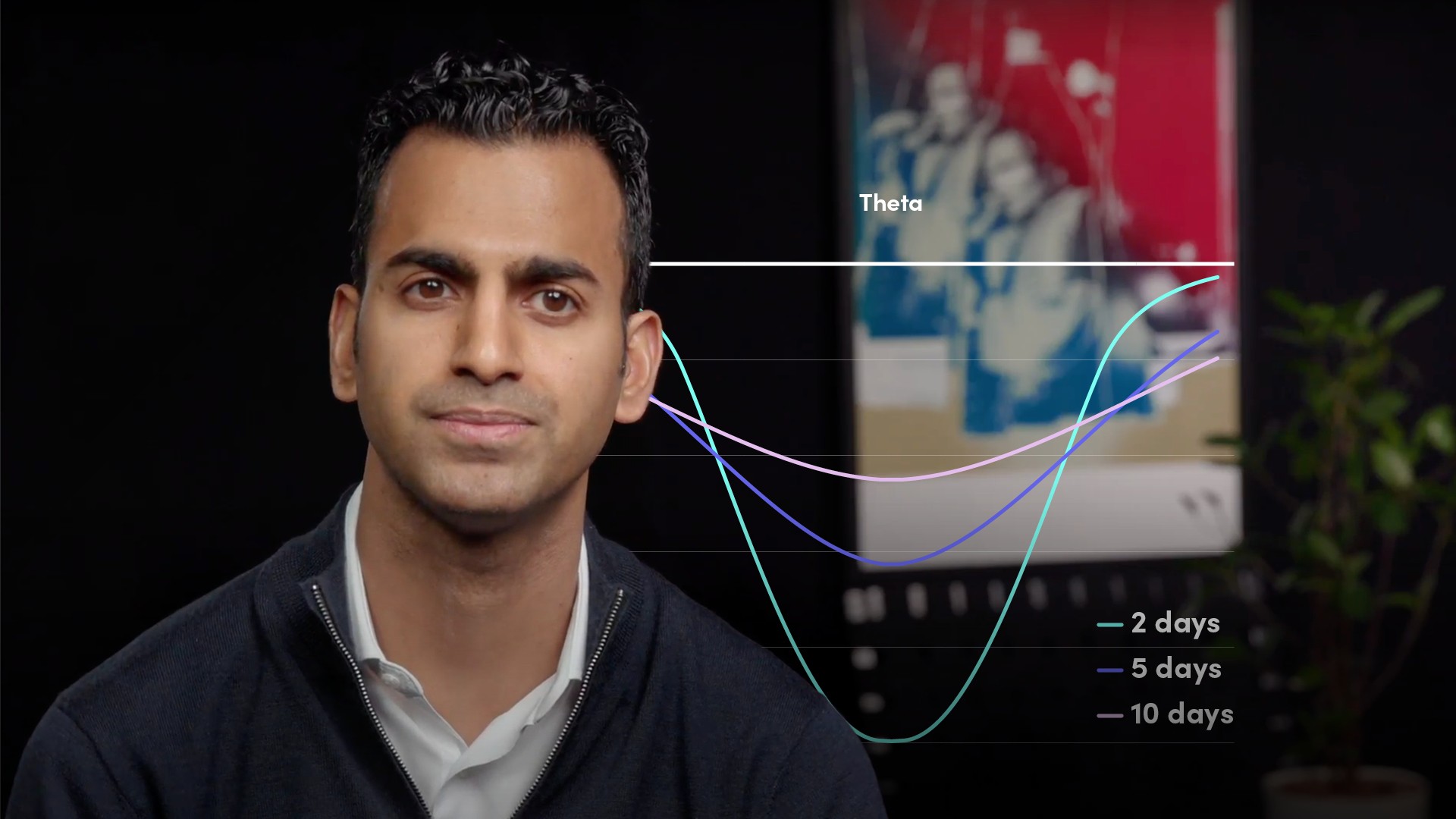

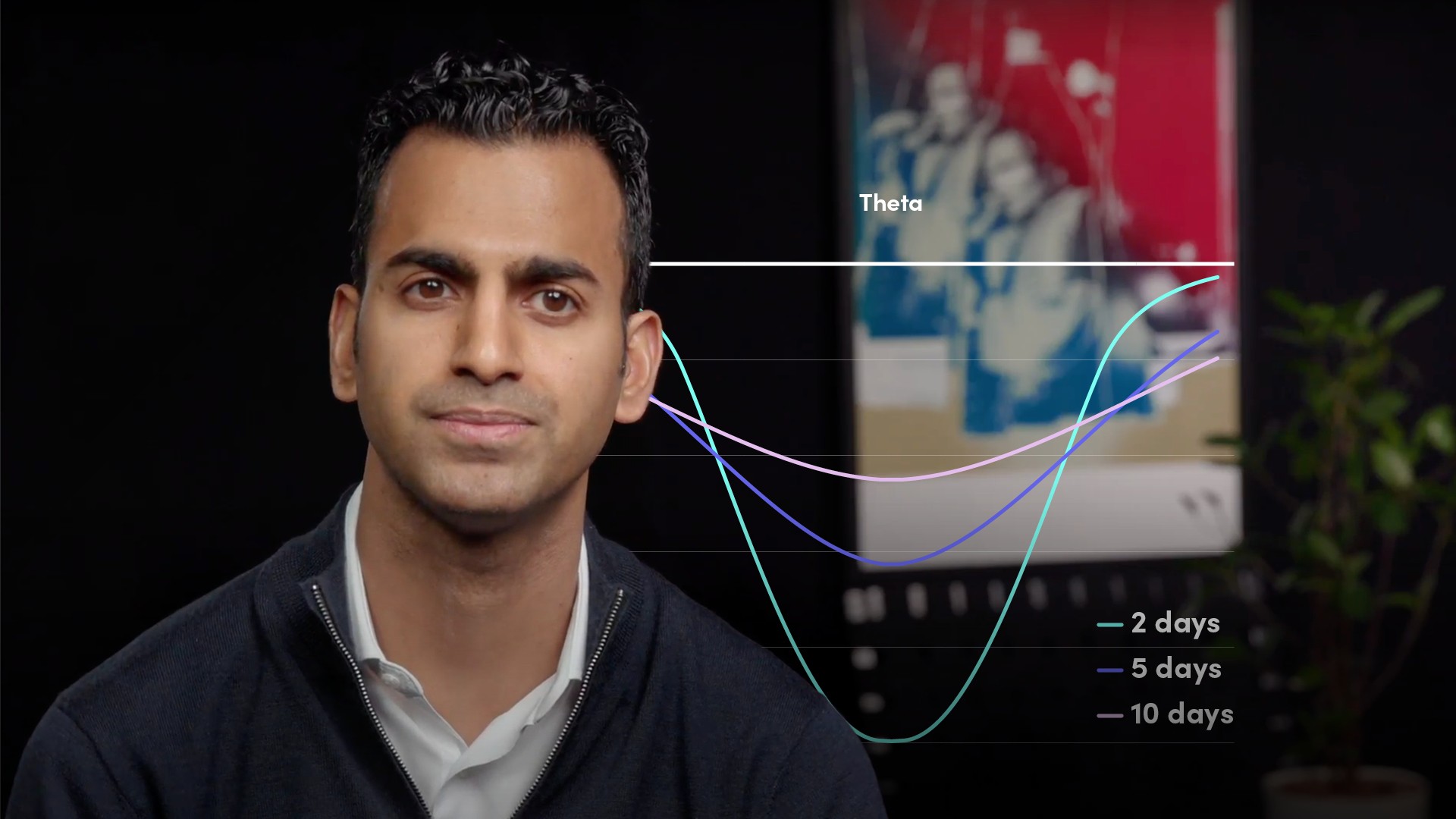

What is the Theta of an option?

If an option is worth 20 dollars today, all things being equal, it will be worth slightly less tomorrow. That incremental difference from one day to the next is THETA or TIME DECAY. THETA is the change in price of an option for a 1 day move in time.

Imran Lakha

There are no available Videos from "Imran Lakha"