Embedding ESG for Strategic Success

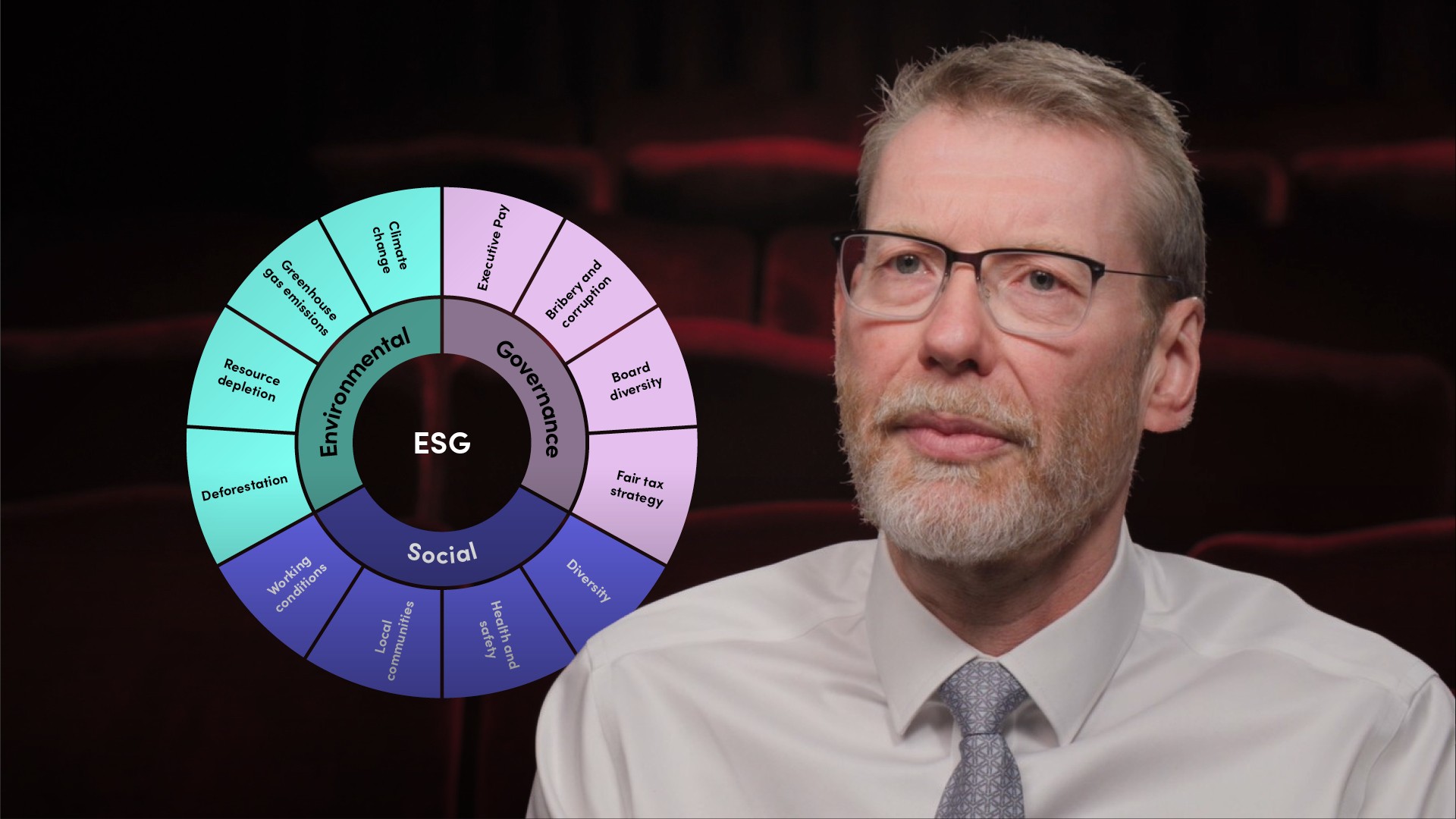

Hans-Kristian Bryn

35 years: Strategic risk management and governance

The focus of this video is specifically on environmental, social and governance considerations and how the "old" approach to ESG can be addressed. This video will outline why telling an 'ESG' story to clients and investors is no longer sufficient. Hans explains how we can embed ESG into both risk and strategy processes to ensure that we manage the risk of not meeting expectations.

The focus of this video is specifically on environmental, social and governance considerations and how the "old" approach to ESG can be addressed. This video will outline why telling an 'ESG' story to clients and investors is no longer sufficient. Hans explains how we can embed ESG into both risk and strategy processes to ensure that we manage the risk of not meeting expectations.

Embedding ESG for Strategic Success

10 mins 26 secs

Key learning objectives:

Outline the concept of ESG

Understand how we create value and resilience from our ESG focus

Learn how ESG should be embedded into planning and decision-making

Overview:

ESG is a key risk that businesses have to address to succeed and meet stakeholder expectations. It is no longer sufficient to tell a good ESG story – you have to demonstrate that ESG is embedded in your risk, strategy and governance processes.

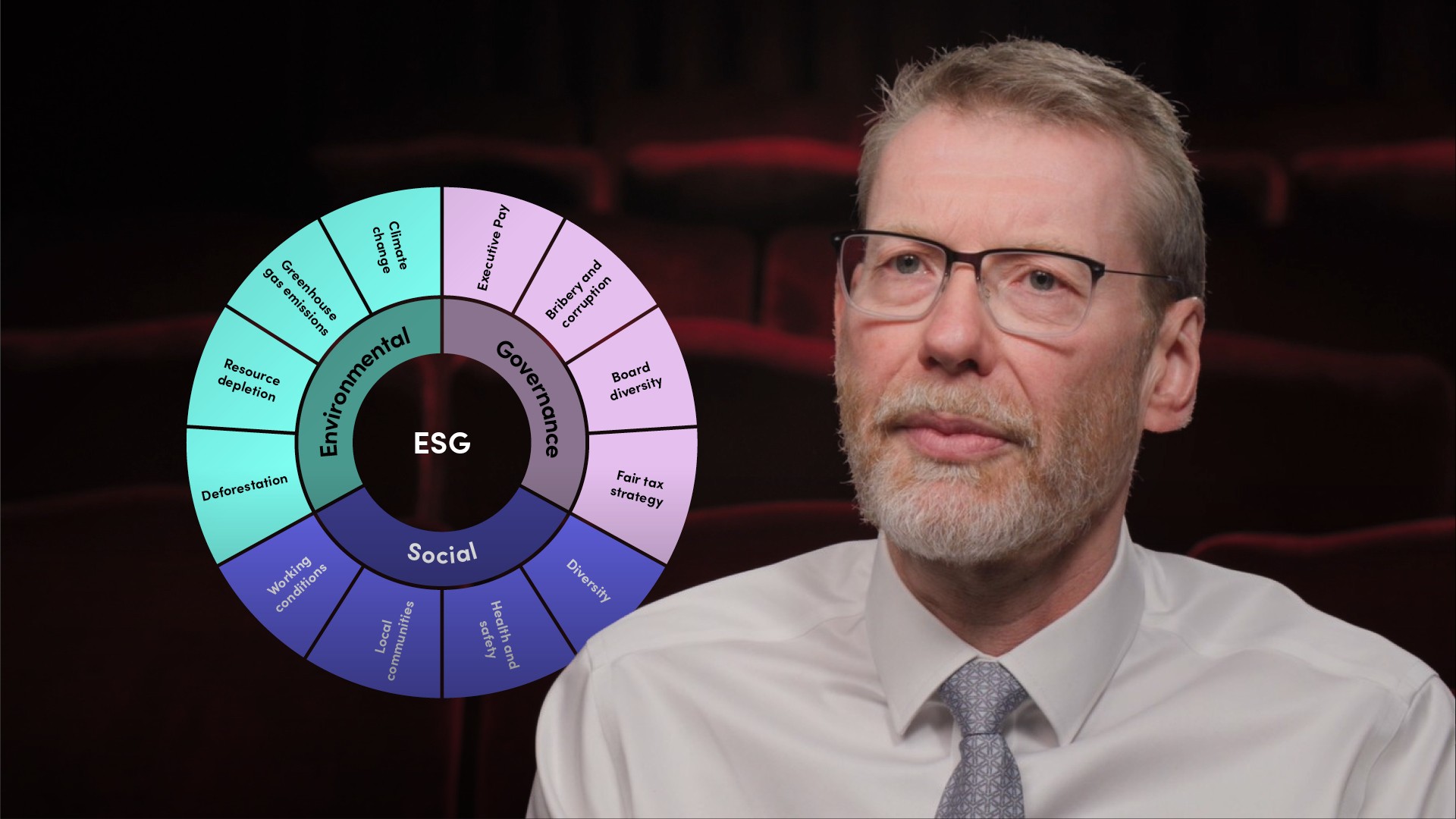

What is ESG?

Environmental, Social and Governance (ESG) approaches are a set of “standards” that organisations use to demonstrate that they are taking a wider stakeholder approach across these areas. Despite the fact that ESG has been on many investors and companies’ agenda for decades, the connection to risk and reward management have varied greatly. Historically, there has been a lot of focus on environmental factors such as single use plastic and climate change but ESG is much wider than previous concepts such as Corporate Social Responsibility.

Equally, ESG actions have mainly been manifesting themselves as compliance activities. This is also reflected in how the growth of corporate governance as a focus area has made rules, regulations and guidance for all ESG related topics mushroom. These requirements have also become increasingly complex and “tick box” focused. Going forward, this “tick-box” mentality is not going to be sufficient to succeed, and to meet the expectations and demands of the wider stakeholder community.

How do we create value and resilience from our ESG focus?

In order to approach ESG differently, many organisations are seeking to take an integrated approach to strategy, risk, actions and behaviours, and performance. By incorporating ESG as an explicit consideration for each element of this approach, organisations can ensure that they are making it an integral part of the process rather than a post-decision ‘ESG-wash’ to try to satisfy stakeholder expectations.

In order for ESG to underpin value creation and resilience, environmental, social and governance considerations should always be part of key business decisions, as they will sooner or later impact the success of any given strategy. That means that the analysis needs to draw on the understanding of risk management, and be underpinned by a clear implementation approach that drives the intended actions and behaviours of the organisation.

Understanding ESG risks and impacts doesn't mean that an organisation can’t plan for and live with them; however, not understanding the potential consequences can be fatal. For example, a number of firms in the garment industry have recently suffered as a consequence of labour and sourcing issues becoming headline news.

How should ESG be embedded into planning and decision-making?

In order to generate value and business benefit from addressing ESG, organisations will see gains from applying a broader frame of analysis, with environmental, social and governance included in the strategy process, as well as specifically in relation to risk management in the following ways:

- Recent crises have shown the importance of building organisations that are resilient to unforeseen events outside of their control and to do this by taking a long-term approach anchored in the purpose of the organisation.

- ESG aspects need to be moved from being compliance obligations to a business-critical issue.

- ESG needs to be incorporated into the decision-making process and governance of the company - and be considered over a longer time horizon.

- ESG needs to be integral to the risk management (and reward) evaluations of the organisation to reinforce and signal the sincerity of the organisation’s intent.

An increased focus on ESG will have significant implications for the internal governance of the organisation. As a consequence, Boards and Executive Committees will have to reset their agendas and priorities. For Executive Management this might mean that the Board will become more probing in the interrogation of the ESG aspects of business design and decisions. Hence, the focus will be on balancing risk and return.

Hans-Kristian Bryn

There are no available Videos from "Hans-Kristian Bryn"