EU Sustainable Taxonomy Reflections

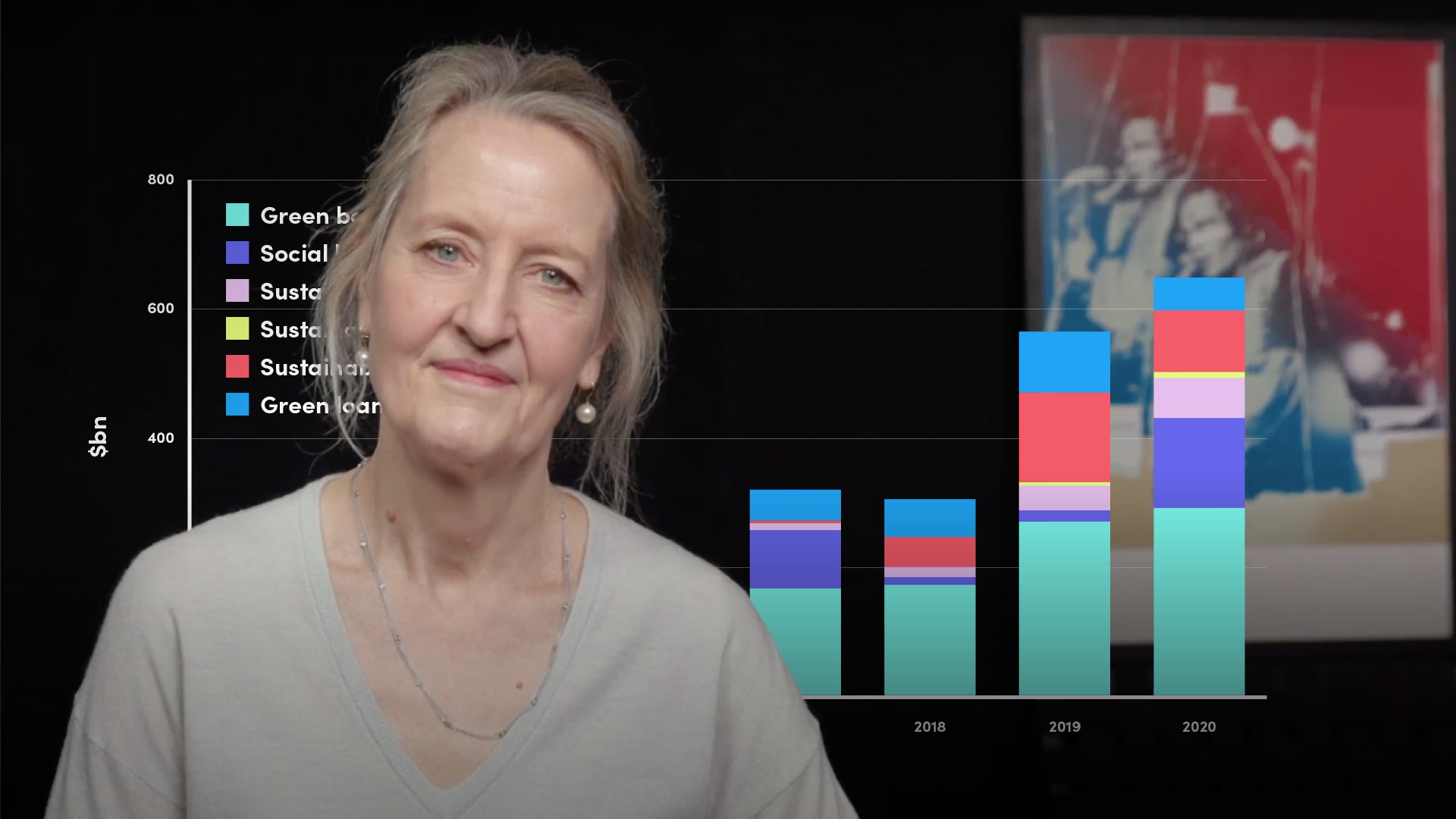

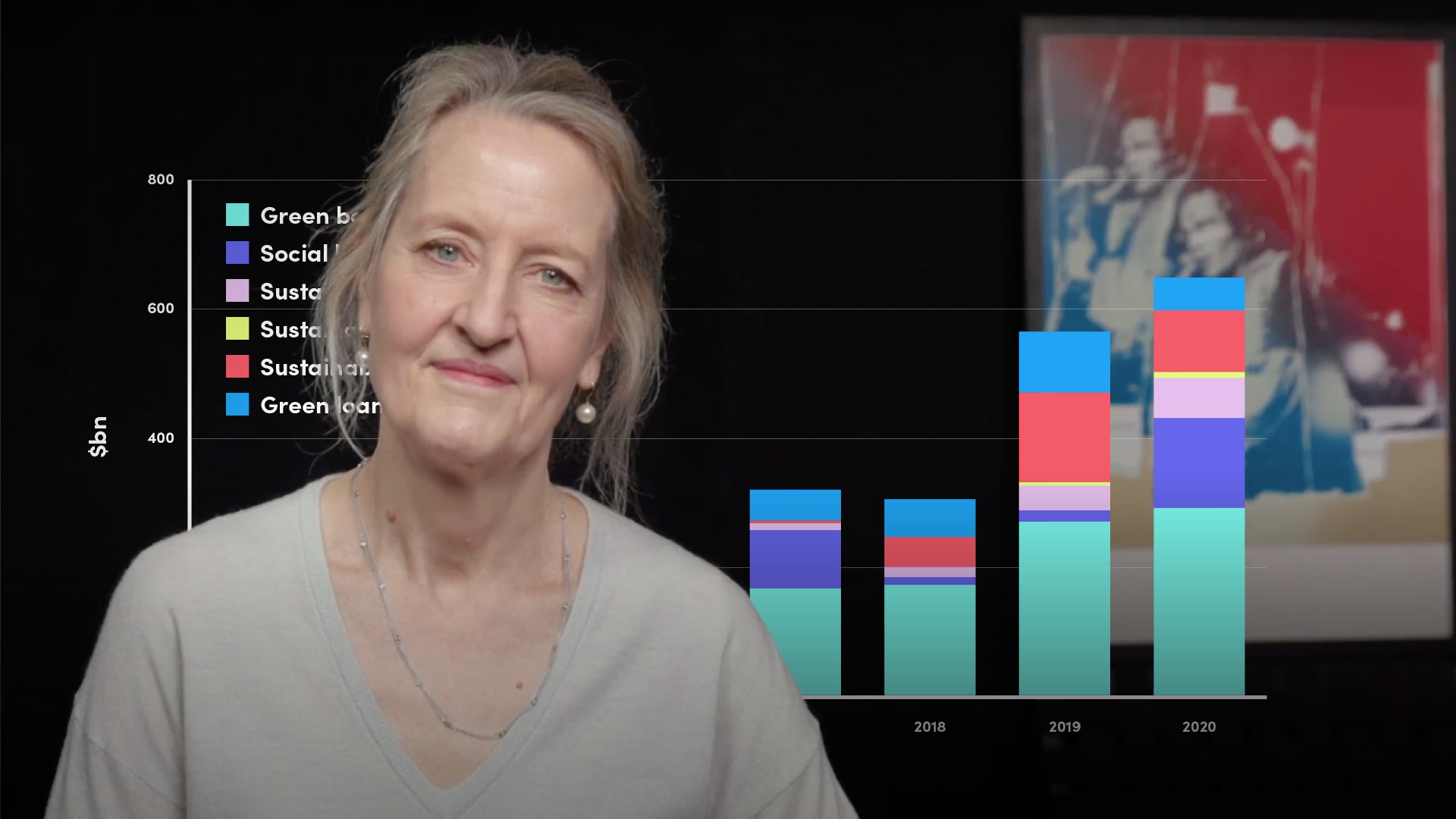

Stephanie Sfakianos

35 years: Sustainable finance & banking

The purpose of this video by Stephanie is to introduce the EU Sustainable Finance Taxonomy. She also explains how it was developed, why is it important, and what will be its implications for market participants.

The purpose of this video by Stephanie is to introduce the EU Sustainable Finance Taxonomy. She also explains how it was developed, why is it important, and what will be its implications for market participants.

EU Sustainable Taxonomy Reflections

9 mins 2 secs

Key learning objectives:

Define Greenwashing

Understand how the EU taxonomy has developed

Identify the eligibility criteria for taxonomy

Understand how eligibility is determined

Overview:

Taxonomy is a dictionary of sustainable activities. It is a tool to help investors, companies, issuers and project promoters navigate the transition to a low carbon, resilient and resource efficient economy.

What is Greenwashing?

The concern that the issuers were making misleading or unverifiable promises to reduce carbon emissions and that the emissions reductions claimed were still not sufficiently ambitious to meet the Paris Agreement climate goals.

How has the EU Taxonomy developed?

The work started in December 2016, when a 37 strong Technical Expert Group, known universally now as the TEG, was convened. They worked for almost two years, and gathered input from more than 200 additional experts and conducted two open consultations, receiving nearly 4000 individual items of feedback during the process. The work of the TEG fed into the EU’s Action Plan on Financing Sustainable Growth, which was published in March 2018.

The Taxonomy Regulation was agreed at the political level in December 2019 which was published in the Official Journal of the European Union on 22nd June 2020, and entered into force on 12th July 2020.

What is the eligibility criteria for Taxonomy?

- Low carbon - Renewable energy and Fully electric vehicles

- Enabling activities - those that facilitate emission reduction in other activities, such as the manufacturing of components for renewable energy production, and the installation of energy efficient systems and appliances.

- Transition activities - Those that are not low carbon today, but which have the scope to transition to being green in the future.

How is eligibility determined?

1.Contribution to environmental objectives - an activity is environ mentally sustainable if it makes a substantial contribution to at least one of six environmental objectives:

- Climate change mitigation

- Climate change adaptation

- Protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

2. Do no significant harm - This means eligible activities in terms of one of the above six environmental objectives, must not undermine any of the others.

3. Meet minimum social and governance standards - it must meet minimum social and governance standards, which are the provisions of:

- The International Bill of Human Rights

- The OECD Guidelines for Multinational Enterprises

- The UN Guiding Principles on Business and Human Rights

- The Declaration on Fundamental Rights and Principles at Work

4. Comply with technical screening criteria - The final provision relates to performance thresholds. These provide the thresholds according to which an activity will be deemed to provide this “substantial contribution”.

Stephanie Sfakianos

There are no available Videos from "Stephanie Sfakianos"