Executive Remuneration at Listed Companies

Sandro Barbato

How do shareholders influence how much an executive gets paid? Join Sandro Barbato as he explores how compensation packages change when a company is listed on a stock exchange.

How do shareholders influence how much an executive gets paid? Join Sandro Barbato as he explores how compensation packages change when a company is listed on a stock exchange.

Executive Remuneration at Listed Companies

13 mins 25 secs

Key learning objectives:

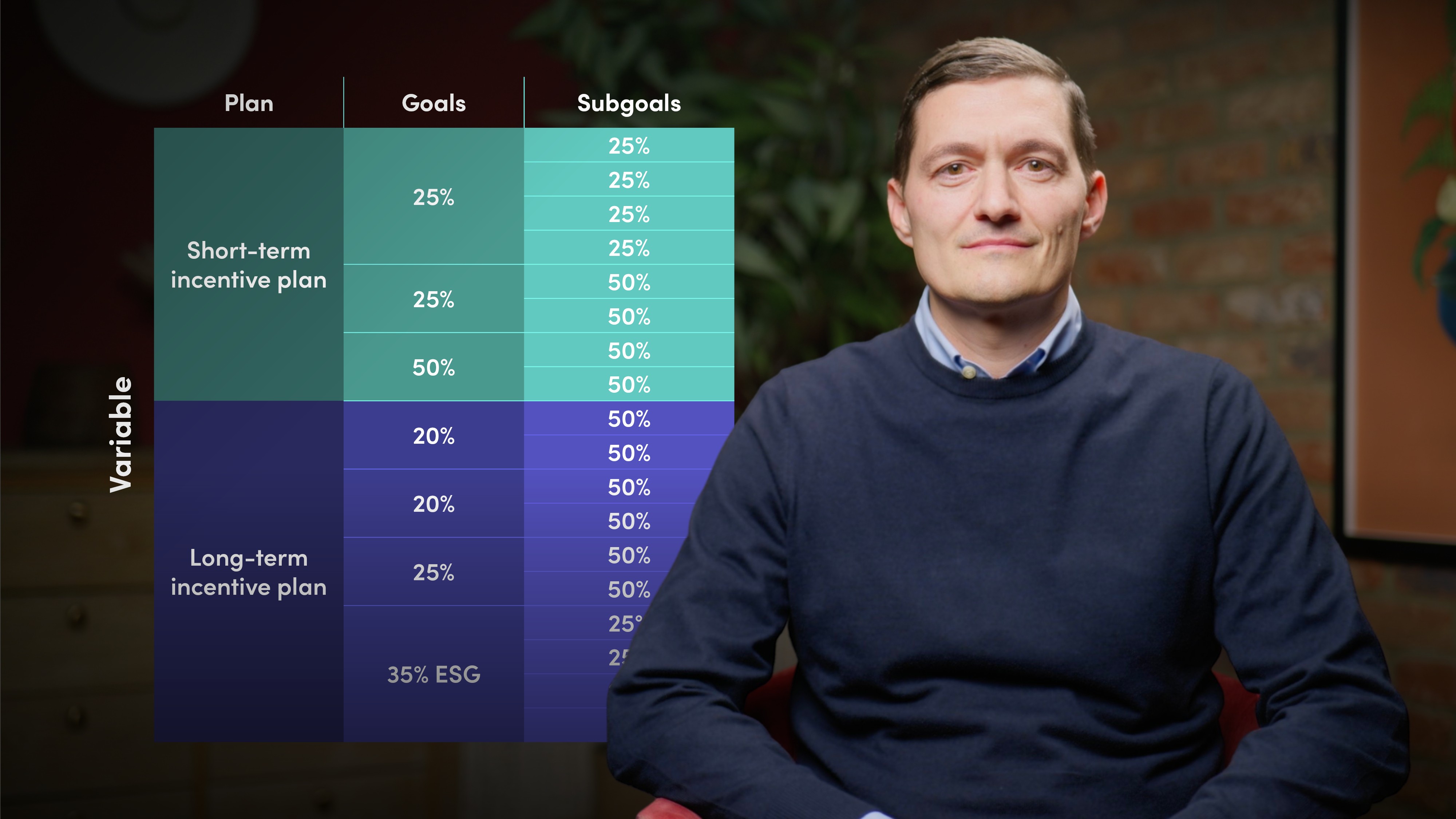

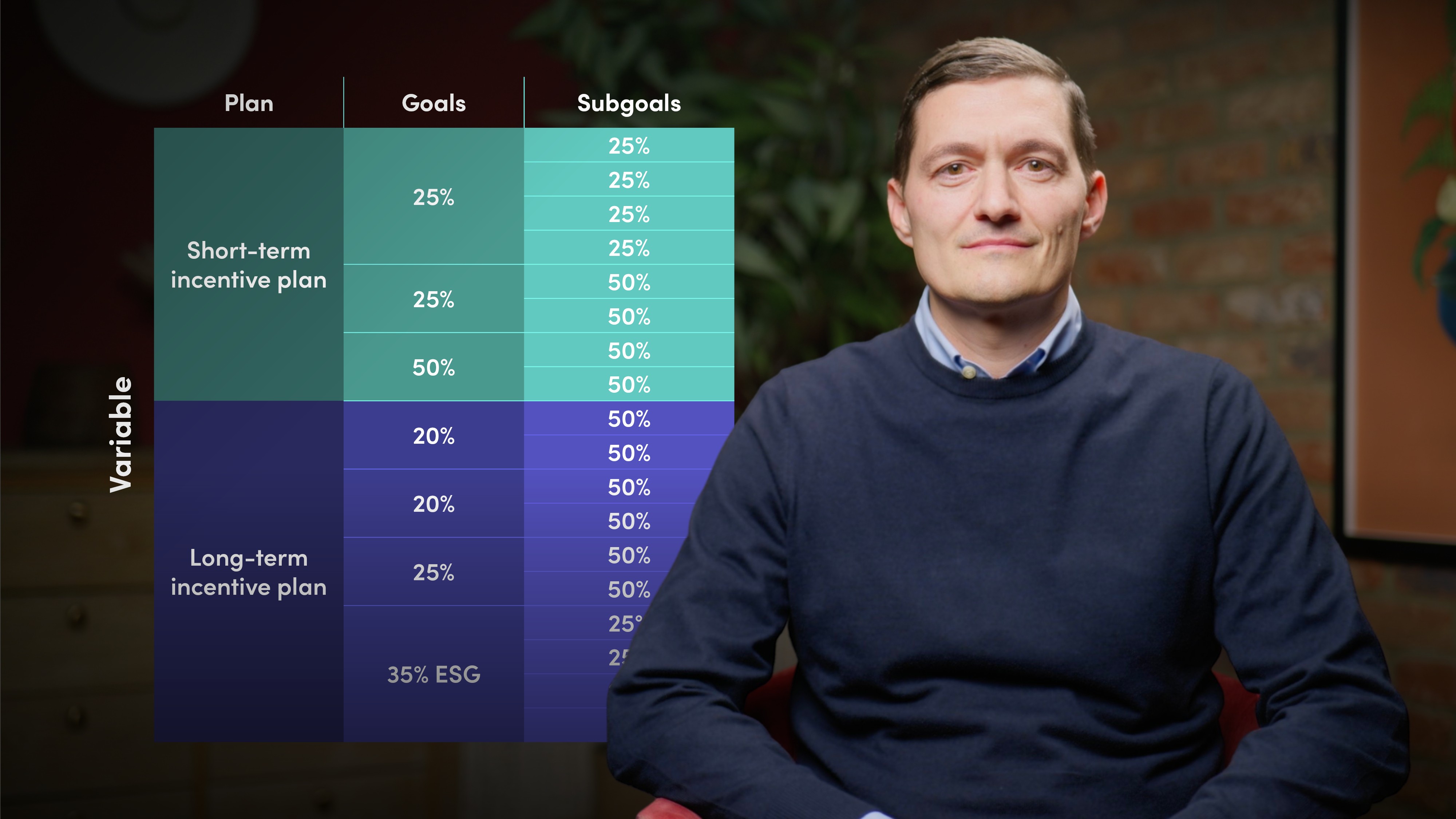

Understand how executive remuneration principles differ for listed companies and the role of shareholders in deciding compensation

Identify how corporate governance impacts compensation policies at listed companies

Describe how ESG and ESG-focused targets are becoming part of executive remuneration packages

Overview:

One of the key components that must be considered when talking about compensation at listed companies is corporate governance. Along with the shareholders, corporate governance plays an important role in deciding how executives are compensated. ESG-related targets, like employee satisfaction and improved ESG-ratings, are also increasingly becoming part of the remuneration conversation.

Sandro Barbato

There are no available Videos from "Sandro Barbato"