Financing a Blockchain Project and Blockchain Security

James Burnie

Financial technology specialist

In this video, James will explain how a tea supply chain could benefit from the use of the technology known as blockchain. He also discusses the operational requirements and potential security issues associated with using the technology. And we briefly look at the potential requirement for participants in the project to hire suitable custodians to handle their tokens.

In this video, James will explain how a tea supply chain could benefit from the use of the technology known as blockchain. He also discusses the operational requirements and potential security issues associated with using the technology. And we briefly look at the potential requirement for participants in the project to hire suitable custodians to handle their tokens.

Financing a Blockchain Project and Blockchain Security

12 mins 12 secs

Key learning objectives:

How is crowdfunding using cryptoassets treated legally?

What is a SAFT?

What is the role of the custodian?

Overview:

Cryptoassets can be used to raise funds using crowdfunding, a process often referred to as an ICO. The regulation of ICOs depends on the nature of the cryptoasset, for example whether it represents a security. In certain cases, the fundraise may occur before the cryptoassets are created, in which case investors often enter into a SAFT, under which they have rights to the cryptoassets when they are created. Before holding cryptoassets you should consider how they will be stored, for example if using a custodian you should consider how secure the custodian is. There are other considerations when holding cryptoassets as well to consider, such as how robust the blockchain protocol is and whether there is a business continuity plan in place if it breaks.

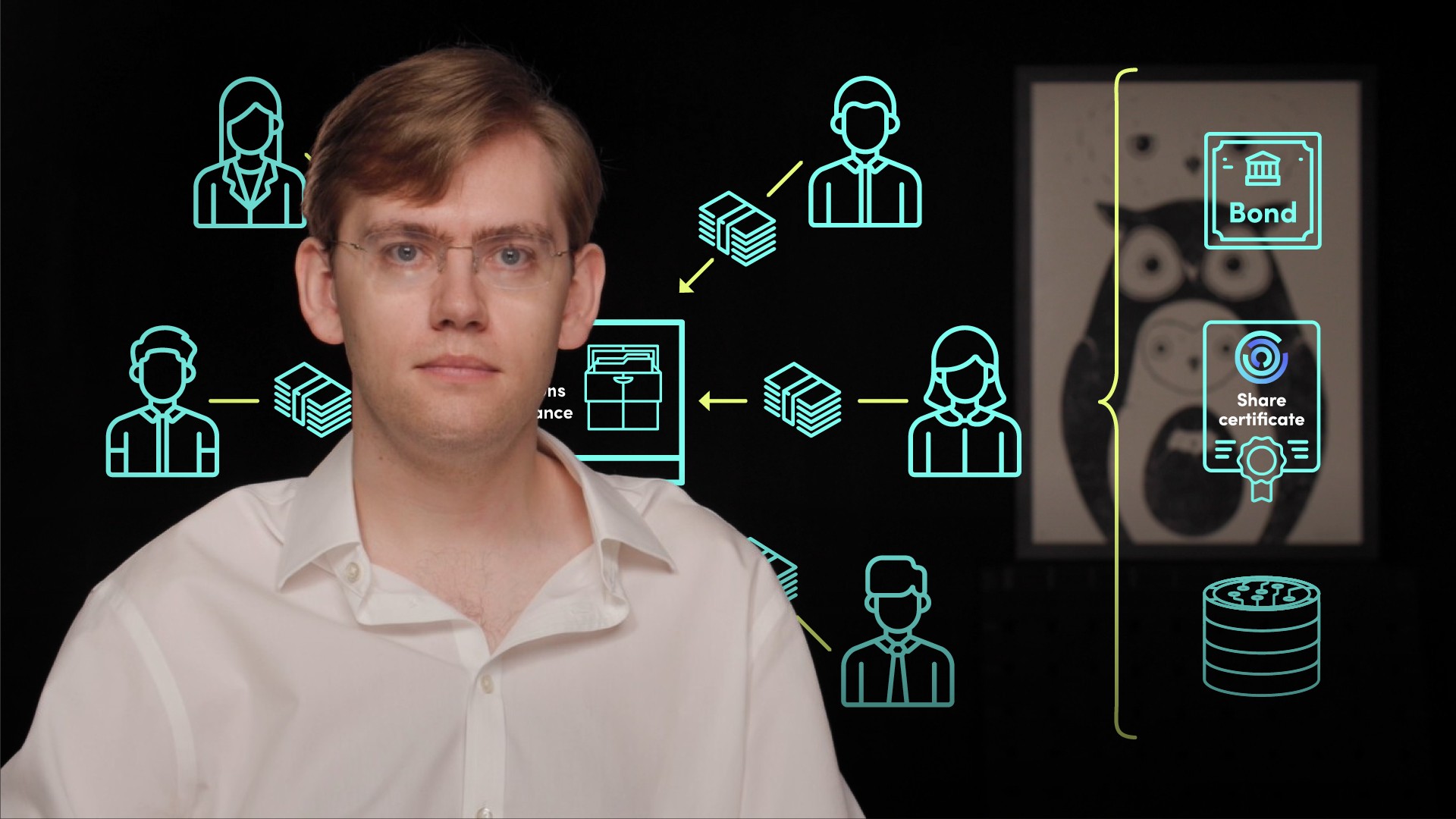

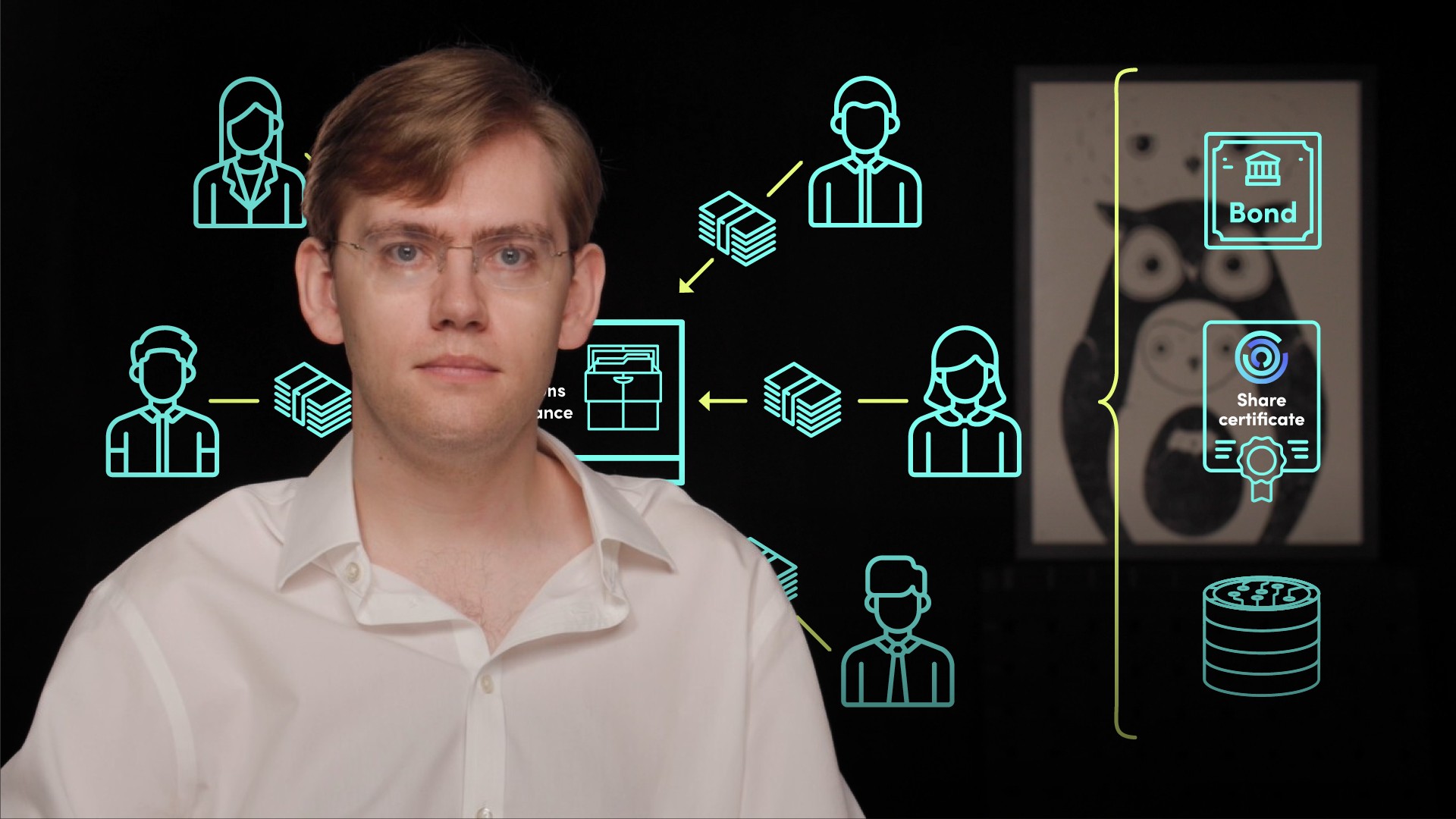

How is crowdfunding using cryptoassets treated legally?

Token-based crowdfunding can go by different names, for example an initial coin offering or ICO or a token generation event or TGE. At their heart, all they involve is selling an amount of tokens in return for traditional, what we call fiat, money. If a token represents a security, then it will fall under the securities framework, and may for example require a prospectus for a crowdfund. If the token does not represent a security, then it will be subject to consumer law protections, for example in terms of having to avoid making any misrepresentation and avoiding terms which are prohibited by public policy. In fact, as a matter of international law under Article 5 of the Rome Convention, any mandatory provision of consumer law of any jurisdiction will override any contractual agreement, and so the offer of any unregulated tokens may be subject to the consumer laws of any country where any potential participant is based.

What is a SAFT?

Where a core focus of raising funds is to build the blockchain product which provides the tokens, there may not be the infrastructure to actually be able sell tokens to consumers. Where this is the case, we may instead sell participants a Sale Agreement for Future Tokens, or “SAFT”, which is effectively a kind of IOU under which we agree to use the money raised to build the blockchain platform, and once it is built to send the agreed tokens to the participants. As a general rule, using a SAFT route is tricky in the US if you are not willing to treat the issuance as a security offering.

What is the role of the custodian?

The custodian’s core role is to keep cryptoassets secure. As such, you should ask how the custodians keeps private keys secure, whether their systems and controls to protect cryptoassets have been audited, and whether for example there is insurance in place to cover the event of cryptoassets being lost. Furthermore, different custodians specialise in supporting different types of token and trading, and in terms of the amount of regulatory support provided, e.g. in terms of checking counterparties from an AML / KYC perspective.

What are some considerations when choosing to deal in cryptoassets?

The blockchain is simply a way of holding information, it is not a guarantee of the information held on-chain (on the blockchain). As such, you need to consider how ensure the quality of the information to be stored on-chain, and one option here is to have a tiered system of access to the blockchain, so that certain administrators have additional abilities to access and influence parts of the blockchain. Another consideration is to what extent there is a risk of a potential virus or glitch in the blockchain, and what systems and controls are in place to protect against this. There should also be a business continuity plan in place in case the blockchain protocol breaks.

James Burnie

There are no available Videos from "James Burnie"