EU Fiscal Austerity Measures

Trevor Pugh

20 years: Trading & hedge funds

Whereas monetary policy in Europe leaned significantly in the direction of largesse, fiscal policy was more tightly constrained. In this video, Trevor explains these fiscal constraints and analyses the causes and effects of these policies.

Whereas monetary policy in Europe leaned significantly in the direction of largesse, fiscal policy was more tightly constrained. In this video, Trevor explains these fiscal constraints and analyses the causes and effects of these policies.

EU Fiscal Austerity Measures

8 mins 56 secs

Key learning objectives:

Identify the views of creditors and debtors on the austerity measures

Who was to blame?

Identify the fiscal constraints imposed on European countries

Understand the impact of austerity

Overview:

The emphasis on fiscal austerity and tight monetary policy had been undertaken on behalf of the creditor, to protect against their mistakes in lending. This caused an economic stranglehold, nearly continuously since July 2007, curtailing economic growth and placing banks in a fragile condition.

How did European Countries react to the Monetary Union?

- Germany - Kohl was keen for European political integration, being of a generation that had seen the destruction caused by WW2. Kohl had no interest in a full monetary union

- UK - Margaret Thatcher was more interested in the creation of the single market

- France - France leaders were more keen on the idea of a monetary union. They saw it to be a mechanism to hitch their economies to that of Germany, and in doing so, lower borrowing costs

- Italy and Greece - These leaders saw the concept as creating some form of ‘external anchor’ which would encourage policy restraint

What were the Fiscal Constraints imposed on European countries?

- Growth and Stability Pact - A 3% limit on the budget deficit to GDP ratio. 2% would be too hard to achieve and 4% would give too much leeway

- German idea of sanctions, including fines for any breach, even though such penalties would simply impose more hardship on countries already struggling

- Requirement that countries should not have debt to GDP ratios in excess of 60%, or those that did should have an intention to get back down below this level

What is an Example of the rules being breached?

In 2003, France and Germany overspent; their budget deficits exceeded the 3% of GDP limit to which they were legally bound. No penalty was imposed however. As of Q1 2019, 14 of the Eurozone’s countries had debt to GDP ratios in excess of 60%. The presence of the rules and the potential for penalties and various types of reprimand ensured that countries could not stray far from the route of fiscal rectitude.What were the views of Debtors and Creditors on Fiscal Austerity?

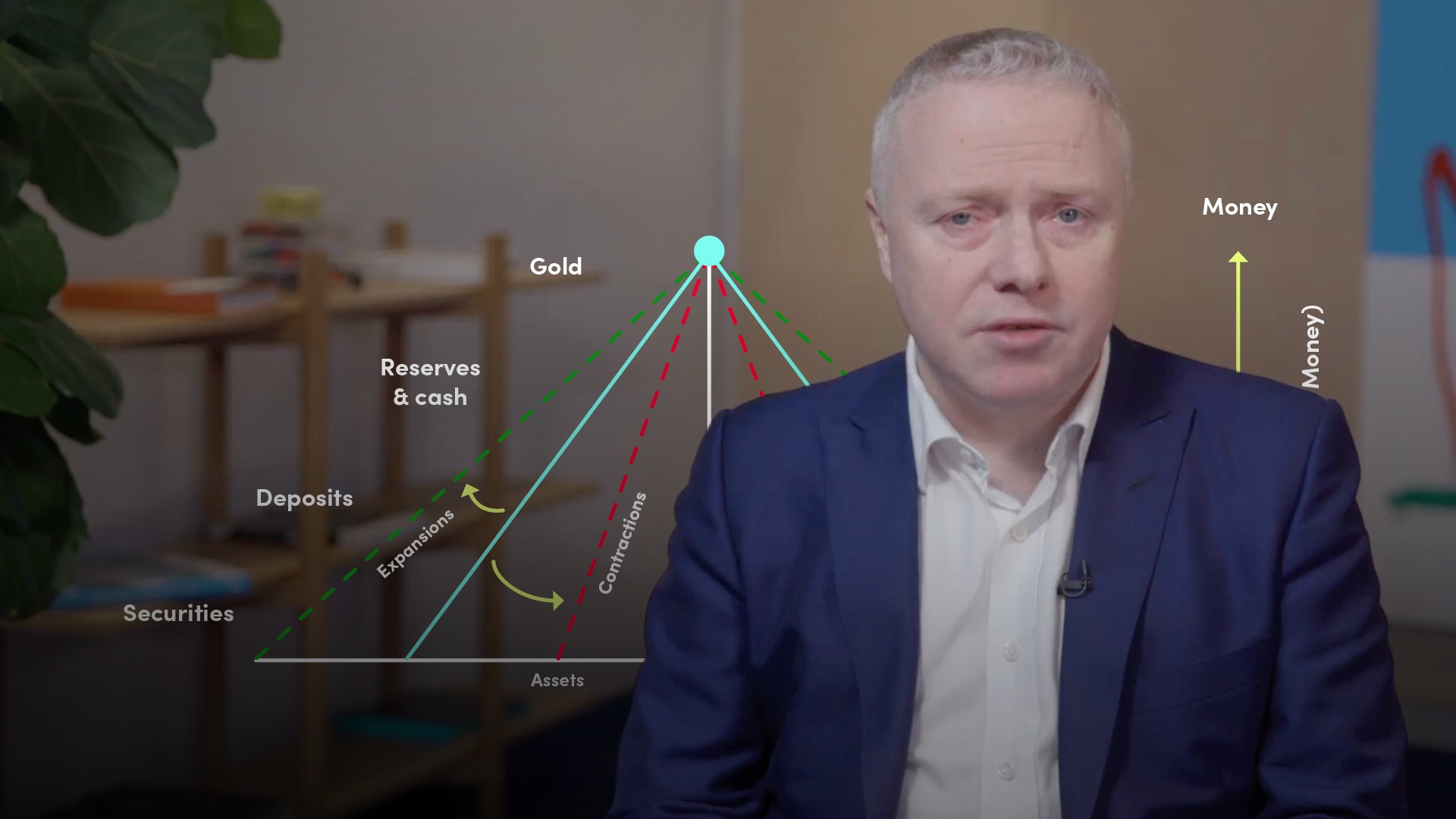

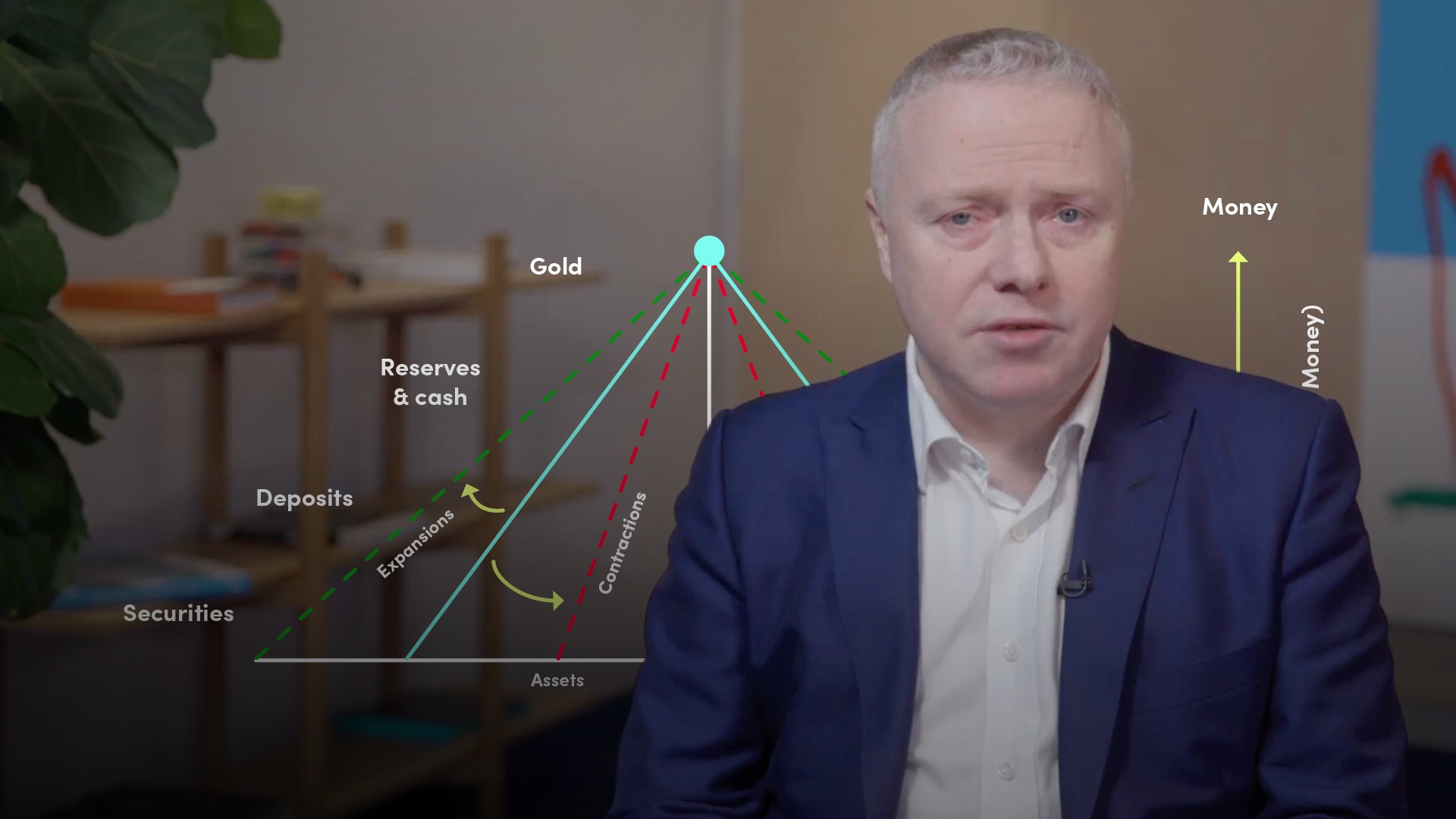

- Creditors - It is in the interest of the creditors for the money supply to remain limited, and for the quality of money to remain high. This ensures that when they get rapid, they get money that has retained its value (achieving fiscal austerity)

- Debtors - For debtors, however, the opposite applies. An expanding money system makes it easier to pay back their debts; inflation is a good thing in their view as most debts are normal, such as mortgages. Debtors also want a more flexible system of money to facilitate trade

Hence, prioritising fiscal austerity and inflation control above all else was the chosen policy objective.

What was the Impact of Austerity on the Eurozone area?

- Greek GDP fell by over 35%

- Youth unemployment hit 45% in 2017

- Curtailed economic growth

- Set off deflationary pressures

- Pushed debt burdens up

- Left banks in a fragile condition

Who is to blame for the negative impacts of Austerity?

- Private creditors should not expect to get rapid in all circumstances: the moral hazard arising from this would be catastrophic. This was seen in the case of Greece over the last decade.

- European lenders repeatedly disregarded evidence and they remained unwilling to learn from experiences elsewhere.

- National political interests pulled economic decision-making in opposing directions, and no-one was accountable.

Trevor Pugh

There are no available Videos from "Trevor Pugh"