Bond Duration and the Price Value of a Basis Point (PVBP)

Lindsey Matthews

30 years: Risk management & derivatives trading

In this video, Lindsey covers the investment strategies in bonds and shows the risks and potential returns on these investments.

In this video, Lindsey covers the investment strategies in bonds and shows the risks and potential returns on these investments.

Bond Duration and the Price Value of a Basis Point (PVBP)

10 mins 11 secs

Key learning objectives:

Define bond’s duration

Learn the calculation of the price difference of a bond given a 1bp change in yield

Define PVBP

Overview:

When interest rates rise, fixed-rate bond prices move lower and vice versa. The longer the rate on an investment is fixed, the more its price moves with changes in interest rates. For bonds, how much a price changes is driven by how long the investment is fixed for.

What is bond duration?

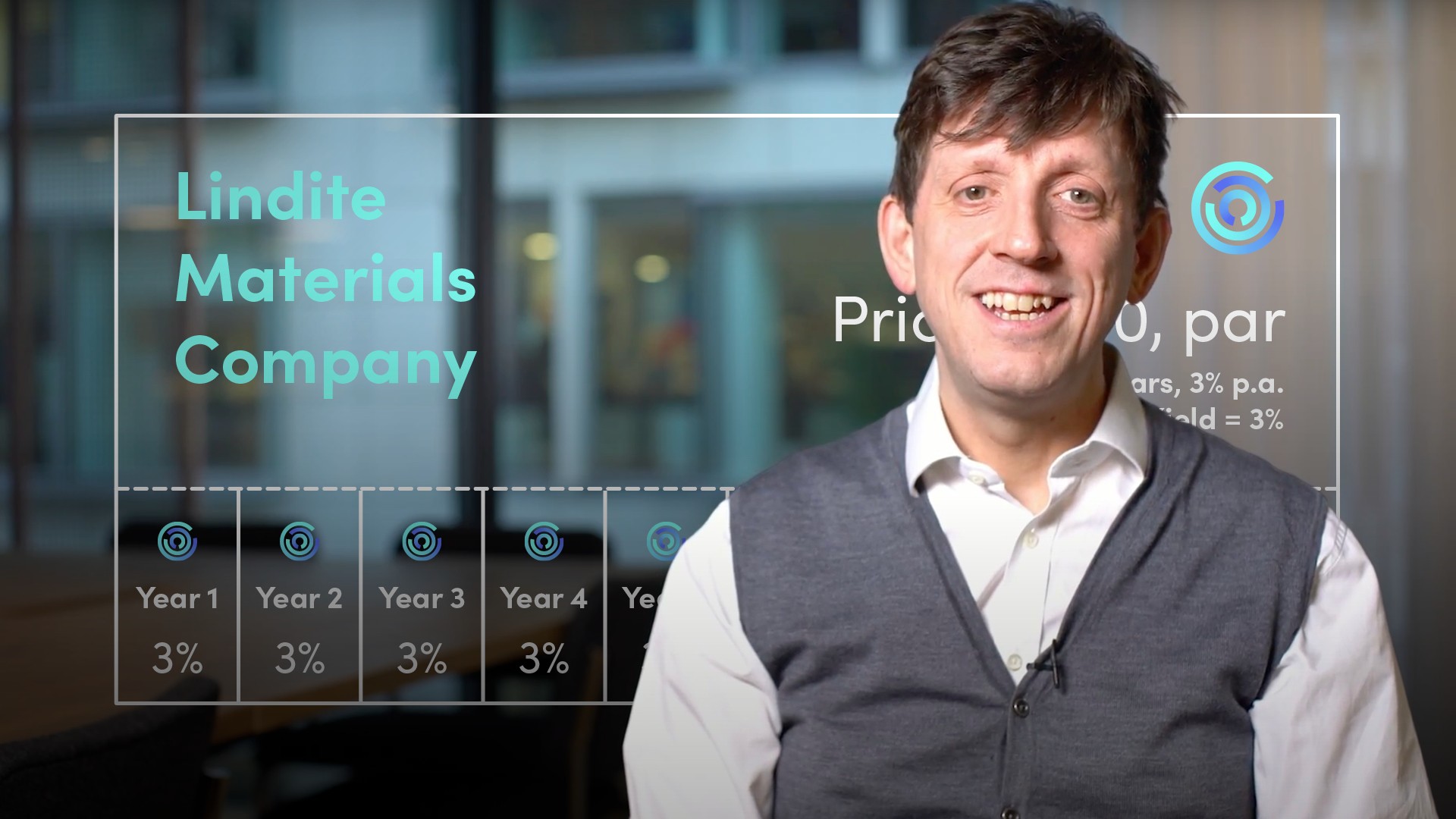

When interest rates rise, fixed-rate bond prices move lower and vice versa. The longer the rate on an investment is fixed, the more its price moves with changes in interest rates. For bonds, the extent of price change is driven by how long the investment is fixed for, taking into account the large payment at maturity and the intervening coupon cash flows. A five-year bond pays most of its return at the five year point, but there are also coupons paid in between. This means that the cash flows are fixed for less than five years on average, perhaps 4.7 years. The measure of how long the cash flows of a bond are fixed for is called the bond’s duration. A five-year bond has a five-year maturity but a 4.7-year duration.How do you calculate the price difference of a bond given a 1bp change in yield?

The yield on a five-year bond with a 2% coupon trading at a price of 100 is equal to the coupon. If interest rates rise, causing the yield to go up to 2.01%, a bond paying 2.01% is now worth 100. So a bond paying only 2% is worth 0.0471 less i.e. 99.953. This is the result of discounting back 0.01% every year for five years at 2.01%. A 1bp change in yield has led to a 4.7bp change in price. The price change is the same as the duration of a five-year bond. The sensitivity of the price of the bond to changes in interest rates is driven by how long the rates are fixed for.What is PVBP?

The sensitivity of the value of the 10-year bond to a 1bp change in yield is higher than it is on a five-year bond. The term for how much a bond price changes for a 1bp change in yield is the Price Value of a Basis Point (PVBP). In the US, it is referred to as DV01 –dollar value of 01 (a basis point). PVBP can be thought of as the slope of a line that relates price and yield. The slope for the 10 year bond is greater than the slope of the five-year bond. The slope of a 30 year bond would be even greater, and the slope of a one-year bond would be even lower. PVBP is very closely related to, but not exactly the same as duration.

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"