Discounting Cash Flow Exercises

Lindsey Matthews

30 years: Risk management & derivatives trading

In this video, Lindsey will run through 4 questions related to the topics he has discussed in the fixed income unlocked series.

In this video, Lindsey will run through 4 questions related to the topics he has discussed in the fixed income unlocked series.

Discounting Cash Flow Exercises

8 mins 47 secs

Key learning objectives:

Identify the formula used to discount future cash flows

Applications of the formula

Overview:

This video is a series of questions to test your knowledge on PV calculations.

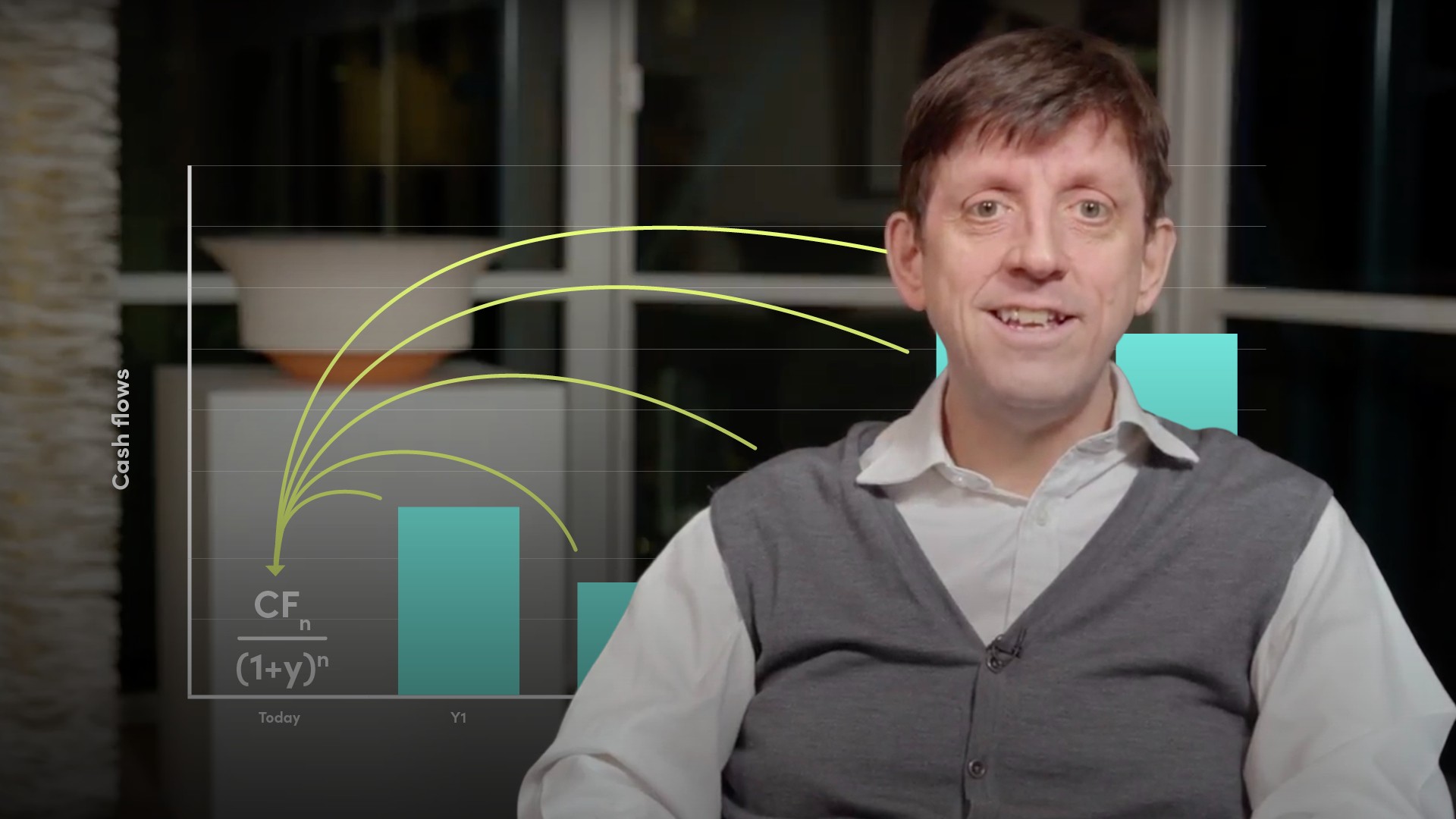

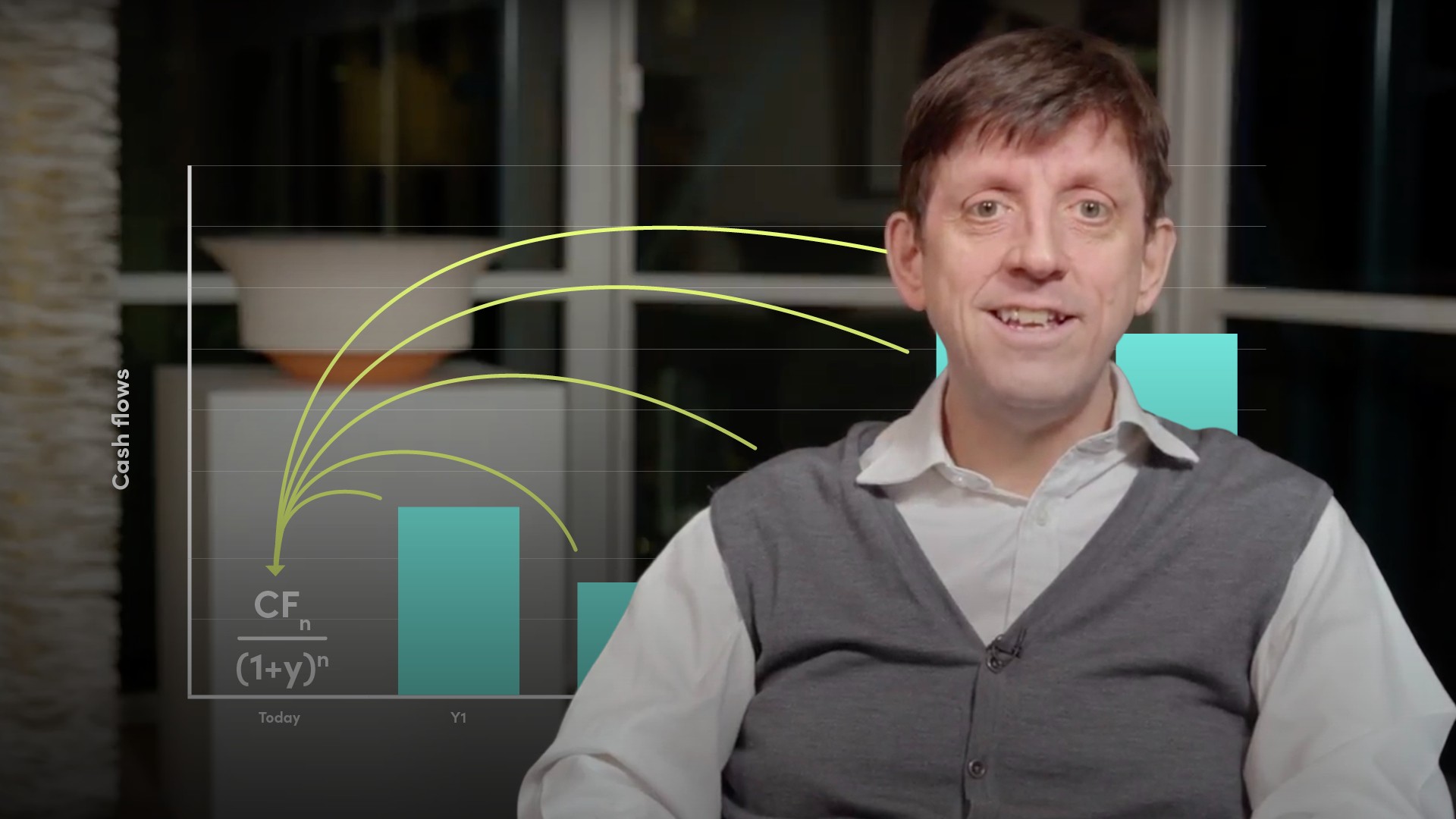

How do we discount future cash flows, at the current yield?

Present value formula outlined below:

PV = CF1/(1+y) + CF2/(1+y)2 + CF3/(1+y)3 + ... + CFn/(1+y)n

What amount would we need to invest today, at the current yield, in order to generate that cashflow at that point in the future?

Question 1: A zero coupon bond pays 100 in 1 year. At a yield of 3% for the year, what is the price today?

Hint: you just need the first term of the formula - PV = CF1/(1+y)

Question 2: A 2 year bond pays a coupon 4, annually, and 100 at maturity. It is trading at a yield of 3%, what is its price?

Hint: use the first two terms of the formula : PV = CF1/(1+y) + CF2/(1+y)2Question 3: Estimate what you think a 4 year bond, paying a 4% coupon, priced at 3% yield is worth.

Hint: 1 every year for 4 years, discounted.Use the following formula: PV = CF1/(1+y) + CF2/(1+y)2 + CF3/(1+y)3 + CF4/(1+y)4

Question 4: A bond pays a coupon of 4% semi-annually - assume 2 every half year. And it is priced at a yield of 3% - or 1.5% for every half year. What is the value of the bond discounted at this yield?

Hint:| Year | Cashflow | Discount Factor | PV |

| 0.5 | |||

| 1 | |||

| 1.5 | |||

| 2 | |||

| 2.5 | |||

| 3 | |||

| 3.5 | |||

| 4 |

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"