Floating Rate Notes

Lindsey Matthews

30 years: Risk management & derivatives trading

In this video, Lindsey moves away from explaining fixed rate investments and discusses floating rate notes, or FRNs, which issues a coupon based on a moving interest rate.

In this video, Lindsey moves away from explaining fixed rate investments and discusses floating rate notes, or FRNs, which issues a coupon based on a moving interest rate.

Floating Rate Notes

6 mins 10 secs

Key learning objectives:

Define floating rate notes (FRNs)

Understand when interest is paid on a typical 5-year FRN

Understand why the floating rate note has very little interest rate risk

Overview:

Floating rate notes are essentially long-dated instruments, where the investor is repaid principal at the final maturity and receives a periodic coupon which changes with interest rate levels. It is also worth noting, FRNs are less susceptible to interest rate risk.

What are floating rate notes (FRNs)?

These are long-dated instruments, where the investor is repaid principal at the final maturity and receives a periodic coupon which varies with the level of interest rates.When is the interest paid on a typical 5-year FRN?

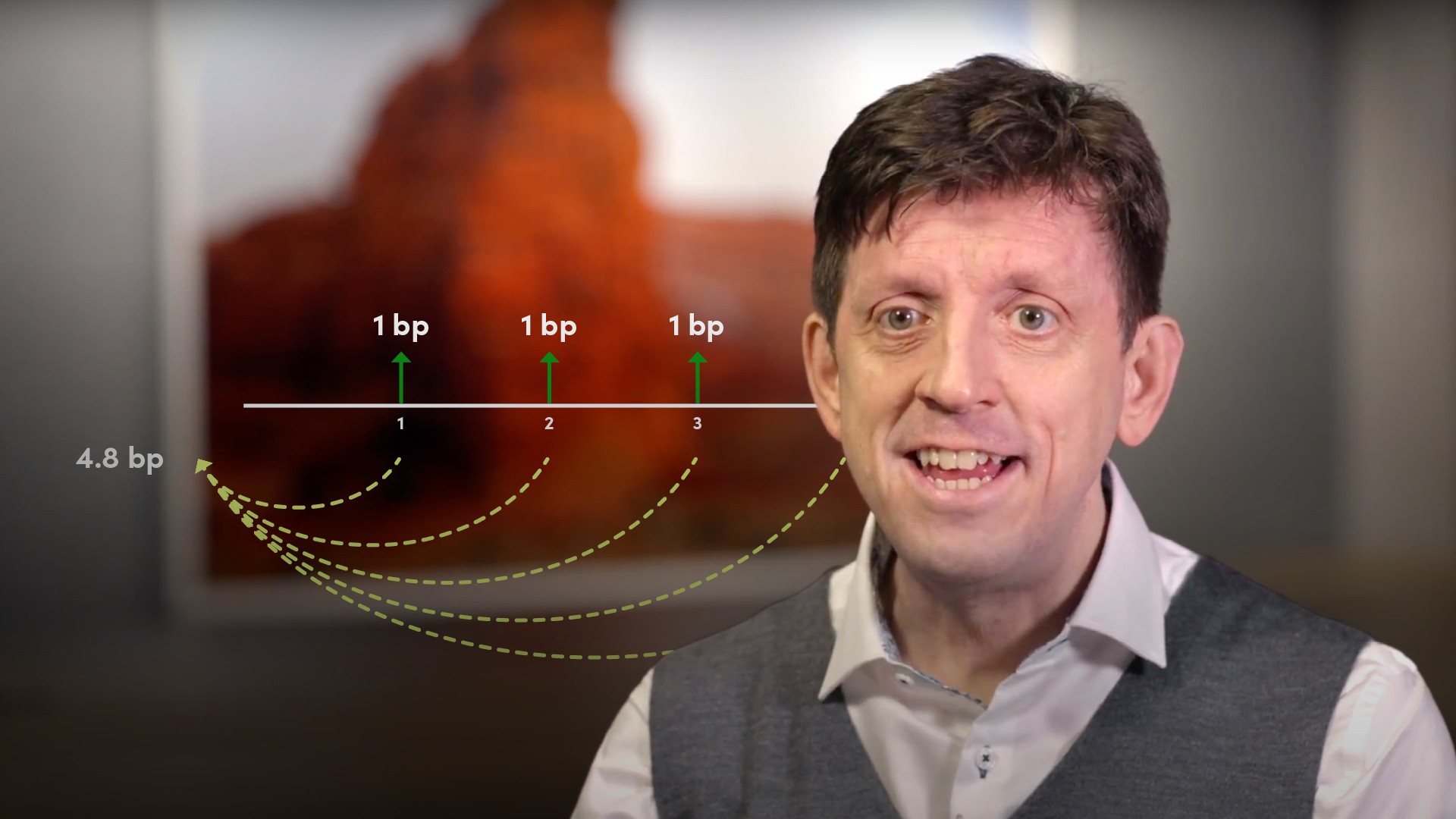

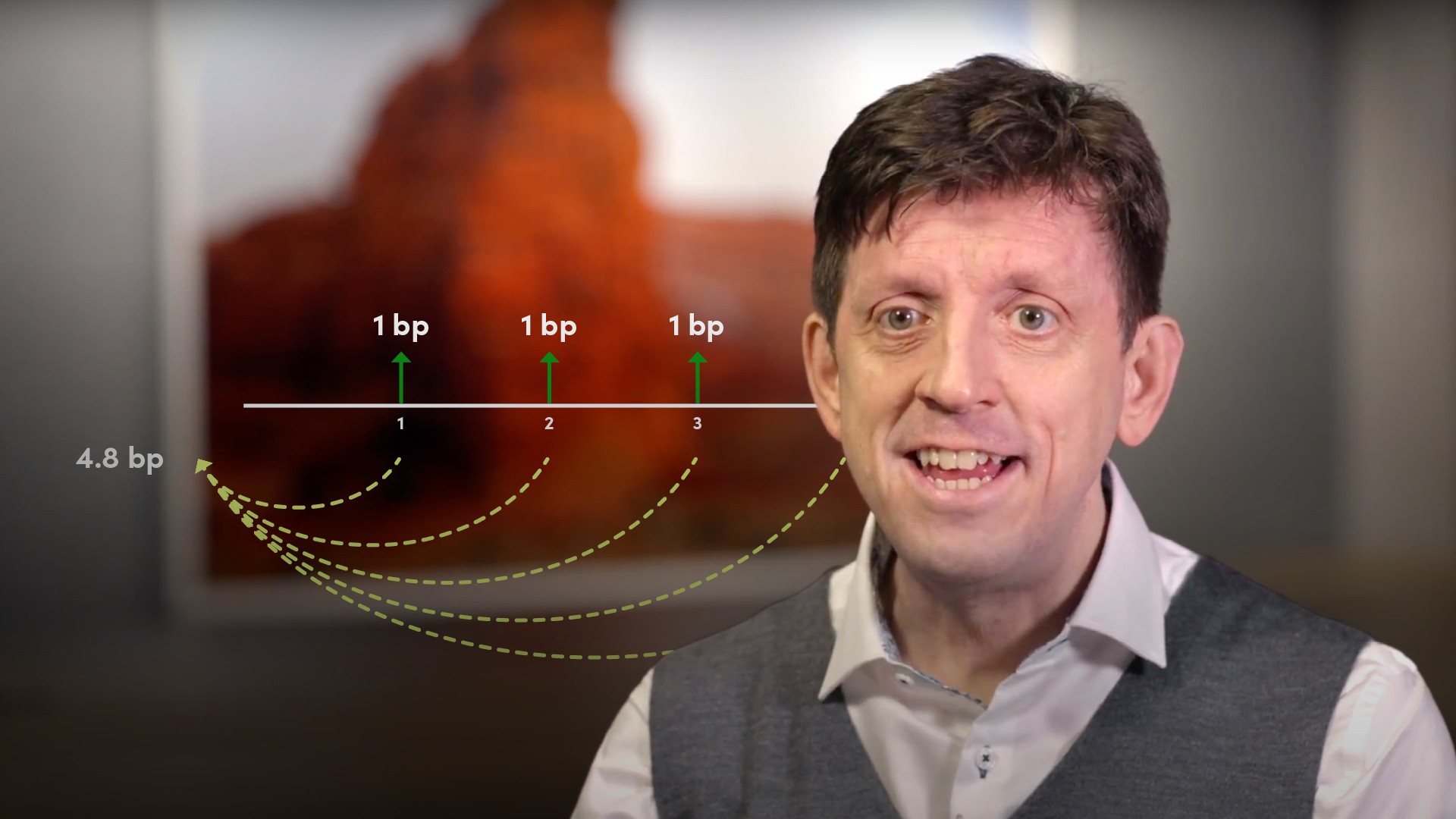

A typical FRN might be a 5-year instrument which pays, for example 3mo LIBOR plus 90 basis points. Every 3 months, the 3month LIBOR rate is observed and 90 basis points are added to it. This then becomes the rate at which interest accrued for the next three months and is paid at the end of that period.When are the coupons paid?

When the floating rate note is first issued, the future coupons are not known. The first coupon is set at the start of the note, and then each of the coupons is fixed in turn, as time passes.How does the sensitivity of the FRN change in relation to interest rates?

A 5-year FRN gives the investor an investment that lasts for 5 years, however, if it is only fixed for the first 3 months, then the duration is 1/4 of a year and the rate sensitivity will be driven by this. A 1bp change in rates will cause the value to move by approximately quarter of a basis point.Why does the floating rate note have very little interest rate risk?

In the LIBOR world, as long as the LIBOR rate has not been fixed, the future value factor and the discount factor cancel each other out. On our FRN, we have locked in a spread of 90bp for 5 years. Thus, any movement in spreads will cause the value of the FRN to change. A 1bp move in spreads will be worth approximately 4.7bp upfront.

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"