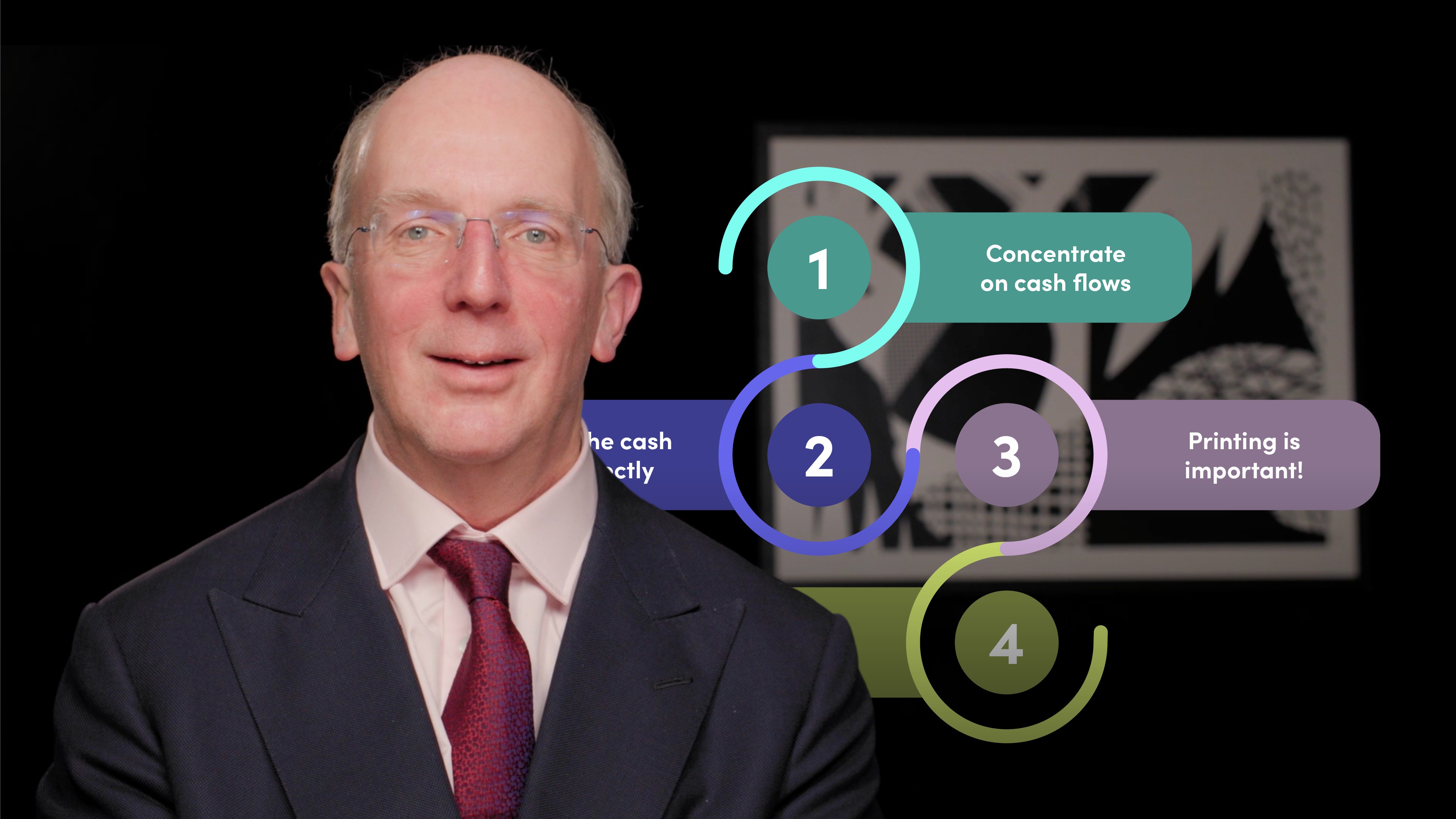

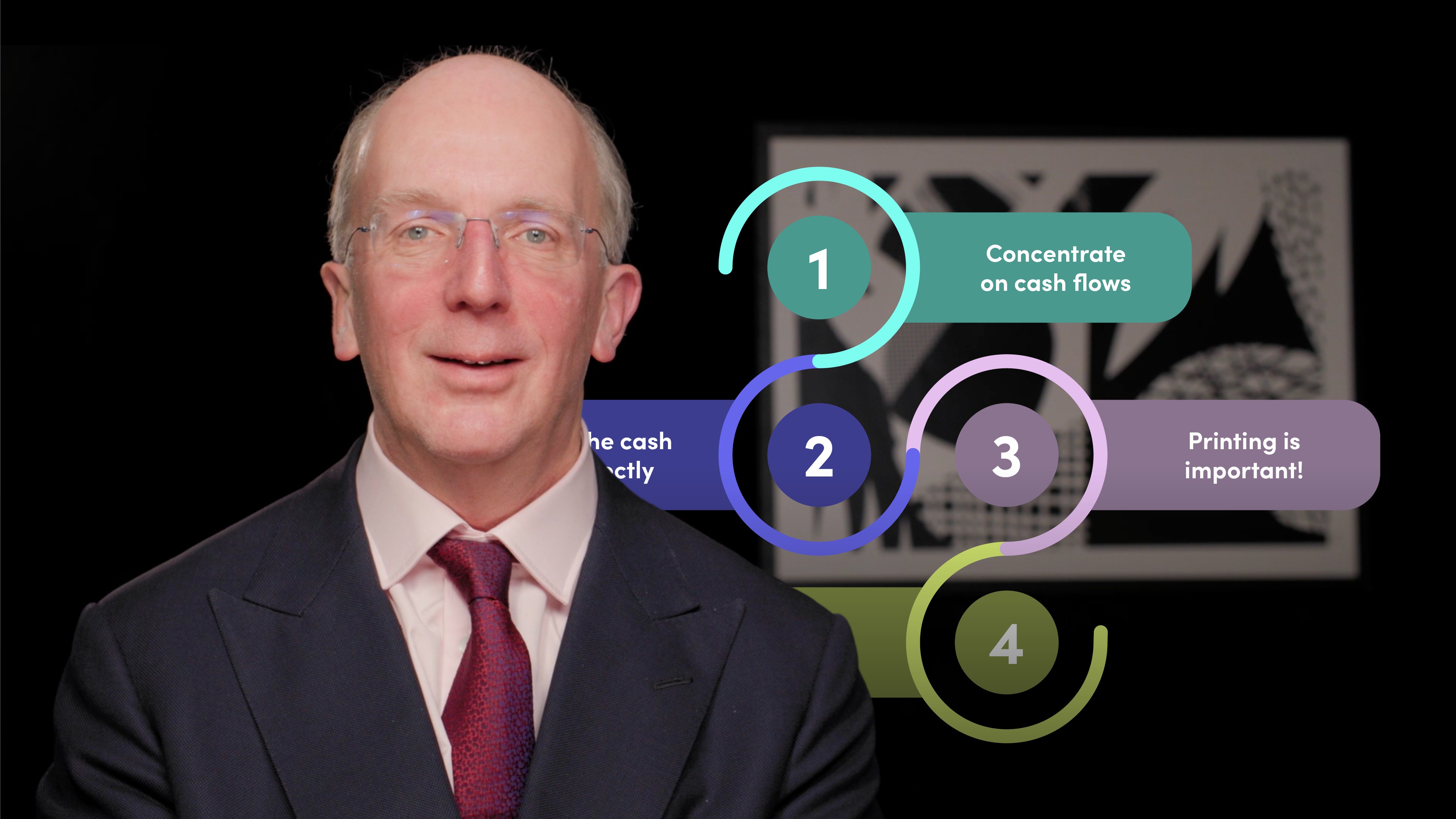

Four Key Tips to Build an Effective Financial Model

David Colver

30 years: Financial modelling

In this video, David explains some good practice methods for making the story that these models tell as effective as possible, with a key focus on cash flows.

In this video, David explains some good practice methods for making the story that these models tell as effective as possible, with a key focus on cash flows.

Four Key Tips to Build an Effective Financial Model

9 mins 29 secs

Key learning objectives:

Learn how to effectively tell a story through cash flows

Learn how to present cash flows directly

Understand how to present a model in a digestible way

Overview:

For financial modelling to be effective, it must be clearly understood by all stakeholders involved. David outlines four steps to ensuring that financial models are clear, decluttered of any unnecessary information and accessible to all. He sums up why cash flows are one of the most important elements to any financial model and why small details such as printing format can make or break a project.

Why is it important to concentrate on cash flows in a financial model?

The central character in the storytelling role of a project is its cash flows. The cash flow prompts three key questions:

- How much money gets made?

- Where does it come from?

- Where does it go, and in what priority order?

These are the questions that people want to understand the answers to. Inputting cash flow centre stage, project finance is quite different from most other branches of finance.

What are the three financial statements that are present in the annual accounts of businesses of all sizes?

- The income statement - used to be called the profit and loss account

- The statement of financial position - used to be called the balance sheet

- The statement of cash flows

Why is a non-traditional direct presentation of a cash flow beneficial?

Cash flows can either be presented directly (non-standard) or indirectly (standard). A direct cash flow is preferred. Starting with revenue and deducting costs, first the ones that vary with revenue, then the ones that are more nearly fixed, and then deduct capital costs, taxes and financing.

There might be some people involved in the project who have accountancy backgrounds and who are much more comfortable with what for them is the conventional cash flow presentation. If a spreadsheet model provides a direct cash flow, it can easily be extended to deliver an indirect one.

Why does good printed output and presentation style matter?

Financial models must be easily accessible and readable to people who spend their days reading spreadsheets and equally, those who don’t. The people reading the financial model will have a wide range of excel literacy. The cash flow must fit neatly onto one page and the financial model must be formatted so that it prints out correctly. Clients do not want to be in a situation where hundreds of sheets are produced by the printer with only a few numbers on each.

How can a spreadsheet be effectively ‘decluttered’?

If a model is to tell an effective story, then the numbers need to be laid out in a way that is lean and devoid of clutter.This means the removal of figures with too many digits. A balance sheet in which some of the numbers have eight significant figures can be hard to read. It is important to scale output in millions or billions so that there are just two, three or four digits visible for most of the numbers on the page. Other forms of clutter could include showing figures with too much labelling.

David Colver

There are no available Videos from "David Colver"