Free Cash Flow Valuation

Sarah Martin

30 years: Corporate Valuations

In this video, Sarah Martin explains the free cash flow perpetuity model and the key value driver formula. She breaks down how we arrive at the key value driver formula, which underpins all valuations.

In this video, Sarah Martin explains the free cash flow perpetuity model and the key value driver formula. She breaks down how we arrive at the key value driver formula, which underpins all valuations.

Free Cash Flow Valuation

10 mins 20 secs

Key learning objectives:

Understand the free cash flow perpetuity model

Understand the key value driver formula

Understand the application of the key value driver formula to calculate valuations

Overview:

One of the most widely used techniques in corporate valuation is the free cash flow perpetuity model. The key value driver formula in turn uses the 4 key variables to arrive at an underlying valuation. These variables include forecast level of earnings (OPAT), growth rate, return on invested capital (ROIC) and risk rate(WACC). It is important to understand how this formula is derived and applied to obtain valuations.

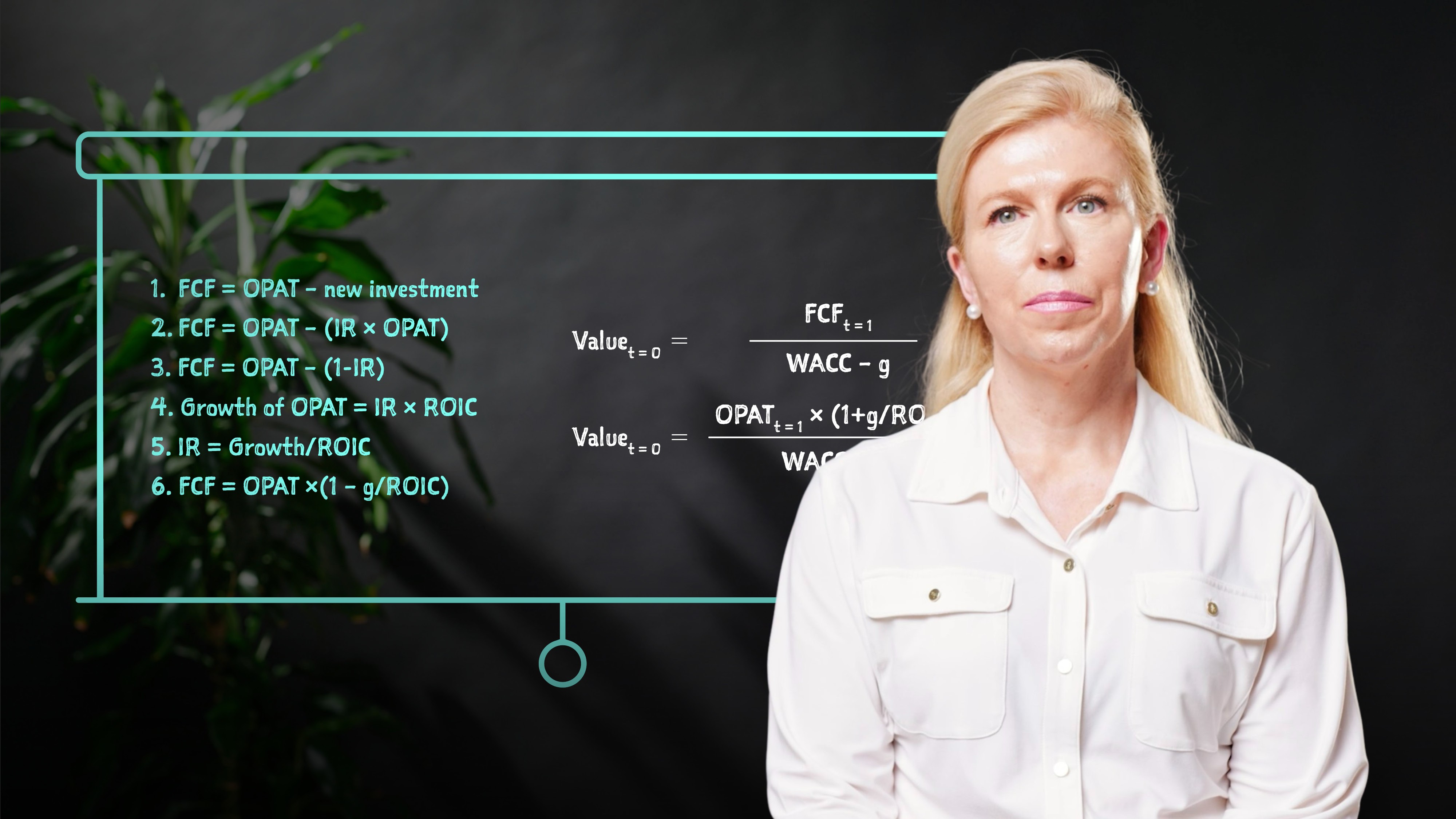

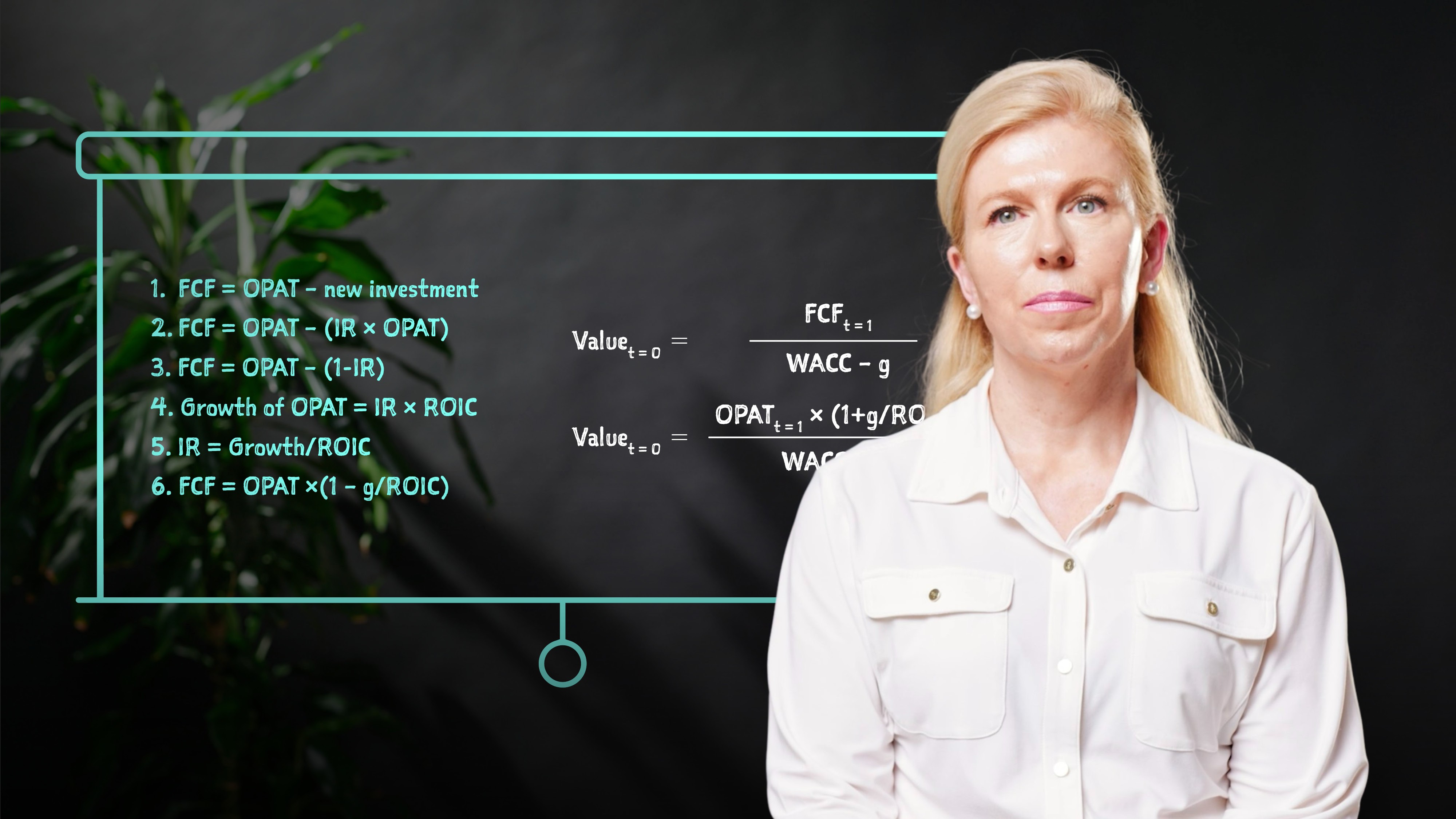

What is free cash flow?

When investors buy shares in a firm, they are buying the future cash flows into perpetuity and here, this refers to the operating cash flows generated by the firm after capital spending, tax and net working capital changes but before finance charges. This is also referred to as unlevered free cash flow (FCF)

Free cash flow formula:

In a simple scenario, where the forecast growth rate is zero, the valuation is just the forecast cash flow divided by the risk rate as shown:

$$NPV (t) = \frac{FCF(t+1) }{WACC}$$

If the rate of growth is g, then the formula for today’s value:

$$NPV (t) = \frac{FCF(t+1) }{WACC - g}$$

This formula only works if the outlook is for a constant growth rate value in the final year of our forecasts and it also does not work if the WACC is higher than the growth.

What is the key value driver formula?

We can re-express the free cash flow perpetuity formula into a second formula called the key value driver formula, as shown below:

$$ NPV (t) = \frac{OPAT(t+1) \times (1 - g / ROIC)}{WACC - g} $$

It directly expresses the 4 key variables that drive all valuations:

- Level of earnings (OPAT)

- Growth outlook (g)

- Risk rate (WACC)

- Return on invested capital (ROIC)

Valuations benefit from high absolute earnings, higher growth, higher ROIC and lower WACC. Equally, valuations will be lower if absolute earnings are lower, growth is low or negative, ROIC is low or negative and WACC is high.

This is a summary formula and assumes that growth and ROIC are constant every year. In real life, this means the formula is best suited to mature firms with steady operations and not suitable for a new or volatile firm.

Sarah Martin

There are no available Videos from "Sarah Martin"