Self-Funding the Bank Balance Sheet

Moorad Choudhry

35 years: Banking and Capital Markets

The basic business of banking involves advancing loans to customers and accepting deposits from customers. Moorad covers the basic concept of bank self-funding, which is underpinned by the fundamental premise that a bank must actually fund itself, not print money, in order to lend.

The basic business of banking involves advancing loans to customers and accepting deposits from customers. Moorad covers the basic concept of bank self-funding, which is underpinned by the fundamental premise that a bank must actually fund itself, not print money, in order to lend.

Self-Funding the Bank Balance Sheet

3 mins 26 secs

Key learning objectives:

Understand how the bank ensures the balance sheet balances

Outline the three sources banks can use to raise funds

Understand what happens if a bank cannot raise funds from these sources

Overview:

A bank cannot simply print or create its own money in order to lend money. It must actually fund itself in order to lend. Funding the balance sheet requires that a bank has in place a source for obtaining the funds. This can come through three sources; its own funds, its customer's deposits or the wholesale market.

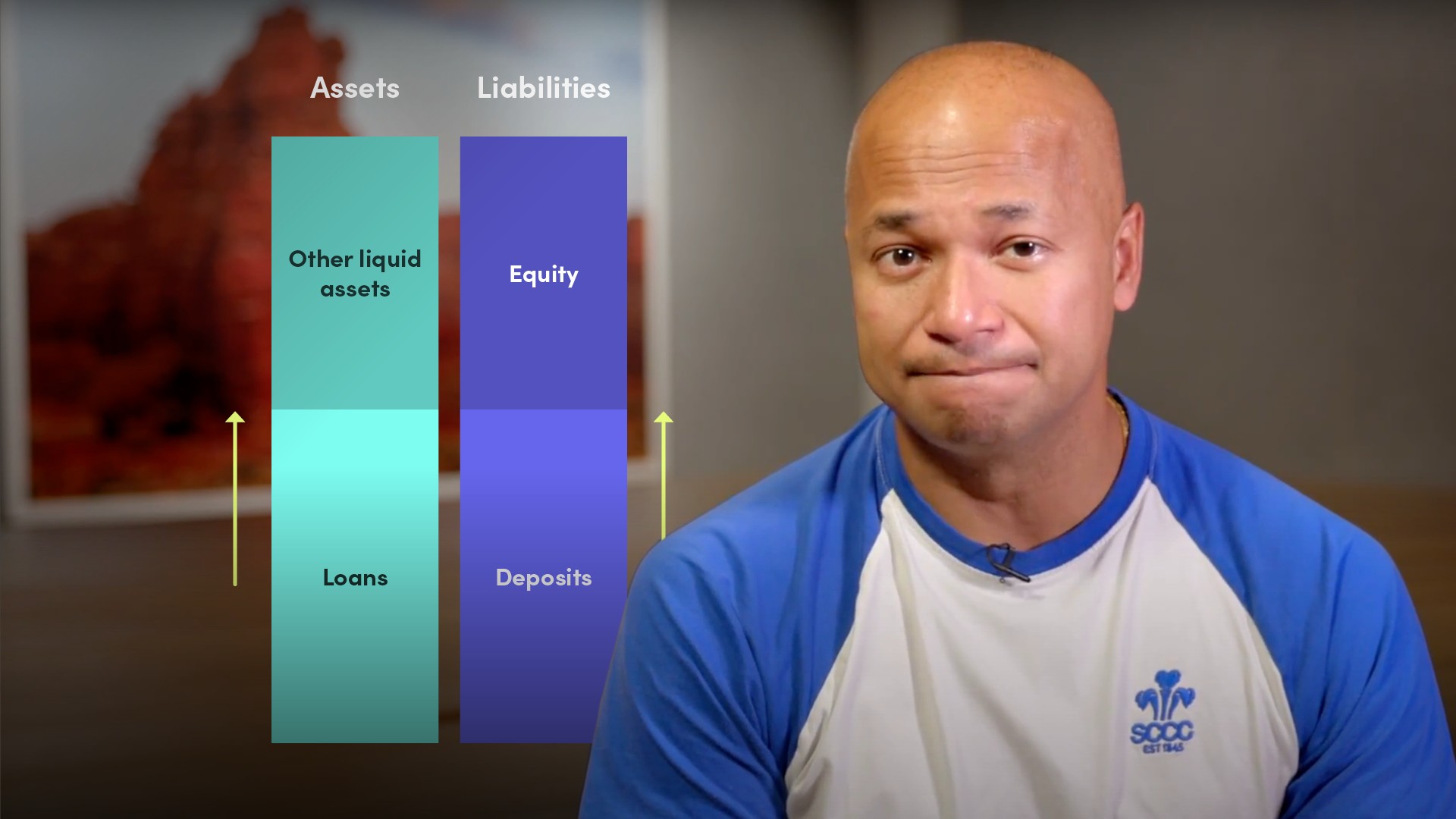

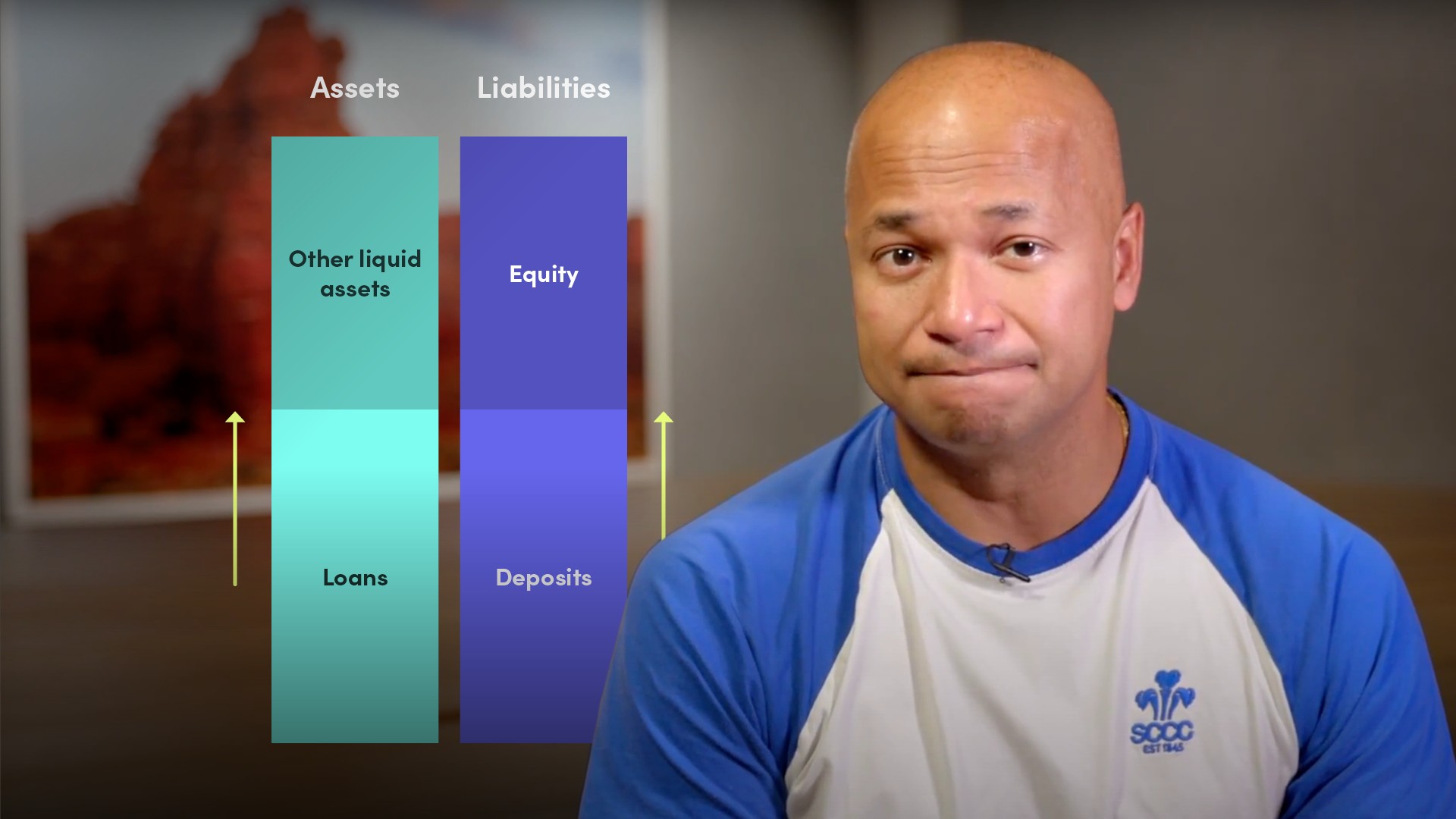

In a nutshell, what does a bank’s balance sheet consist of?

The basic business of banking involves advancing loans to customers and accepting deposits from customers. This together with the bank’s own shareholders’ equity and its portfolio of risk-free liquid assets represents the bank’s balance sheet.

What is fractional reserve banking?

The concept of fractional reserve banking is that a loan is self-funded; every time that a bank advances a loan, it “creates” a deposit of equal notional value alongside it. Thus, the balance sheet balances.

How does the bank ensure the balance sheet balances?

A bank creates a double-entry in its general ledger, so that a £100 loan is simultaneously “balanced” with a £100 deposit, but nevertheless, the bank has to find that £100 itself. It must obtain that £100 from somewhere else in order to be able to fund the £100 loan it has made. It cannot simply create £100 and then lend it on to a borrower.

In order to fund the loan advance, through what sources can the £100 come from?

- Its own funds, that is, shareholders’ equity. Generally, except for start-up banks, it is not considered good practice to invest one’s own funds in credit-risky assets such as customer loans.

- Its customers’ deposits.

- The wholesale market. This will be funds raised either from other banks; or from capital market investors.

What happens if a bank cannot raise funds from these sources?

If a bank seeks to make a loan and can’t fund it from any of these sources, then it will not be able to make the loan. In other words, it won’t be able to advance the loan monies to the borrower.

Moorad Choudhry

There are no available Videos from "Moorad Choudhry"