Funds Transfer Pricing and Term Liquidity Premium

Moorad Choudhry

35 years: Banking and Capital Markets

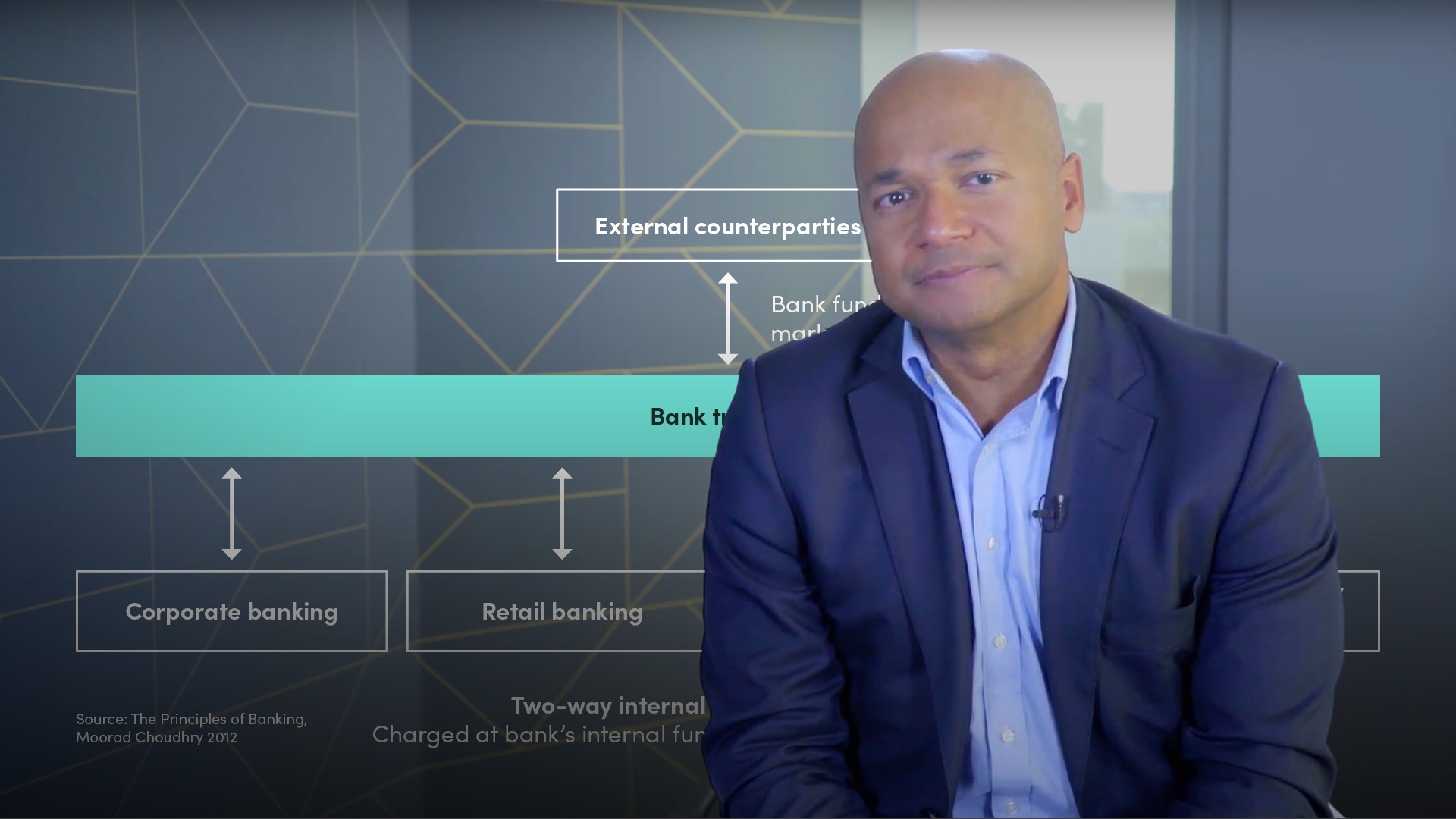

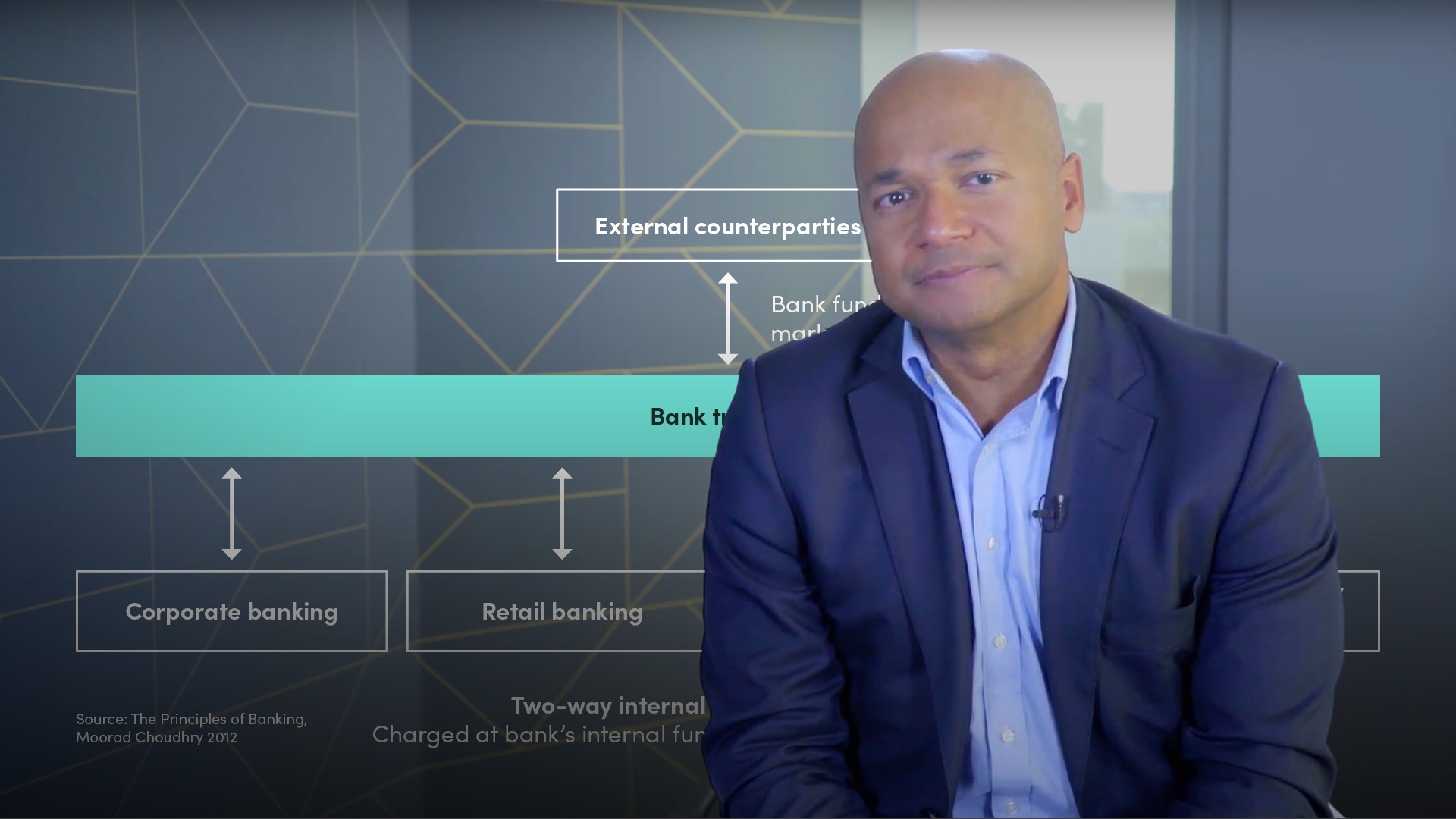

In this video, Moorad describes how banks measure and control their internal costs and allocation of funding, including the critical role played by a bank's treasury department.

In this video, Moorad describes how banks measure and control their internal costs and allocation of funding, including the critical role played by a bank's treasury department.

Funds Transfer Pricing and Term Liquidity Premium

16 mins 59 secs

Key learning objectives:

Define Fund Transfer Pricing

Learn about who operates the FTP and how it is managed

Discuss the rate that should be used to calculate FTP

Understand how FTP should be presented and visualised

Overview:

Funds Transfer Pricing is performed by the treasury desk of a bank. It is used to estimate the overall profitability of a company and its individual business lines. There are many different ways to calculate this funding rate and should be applied to companies on an independent basis.

What is the Background of FTP?

There is a wide variety to be observed in FTP systems across banks. Different banks use FTP to achieve different objectives. In some banks, the “purist” approach is followed, and FTP is used to apply the cost of term liquidity premium risk to the bank’s customer lending rate, while other banks use it more as an internal accounting tool, where profit is “transferred” across profit centres. Applied correctly, Funds Transfer Pricing is a key element in a bank’s liquidity risk management framework.

Bank internal funds pricing mechanism is also called funds transfer pricing (FTP), firm liquidity pricing (FLP), liquidity transfer pricing (LTP) or term liquidity premium (TLP). Although these terms are not strictly synonymous, it’s typically operated by the bank’s Treasury function. The Treasury is also responsible for external balance sheet liquidity risk management, as well as interest rate risk. FTP is the price at which an individual business line raises funds from its own Treasury desk, or which it earns on deposits placed with the Treasury. This is essential to the risk management process. Different asset types place different liquidity pressures on the Treasury funding desk, thereby demanding a structurally sound internal funding pricing policy that is appropriate to the type of business line being funded.

What are the objectives of the Bank Policy Standard?

A formal internal funding policy is necessary in order to make explicit to business lines the need for the bank to cover the cost of its liquidity risk exposure. The objectives of the policy are:

- To ensure consistent liquidity pricing behaviour amongst the business lines

- To remove interest rate risk, and if necessary FX risk, from business lines and centralise them in the Treasury function

- To include the bank’s cost of liquidity term premium in product pricing

What is the ‘Term Liquidity Premium’?

The principal debate concerns exactly what the Treasury is pricing when it sets the FTP. If one accepts that a bank undertakes maturity transformation in the ordinary course of business, then logic dictates that the FTP charge should be a term liquidity premium only. For example, the internal rate from Treasury to the Corporate Banking division looking to price a 5-year bullet corporate loan would be the 5-year TLP. The FTP would then equal: FTP = Short-term funding rate + TLP

While it is always important to ensure that the correct cost of liquidity is allowed for in the internal funding model, it needs to be set in line with commercial and practical reality. Banks operate in a competitive, supply and demand market, so the ultimate customer rate for loans and deposits is strongly influenced by the market, as opposed to the FTP rate.

How do we Calculate the ‘Term Liquidity Premium’?

The base case scenario would be for a bank to have access to the wholesale markets at Libor across the entire term structure. The starting point is the rate at which the bank can raise funds in the market. For a large bank, its primary issuance level will lie above the secondary market level.

Given an individual bank’s structure, it may choose to give higher weight to proxies. Since there is no explicit transparent rate for the term liquidity premium, a bank will have to exercise some judgment when setting the rate.

What is the FTP curve, and what does it tell us?

The actual internal funding curve template, be it the TLP or all-in FTP curve, should be included in the bank’s funding policy document and reviewed on a regular basis. The FTP rate structure should be presented as a curve. The FTP curve will state explicitly the rate paid or received by the business lines for assets and liabilities across the term structure. The final customer pricing would incorporate the cost of capital, the required margin and an add-on for customer credit risk.

Moorad Choudhry

There are no available Videos from "Moorad Choudhry"