What is the purpose of the all-in cost analysis?

A dynamic of convertibles, of course, is that the final outcome is not certain – and dependent primarily on the future share price of the issuer. If, after issuing a convertible bond the share price performs incredibly well, the issuer would, in retrospect, have been better off selling bonds and paying the bond coupon rather than having issued equity or equity options embedded in a convertible bonds at the cheap historical price. Conversely, if the share price performs very poorly and is unchanged, or indeed falls over the life of the convertible bond then the issuer would have been better off selling equity on day one instead rather than issuing bonds or convertibles and having paid the coupons associated with those instruments. To help visualise this, one technique is to try and show the investor return for convertibles compared with bonds and equities. This is done by considering the all-in cost of each instrument. To help with this, it is assumed that equity is bought back at the maturity of the bonds.

What is the difference between standard and mandatory convertibles?

If you consider a normal convertible, it is a debt security with a call option included. The issuer gets to reduce their ongoing cost of funds by selling optionality to investors, and this effectively subsidises the ongoing coupon cost. It also provides protection for investors. If the share price does not perform, then the convertible bond is fundamentally a debt security.

A mandatory convertible on the other hand puts no optionality in the hands of investors. It simply turns into equity at maturity. It therefore provides no significant share price downside protection.

How can the call spread overlay impact the conversion price of a convertible bond?

Investors in the convertible market often like to own what can be called a balanced convertible – one where the premium is not so high that the equity upside is unlikely, while still receiving some coupon. Simply put, the higher the conversion premium, the less valuable the embedded call option and so the resulting coupon is higher.

However, issuers may have a strong positive view on their likely future share price performance. How do we help issuers who have that positive view on their share price, but where we know that there isn’t such a deep market for such high premium instruments? We can do this synthetically, by raising the effective premium through equity derivative options struck behind the scenes between the issuer and the underwriters.

What is net share settled convertibles?

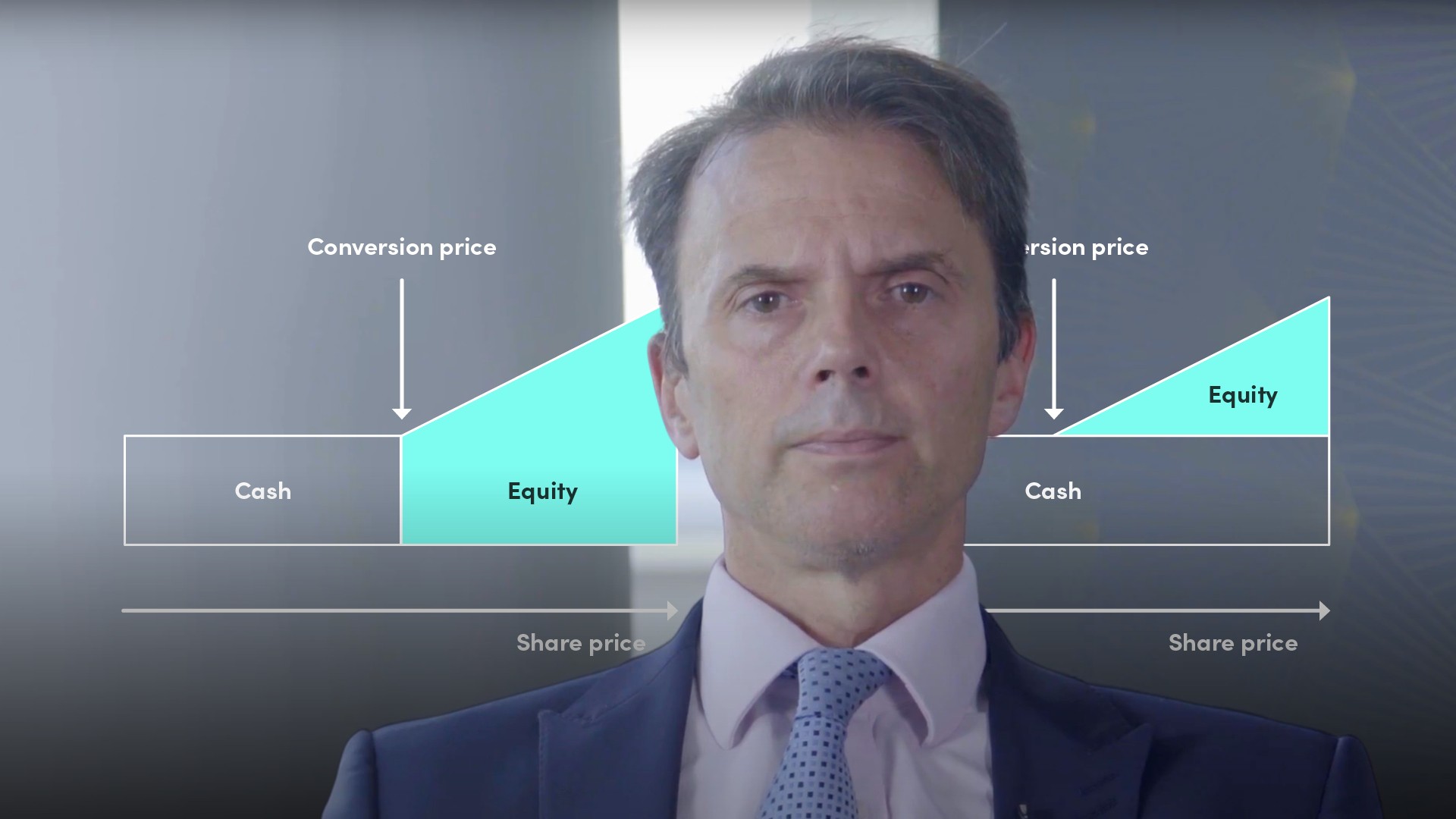

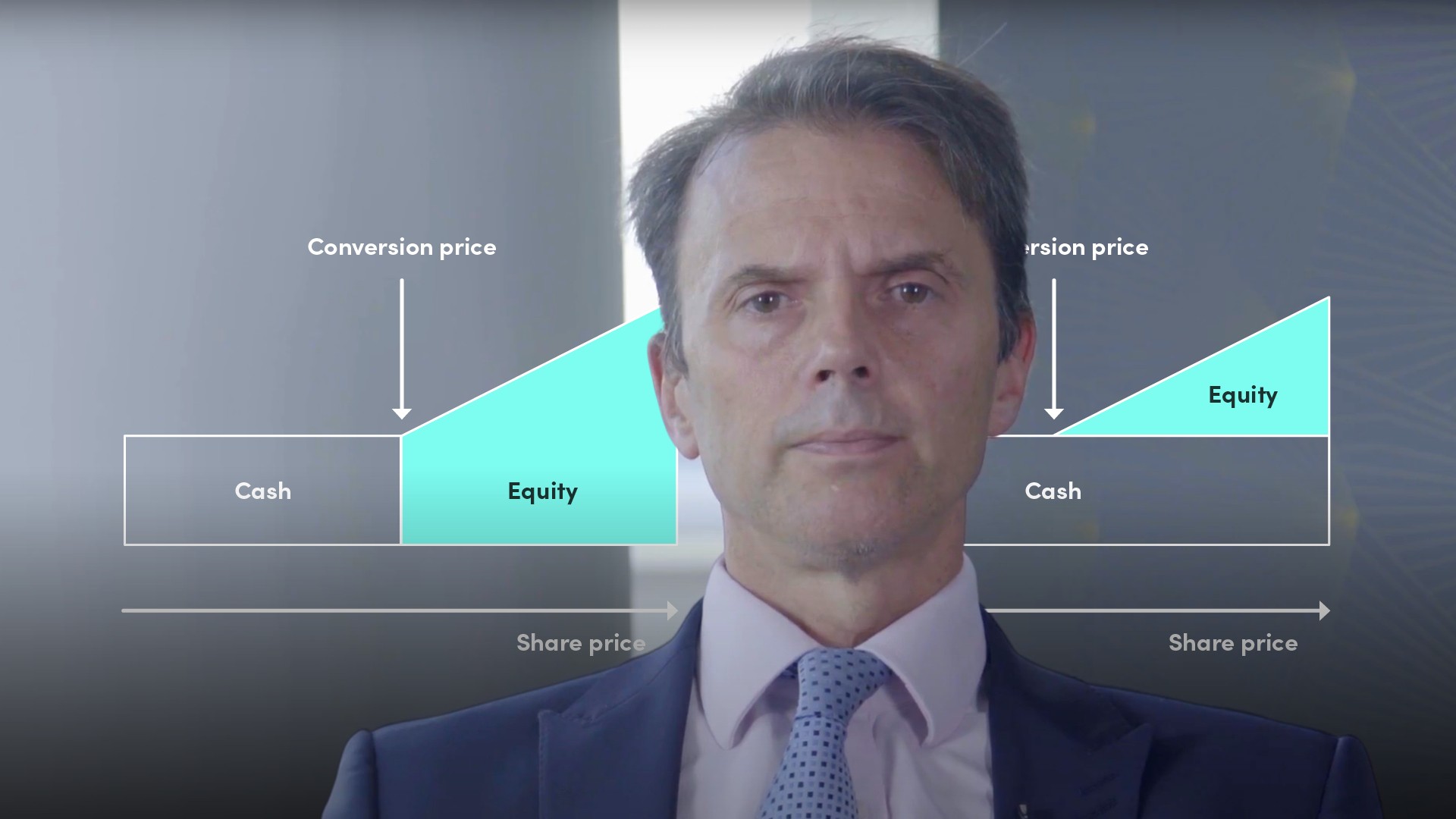

Another feature of convertibles that some issuers wish to vary is the transition at the conversion price from 100% debt to 100% equity. This can create uncertainty around the capital structure, although it can be somewhat mitigated through issuer call options during the life of the instrument. Net share settlement makes the cash-flows underpinning the convertible behave more like debt at maturity. With this structure, the issuer always repays the original principal amount in cash, like a normal bond, and only the value of shares above the conversion price is settled in equity.

How does the investor base of convertible bonds change depending on share price?

Once issued, the profile of the convertible bond is constantly changing depending mostly on share price, but also credit spread, time to maturity, and other factors like changes to dividend policies and stock volatility. If the share price rises, the instrument becomes more like equity. On the downside, if the share price falls well below the conversion price the value of the instrument is determined by the bond floor, and share price movements have little impact.

During the life of a convertible bond, not only does the delta change and the characteristics of the convertible, but potentially also the investor base. For instance, when the share price trades up a lot, then it is attractive to equity income funds rather than the original outright convertible funds. And similarly, if the share price falls, the instrument might be purchased by bond funds. The two largest groups though are hedge funds and convertible outright or long only funds. These two groups can have quite different perspectives on the product.

How do investors calculate the risk/reward payoff in a convertible bond?

One of the key features that outright investors will consider in a bond is the risk/reward payoff. One method to consider is how much the convertible bond pays over the life relative to the underlying equity, also known as the payback time. Looking at the convertible simply as an equity investment, then you are paying a premium over their share price while also receiving a coupon that is above the dividend yield. Payback is the time it takes for the extra coupon, in years, to compensate for the premium.

How do hedged investors manage their risk/return profiles?

Hedge funds can take a very broad approach to investing and customise their risk/return profile to their investment views. They often try and generate returns regardless of share price direction and seek to control risks they feel uncomfortable owning. Hedge funds can follow many different strategies given the hybrid nature of convertibles. Some typical examples include volatility trading, income advantage and fixed income/credit play.