Clearing House Initial and Variation Margins

Abdulla Javeri

30 years: Financial markets trader

In the final video, Abdulla discusses a prominent characteristic of exchanges in that they use clearing houses to act as a central counterparty for all transactions. A Clearing House guarantees the performance of futures and options contracts traded on its associated exchange. And secondly, to protect itself from the risk of default it operates a margining system.

In the final video, Abdulla discusses a prominent characteristic of exchanges in that they use clearing houses to act as a central counterparty for all transactions. A Clearing House guarantees the performance of futures and options contracts traded on its associated exchange. And secondly, to protect itself from the risk of default it operates a margining system.

Clearing House Initial and Variation Margins

6 mins 13 secs

Key learning objectives:

Describe a clearing house and its main functions

Outline the types of margins applied to contracts

Outline the benefits of posting an initial margin

Understand what happens when a clearing member fails to meet any of its margin obligations

Overview:

Clearing Houses are firms that provide various services to derivatives and stock exchanges. Clearing Houses ‘clear’ trades on exchanges, in other words they handle most of the administrative processes of transactions, including confirmation and matching, post trade position keeping and oversee parts of the delivery and settlement processes.

What is a clearing house, and what are their main functions?

- Perhaps their main function is to act as central counterparty in every transaction conducted on an exchange. In other words, buyer to very seller and seller to every buyer

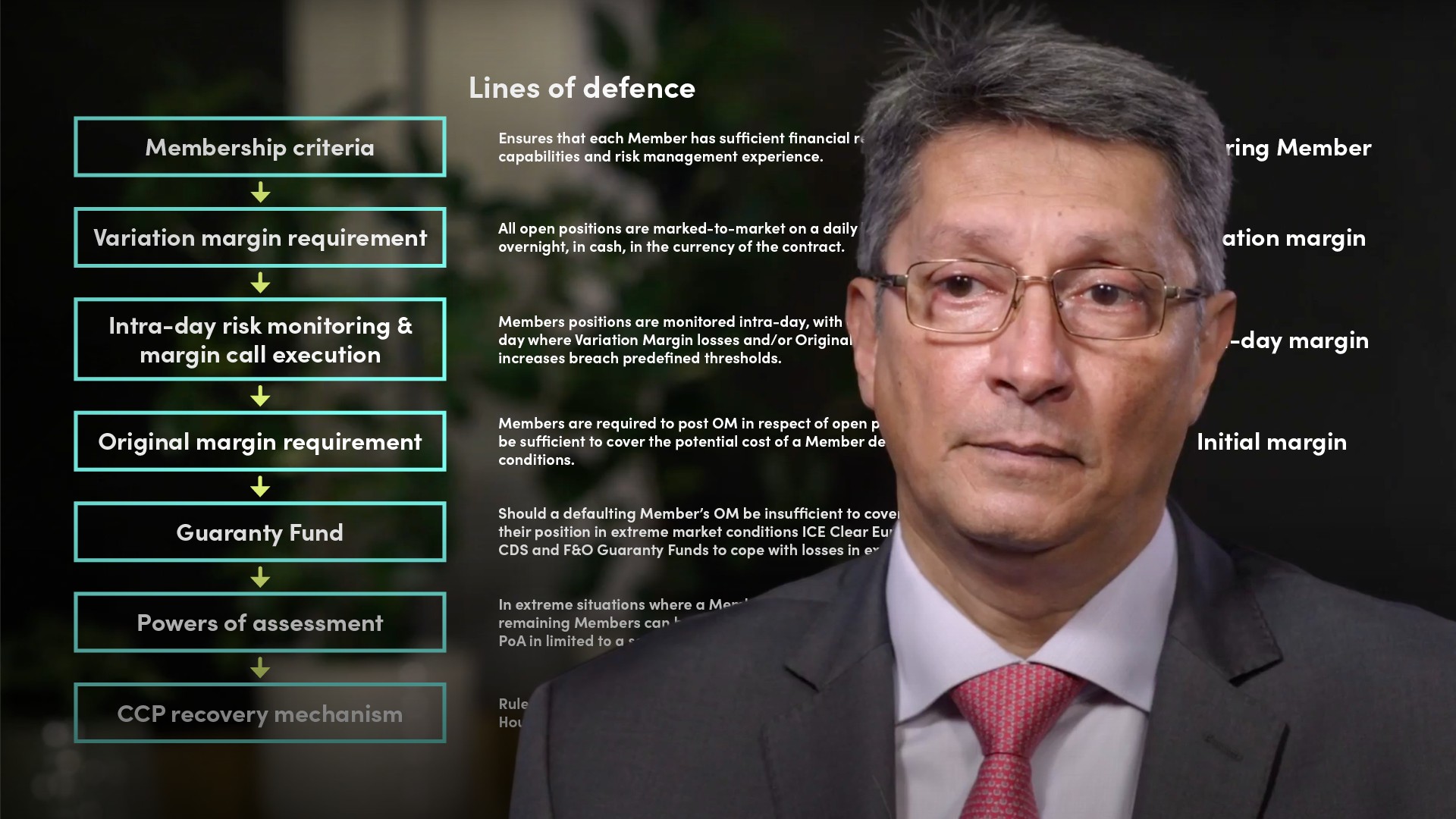

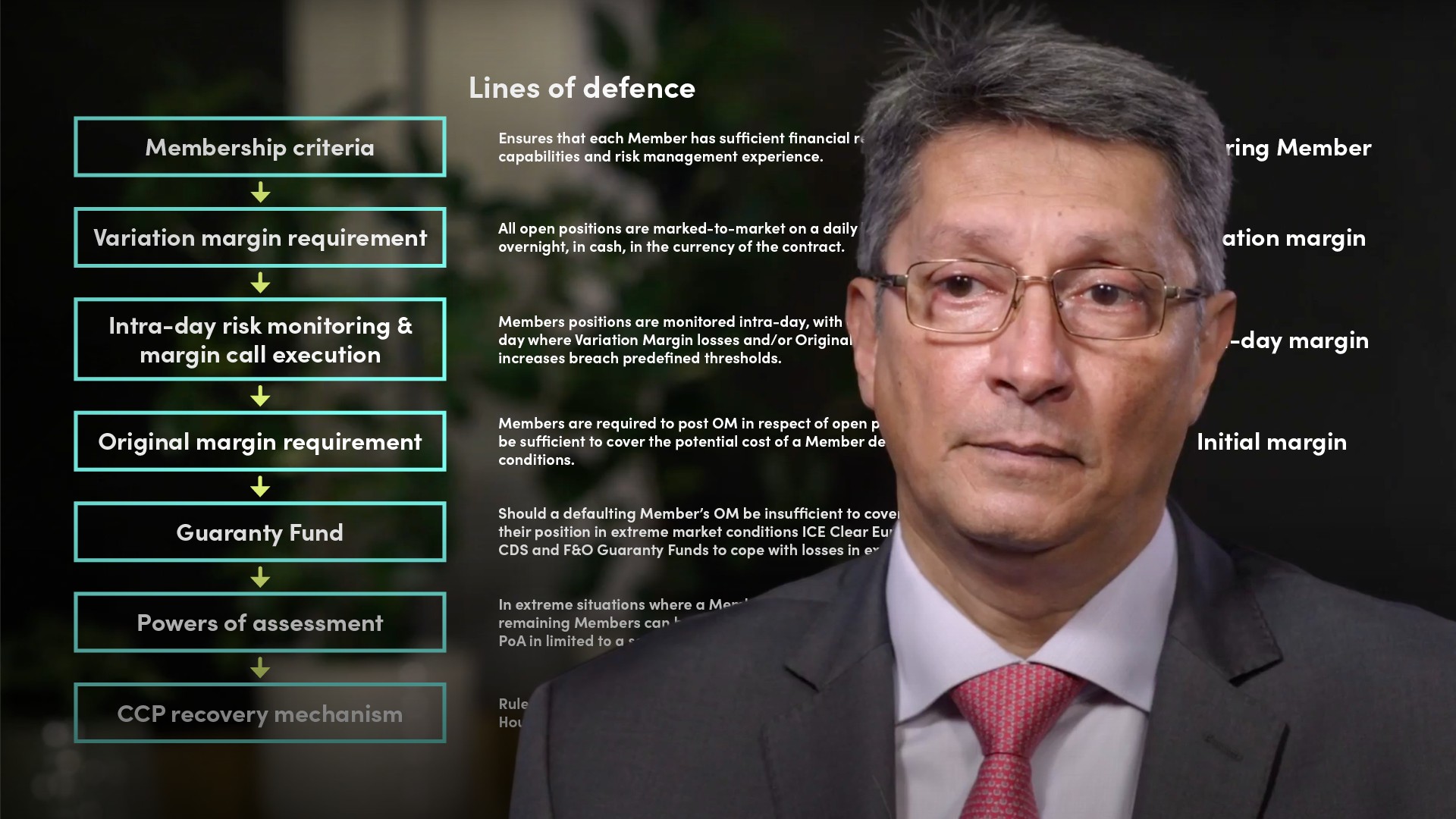

- In acting as counterparty in every transaction, the Clearing House assumes counterparty credit risk – the risk that their counterparty defaults on their financial or delivery obligations thereby leaving the Clearing House with a financial loss

- To protect against the potential losses that they could incur, Clearing Houses deploy a number of measures that mitigate the counterparty credit risk to themselves

- These measures allow them to guarantee the performance of contracts, which in turn provides confidence to market participants. Clearing House guarantees usually only apply to their immediate counterparty – A clearing Member of the exchange

What are the various types of margin applied to contracts?

- Initial (original) margin – Collateral that must be available to the Clearing House and must be posted for all open positions by Clearing Members. It is levied on a per contract basis and is determined by the volatility of the underlying asset. It is usually a small fraction of the underlying contract value.

- Intra-day margin – Additional funds that must be posted on demand, in cash, usually in periods of high volatility.

- Variation margin – The daily accounting for profits/losses on open positions resulting from the marking to market process.

What is the benefit of posting an initial margin?

Futures and options contracts are leveraged instruments and therefore potentially dangerous. By posting initial margin, which is a small fraction of the contract value, participants gain exposure to the returns on the entire contract value. It is possible that small adverse movements in the contract price could result in losses greater than the initial margin – greater than 100% loss.

What happens when a clearing member fails to meet any of its margin obligations?

- Their positions will be closed

- This would likely crystallise a net loss and those losses will be funded by the initial margin

- The clearing house guarantees funds and its own capital would have to absorb any additional losses

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"