Global Economic Spillover Effects of the War in Ukraine

Urvish Patel

Macro Economist

In this video, Urvish will highlight how the war in Ukraine has impacted the world economy, including through higher energy and food prices, weaker confidence, and a reduction in trade. He will then analyse the channels through which the war has specifically impacted the UK and household income levels.

In this video, Urvish will highlight how the war in Ukraine has impacted the world economy, including through higher energy and food prices, weaker confidence, and a reduction in trade. He will then analyse the channels through which the war has specifically impacted the UK and household income levels.

Global Economic Spillover Effects of the War in Ukraine

15 mins 36 secs

Key learning objectives:

Outline the impact of the war on the global economy

Outline the impact of the war on UK household incomes.

Overview:

On the 24th February 2022, Russia launched a major invasion of Ukraine, in a major escalation of the Russo-Ukrainian War that began in 2014. The world responded with a wave of massive sanctions on individuals, commercial banks and the central bank. These sanctions, coupled with reduced trade between Russia and the west, won’t just negatively impact the Russian economy, they’ll have profound effects on economies around the world through negative spillovers. The outcome of this will mean higher commodity prices, weaker confidence, lower real incomes and significantly reduced global economic growth.

What is the impact of the war on the global economy?

Main impact is being felt through higher energy prices, financial market volatility and weaker confidence.

Ukraine is not a major trade partner of any other major economy, while Russia has a large exposure to the EU and UK.

There will be rising commodity prices. Ukraine and Russia produce about a quarter of the global output of wheat, 20% of corn and other coarse grains and 80% of sunflower oil. This is particularly worrying in the emerging markets, as they rely heavily on imported grain and food represents a high share of household spending

Energy costs are also going to continue rising. The EU imports 60% of its energy needs from Russia (25% of its crude oil and 50% of natural gas). The amount this impacts member states will depend on their reliance on Russian gas and oil. The biggest concern here is the approaching winter where supplies may be disrupted and prices may rise even higher.

Forecasted global GDP has also contracted since the invasion, with the 2022 and 2023 forecast being 3.3% and 3.2%, down from 4.2% and 3.5%, respectively.

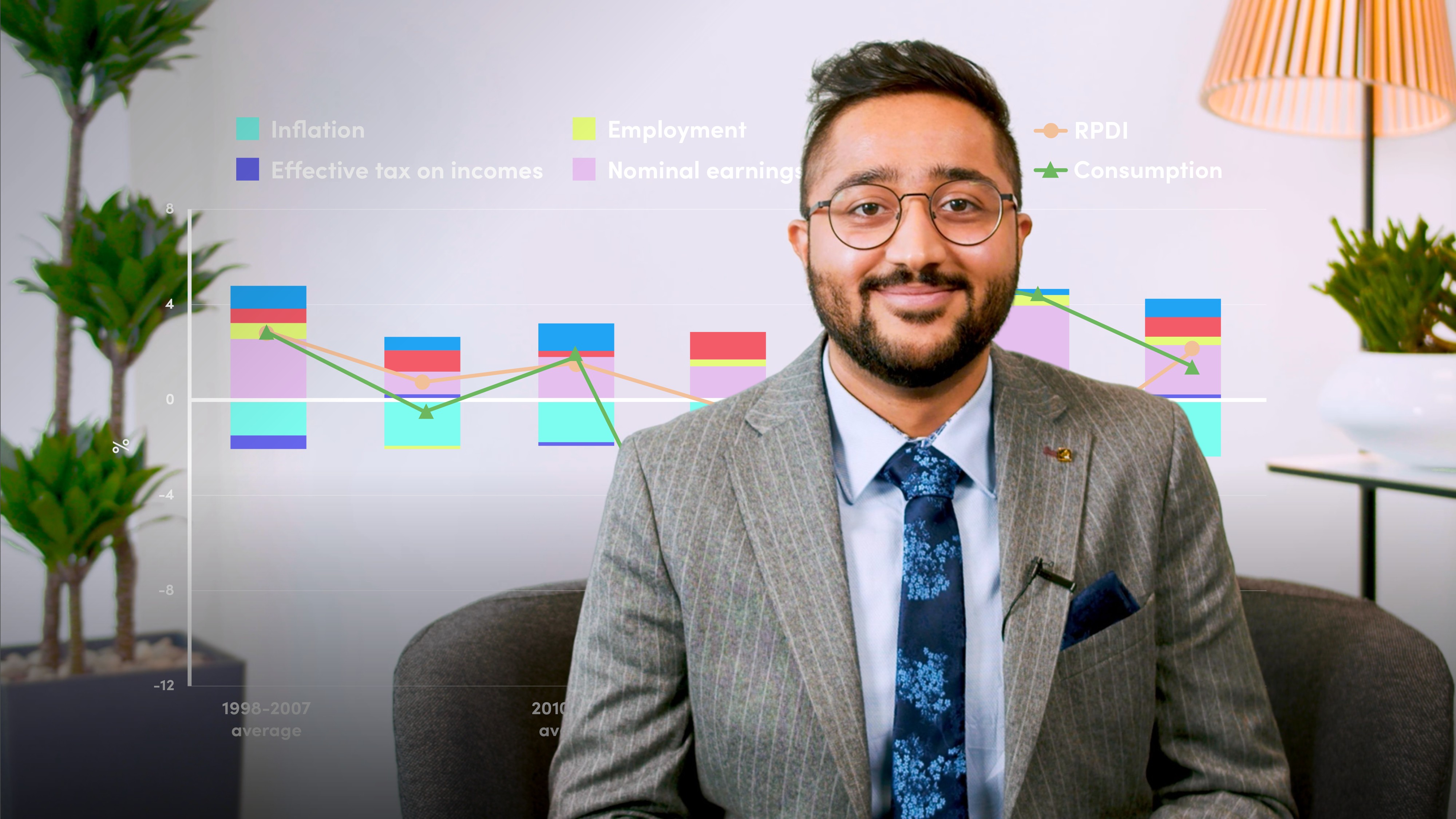

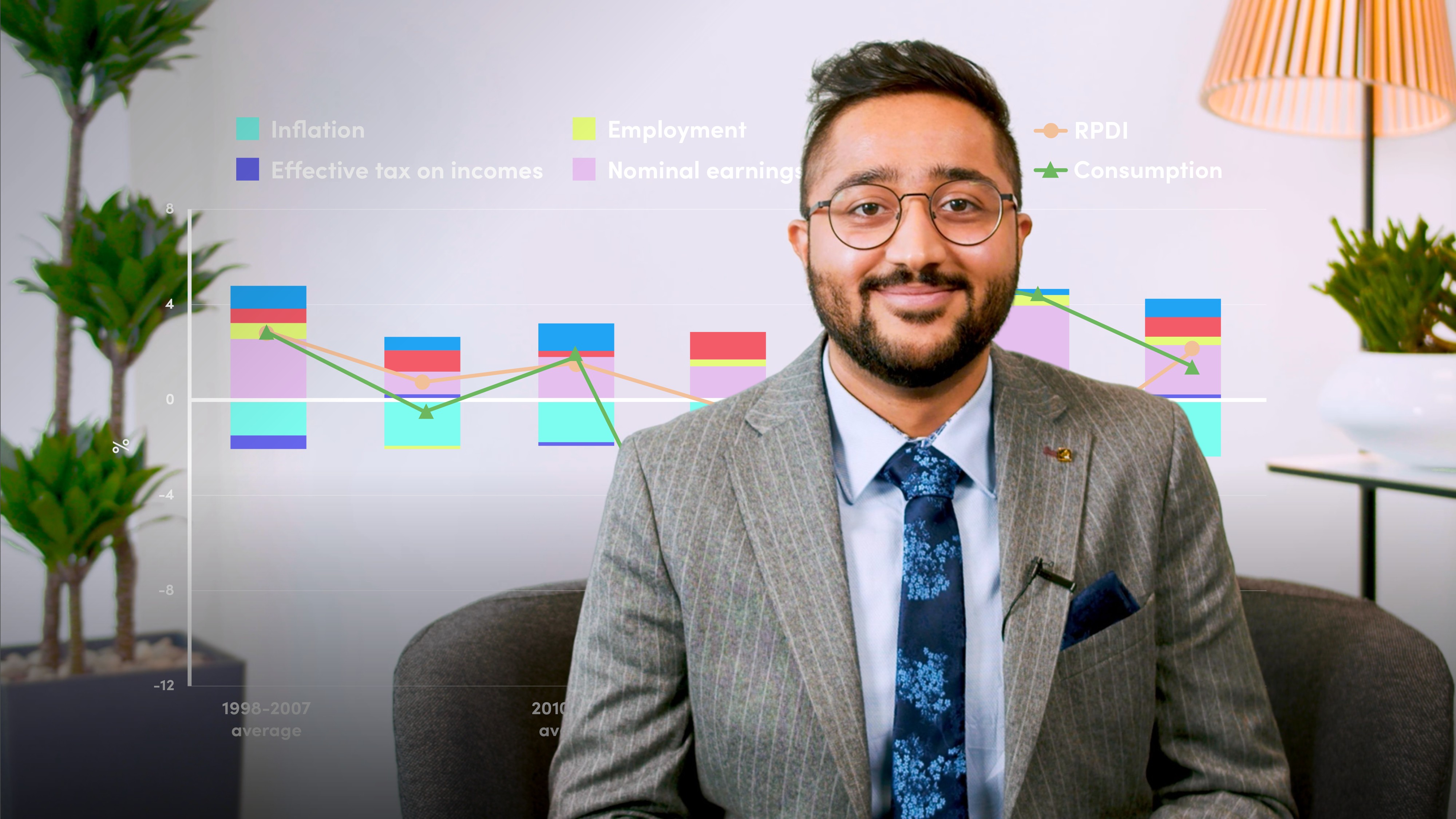

What impact will the war have on UK household incomes?

The sanctions and supply chain disruptions have increased import inflation, feeding into higher consumer prices. HIgher domestic inflation directly reduces real disposable incomes, consumption and therefore GDP. If the shock is permanent, this represents a rapid transition to a new lower equilibrium growth path for the UK, meaning permanently lower real incomes for UK households.

Real incomes are expected to fall -2.4% in 2022 and will not return to growth above 0% until inflation is under control.

It is estimated that 1.5 million households across the UK face food and energy bills greater than this disposable income.

Fiscal transfers have been introduced by the UK government, designed to support the cost of living crisis, however these are being eroded in real time.

What impact will the war have on the UK economy?

Higher domestic inflation is likely to lead to tighter monetary policy (higher rates), but this will increase the user cost of capital, dampening investment and GDP. Weaker global demand will also reduce UK exports.

However, the UK government is likely to increase spending on defence and refugee resettlement costs, which may provide a small short-term boost to government consumption.

The overall effect on UK GDP is slower growth than initially forecast. GDP is expected to grow by 3.5% in 2022, followed by 0.8% and 0.9% in 2023 and 2024 respective. However, UK inflation is likely to rise to double figures towards the end of 2022 and likely to remain above target through 2023.

Urvish Patel

There are no available Videos from "Urvish Patel"