Hedge Funds as an Asset Class

Trevor Pugh

20 years: Trading & hedge funds

Hedge funds occupy an important place in the asset class spectrum. Unlike traditional asset classes they have the ability to add returns regardless of market direction. This video by Trevor Pugh is a brief introduction to hedge funds, wherein he highlights the important characteristics of hedge funds and also talks about some of its distinguishing features.

Hedge funds occupy an important place in the asset class spectrum. Unlike traditional asset classes they have the ability to add returns regardless of market direction. This video by Trevor Pugh is a brief introduction to hedge funds, wherein he highlights the important characteristics of hedge funds and also talks about some of its distinguishing features.

Hedge Funds as an Asset Class

15 mins

Key learning objectives:

Define short selling

Outline the two major characteristics of hedge funds

Define unencumbered cash

Overview:

Hedge funds have unquestionably earned a place in the portfolios of more sophisticated investors. Their use of short selling and leverage helps them to stand out from more traditional investments. They are typically lower than equities, but with reduced volatility, making them a more appealing prospect in many models.

What is Short selling?

Short selling is where a fund sells an asset such as an equity which it does not own. It can do this by borrowing the security in order to allow it to make delivery to the buyer. This borrowing is normally done on an overnight basis but can be continually ‘rolled over’ or extended on a daily basis.

What are the two major characteristics of hedge funds?

- The ability to short sell

- The use of leverage

What are the features of hedge funds?

- Fees are higher than other asset classes, and composed of a management fee and performance fee

- Minimum investment tends to be considerably higher than normal funds, and the investment tends to be marketed at sophisticated investors and institutions

- Liquidity terms are frequently tougher in a hedge fund than a regular fund. These are the terms on which an investor can withdraw their investment.

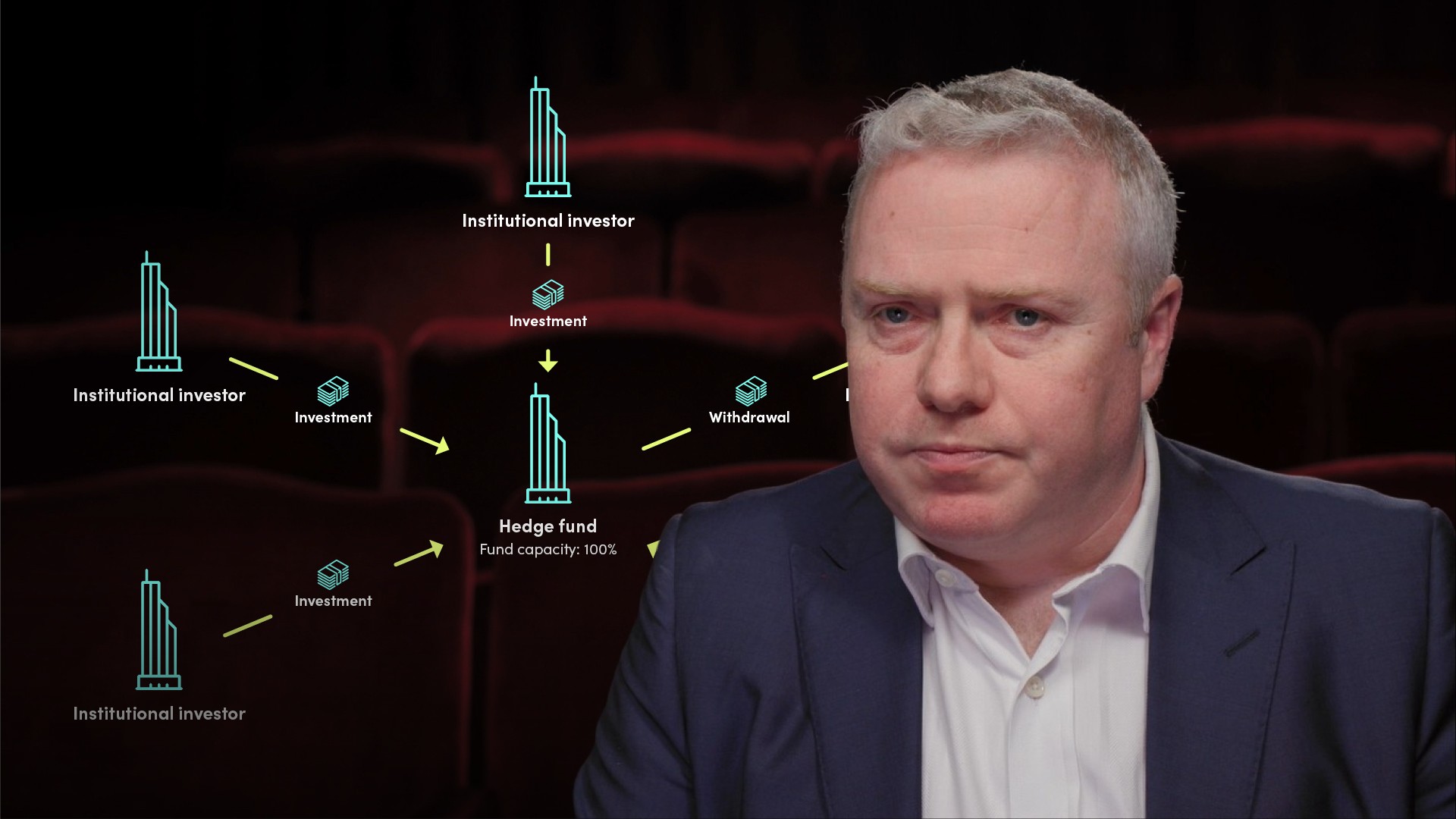

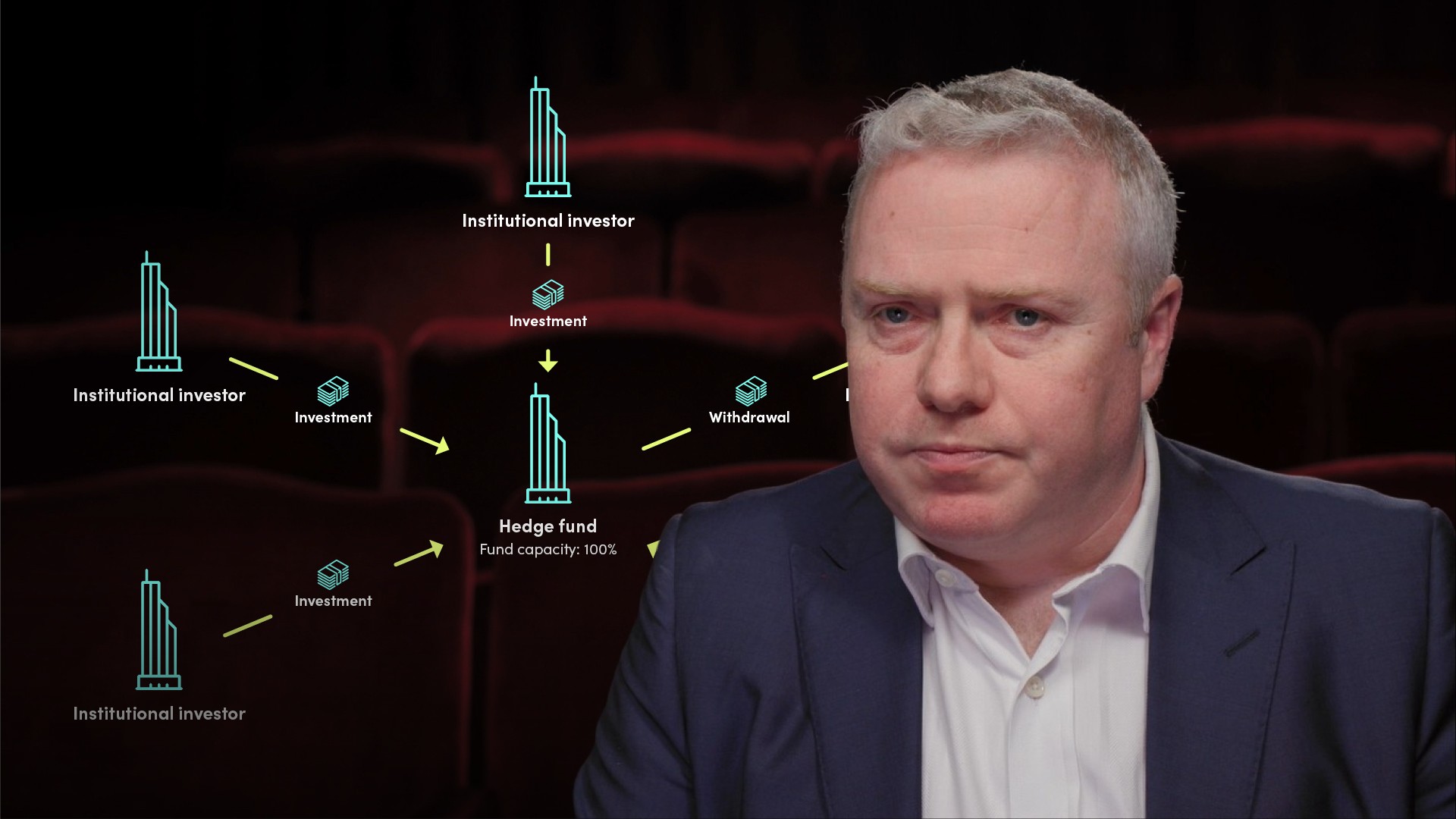

Why are liquidity terms tougher in hedge funds?

- There may be more illiquid positions in a hedge fund which can take longer to unwind

- A sudden withdrawal of a large amount of the AUM of a fund can have a destabilising effect on the fund positions

What is the Capital Asset Pricing Model?

The model that describes the relationship between risk and expected return for a security, usually equities.

The expected return is made up of two parts:

- The risk free rate - the yield on a US Treasury bond, as these are considered to have zero risk.

- The expected return of the market over and above the risk free rate, multiplied by the Beta of the stock.

What is Unencumbered cash?

This cash is not deployed in the market in any way and serves as a buffer for losses.

Trevor Pugh

There are no available Videos from "Trevor Pugh"