How to Address the Climate Risk Divide

Kris De Meyer

16 years: Neuroscientist

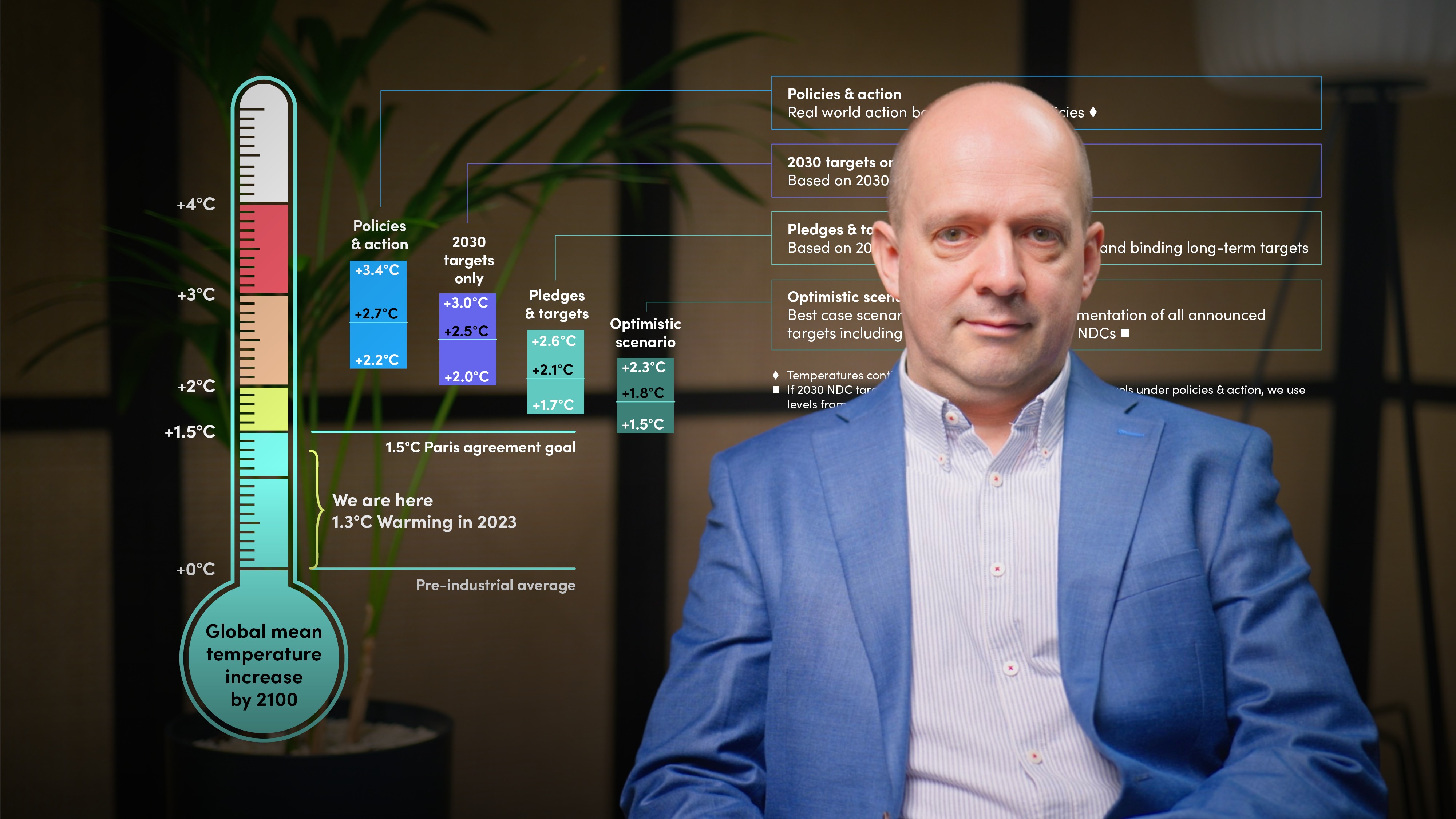

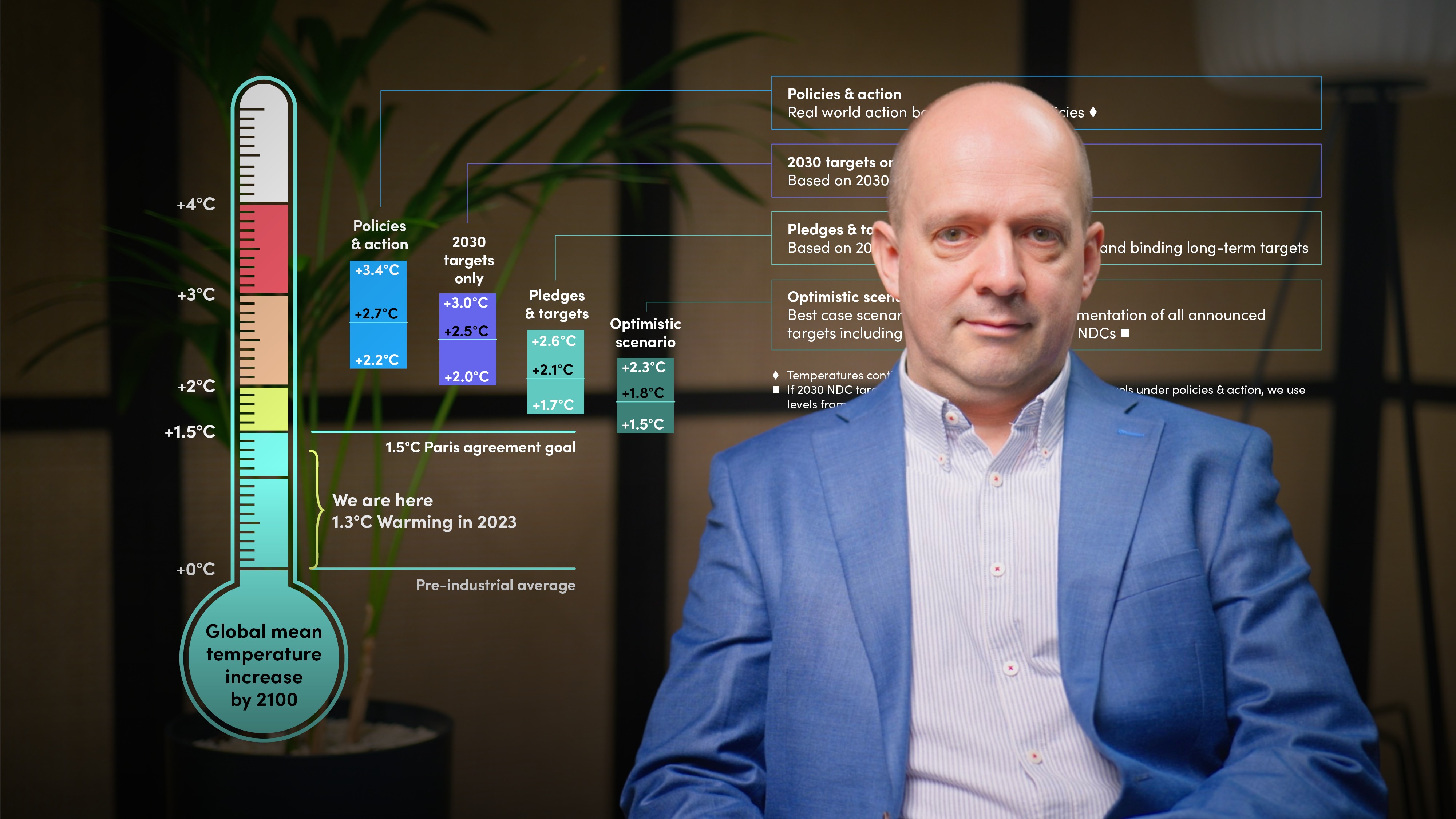

The climate risk divide that means climate scientists and the financial markets can't see eye to eye. Join Kris De Meyer as he explores how to bridge this divide.

The climate risk divide that means climate scientists and the financial markets can't see eye to eye. Join Kris De Meyer as he explores how to bridge this divide.

How to Address the Climate Risk Divide

10 mins 35 secs

Key learning objectives:

Identify the 3 steps to close to climate risk divide

Understand what each step involves

Overview:

There are 3 steps we can take to close the climate risk divide: reminding ourselves of misunderstanding when it comes to differing meanings of climate risk, creating a touchpoint for risk communications between scientists and financial markets and using qualitative risk information effectively.

Kris De Meyer

There are no available Videos from "Kris De Meyer"