Introduction to Risk-Free Rates (RFRs)

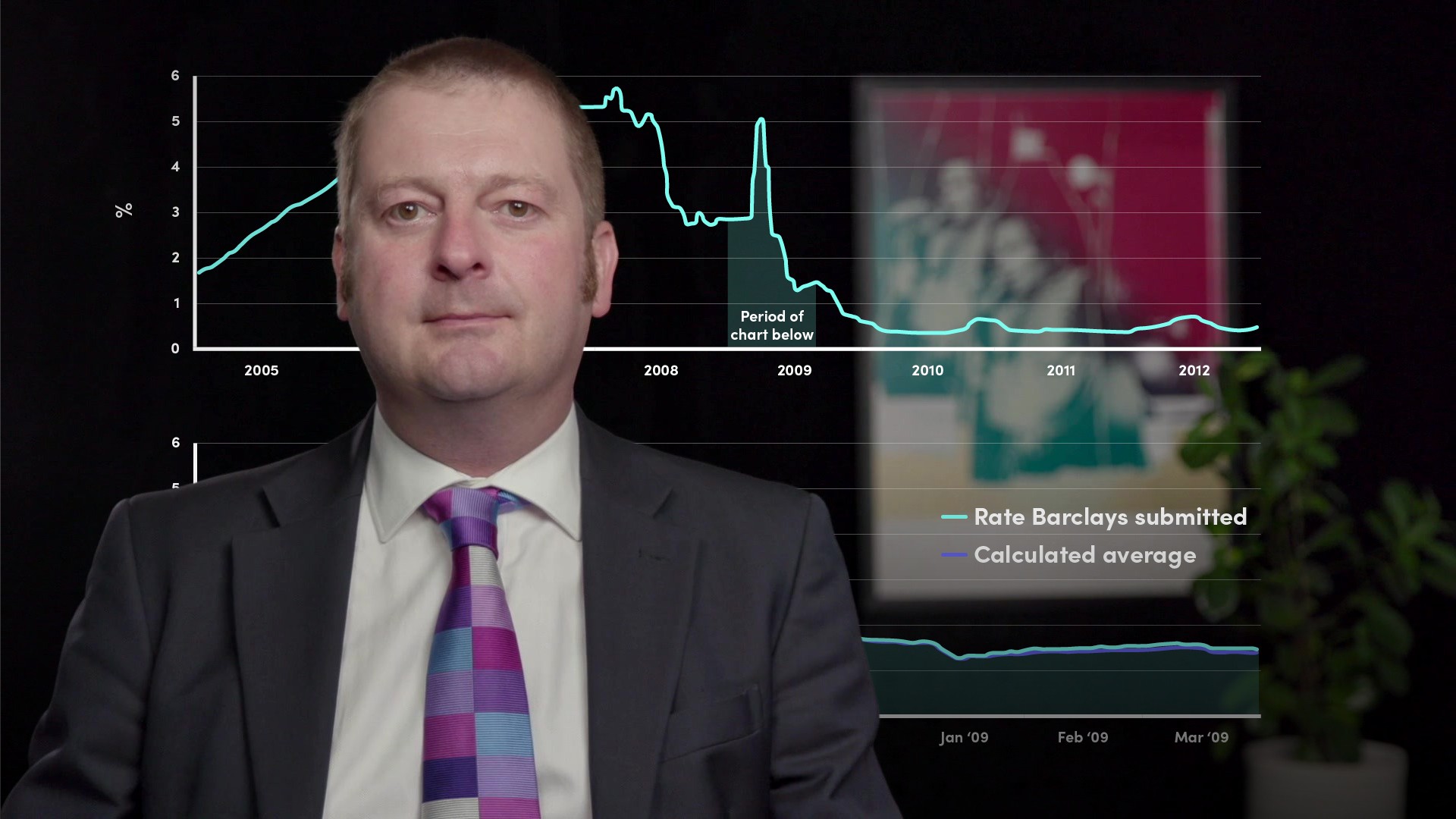

John Ewan

20 years: Interest rate benchmarks

In the first video of his series, John introduces the IBOR transition process. He begins by explaining how LIBOR emerged, became one of the major focal points for regulators and central banks and was entrenched in all markets for all financial market participants. John briefly explores the two unavoidable issues with LIBOR that have surfaced in the last few years.

In the first video of his series, John introduces the IBOR transition process. He begins by explaining how LIBOR emerged, became one of the major focal points for regulators and central banks and was entrenched in all markets for all financial market participants. John briefly explores the two unavoidable issues with LIBOR that have surfaced in the last few years.

Introduction to Risk-Free Rates (RFRs)

9 mins 11 secs

Key learning objectives:

Understand the background and emergence of LIBOR

Understand the two major problems with LIBOR

Understand RFRs and the differences between the RFRs

Overview:

LIBOR – the London Interbank Offered Rate - emerged from obscurity to become one of the main focal points for regulators and central banks and was entrenched in all markets for all financial market participants which include global banks, asset owners, retail customers or anyone else with any exposure to financial products.

What is the background of LIBOR, and how did it emerge?

LIBOR was conceived at the end of the nineteen eighties as a basis for measuring the interest to be paid on syndicated loans. The use of LIBOR mushroomed and used in a wide variety of financial products, from basic retail loans such as college loans and mortgages to complex financial derivatives. Due to the complexities of these products and the fact that many are traded over the counter or OTC, no one knows precisely how much money is connected to LIBOR, but estimates vary from 200-500 trillion US dollars.

What are the two major problems with LIBOR?

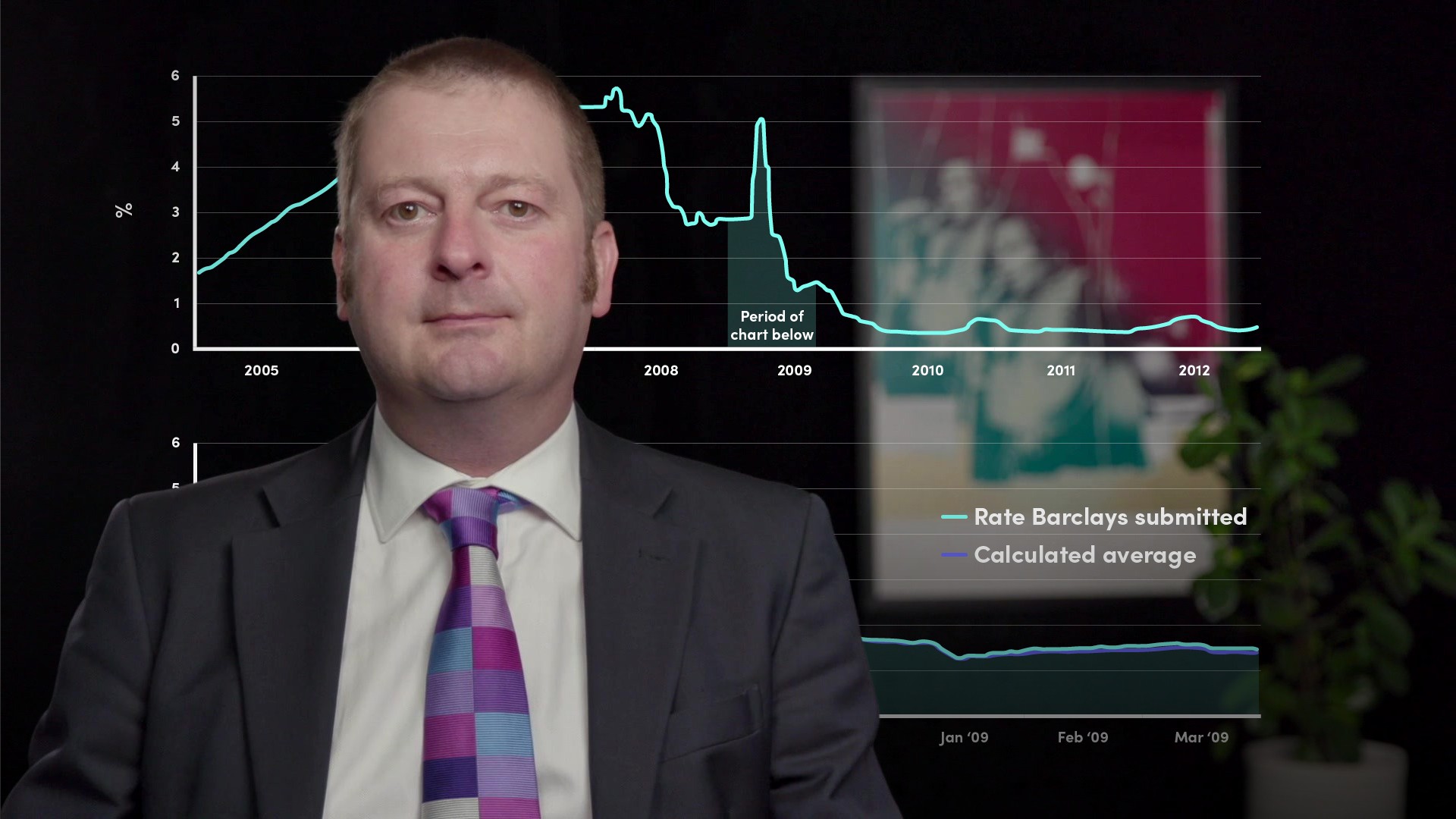

- Effect of the global financial crisis of 2007-2009 - Everyone was concerned about the health of banks, and as markets were paralysed, none of the normal sources of information were reliable. Markets realised that the rate banks quoted for LIBOR per day could be viewed as a proxy for their financial strength – after all, the best banks would borrow at the lowest rate. This led to claims of "lowballing," i.e. that banks quoted unfairly low prices to cover up their true health.

- Traders realised that they could set up highly leveraged positions in derivatives markets that reference LIBOR. And if they were able to manipulate the LIBOR number on the days that their derivative positions were reset against LIBOR, they would be able to guarantee a profit.

They bribed the individuals responsible for submitting LIBOR rates to lie about their actual cost of money. As a result, banks and brokers were fined billions of dollars, a lot of people were losing their jobs, and about two dozen people from a variety of different financial institutions were serving jail terms.

When is the deadline for replacing LIBOR?

As a result of the fiasco, the regulators have taken the opinion that LIBOR is no longer fit for purpose and must be replaced. The deadline for replacing LIBOR is the end of 2021. The Bank of England has advised that market participants should not issue or offer products that reference LIBOR which expire after their end 2021 deadline.

What are RFRs?

Almost every market has a LIBOR equivalent or near equivalent – EURIBOR in Europe, TIBOR in Tokyo, SIBOR in Singapore, UBIBOR in Ulan Bator and so on. All these are being reformed or replaced. For many markets, the replacements are known as RFRs or “Risk Free Rates”. These vary in details but share certain commonalities:

They are based purely on actual transactions and all of these transactions are in overnight markets.They are not risk free.

What are the different types of RFRs?

RFRs are overnight rates, they typically set significantly below the related IBOR rate, which is typically quoted over a 3 or 6 month period.

- The RFRs for the US Dollar, and Swiss Franc are based on secured repurchase transactions known as Repo transactions

- The dollar RFR is known as SOFR – the Secured Overnight Financing Rate. It has been published by the New York Federal Reserve since April 3rd 2018

- The Sterling RFR is SONIA -- the Sterling Overnight Index Average -- published since 1999 by the Wholesale Markets Brokers Association. Since 2016 it has been produced by the Bank of England

- Euro RFR is ESTER -- the Euro Short-Term Rate -- published since October 2019 by the European Central Bank

- Swiss RFR is SARON -- the Swiss Average Rate Overnight -- and has been published by SIX, the Swiss exchange, since 2009

- TONAR -- the Tokyo Overnight Average Rate -- is the Japanese RFR, and has been published by the Bank of Japan since 2016

John Ewan

There are no available Videos from "John Ewan"