IBOR Transition Update and Legacy Contracts (Dec 20) II

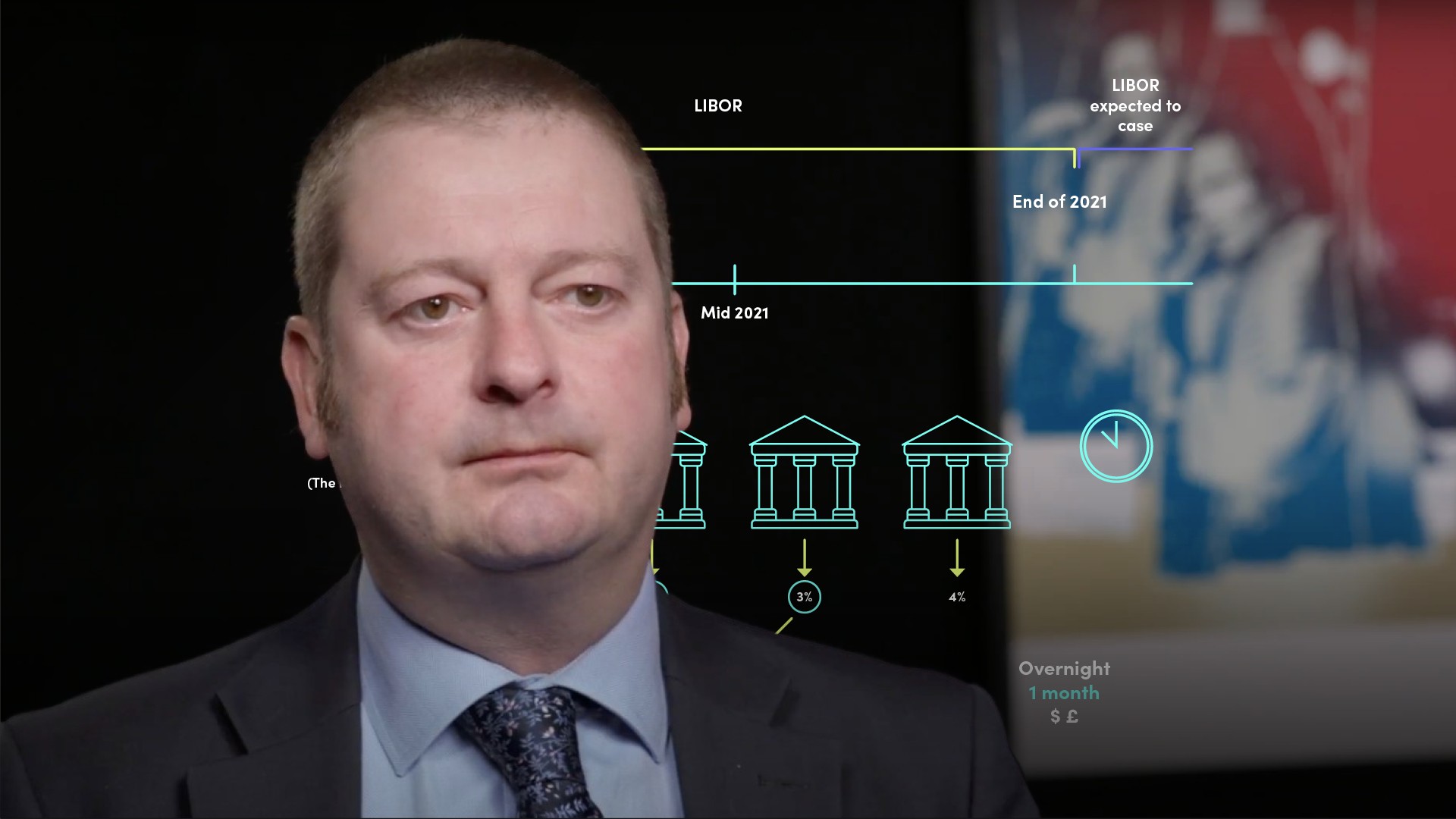

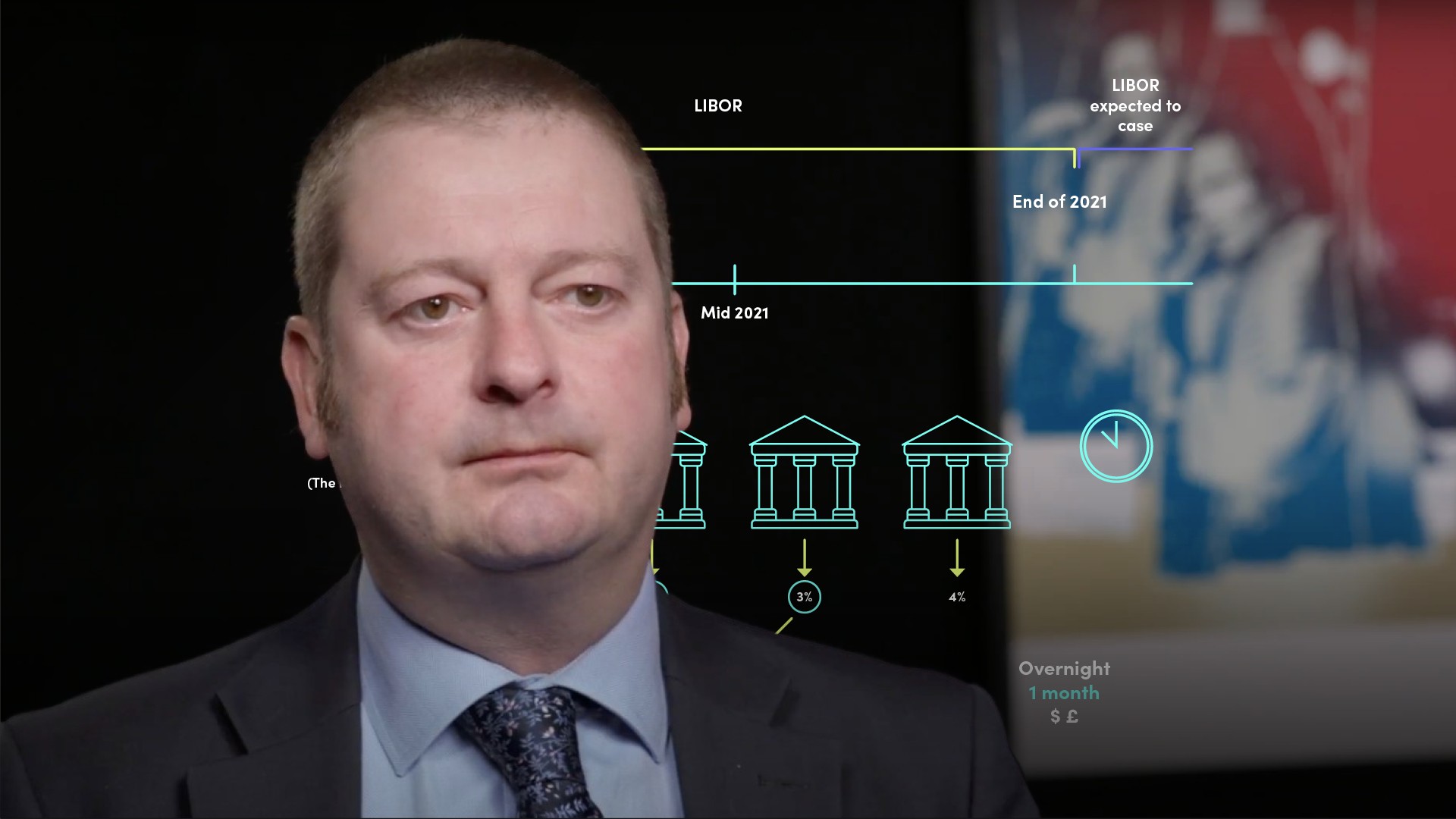

John Ewan

20 years: Interest rate benchmarks

In this video, John briefs about the expectations of regulators to the end of 2021 and then explains what is happening between now and the end of 2021 for the LIBOR equivalents in other currencies.

In this video, John briefs about the expectations of regulators to the end of 2021 and then explains what is happening between now and the end of 2021 for the LIBOR equivalents in other currencies.

IBOR Transition Update and Legacy Contracts (Dec 20) II

9 mins 23 secs

Key learning objectives:

Understand what regulators expect by the end of 2021

Describe the tough legacy contracts

Understand what is happening between now and the end of 2021 for the LIBOR equivalents in other currencies

Overview:

The FCA has stated that the contribution banks have agreed to continue providing inputs until the end of 2021, but may not continue to do so. LIBOR exists only because a set of contributor banks agrees to contribute data on a daily basis. This is risky because, over the last decade, banks have been fined billions of dollars for exploiting or violating the benchmark submission process.

What are the expectations of regulators by the end of 2021?

- All new business should either be conducted at alternative rates or be capable of switching at limited notice.

- All business-critical systems and processes should either be conducted without reliance on LIBOR, or be capable of being changed to run on this basis at limited notice.

- For any legacy contracts for which it has not been possible to make these amendments, the implications of cessation or lack of representativeness should have been considered and discussed between the parties, and steps taken to prepare for this outcome as needed. The scope and impact of any steps taken by authorities to support tough legacy contracts, if available, should have been clearly understood and taken into account.

What are tough legacy contracts?

The concept was introduced by the FCA and other regulators. These are contracts which genuinely have no realistic ability to be renegotiated or amended to transition to an alternative benchmark.

What is happening between now and the end of 2021 for the LIBOR equivalents in other currencies?

- Japan - There is a risk free rate called TONAR - the Tokyo Overnight Average Rate.The debate on whether to discontinue their local IBOR – TIBOR – has not been resolved

- Canada - The LIBOR equivalent is CDOR - the Canadian Dollar Offered Rate and the Risk Free Rate is CORRA – the Canadian Overnight Repo Rate Average. The Bank of Canada and various market led groups are assessing the future viability of CDOR and moving the market to CORRA

- Australia - The local LIBOR equivalent is BBSW – the Bank Bill Swap Rate. This is run by the Australian Stock Exchange, which has said it intends to continue producing the rate beyond 2021 with a raft of ongoing reforms

John Ewan

There are no available Videos from "John Ewan"