Impact of Corporate Actions on a Fund I

Mark Doran

40 years: Fund management

In this video, Mark defines what corporate actions are before going through some of the most common types of corporate actions, along with practical examples of how they all work in terms of the mathematical calculations that need to be completed.

In this video, Mark defines what corporate actions are before going through some of the most common types of corporate actions, along with practical examples of how they all work in terms of the mathematical calculations that need to be completed.

Impact of Corporate Actions on a Fund I

13 mins 13 secs

Key learning objectives:

Understand what a corporate action is

Outline how coupon payments impact funds

Outline how dividend payments impact funds

Overview:

Corporate actions are quite literally, actions taken by a corporate. They are actions taken in the events of the life of a security, typically initiated by the issuer, which affects the existing holders of that security. Examples of corporate actions include dividend payments, and coupon payments.

What is a corporate action?

Corporate actions are actions taken during the life of a security that impact the holders of that security. Three big types of corporate actions are the distribution of benefits to existing shareholders, through dividends or interest (coupons). Issuers could also change the securities structure, whether through doing a buy back, or a stock split for example, and a third type of corporate action could be where the holder converts a convertible security.

How do coupon payments impact a fund?

Coupon payments are interest payable by an issuer to bondholders at predefined times, therefore it is important for funds to be aware of when they should expect to receive this income.

Interest can be fixed-rate or floating rate. So, for example: A US dollar 1,000,000 face value of XYZ bonds with an annual coupon of 6.50% would entitle the position holder to a $65,000 coupon payment. That is 1,000,000 x 6.50%.

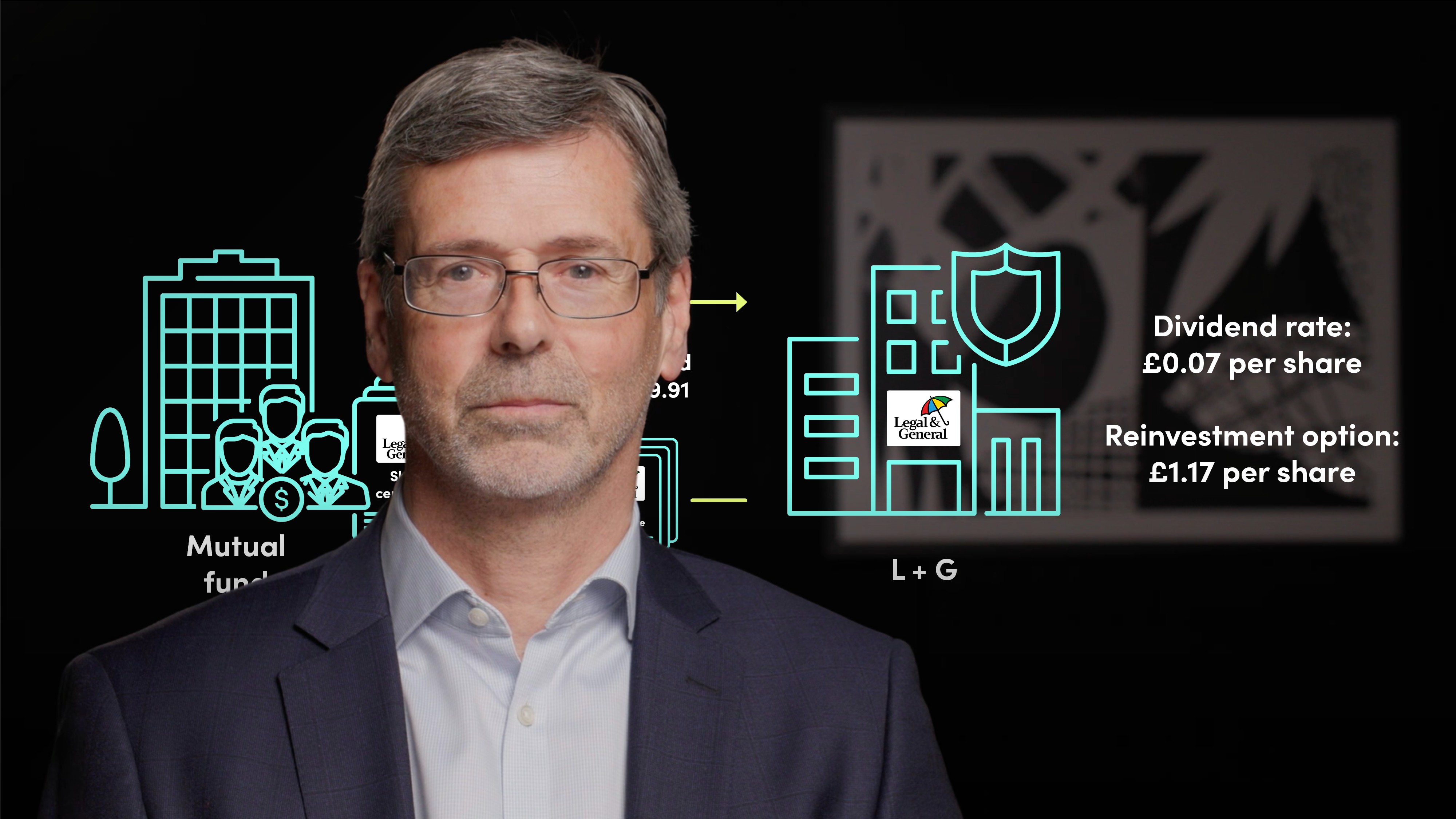

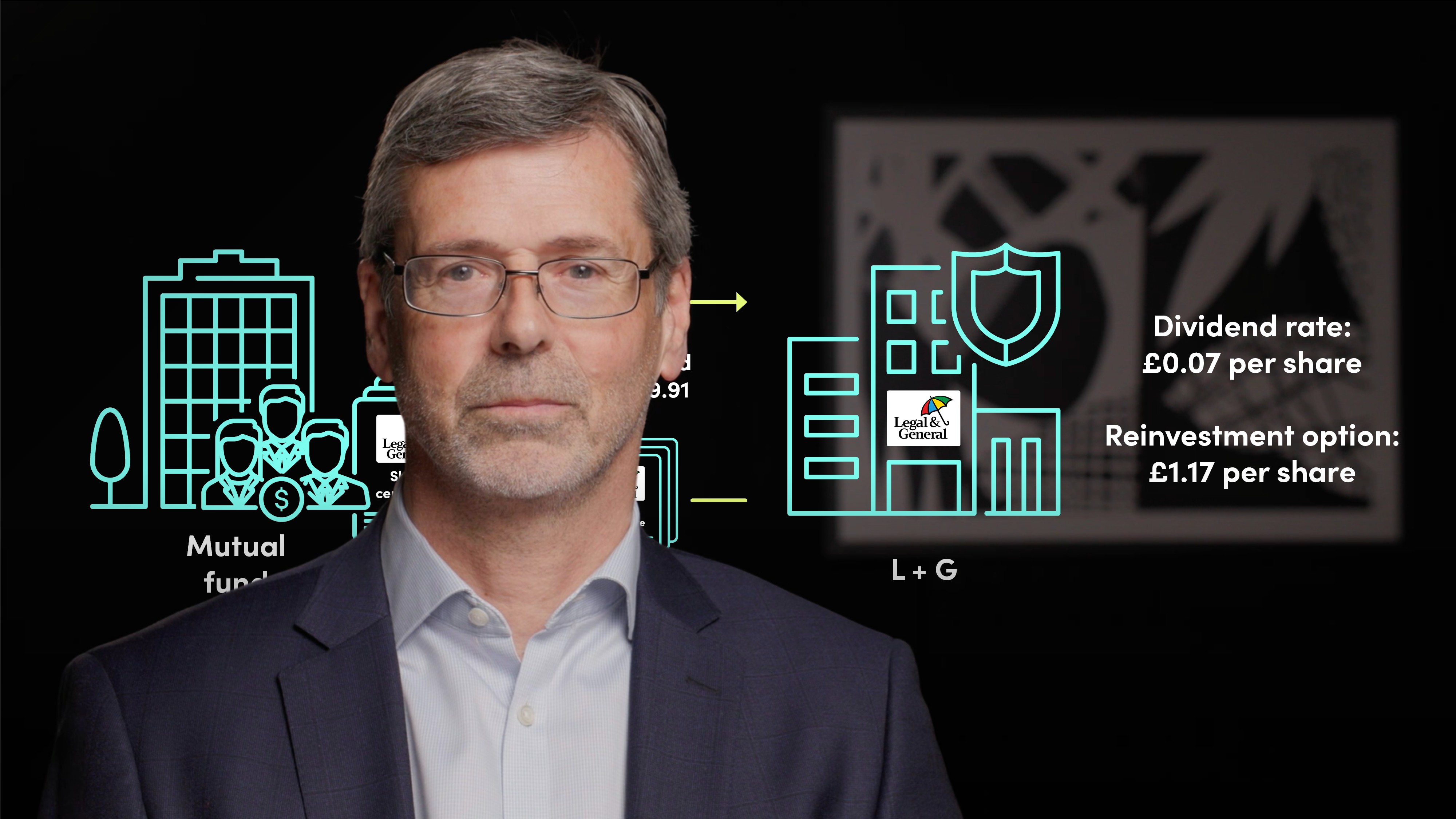

How do dividends impact a fund?

Dividend payments are a distribution of a company’s earnings, for a defined earnings period, to equity position holders. There is no guarantee of a dividend payment.

Dividends may occur as cash or securities. The payment of Cash dividends is where the distributing company decides to pay a dividend in a single designated currency. This is a mandatory event, which means that the shareholder doesn’t get a say in the matter. The payment of securities as dividend is known as script dividend, and again, is a non-mandatory event.

An example of a Scrip Dividend would be where the basis of allotment is equivalent to one new share for every £17.136 of dividend entitlement, that being the current share price. The dividend cash equivalent is 41.2 pence per share.

Therefore, if you have a holding of 1,000,000 shares, this would result in a dividend of £412,000. However, in this case, instead of the cash, the holder will receive £412,000 / £17.136 which is equal to 24,042 shares.

Many investors like to use Dividend reinvestment plans, or DRIPS. In this case, when a cash dividend is paid, the money is reinvested into the purchase of further shares from the same issuer, at a current price.

Mark Doran

There are no available Videos from "Mark Doran"