Impact of Corporate Actions on a Fund II

Mark Doran

40 years: Fund management

In this video, Mark discusses liquidity distributions and equity restructuring, before spending some time considering the impacts of dividends on investment returns and corporate actions on a fund.

In this video, Mark discusses liquidity distributions and equity restructuring, before spending some time considering the impacts of dividends on investment returns and corporate actions on a fund.

Impact of Corporate Actions on a Fund II

16 mins 48 secs

Key learning objectives:

Outline liquidity distributions

Understand the different types of equity restructuring

Understand the impact of corporate actions on a fund

Overview:

It is essential that funds are aware of corporate actions in order to prevent the value of the fund being negatively affected whilst also ensuring that any profitable opportunities aren’t missed. Equity restructuring is one of the main forms of corporate action and could include bonus issues, stock splits, buy-backs and rights issues.

What are liquidity distributions?

When a company is bankrupt, liquidators are brought in to wind up the company. During this process, they may make several cash distributions to shareholders as assets are sold off, before a final payment when the security ceases to exist.

What are the main types of equity restructuring and what is the point?

Equity restructuring is done with the intention of adding value for current shareholders.

Bonus issues are a type of equity restructuring. This is where extra shares are given to current shareholders for free. Securities issued through such events as bonus issues may have different characteristics to existing shares, particularly with reference to dividend payments, for example, not being entitled to the next dividend.

Stock splits is another type of equity restructuring. This is done with the intention of reducing the stock price which can be desirable as stocks with high values can be seen as illiquid by some investors. Following the split, investors are left with more but cheaper stocks. The reverse of stock splits is known as consolidation, and has the intention of raising the stock price. Following the consolidation an investor would have fewer, more valuable shares.

A buyback is a voluntary type of equity restructuring and involves the repurchase of issued capital at a certain price. The idea of a buyback is that when a company has made a large profit, they can ‘give back’ to their shareholders by buying back shares and pushing up the share price. Those investors that don’t sell their shares will now be left holding a higher value.

Finally, we have rights issues. This is where existing shareholders are given the opportunity to buy more shares at a discount to current market prices. New shares are offered in proportion to the existing holding.

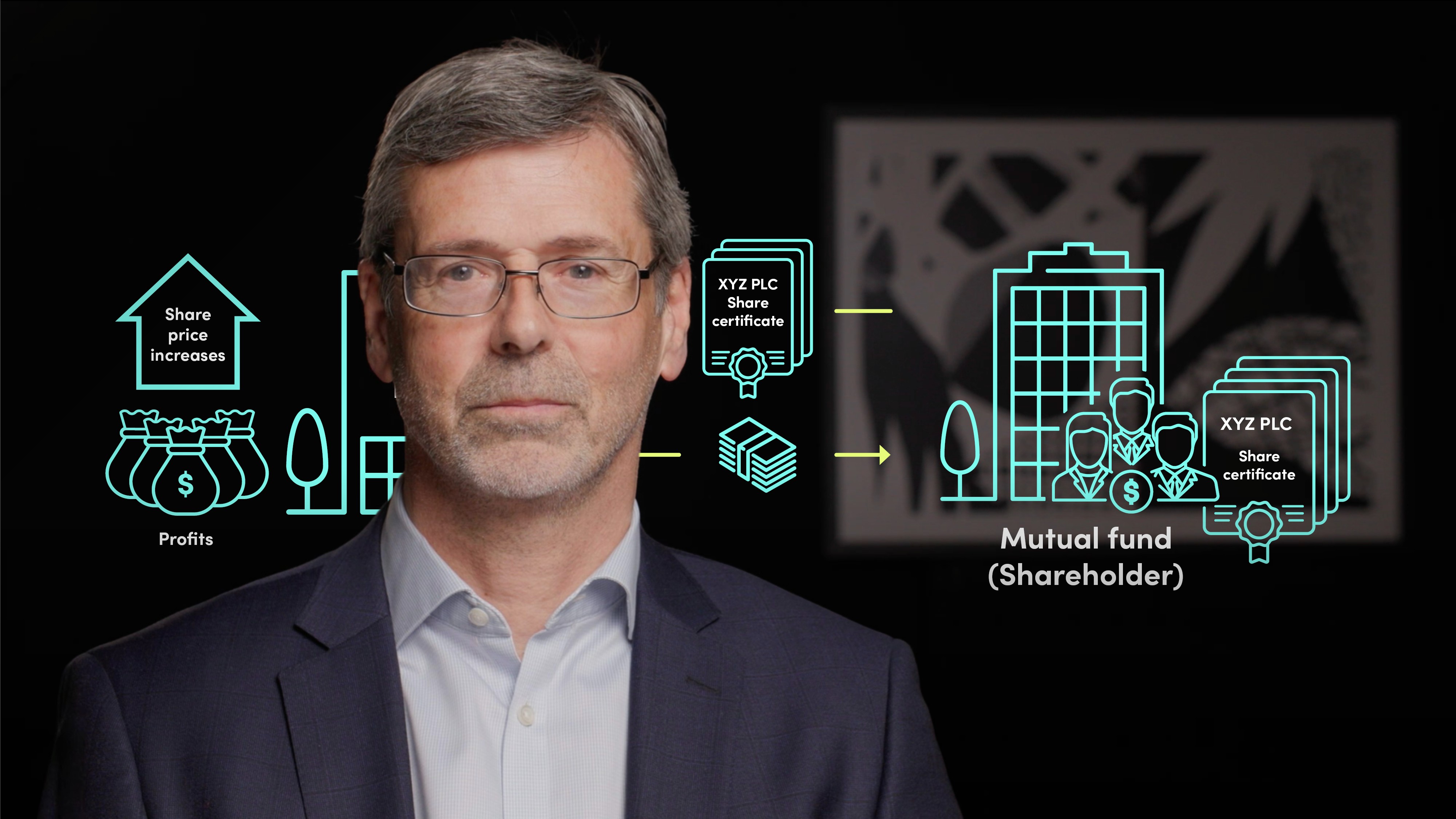

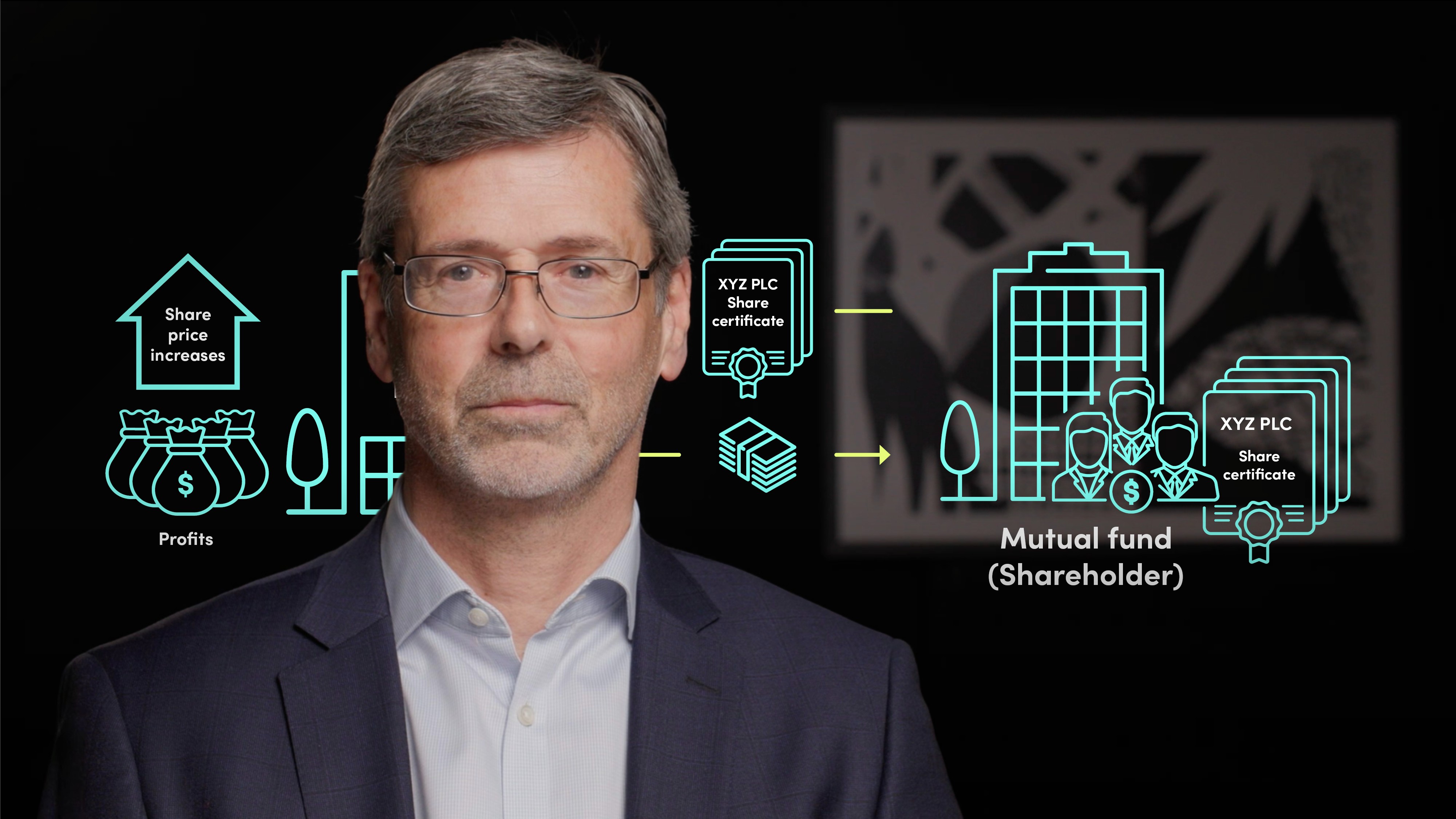

How do corporate actions impact funds?

How income and profits on investments are taxed can have a big impact on investors. Dividends are taxed as income, whereas any profit on sold assets is taxed as capital gain.

Bonus issues have little impact on funds, there will be more shares, but there is no change in capital value.

Stock splits will also increase the number of shares, but again, the capital value remains the same.

Buy-backs use the company’s cash to buy the company’s own shares, this may push the share price higher, but it is not guaranteed.

Rights issues create new shares, however the price usually drops after the issue.

Mark Doran

There are no available Videos from "Mark Doran"