What is General (Non-Life) Insurance?

Ted Wainman

20 years: CA & educator

In this video, Ted discusses the various forms of general insurance and explores the concept of IBNR – Incurred but Not Reported – this refers to the statistical calculation of claims relating to events that have occurred but have not yet come to light.

In this video, Ted discusses the various forms of general insurance and explores the concept of IBNR – Incurred but Not Reported – this refers to the statistical calculation of claims relating to events that have occurred but have not yet come to light.

What is General (Non-Life) Insurance?

9 mins 1 sec

Key learning objectives:

Outline the various categories of general insurance

Understand the difference between short and long-tail business

Describe IBNR

Overview:

General insurance refers to all insurance that is not related to life (or death) of an individual. There are many different categories of general insurance including property, marine & cargo, medical, motor and aviation.

What are the various categories of general insurance?

General insurance is categorised between the various types of business being insured – such as aviation, marine and motor.

What is the difference between short and long-tail business?

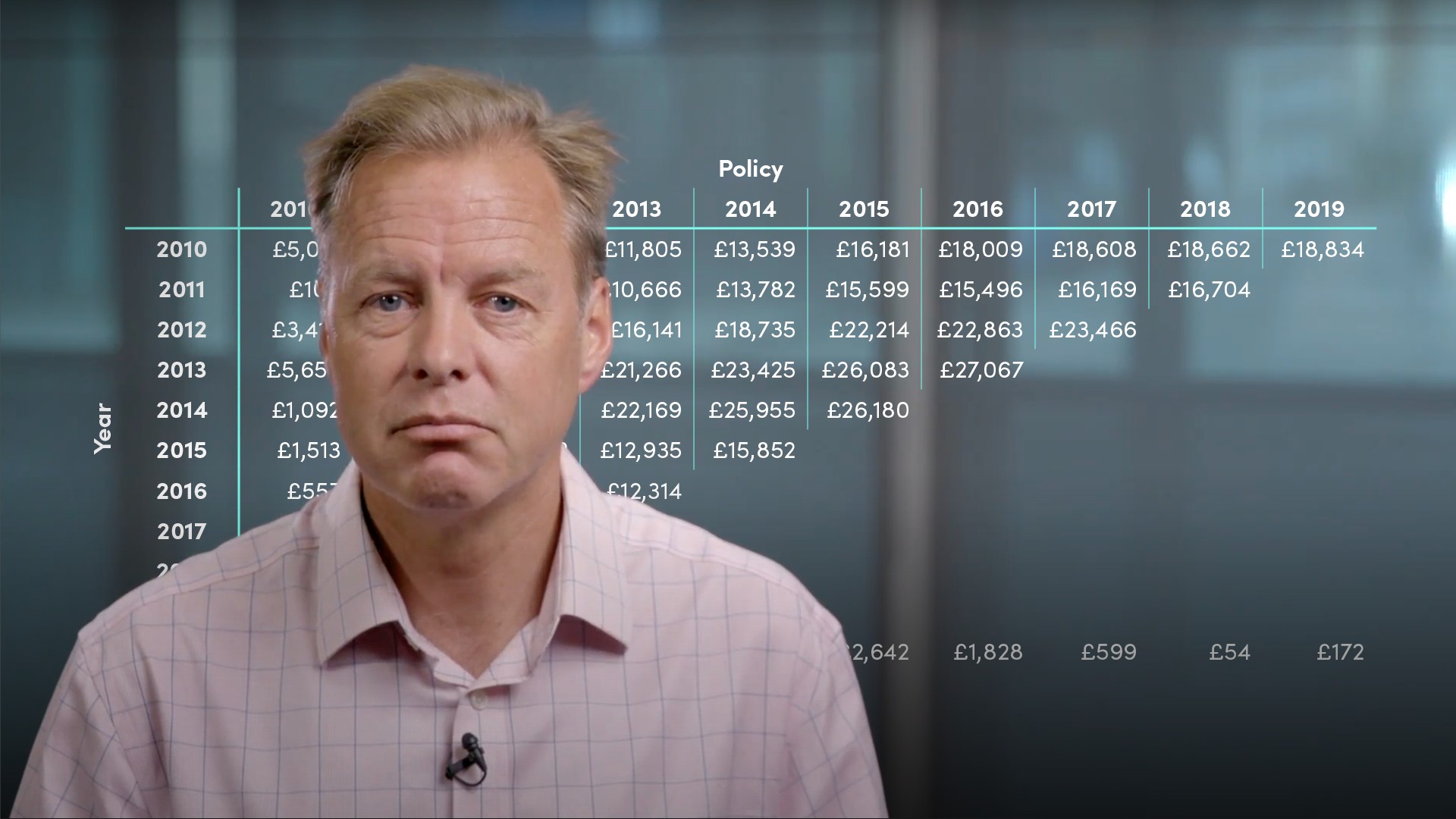

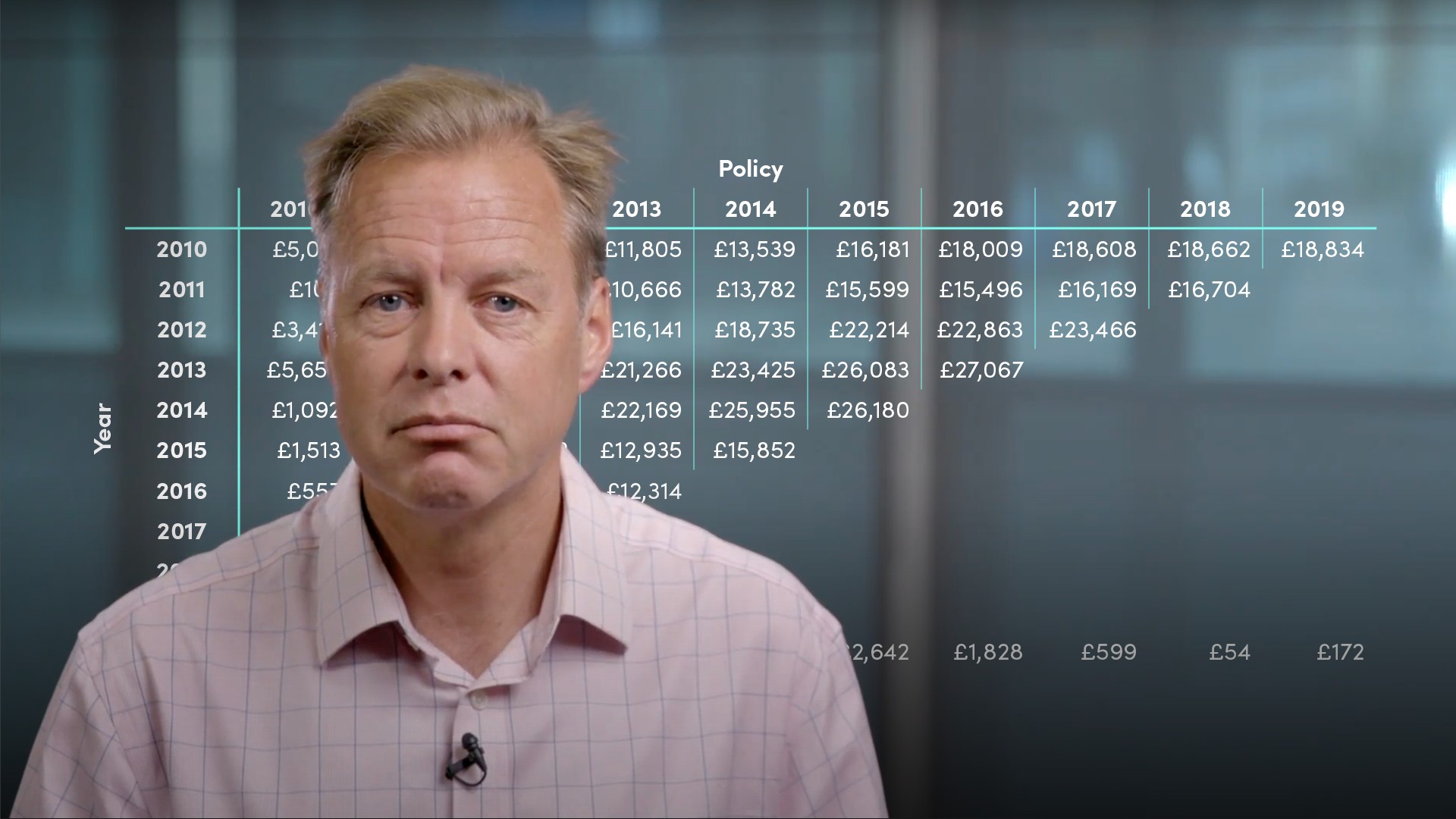

For some policies the event that triggers a claim (for example a car accident) will be notified to the insurance company within a relatively short period of time; these are known as ‘short tail’ policies. For other policies (such as medical malpractice) it can take many years for the event to become known – and so the associated claims may be paid out many years after the policy was taken out. This type of business is known as ‘long-tail’.

What is IBNR?

When reporting their financial results, insurance companies are required to estimate the amount of claims that have occurred, but have not yet been reported (particularly relevant to their long-tail business). This statistical estimation is known as IBNR – or Incurred But Not Reported.

Ted Wainman

There are no available Videos from "Ted Wainman"