Insurance Company Credit Rating Methodology

Gurdip Dhami

25 years: Treasury & ratings

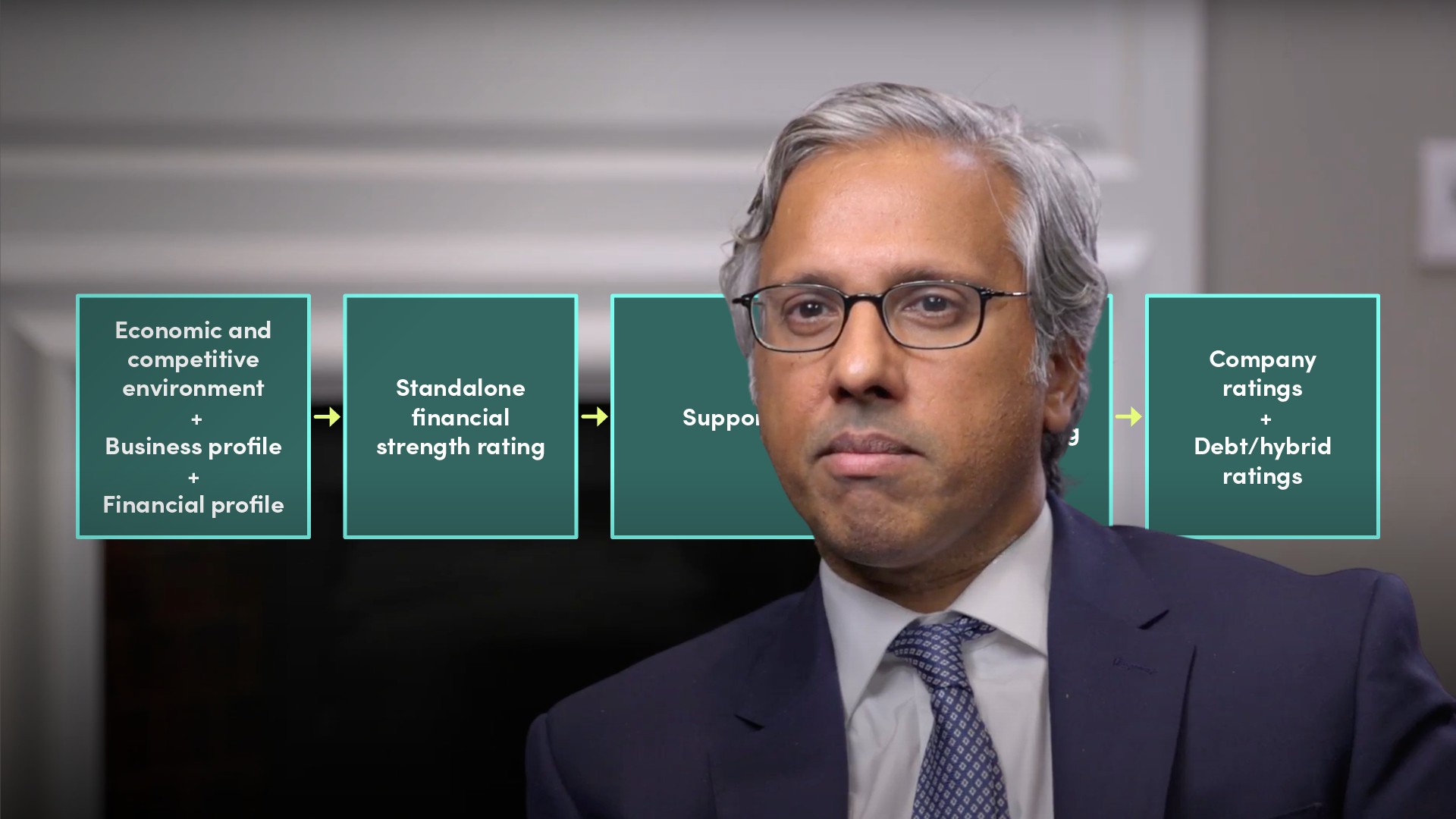

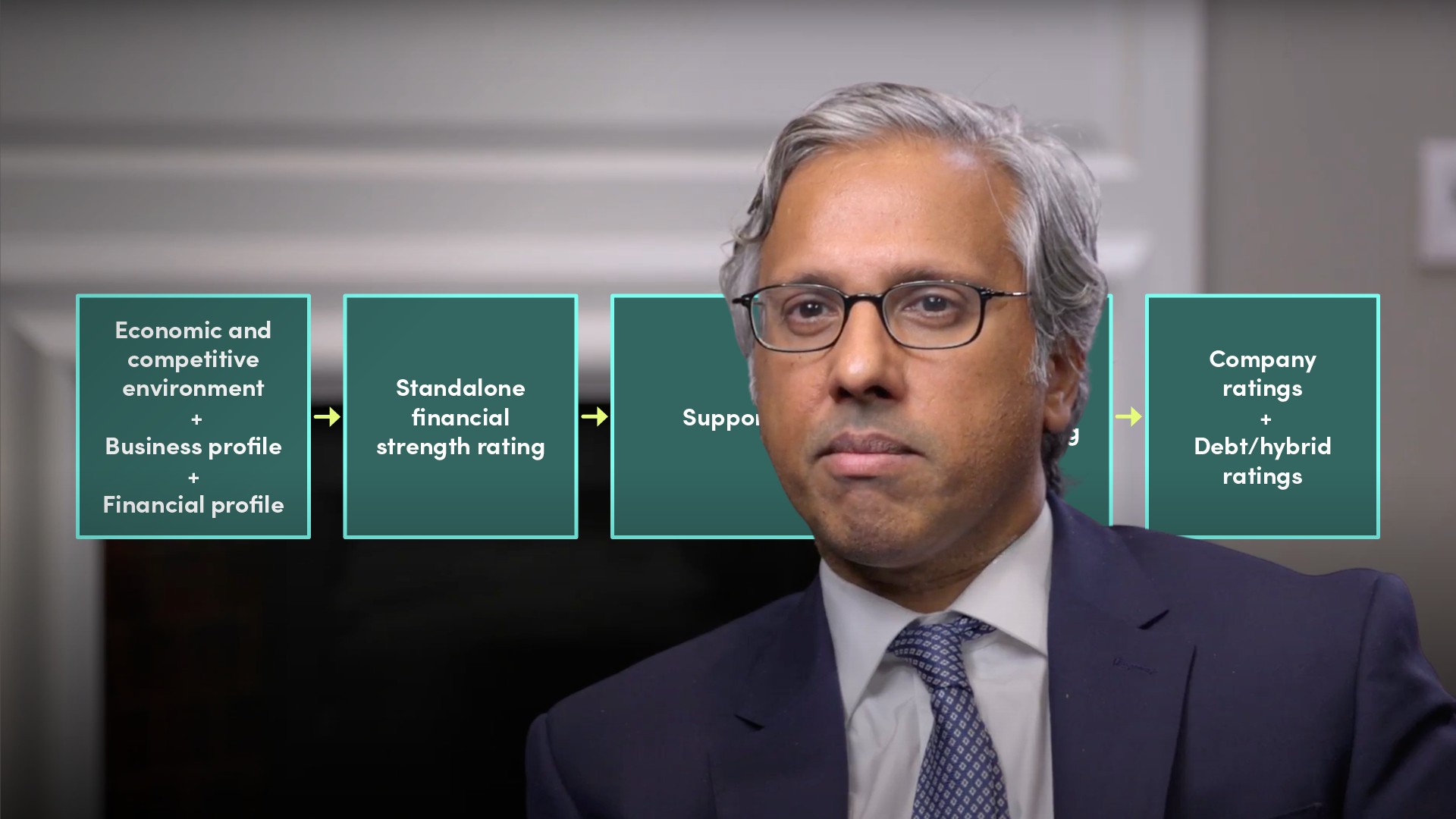

Gurdip provides an insight into the general approach taken by agencies for rating insurance companies. Each of Moody’s, S&P and Fitch assess the operating environment, business profile and financial profile of insurance companies by scoring and then combining credit factors to arrive at a standalone rating.

Gurdip provides an insight into the general approach taken by agencies for rating insurance companies. Each of Moody’s, S&P and Fitch assess the operating environment, business profile and financial profile of insurance companies by scoring and then combining credit factors to arrive at a standalone rating.

Insurance Company Credit Rating Methodology

16 mins 47 secs

Key learning objectives:

Outline the different methodologies used by the three rating agencies

Identify types of credit factors used in rating methodologies

Understand an IICRA score

Overview:

Each of Moody’s, S&P and Fitch assess the operating environment, business profile and financial profile of insurance companies by scoring and then combining credit factors to arrive at a standalone rating. Furthermore all three agencies use peer group analysis as a check on their final rating.

How do agencies assess capital levels?

Each agency methodology has a credit factor focusing on capital. When they assess this factor, they are evaluating the level of capital that an insurance company has compared to the risk profile of the company – the greater the surplus, the stronger the factor.

What are the three types of credit factors used in rating methodologies?

- Operating Environment

- The business profile or qualitative risks

- Financial or quantitative risks

What are some potential questions around company strategy?

- Does the company have a clearly articulated focused strategy based on its vision, mission and values?

- How has the strategy been disseminated throughout the company?

- Is the strategy consistent with the economic and competitive environment?

- Has management had a consistent strategy?

- Does the company have the financial and management resources to carry out its strategy?

What methodology does Moody’s use to provide a rating?

Moody’s uses a scorecard in which the credit factors are each scored and then a weighted average score is produced which is mapped to a Financial Strength Rating.

- Moody’s initially scores each factor using a 7 point scale ranging from Aaa to Caa and lower. This initial score is based on the ratios set out in their methodology which are calculated using the profile and performance of the insurer. The initial score is reviewed by the rating agency analysts and if required may be adjusted for example to take into a trend which is not reflected in the calculated ratios.

- Moody’s then combines the scores of each rating factor using standard weights to produce a weighted average score. The weighted average score is then mapped to an actual initial standalone rating.

- The Moody’s analysts will examine other factors listed in their methodology which are not in the standard scorecard such as governance, risk management, environmental risk, accounting policies and along with any other relevant risks.

What credit factors does S&P use?

Unlike Moody’s, S&P doesn’t use a scorecard but instead aggregates the credit factors using the 7 main credit factors:

- Competitive position

- Insurance industry and country risk assessment

- Capital and earnings

- Risk exposure

- Funding structure

- Governance

- Liquidity

What is an IICRA score?

The IICRA score represents the level of risks that an insurer faces from the environment in which it operates and is scored from ‘very low’ to ‘very high’.

How are the following scores calculated?

- Financial Risk Profile score - Produced by assessing Capital and Earnings and then adjusting this using the assessment for the factors ‘risk exposure’ and ‘funding structure’.

- The Capital and Earnings score - Is an output from S&P’s capital model for insurers.

- Risk Exposure factor score - Is based on S&P’s analysis of the following four areas: Risk controls, Risks not captured by the capital and earnings analysis, Risk concentrations or risk diversification, and Complexity of products and risks.

- The ‘funding structure’ score - Is based on S&P’s analysis of leverage and interest coverage which again I will comment on in a later video.

How does Fitch’s approach differ from the other agencies?

Fitch’s approach is more like Moody’s in that firstly its main credit factors are scored from AAA to single B and then are then weighted to produce a weighted average overall standalone rating. However unlike Moody’s the weightings for the credit factors are not specified as percentage weights in the published criteria but instead Fitch uses a broader scale to show the importance of each credit factor for the rating using a three level influence score:

- Moderate influence

- Lower influence

- Higher influence

Which credit factors have the most importance in Fitch’s methodology?

Business Profile, Capitalisation & Leverage and Financial Performance & Earnings.

How are the following scores calculated?

- Fitch’s Business Profile is scored using an assessment of Competitive Position, Business Risk Profile and Diversification

- The factor Competitive Position is scored by assessing operating scale, brand strength, franchise value, market share, service and distribution capabilities

- The factor Business Risk Profile considers areas such as the breadth of product offerings and the stability/incentives of distribution channels.

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"