Introduction to Insurance Funding and Capital Ratings I

Gurdip Dhami

25 years: Treasury & ratings

In this video, Gurdip describes how the Financial Strength Rating is used as an anchor rating and why there is often a rating differential between the holding company and its subsidiaries.

In this video, Gurdip describes how the Financial Strength Rating is used as an anchor rating and why there is often a rating differential between the holding company and its subsidiaries.

Introduction to Insurance Funding and Capital Ratings I

12 mins 46 secs

Key learning objectives:

Identify how a financial strength rating is used as an anchor rating

Understand why there is often a rating differential between the holding company and its subsidiaries

Understand what a financial strength rating is

Overview:

The Financial Strength Rating is used as anchor rating to derive the senior unsecured bond rating, subordinated debt rating and hybrid capital rating. The Financial Strength Rating itself is based on the rating agency criteria.

What is a Financial Strength Rating?

The Financial Strength Rating is an opinion of the ability of an insurance company to pay its insurance policyholders. For example a Non-Life insurance company may provide insurance to motorists and homeowners and these are the policyholders.

How is financial strength rating used as an anchor rating?

The Financial Strength Rating is commonly described as an anchor rating because it is used to derive debt and hybrid capital ratings. The process for calculating the rating differential between the anchor rating and derived ratings is often referred to as ‘notching’. The ratings of debt and hybrids are often lower than the Financial Strength Rating because policyholders usually have first claim on the income and assets of the insurance company.

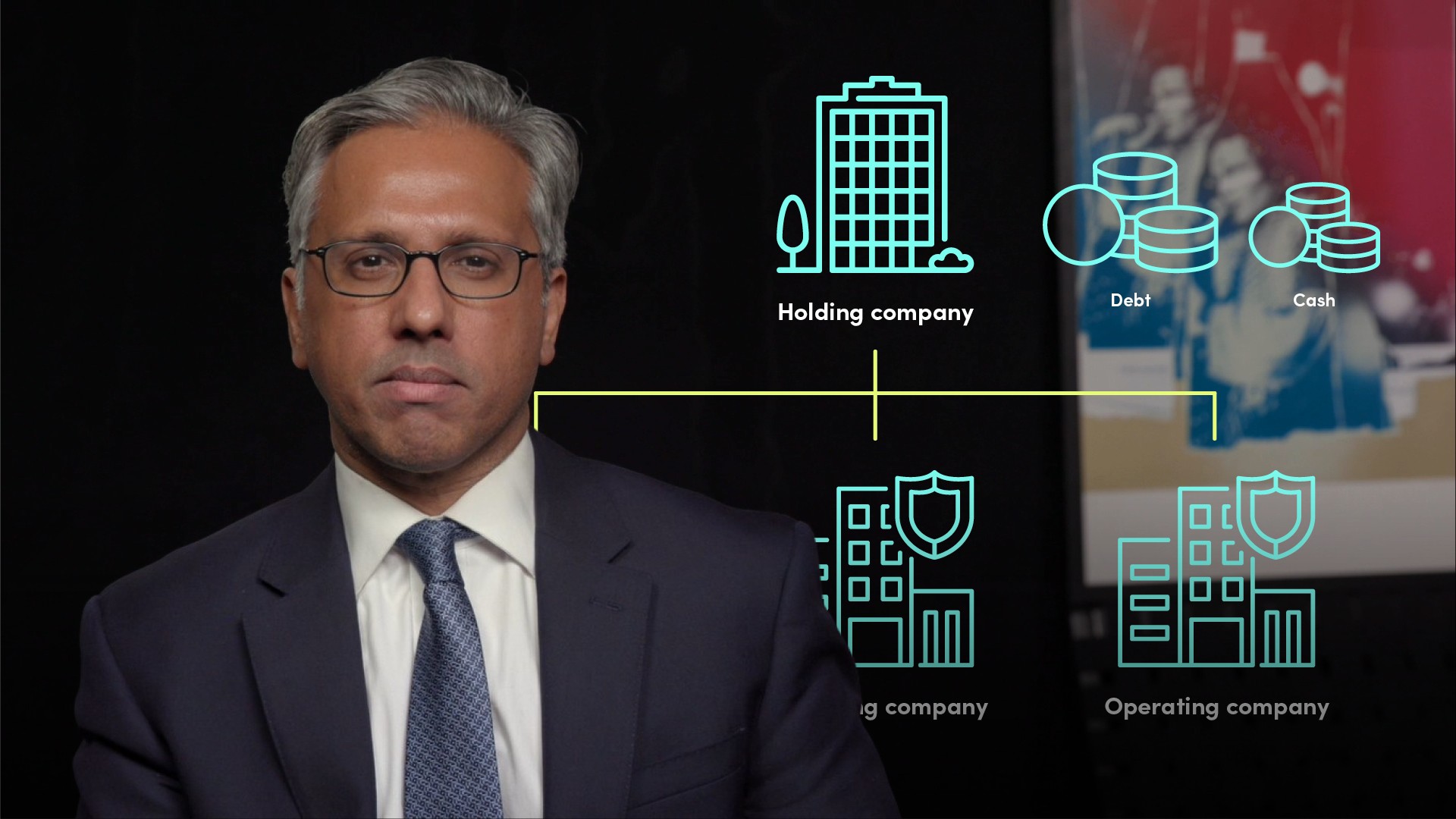

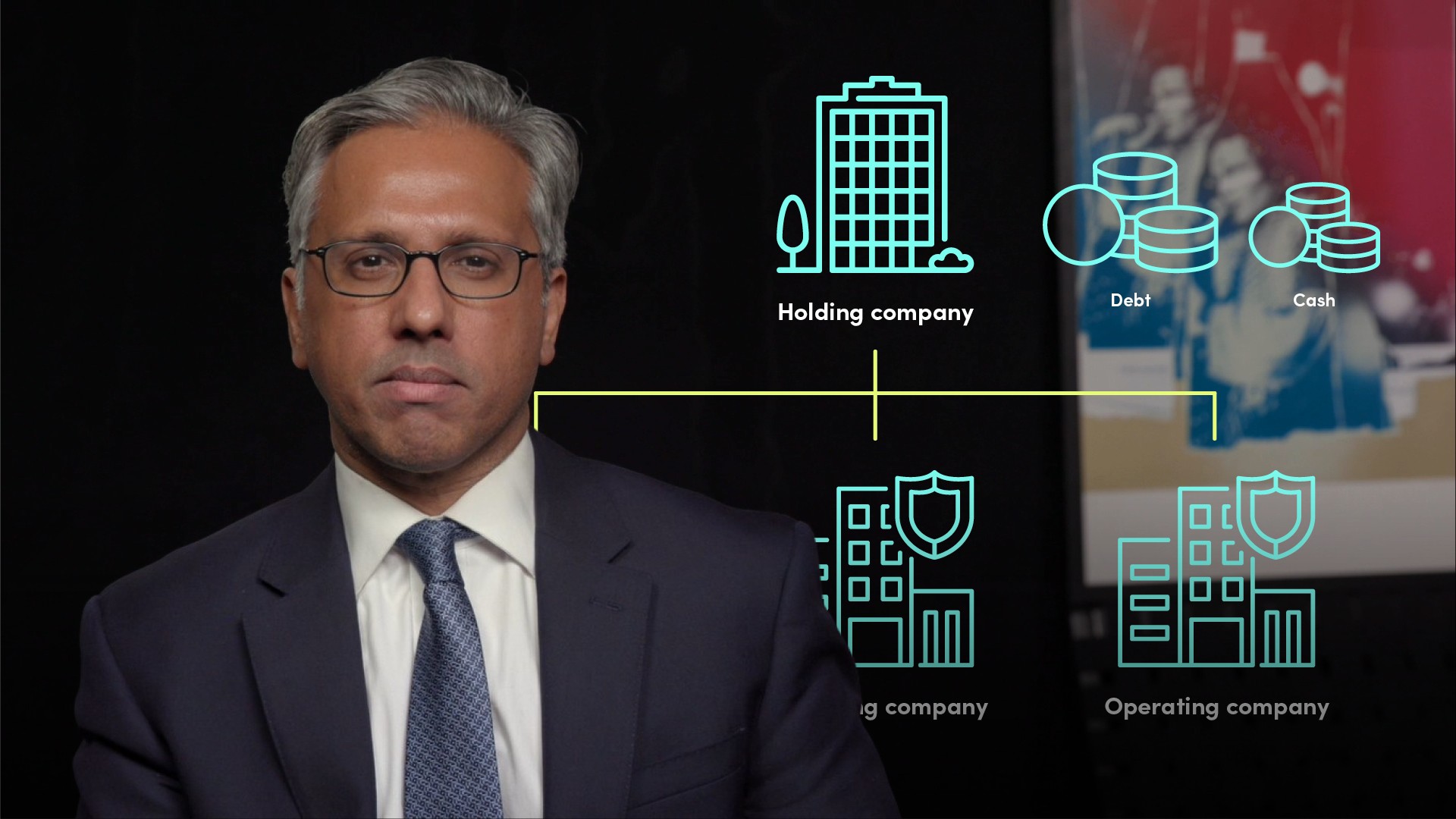

Furthermore, if an insurance company has a holding company, instruments issued by the holding company are usually rated lower than the debt rating of instruments issued by the insurance company - that is, there is a holding company/operating company rating differential.

Why is there often a rating differential between the holding company and its subsidiaries?

Insurance companies often have a parent holding company which does not itself have insurance operations. The holding firm holds insurance operating businesses, which hold insurance assets and produce revenue from insurance operations. The holding company is dependent on cash flow from subsidiary companies to pay interest and principal amounts on its obligations. In a stress scenario the insurance company policyholders will usually be paid first, before other creditors including senior unsecured creditors. This means that payments to the holding company are by way of dividends which are decided by directors of the insurance subsidiary and therefore discretionary. Insurance companies' holding company notching is wider when the holding company is unregulated because holding company creditors don't benefit from regulatory oversight.

Insurance groups usually have less incentive to hold capital at holding company level and there may be restrictions of flow of capital from supervised operating company to holding company. The group solvency ratio for a holding company can be two or three notches, depending on whether it is regulated or unregulated.

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"