Overview of Global Insurance Regulators

Sukhy Kaur

15 years: Debt capital markets

In the second video in Sukhy’s series, she discusses the equivalent of the ‘Basel Committee’ in insurance; the International Association of Insurance Supervisors, or IAIS. She then outlines the Insurance Core Principles, or ICPs before introducing global insurance regulators from the European Union, United States and Asia.

In the second video in Sukhy’s series, she discusses the equivalent of the ‘Basel Committee’ in insurance; the International Association of Insurance Supervisors, or IAIS. She then outlines the Insurance Core Principles, or ICPs before introducing global insurance regulators from the European Union, United States and Asia.

Overview of Global Insurance Regulators

15 mins 33 secs

Key learning objectives:

Understand the role of insurance regulators in the UK, the US and Asian countries

Understand the background and the need for IAIS

Outline the three stages of ICPs

Understand why Solvency 2 was needed in Europe

Overview:

Basel is viewed as the holy grail of banking regulation against which all local regulatory frameworks are measured. In a similar fashion to Basel, the IAIS is currently making a similar scene, through the development of the first global supervision standards for the insurance industry.

What is the International Association of Insurance Supervisors?

Formed in 1994, it's one amongst the key bodies setting higher-up standards within the insurance industry. Its main mission is to promote cooperation between international insurance supervisors. Members of the IAIS comprises insurance supervisors and regulators across over two hundred jurisdictions round the globe. This membership covers 97% of the world's insurance premiums. The IAIS is primarily responsible for developing Core Principles which translate into Standards to form an effective and consistent framework.

There are more than 20 Insurance Core Principles, also known as ICPs, which can be split into following categories:

- Powers, responsibilities and independence of supervisors

- Supervisory issues

- Qualitative requirements

- Quantitative requirements

- Conduct of Business

The ICPs can be broken down into three stages:

- Stage 1 - ICPs are the essential elements to which insurance companies should adhere to

- Stage 2 - The ICPs are translated into Standards, which are the fundamental high-level requirements

- Stage 3 - The IAIS then provides guidance on how these principles and standards should be applied

What are the two primary steps for ICP methodology?

- Firstly, an assessment of an insurer against each Standard. This assessment ranges within various degrees of observation, including largely observed to partly or not observed.

- These observations are then combined to provide an overall rating to the insurer. There are also self-assessment tools available for the insurers themselves.

What is the role of EU insurance regulators?

The European Insurance and Industrial Pensions Authority (EIOPA) is an independent supervisory body responsible for ensuring that solvency two is implemented uniformly across Europe. EU insurance firms have been regulated under the Solvency One framework for several years, Solvency two Scheme has been in effect since the beginning of 2016. EIOPA was created as part of the establishment of three new European watchdogs, the other two are - The European Banking Authority (EBA) and The European Securities and Markets Authority (ESMA).

How has the Solvency two framework evolved over the years?

- In 2001, the European Commission launched a review of existing insurance regulations. This kickstarted the initial Solvency two process

- In between, 2004 – 2006 the European Commission called on the advice of CEIOPS to assess various parts of the insurance industry. A three-pillar approach similar to the banking system was being explored

- In July 2007, just before the financial crisis, the Commission officially adopted Solvency 2

- In the aftermath of the crisis, in 2009, CEIOPS released a study entitled 'Lessons from the Crisis' in which it recommended Solvency two as a response

- Between 2005 – 2010 there were a number of impact assessments, known as Quantitative Impact Studies, running in parallel in order to assess the practical implications of Solvency two

- The next couple of years were spent finalising elements, including the decision of which other jurisdictions were deemed equivalent to Solvency two

- On 1 January 2016 the Solvency two framework was finally applicable to all European insurance companies

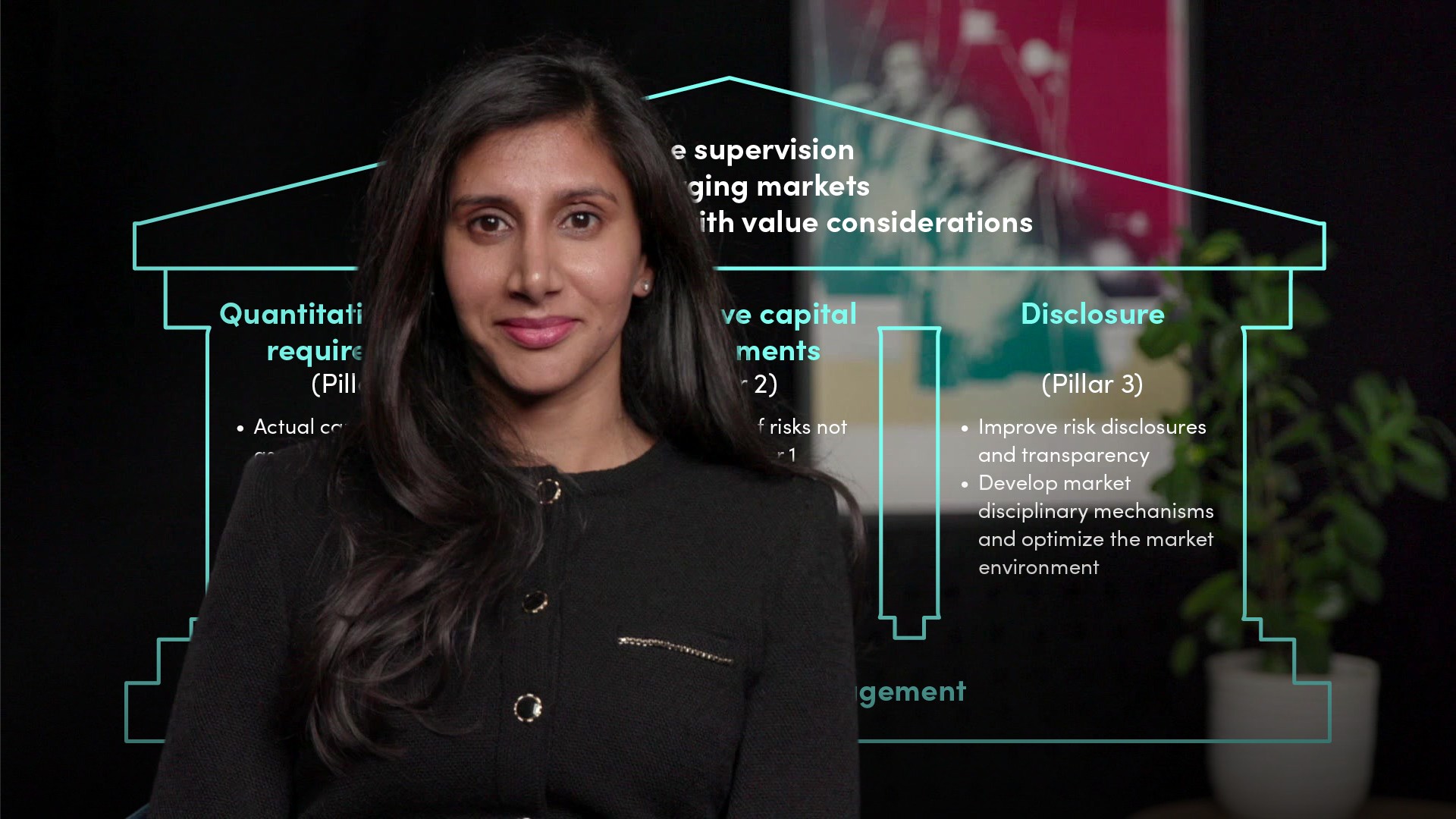

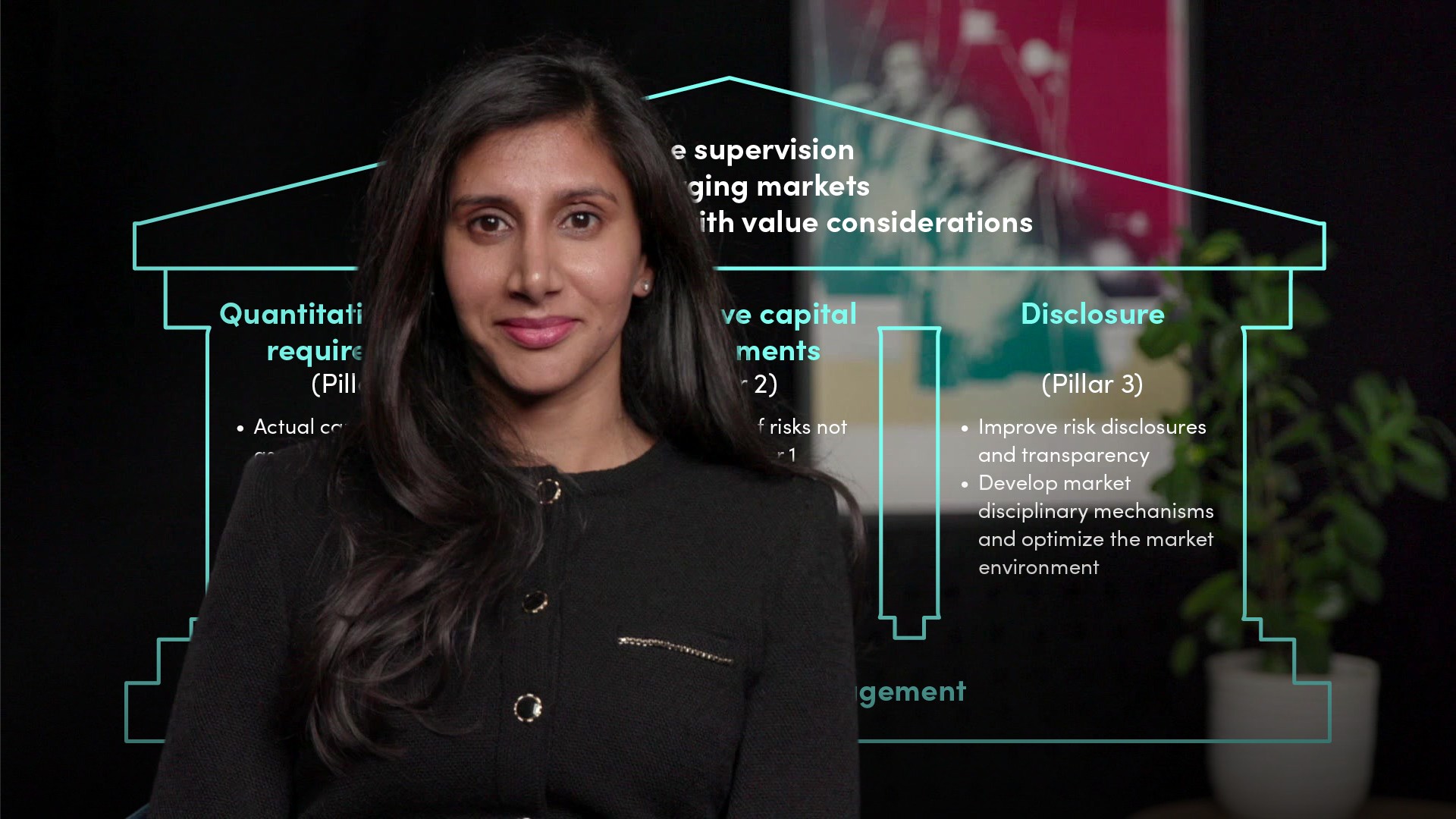

Solvency 2 can be divided into two pillars:

- Pillar 1 - sets out quantitative requirements

- Pillar 2 - consists of the requirements for risk management and governance

- Pillar 3 - addresses transparency and disclosure to the public

Who are the UK Insurance Regulators?

Two regulatory bodies relevant to the UK financial sector have been in place since 2013:

- The Prudential Regulatory Authority - promotes the safety and soundness of financial institutions, including insurers, and the protection of policyholders

- The Financial Conduct Authority - Regulates how firms behave, as well as the integrity of the UK's financial markets

Who are the United States insurance regulators?

In the United States, the insurance industry is governed by each Member State and not by a single national regulatory authority. Insurers and reinsurers are regulated by the state government officials often referred to as Insurance Commissioner, they are responsible for the supervision and implementation of relevant requirements and laws.

The National Association of Insurance Commissioners, NAIC, was founded by its members in 1999. They are the Chief Insurance Regulators in the 50 states, the District of Columbia and five U.S. territories. The NAIC is not a regulator but provides a central forum for its members to establish standards and coordinate their regulatory oversight.

In the light of the 2008 financial crisis, the NAIC re-evaluated several key areas of the regulation:

The evaluation of Risk Based Capital, often referred to as RBC

Adopted a significant new US insurance regulation which went into effect on 1st Jan 2015

Who are the Asian Insurance Regulators?

- In China the China Banking and Insurance Regulatory Commission, the CBIRC, regulates insurance companies. China has officially launched a three-pillar regime, similar to Solvency Two, known as the China Risk-Oriented Solvency System, or C-ROSS, which was implemented in 2016

- Insurers in Singapore are governed by the Singapore Monetary Authority or the MAS. The Risk-Based Capital Structure was first adopted by the insurance industry in Singapore in 2004. Over the years, the framework has evolved to align itself more closely with international norms

- The Financial Services Agency, the FSA, is the regulatory authority for the insurance industry in Japan. Japanese insurers are governed by the Insurance Business Act, the IBA. The IBA shall measure the solvency margin ratio under the risk-based capital regime

- In Hong Kong, the insurance authority is the primary regulator of insurance companies. There is no group-wide supervisory framework in Hong Kong - insurers are instead regulated on a solo basis

Sukhy Kaur

There are no available Videos from "Sukhy Kaur"