Interpreting PE Ratios

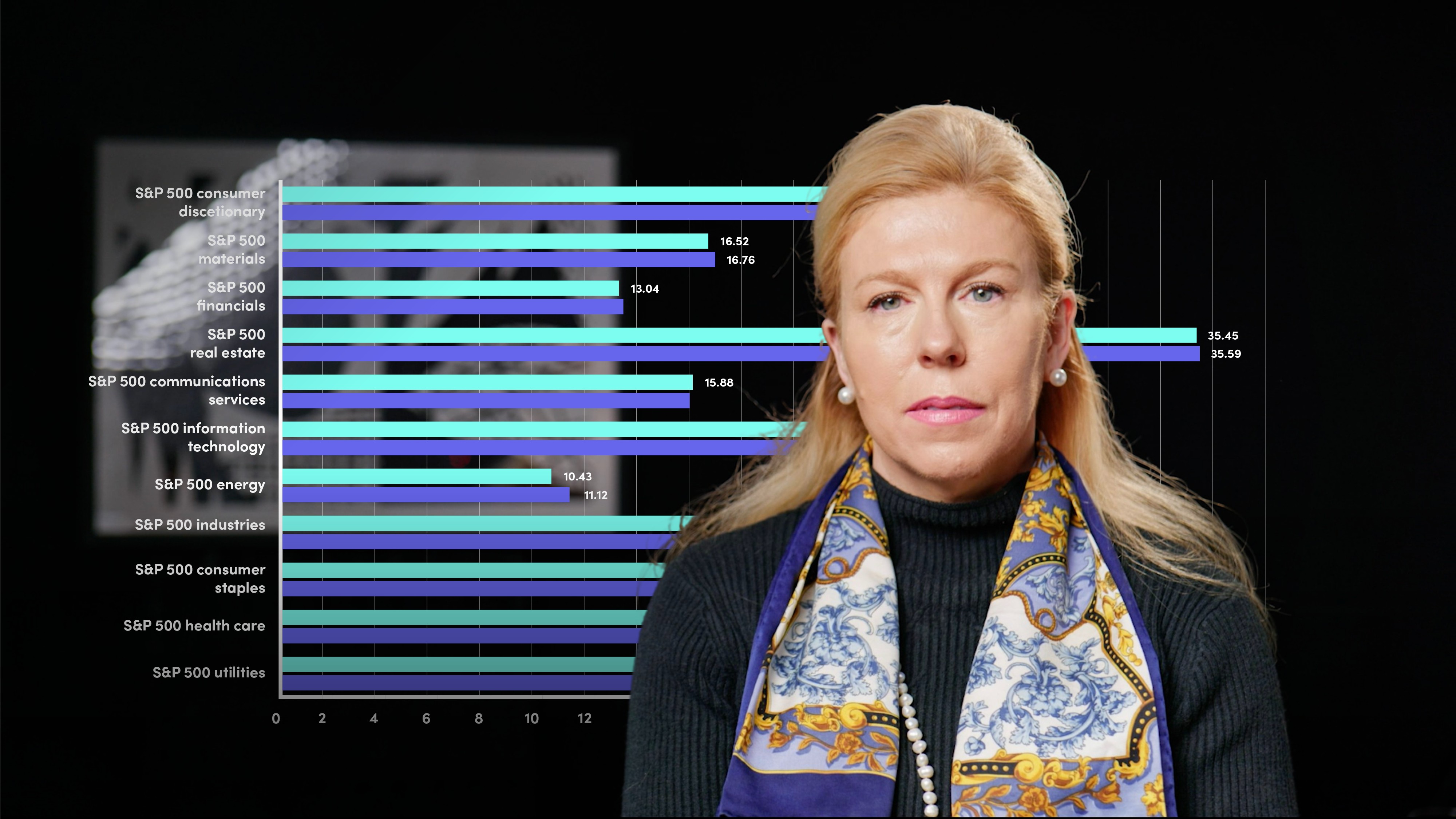

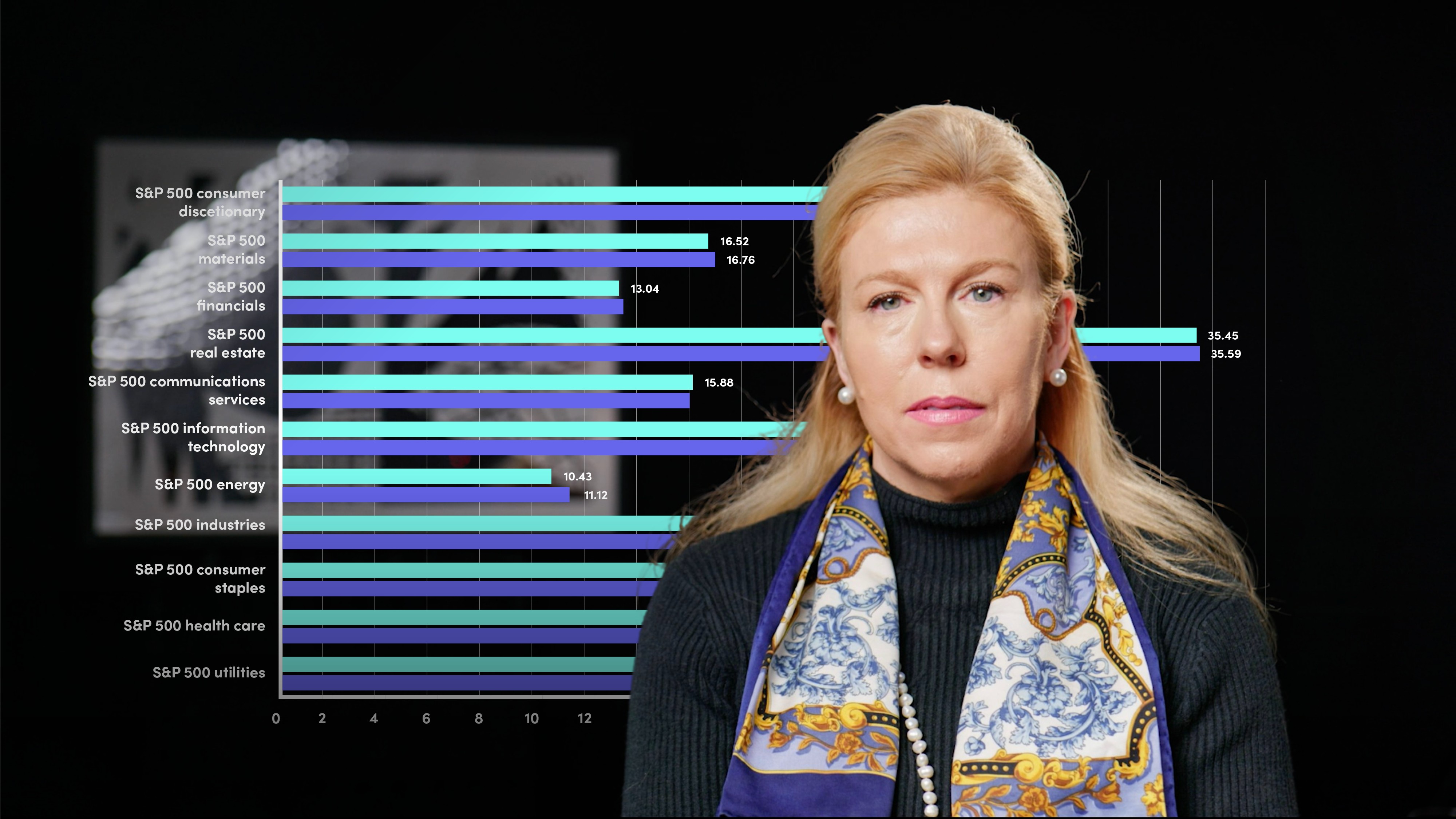

Sarah Martin

30 years: Corporate Valuations

In the previous video on equity multiples, Sarah Martin introduced PE ratios. In this video she delves deeper into this topic and explains how to interpret PE ratios. She also expands on the adjustments that need to be made to arrive at an appropriate underlying valuation when using PE ratios.

In the previous video on equity multiples, Sarah Martin introduced PE ratios. In this video she delves deeper into this topic and explains how to interpret PE ratios. She also expands on the adjustments that need to be made to arrive at an appropriate underlying valuation when using PE ratios.

Interpreting PE Ratios

8 mins 34 secs

Key learning objectives:

Understand what a low PE ratio could mean

Understand what a high PE ratio could mean

Understand the adjustments that need to be made for net cash distortions

Understand the adjustments that need to bede for quasi-debt and non-core earnings

Overview:

PE ratios can be difficult to interpret. This is firstly because, the net profit metric used in PE ratios combines the operating performance and the capital structure. In addition to this, there are other distortions that can be caused due to a net cash position or due to quasi-debt items. It is important to understand this and keep this in mind when using PE ratios to arrive at meaningful equity valuations.

What does a low PE ratio mean?

If the firm has a low PE ratio, typically means it is a firm with low or negative ROIC, low or negative growth and a higher WACC. It can also mean that the firm’s earnings are expected to fall in future. A low PE ratio does not always represent good value. Its earnings may be on a downward trend and its future PE is rising and becoming high

What does a high PE ratio mean?

A high PE ratio could mean that it is a good firm, with high growth, high ROIC and a reasonably low cost of capital. It could also mean that the firm’s net profit has fallen this year but that the market is expecting a recovery. A high PE ratio could also indicate that the firm has very high leverage and its net profit is low due to high interest charges, causing an bias in the PE ratio.

How are PE ratio distortions caused by net cash positions?

PE ratios are based on net income and this metric is obviously calculated after finance income and finance expense. PE ratios can become distorted due to net cash, particularly if interest rates are low. Net cash means the firm has more cash and cash equivalents than total debt.

How should you adjust the numbers for a firm whose PE ratio is distorted by net cash balances?

Deduct net cash from the market value of equity and deduct the after-tax interest income from the net profit and we will have the underlying PE ratio of the firm’s business operations.

What are the adjustments to be made for quasi-debt whose cost is not reflected in net profit?

Equity valuation is based on net profit and therefore takes account of net debt via the interest charge. Many firms will have debt-like liabilities whose cost may not have been deducted to arrive at underlying net profit.

Imagine a firm with derivatives liabilities. For example, if a firm has derivatives liabilities that rise by 500 million dollars between the start and end of the financial year, this increase will be shown as an exceptional charge in the income statement and will be ignored from the multiple valuation. However, the equity valuation has fallen by 500 million dollars as equity investors now owe an extra 500 million dollars to the derivatives counterparty. So, we have to adjust the equity valuation up or down to reflect changes in quasi-debt liabilities such as derivatives, retirement benefit deficits and off-balance sheet liabilities.

What are the adjustments for non-core earnings?

If a firm has assets that are not operating assets, it is better to value these separately from the valuation of the underlying business. An example of this would be an industrial firm which has surplus property and is renting it out to receive rental income. Don’t value the rental income using the PE ratio of the industrial business. Exclude the after-tax rental income from the total net income and then you are just valuing the underlying business. Work out the value of the surplus property and then add this on to the value of the underlying business.

Sarah Martin

There are no available Videos from "Sarah Martin"