Introduction to Commercial Paper (CP)

Peter Eisenhardt

30 years: Capital markets & investment banking

In this video, Peter outlines a commercial paper. He begins by explaining what commercial paper is all about and goes on to talk about the interest of investors and borrowers in commercial paper. He further explains what can go wrong and finishes by talking about the future of commercial paper.

In this video, Peter outlines a commercial paper. He begins by explaining what commercial paper is all about and goes on to talk about the interest of investors and borrowers in commercial paper. He further explains what can go wrong and finishes by talking about the future of commercial paper.

Introduction to Commercial Paper (CP)

20 mins 34 secs

Key learning objectives:

Explain the discount factor in CP

Learn why borrowers like CP

Learn why investors like CP

Identify the issuer and buyer of CP

Learn the 10 steps to issuing CP

Understand how investors get comfortable buying CP

Overview:

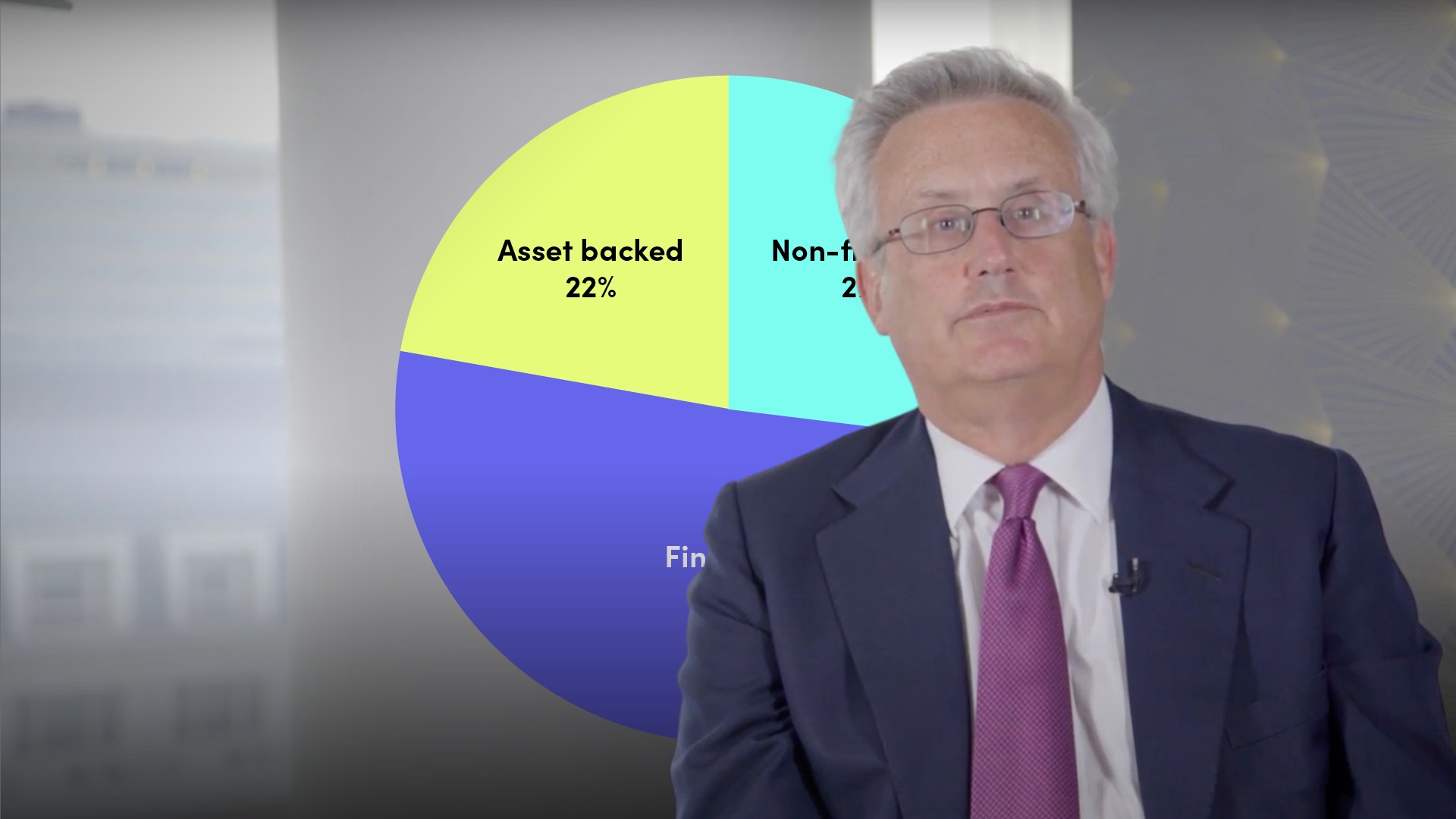

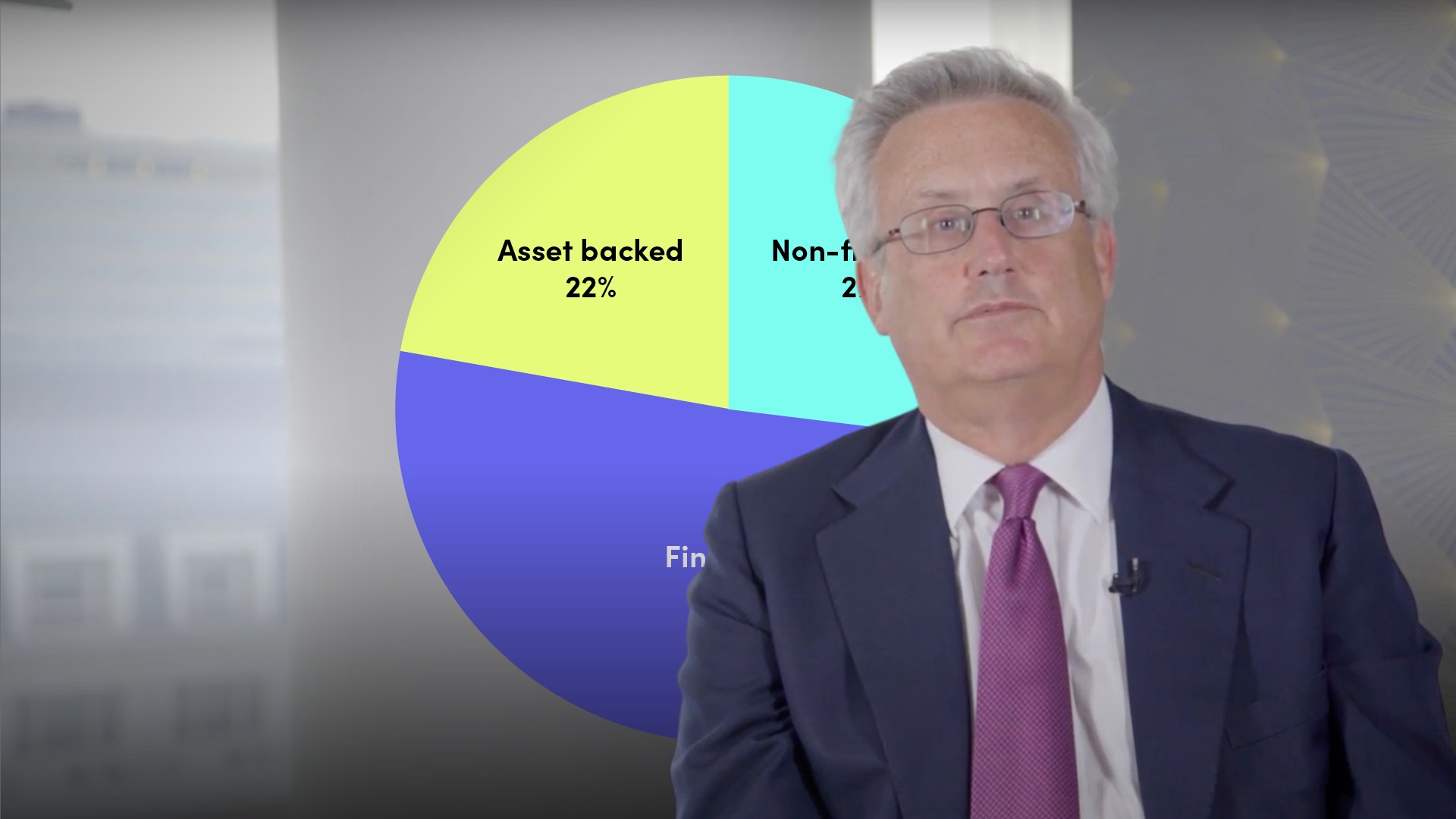

Commercial Paper (CP) is a tradable debt instrument with maturities up to one year. Borrowing in the CP market is one of the tactics companies can use to source short term funding and keep the overall cost of liabilities down. Most large companies issue CP as part of their regular financing activities.

- Cost: a big advantage of CP over bank borrowing is cost. Banks dislike lending to highly rated companies as the spreads are very low but will help companies place CP

- Flexibility: the CP market is huge, so highly rated companies can borrow on demand: when they, how much, for how long and in the currency they want

- Market presence: CP programmes allow companies to tap the market on a regular basis. Every time companies issue CP, they see what the market thinks of them

- Cost: CP can offer a higher returning alternative to bank deposits

- Flexibility: for investors with very specific investing needs, they can seek issuers willing to issue CP that suits their needs in terms of amounts, maturities, and currencies

- Diversification: borrowers can choose the sectors and credits that suit their risk appetite and achieve the level of diversification required

- To facilitate quick and cost-effective issuance, CP is issued under the documentary framework of a programme. Programme documentation sets out the terms and conditions, representations and warranties made by the issuer, the form of the notes and any selling restrictions

- Issuers choose a dealer panel to distribute the CP to investors. One dealer is appointed as ‘arranger’ to represent other dealers and investors

- Investor marketing is launched, with the information memo sent by dealers to investors. Conference calls and roadshows may follow. Portfolio managers and credit officers review the credit strength of the issuer and the programme and, if approved, establish credit limits

- Dealers begin an active dialogue with the issuer, advising on market conditions. Specific issuing opportunities and investor appetite are communicated to the issuer

- When they are ready to issue, issuers tell dealers how much they would like to borrow, in what currency and for how long

- Issue levels are agreed and the dealer sends information to sales teams and investors

- Sales teams gauge feedback from investors. Many borrowers also post indicative levels on market data systems, alongside a list of authorised dealers

- If investors want to buy, a trialogue takes place between issuer, dealer and investor and a trade is agreed.

- The Issuing and Paying Agent passes trade details from dealers to the clearing system

- CP is usually held to maturity but investors expect dealers to provide liquidity if they have an unforeseen need to sell

- High ratings: Most issuers have short-term ratings equivalent to long-term single A or better

- Length of investment: companies generally don’t go bust overnight. When warning signals emerge, investors only have to wait a short time for their investment to mature

- Backstops: to secure high ratings, CP programmes can have a bank backstop where a bank commits to lend to a corporate borrower if its CP cannot be rolled over and funds are needed to pay off the investor at maturity

- Diversification: top-rated money funds are highly rated and in the very rare instance of a default, losses may well be covered by interest earned on the diversified portfolio

- Over reliance: Given the low risk appetite of investors in this market, they will shut off the tap at the first sign of any trouble

- Forgetting risk/return: taking substantial credit risk for the sake of a few extra basis points

- Maturity transformation: If investors roll over CP for years in effect funding long-term liabilities, they will not receive adequate compensation for the risk they are taking

- Inadequate backstops: backstops can be badly structured so won’t kick in as expected

- Asset-backed commercial paper (ABCP) is only as good as the underlying assets

Peter Eisenhardt

There are no available Videos from "Peter Eisenhardt"