Introduction to Financed Emissions

Michelle Horsfield

25 years: Sustainable Finance

In this video, Michelle will provide a walkthrough of the steps that could be adopted by financial institutions to reduce their financed emissions. She will explain this by splitting it into 4 stages: calculating the current emissions, assessing the shape of the future path, planning for reductions and setting targets and embedding them into the organisation.

In this video, Michelle will provide a walkthrough of the steps that could be adopted by financial institutions to reduce their financed emissions. She will explain this by splitting it into 4 stages: calculating the current emissions, assessing the shape of the future path, planning for reductions and setting targets and embedding them into the organisation.

Introduction to Financed Emissions

15 mins 53 secs

Key learning objectives:

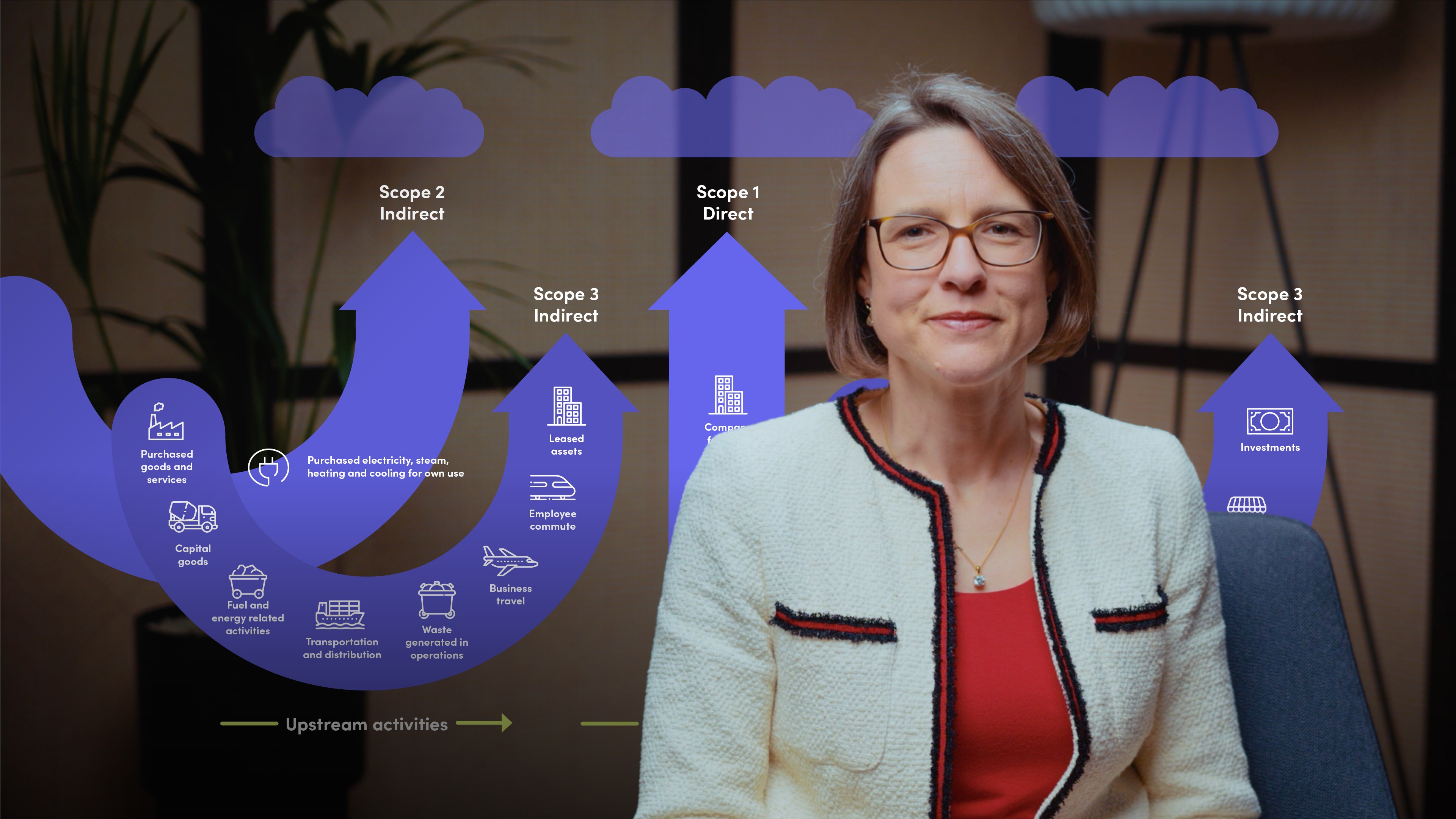

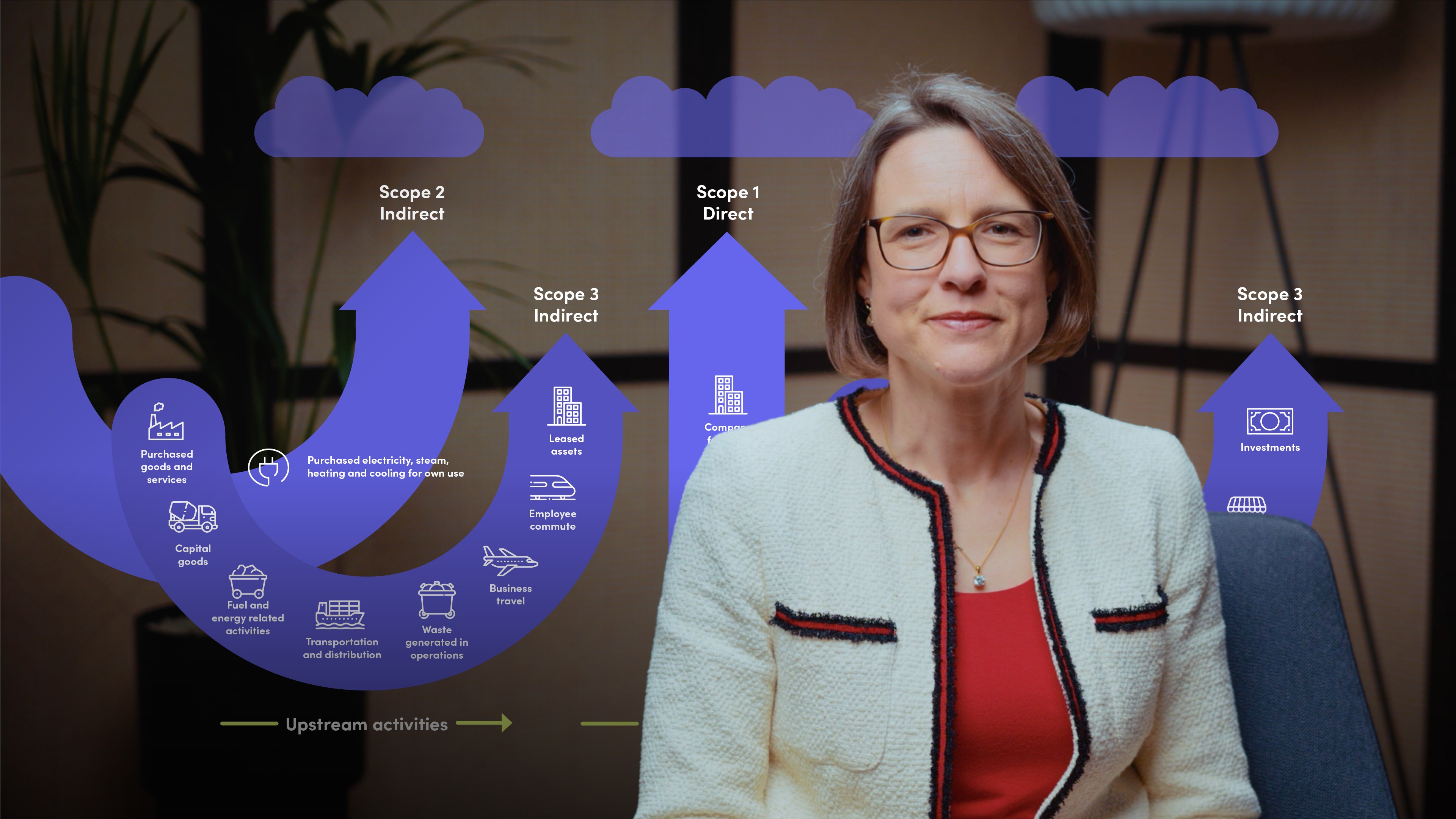

Understand what are financed emissions and why financial institutions need to reduce this

Understand how to calculate financed emissions

Understand how to assess the future path of financed emissions and plan for reductions

Understand how to execute the reduction of financed emissions and embed it within the organisation

Overview:

Financial institutions play a major role in helping organisations achieve net zero. One of their main objectives in this transition is to reduce their financed emissions. This is the metric for which financial institutions are held accountable for their contributions. It is very pertinent for financial institutions to stay on top of financed emissions numbers and start reducing this as we transition to a sustainable future.

- Real world GHG emissions (all scopes, 1, 2 and 3) must be calculated. These can usually be found in an organisations’ annual or sustainability report. This is usually reported in thousands of tonnes, or millions of tonnes. Data that comes from a physical metre that’s been regularly calibrated and has been externally audited is a lot better to work from than just using sector-based proxies.

- Next we need to find the portion of the emissions attributed to the financial institution, and this attribution factor is really the share of the value. The share is because usually there are lots of different financial market players involved in a big asset. (Although this is just drawn exposure.

- Next we have to calculate the value of the asset. This is known as ‘enterprise value including cash’ or EVIC. The emissions value should match the year the enterprise value has been taken for.

- Reduce the amount that is lent (not good for business though)

- Engage with clients to support their low carbon transition

- Steer portfolio towards companies with strong transition plans

- Increase lending to low carbon or zero carbon financing opportunities

- Targets based on intensity (units of activity eg: tonnes of steel produced)

- Economic measures (eg: emissions per unit of revenue)

- Absolute emissions (direct number of tonnes of carbon dioxide emissions being financed)

- Training and resourcing people across the company to become fluent in this new vocabulary.

- Story-telling and managing stakeholders

Michelle Horsfield

There are no available Videos from "Michelle Horsfield"