Introduction to Funds and Fund Accounting

Mark Doran

40 years: Fund management

In this video, Mark explains the benefits of maintaining an accurate record of a fund's investment activities to guarantee that the fund continues to function as planned for its investors.

In this video, Mark explains the benefits of maintaining an accurate record of a fund's investment activities to guarantee that the fund continues to function as planned for its investors.

Introduction to Funds and Fund Accounting

4 mins 46 secs

Key learning objectives:

Outline the purpose of funds and fund accounting

Understand how investment funds operate

Outline common investment types and how performance is measured

Overview:

Investment funds reduce the risks that come with the gamble of investing by pooling funds with like-minded people and organisations. Keeping an accurate account of a fund’s investment transactions ensures the smooth running of a fund. Fund accounting allows for the recording, analysis and dissemination of the financial information of the fund. It allows for planning, strategy and allocation of resources, whilst also providing investors with an overview of the health and overall performance.

What are investment funds and why is fund accounting important?

Investment funds are a way of investing money alongside other investors with pooled money reducing the risk of investing. There are many different types of funds including mutual funds, hedge funds and private equity funds to name a few.

Fund accounting recognises assets and liabilities, along with income and expenses. The liabilities of the fund are largely made up of the investors’ money, but would also include management fees charged by the fund, such as Annual Charges and Performance Fees.

It is essential to keep an up to date accounting of the fund’s investment transactions and its balance sheet to ensure a smooth running of the fund.

How does an investment fund operate?

Investors can buy shares or units within the fund from asset managers, either directly or online through fund supermarkets. The frequency with which investors can buy or sell shares depends on the type of fund.

The value of the assets within the fund needs to be calculated frequently in order to determine the price at which the shares of the fund will be available. The value of a share or unit of a fund is known as the Net Asset Value and is calculated by dividing the total value of the assets by the number of shares within the fund.

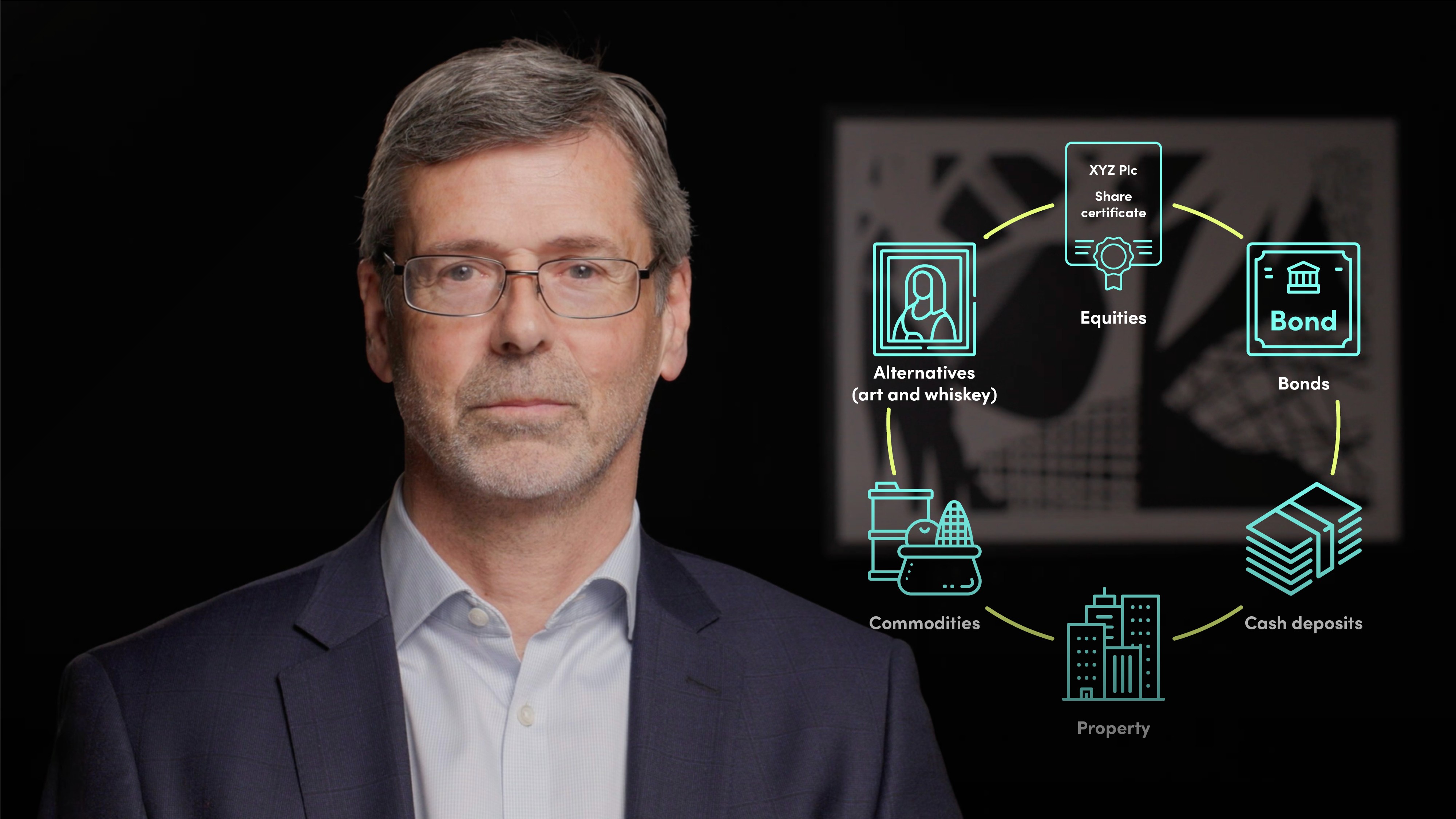

What are the typical investment types and how is performance measured?

The type of investments held by funds will depend on the fund type, however common investments include equity, bonds, cash deposits held with banks, property (both retail and commercial), commodities and alternatives, such as fine art and whiskey.

To measure performance, many funds are measured against a benchmark. This way investors can see if their fund is performing better or worse than the rest of the market. A benchmark might be the UK’s FTSE 100, for example.

Mark Doran

There are no available Videos from "Mark Doran"