Introduction to Green and Energy Efficient Mortgages

Luca Bertalot

Secretary General: The European Mortgage Federation

In the second video of this four-part video series, Luca explores the role of energy-efficient mortgages in reducing the pollution caused by inefficient homes. He further talks us through how ‘green mortgages’ work, what requirements are needed, and how these loans can be used to make homes more efficient.

In the second video of this four-part video series, Luca explores the role of energy-efficient mortgages in reducing the pollution caused by inefficient homes. He further talks us through how ‘green mortgages’ work, what requirements are needed, and how these loans can be used to make homes more efficient.

Introduction to Green and Energy Efficient Mortgages

9 mins 32 secs

Key learning objectives:

Learn how energy efficient mortgages can be used to ‘green’ homes

Define the role of the Energy Efficiency Mortgage Initiative and the Energy Efficient Mortgage Label

Overview:

Energy efficient mortgages have the potential to significantly reduce the energy consumption and emissions of residential properties. To help increase awareness of the products, industry initiatives such as the Energy Efficiency Mortgage Initiative are promoting the use of an Energy Efficient Mortgage Label with the aim of promoting consumer interests, helping with regulatory compliance and investor transparency due diligence.

What are the benefits of energy-efficient mortgages?

The key aim of energy-efficient mortgages is efficiency, efficiency, efficiency. It is the only tangible element important for borrowers, banks and investors. Retrofitting households changes the nature of the asset itself and the credit risk linked to the asset.

The benefit for banks is that they can change the credit risk profile of the asset when used as collateral or as a guarantee. It should also increase the value of the property.

The benefit for the borrower is again, an increase in property value, but significantly reduced energy costs, usually at least 50%, but it can be higher in certain cases.

What is the Energy Efficiency Mortgage Initiative trying to achieve?

This initiative is establishing a comprehensive ecosystem from the origination of a label for energy efficiency mortgages to the issuance of energy efficiency green cover bonds. The Energy Efficiency Mortgage Initiative meets evolving ESG criteria, and consumer and issuer needs and facilitates regulatory compliance and investor transparency due diligence. This industry initiative has mobilised more than 70 European banks, supported by 55 non-lending organisations and more than 20 public authorities across the continent.

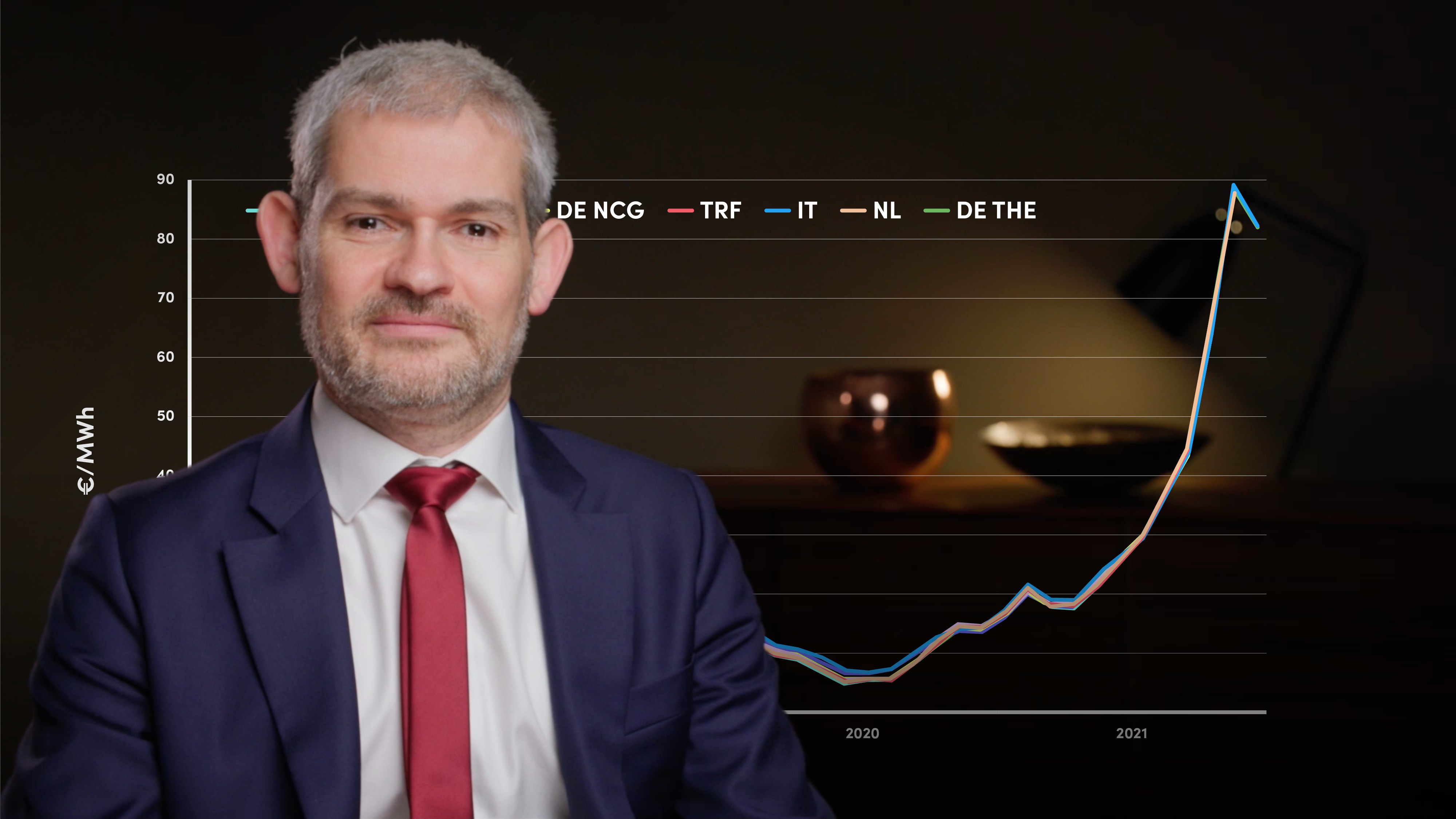

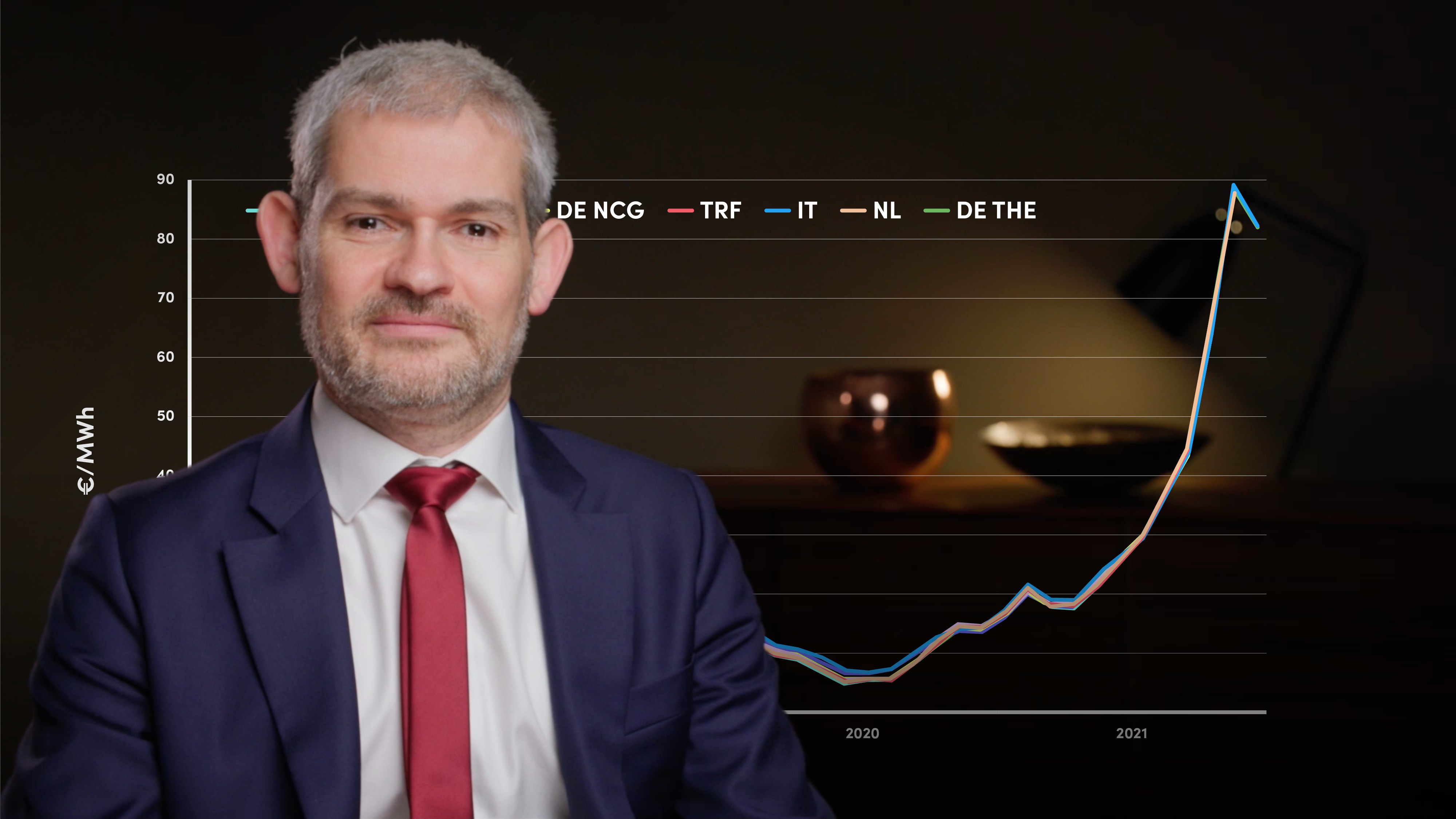

The initiative is changing the entire mortgage value chain from the retail side to the funding side. The funding side is important because we have to think that the consumer has to finance an asset for usually over 20 years. So the bank has to build a funding line, which will cover this liquidity gap in its balance sheet. Energy-efficient mortgages can be a solution because they can stabilise the capacity of banks to access capital markets with energy-efficient covered bonds, for example. However, due to a lack of transparency, investors may be tough to convince.

Due to this, a clear benchmark needed to be set for investors, so in 2021 the EMF-ECBC launched a new initiative looking at the retail side, the Energy Efficient Mortgage Label.

What are the objectives of the Energy-efficient Mortgage Label?

The energy efficiency mortgage label has three key objectives.

- To help consumers retrofit their houses with the aim of transforming residential and commercial properties into greener assets

- To help banks in making regulatory disclosures in order to respond to the compliance requirement for European regulation, such as the EU

- Taxonomy or the Energy Performance Building Directive

- To support investors in their due diligence

Luca Bertalot

There are no available Videos from "Luca Bertalot"