Introduction to the TCFD

Keith Mullin

35 years: Capital markets editorial

In this video, Keith delves into the Task Force on Climate-related Financial Disclosures and its impact on the financial world. He explains the establishment of the TCFD to develop recommendations for better climate-related financial reporting, aimed at helping market participants understand the financial implications of climate change. He highlights the TCFD's four key organisational elements of governance, strategy, risk management, and metrics and targets, each supported by detailed disclosures.

In this video, Keith delves into the Task Force on Climate-related Financial Disclosures and its impact on the financial world. He explains the establishment of the TCFD to develop recommendations for better climate-related financial reporting, aimed at helping market participants understand the financial implications of climate change. He highlights the TCFD's four key organisational elements of governance, strategy, risk management, and metrics and targets, each supported by detailed disclosures.

Introduction to the TCFD

12 mins 6 secs

Key learning objectives:

Outline the purpose of the TCFD

Identify the users of the TCFD recommendations

Understand the TCFD recommendations

Overview:

The Task Force on Climate-related Financial Disclosures (TCFD) was established to develop recommendations for more effective climate-related disclosure around the financial impact of climate change, so that market participants can better understand the financial implications of physical and transition risks and make better pricing and capital allocation decisions. The Taskforce provides recommendations structured around four key organisational elements, governance, strategy, risk management and metrics and targets, each supported by specific disclosures.

What is the TCFD?

Established in 2015, the TCFD aims to improve the quality of corporate disclosure around the financial impact of climate change. The TCFD was created following a request from G20 finance ministers and central banks governors to the FSB in 2015 to come up with an action plan. Mark Carney, then governor of the Bank of England and FSB chair, set up the TCFD, appointing Michael Bloomberg as its chair.

They have provided a set of recommendations and a framework for companies and financial institutions to provide better information to their stakeholders. The inaugural set of voluntary recommendations were issued in 2017. Since 2018, the taskforce has published annual status reports on disclosure practices, investor perspectives and areas for improvement.

Who are the users of the TCFD recommendations?

As of September 2022, the TCFD claimed around 3,800 supporters in 95 jurisdictions with a market cap of more than $26.7 trillion; plus over 1,500 financial firms responsible for assets of almost $216 trillion.

Governments and regulators have also widely adopted the TCFD’s recommendations. These are now starting to inform public policy and form the basis of climate regulation, and tools such as climate stress testing.

What are the TCFD recommendations?

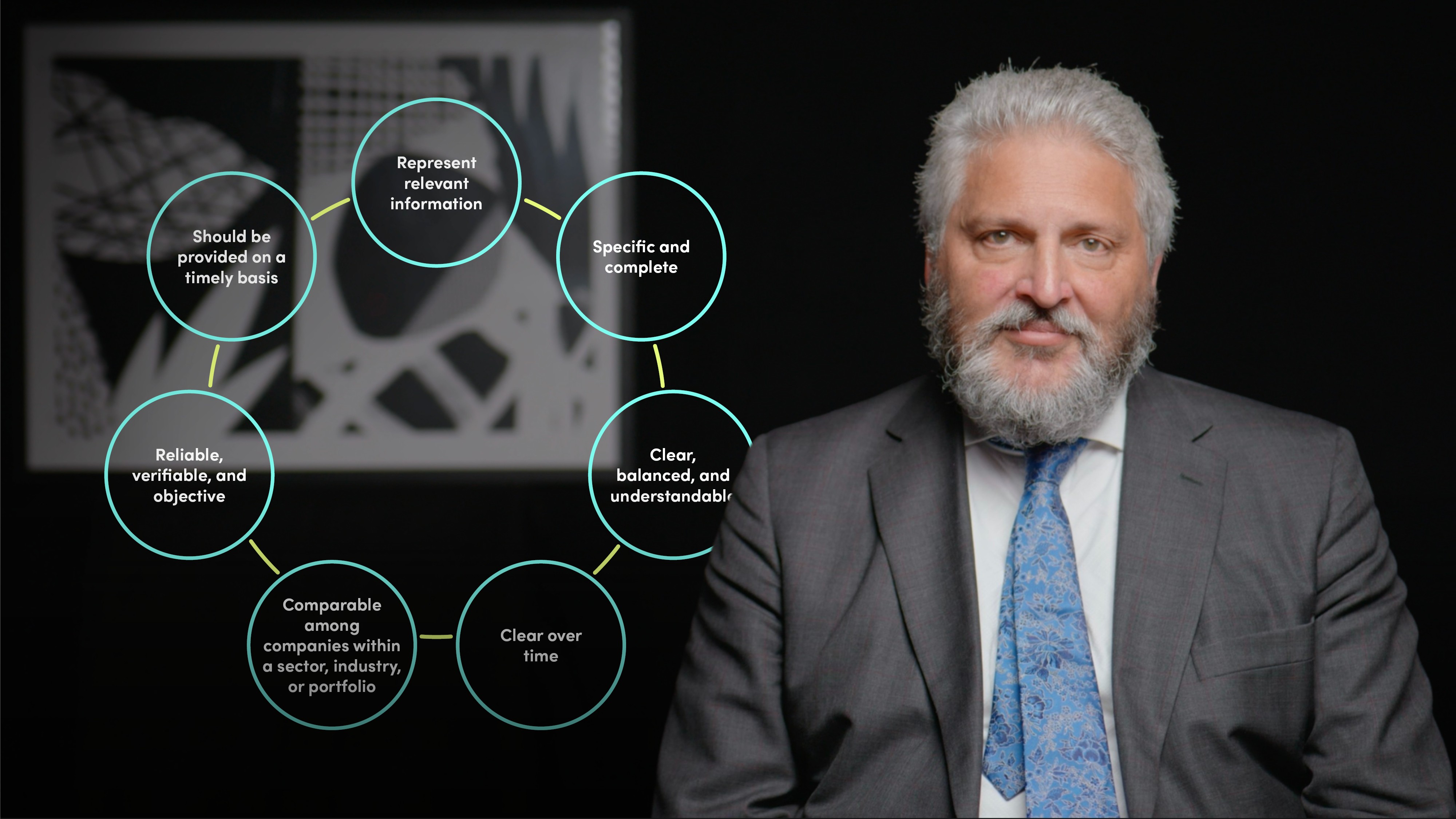

TCFD’s recommendations are structured around four core operational themes: governance, strategy, risk management, and metrics and targets. Governance asks companies to disclose their governance around climate-related risks and opportunities including board oversight and management action. Strategy seeks disclosure around the actual and potential impacts of climate-related risks and opportunities on a company’s businesses, strategy, and financial planning when this information is material. Risk management asks companies to disclose how they identify, assess and manage climate-related risks. Metrics and Targets seek disclosure around the metrics and targets companies use to assess and manage relevant climate-related risks and opportunities where this information is material.

Below the four themes lie 11 recommended disclosures.

The TCFD differs from the SASB Standards due to the fact that they have different disclosure types. The TCFD focuses on more general recommendations that ask companies to provide qualitative information and there is no bar per se that companies have to rise above to achieve alignment.

SASB has written a set of minimum standards that companies have to meet to achieve alignment and this asks for more quantitative disclosure. SASB focuses on quantifying and reporting the outward ESG impacts and risks of an organisation’s performance, whereas the TCFD addresses how climate change might impact the organisation’s ability to create value.

However, they are complimentary, SASB has even published an implementation guide on how to use the SASB Standards to put TCFD Recommendations into place.

Keith Mullin

There are no available Videos from "Keith Mullin"