IRRBB Behavioural Risk

Paul Newson

20 years: Market Risk

Given that practically all loans and deposits can be withdrawn right away, behavioural risk can exist with regard to almost every retail banking product. Join Paul as he looks at the topic of what is termed IRRBB behavioural risk.

Given that practically all loans and deposits can be withdrawn right away, behavioural risk can exist with regard to almost every retail banking product. Join Paul as he looks at the topic of what is termed IRRBB behavioural risk.

IRRBB Behavioural Risk

14 mins 53 secs

Key learning objectives:

Understand how behavioural risk impacts NII and EV calculations

Outline how prepayment risk impacts the calculations

Outline the issue with non-maturing deposits

Overview:

To calculate the net interest income sensitivity or economic value sensitivity the repricing date of the products has to be known. In reality, it is hard to know when these items will reprice due to behavioural risk. Customers can pay back money early or withdraw money unexpectedly and banks will have to take this into consideration when calculating their sensitivity analyses.

How does prepayment risk impact the calculations?

The fundamental problem is that, in almost every case, customers have the legal right to repay any loan they have taken out.

Take the example of a mortgage. Prepayment of a variable rate mortgage doesn’t matter as the amount repaid can be lent out to another customer at an equivalent rate of interest.

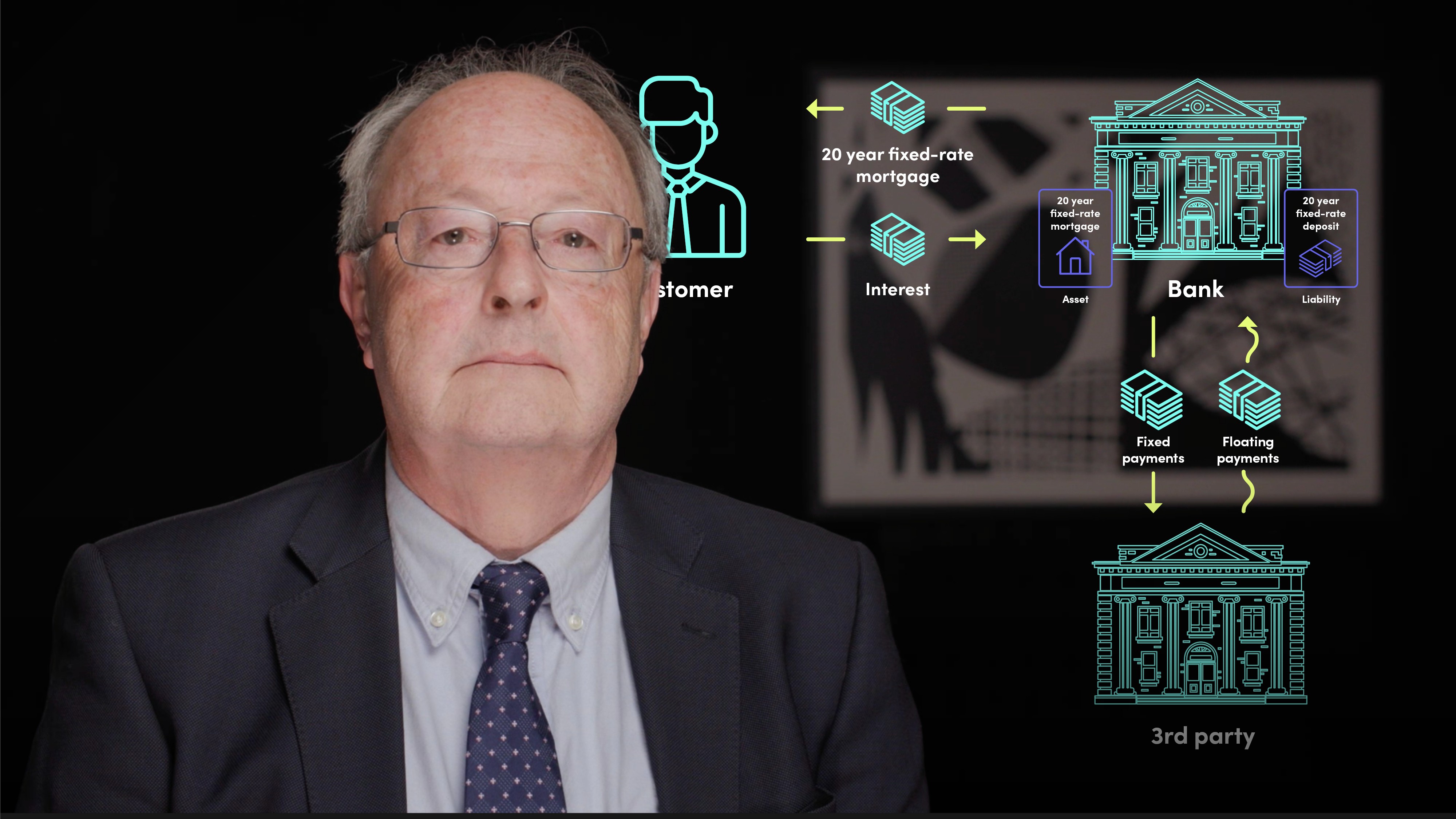

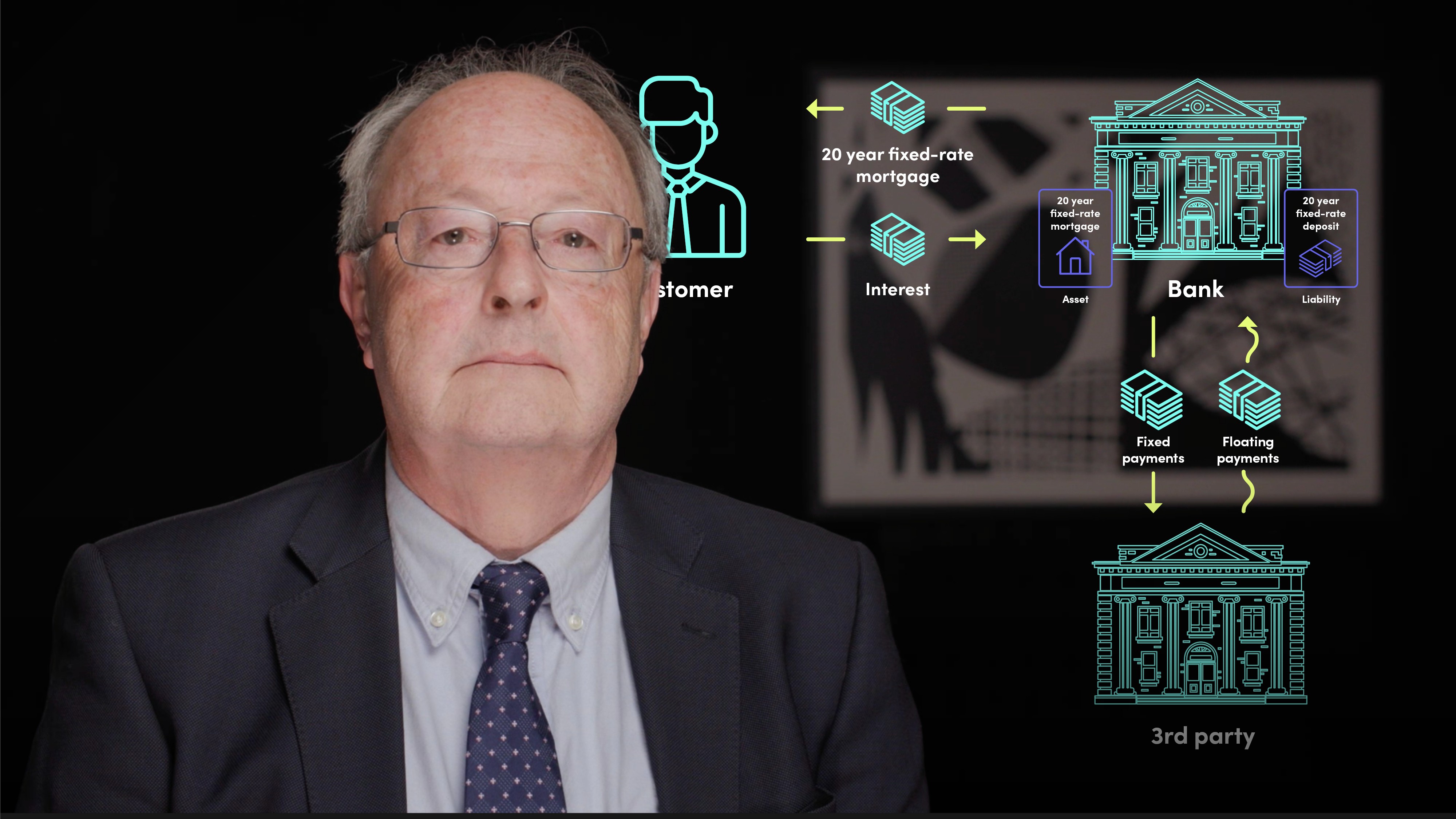

Prepayment of a fixed-rate mortgage could be problematic. The bank is likely to have hedged the loan and if the customer repays the bank, the bank will be left with an open risk position. If interest rates have, in the meantime, fallen it will incur a loss.

To avoid this, when hedging a portfolio of fixed-rate mortgages, it will make some assumptions about the likely rate of prepayment, meaning they’ll hedge to the behavioural repayment profile, rather than the contractual repayment profile.

People also modify their prepayment behaviour in relation to changes in interest rates. If rates go down sufficiently, it may seem worth prepaying the existing mortgage and remortgaging with another bank at the lower rate. Alternatively, an increase in rates might reduce the level of prepayment as re-financing would obviously cost more. The bank loses in both cases. In the first scenario there is a higher level of prepayment than expected, and in the second example, prepayment is lower and the bank might be under-hedged.

To prevent the issues illustrated banks have two options:

- Levy a prepayment charge.

- Periodically review the actual prepayment behaviour of a portfolio and re-adjust the hedging.

How do non-maturing deposits impact the calculations?

Non-maturing deposit accounts comprise all those deposits that have no defined contractual maturity date, but the customer has the right to withdraw their money immediately.

The fundamental question about these accounts is when, exactly, will they “reprice”, and by “reprice” we mean: either when might the bank change the interest rate it pays? Or when might the customers withdraw their money? There is no right answer.

Banks could treat these accounts as overnight deposits and that funds should be placed in overnight assets. However this would be detrimental should rates fall, resulting in lower income from the assets but the same cost on the deposits.

Banks could also treat these accounts as insensitive to external interest rates, i.e. balances will remain with the bank regardless of the level of external interest rates. This is the most commonly used approach, and if undertaken assets need to be invested at a repricing maturity longer than overnight both in order to reduce income volatility and to protect the bank from margin compression should rates fall.

To summarise, deciding on an appropriate investment term for non-maturing deposits is one of the most difficult aspects of interest-rate risk management in the banking book, and there is no risk-free solution.

Paul Newson

There are no available Videos from "Paul Newson"