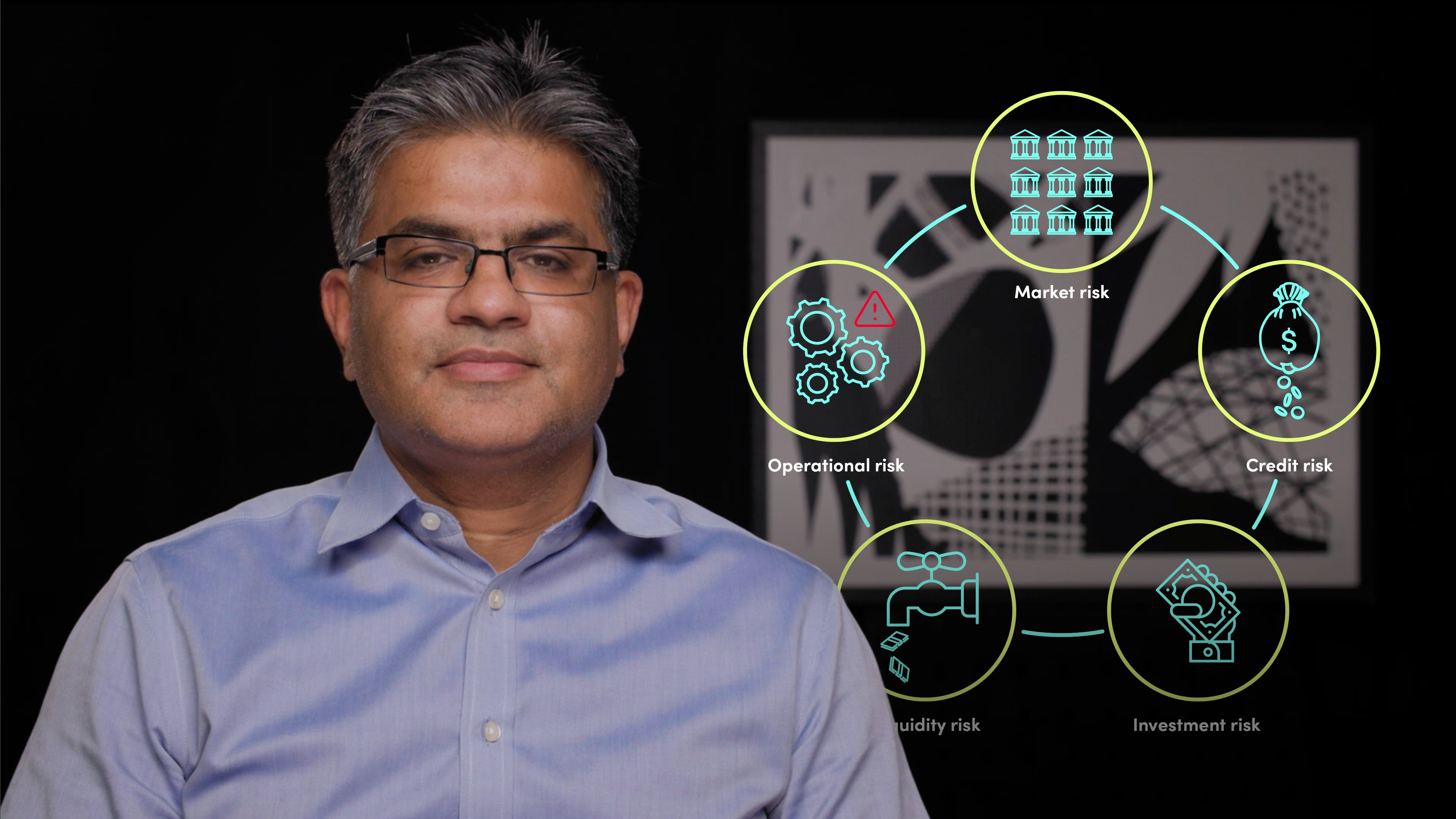

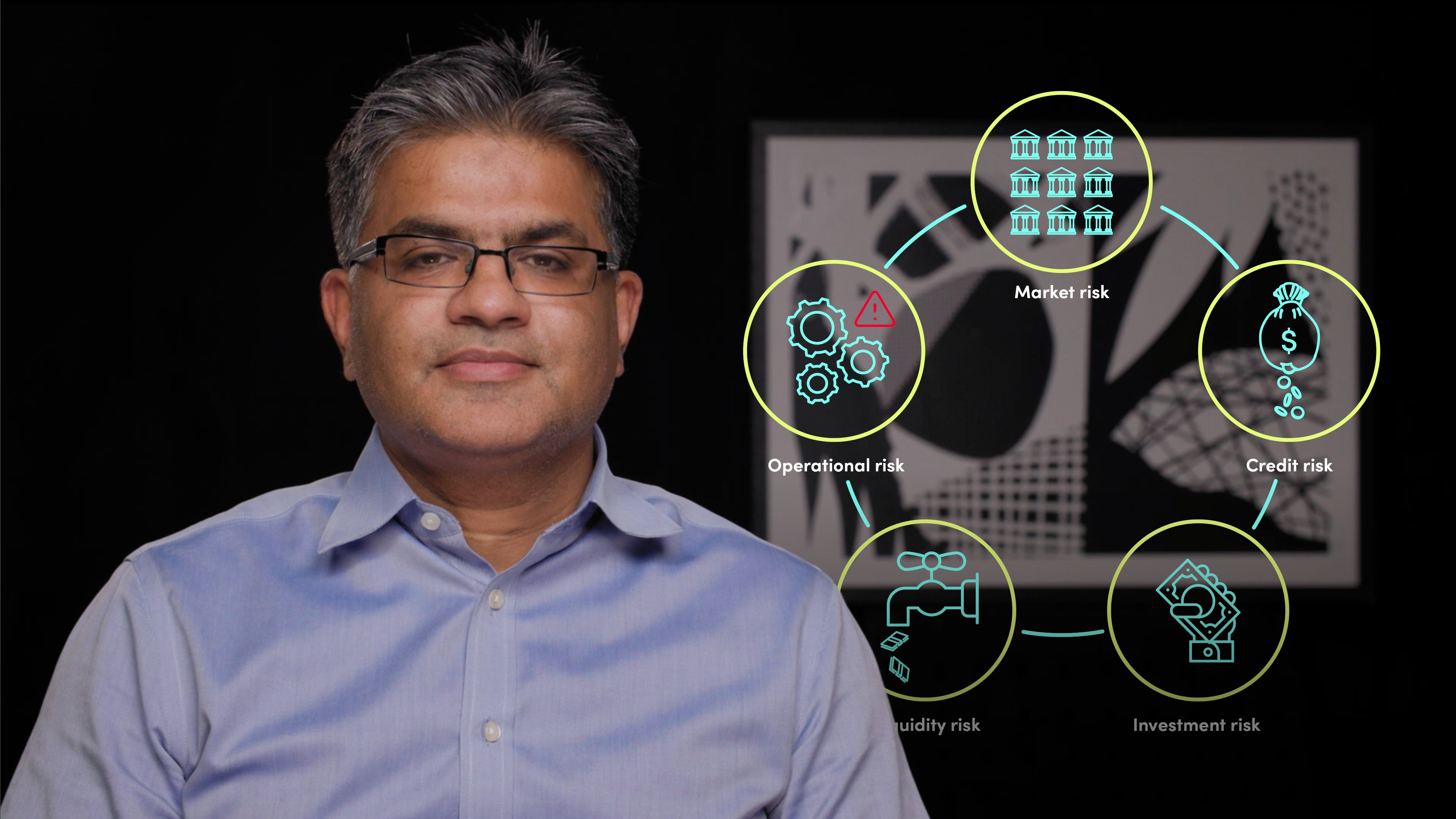

Key Risks for Wealth Management Firms

Faisal Sheikh

25 years: Wealth and risk management specialist

The primary risks that a wealth management firm and its clients are exposed to are similar to those faced by the rest of the financial industry. In this video, Faisal explains each of these primary risk categories and their impacts, as well as aspects of the risk management framework and oversight established by wealth management firms to manage them.

The primary risks that a wealth management firm and its clients are exposed to are similar to those faced by the rest of the financial industry. In this video, Faisal explains each of these primary risk categories and their impacts, as well as aspects of the risk management framework and oversight established by wealth management firms to manage them.

Key Risks for Wealth Management Firms

6 mins 25 secs

Key learning objectives:

Outline the risks faced by wealth management firms

Understand how the risks impact wealth management firms and their clients

Understand how these risks are managed

Overview:

Risks a wealth management firm and its clients are exposed to are similar to those faced by the rest of the financial industry, specifically market, credit, investment, liquidity and operational risk. These risks will however impact wealth management firms and their clients in different ways, and to different extents, when compared to other firms in the financial sector.

How does market and credit risk impact wealth management firms?

Market risk is the risk of losses arising from movements in market prices for assets. Given wealth managers do not hold proprietary positions, market risk isn’t that significant for them. Market risk can arise inadvertently from errors made in placing client trades for example. However, even if a loss does arise from these positions, it’ll be classed as an operational risk loss.

Credit risk describes the risk of default on a debt or loan arising from a borrower failing to make payments. This is more relevant in wealth management as they do provide credit facilities, however, most lending is protected by collateral. A failure to have sufficient collateralised assets to cover a client default is also classed as an operational risk loss as again, this uncollateralised position was not intended. Firms manage this risk using a credit risk team and associated policies and systems, such as monitoring exposure, escalating capital shortfalls and the closure of positions.

How does investment and liquidity risk impact wealth management firms?

Investment risk covers the likelihood of losses relative to the expected return on any particular investment occurring. This is relevant to wealth managers and their clients when portfolios significantly underperform relative to their benchmark. tHis will be managed during the portfolio management process through policies, procedures and systems.

Liquidity risk applies to situations where, for a certain period of time, a given financial asset or security cannot be traded quickly enough in the market without impacting the market price. This is also managed through various policies, procedures and systems, for example having a policy of only holding highly liquid positions or not over investing into a specific fund or issuer.

How does operational risk impact wealth management firms?

Operational risk is the risk of losses resulting from ineffective or failed internal processes, people or systems, or from external events that can disrupt the flow of business operations.

This is by far the most relevant risk to wealth management firms and their clients and can include the likes of fraud, business continuity, conduct risk, financial crime, regulatory compliance and information security.

Faisal Sheikh

There are no available Videos from "Faisal Sheikh"