Key Stakeholders in Venture Capital ESG

Johannes Lenhard

ESG & VC Specialist

A lot has changed in 10 years - ESG is at the forefront. But who are the stakeholders in the venture capital sphere pressing forward? Join Johannes Lenhard in this video as he explores the regulators, LPs and asset owners pushing for ESG in Europe and North America.

A lot has changed in 10 years - ESG is at the forefront. But who are the stakeholders in the venture capital sphere pressing forward? Join Johannes Lenhard in this video as he explores the regulators, LPs and asset owners pushing for ESG in Europe and North America.

Key Stakeholders in Venture Capital ESG

8 mins 34 secs

Key learning objectives:

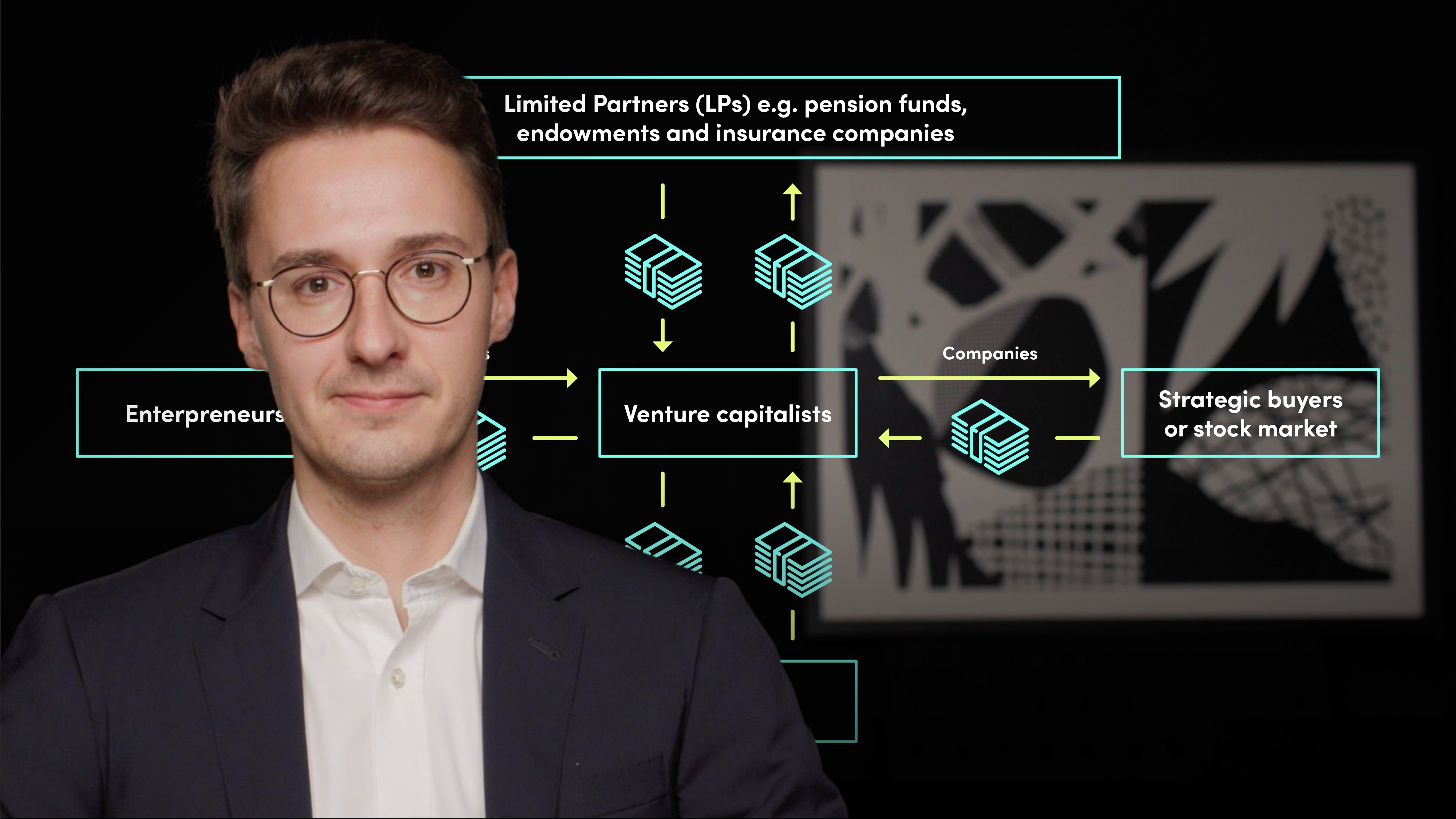

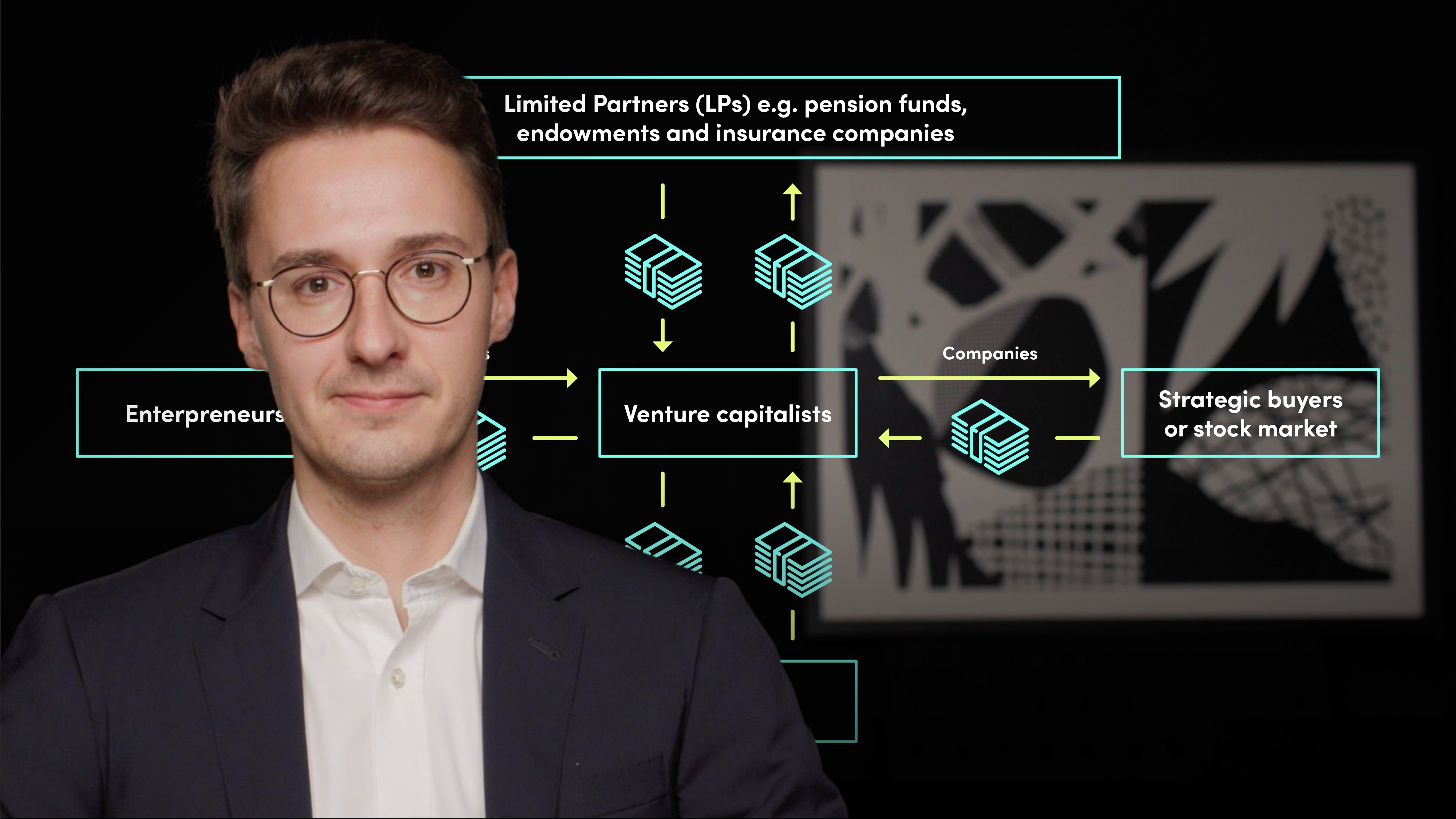

Identify the different stakeholders in venture capital

Identify which stakeholders are pushing and slowing ESG progress

Understand how this differs between Europe and the US

Overview:

In Europe, the Sustainable Finance Strategy, including the Sustainable Finance Disclosure Regulation (SFDR), came into effect in March 2021. In the US, the regulatory response is lagging but the Securities and Exchange Commission has made noise about its interest in pushing ESG into the investment community. LPs and asset owners are influenced by the regulatory push and are actively asking questions around ESG but issues with American LPs remain.

How have regulators been pushing ESG?

The EU’s Sustainable Finance Strategy, including the Sustainable Finance Disclosure Regulation (SFDR), came into effect in March 2021. While the exact and concrete impact and reporting requirements for VC funds are not 100% direct, the overall direction is clear. ESG is something that all investors, including VCs, have to report on and be more transparent about. For example, having an SFDR policy accessible on the fund’s website to directly reporting on a set of reasonably onerous ESG metrics, including several environmental metrics and governance questions. While the requirements will vary quite drastically depending on how you classify yourself (between a so-called Article 6 fund that is not at all focused on sustainable investing to an Article 9 Impact-driven fund) there is already a need for a new kind of ESG accounting for investors doing business in Europe.

In an American context and most other jurisdictions, ESG has not yet become something enforceable. The Securities and Exchange Commission is lagging but has made noise about its interest in pushing ESG into the investment community.

How have LPs and asset owners been pushing ESG?

LPs and asset owners are absolutely influenced by the regulatory push. VC funds who are fundraising right now from LPs will unilaterally report that every LP is asking questions around ESG. Their so-called ESG due diligence questionnaire might vary from being very basic to being comprehensive and sophisticated. It is often modelled on the the Principles for Responsible Investment (PRI), or the Institutional Limited Partners Association (ILPA) questionnaires, which they developed for buyout funds.

Unfortunately American LPs have brought to the fore two persistent issues.

1. For many LPs, ESG does not play a decisive role in choosing managers at the moment. Particularly for asset managers focused on increasing their fund size or endowment (rather than managing a State fund), getting into VCs which have historically financially outperformed the market is more important than making sure the VC considers ESG principles.

2. Even for the ones willing to comprehensively push ESG, confusion persists as to what exactly they should be asking, measuring and requiring reporting on.

Johannes Lenhard

There are no available Videos from "Johannes Lenhard"