Lessons from the 2008 Financial Crisis

Richard Boardman

20 years: Sales & Trading

Closer analysis of the systemic nature of institutions, particularly around their willingness to finance each other, proved to be the trigger to the evaporation of confidence in banks during the crisis. Richard provides his perspective as to why the confidence in banks declined during the historic event, and focuses on Investment Banks, the Repo Market and Special Purpose Vehicles.

Closer analysis of the systemic nature of institutions, particularly around their willingness to finance each other, proved to be the trigger to the evaporation of confidence in banks during the crisis. Richard provides his perspective as to why the confidence in banks declined during the historic event, and focuses on Investment Banks, the Repo Market and Special Purpose Vehicles.

Lessons from the 2008 Financial Crisis

12 mins 1 sec

Key learning objectives:

Define the financial crisis

Understand how the three ‘nodes’ contributed to collapse

Overview:

The financial crisis and collapse of the global economy can be traced back to the fundamental distrust of financial institutions. From there, the over-reliance on the repo market and inaccuracy of valuations and models are among our biggest takeaways today.

What was the Financial Crisis?

The Financial Crisis was a globally connected episode where confidence in and between banks evaporated, leading to a sharp and prolonged impact on balance sheets in the public and private sectors.

What are the three key ‘nodes’?

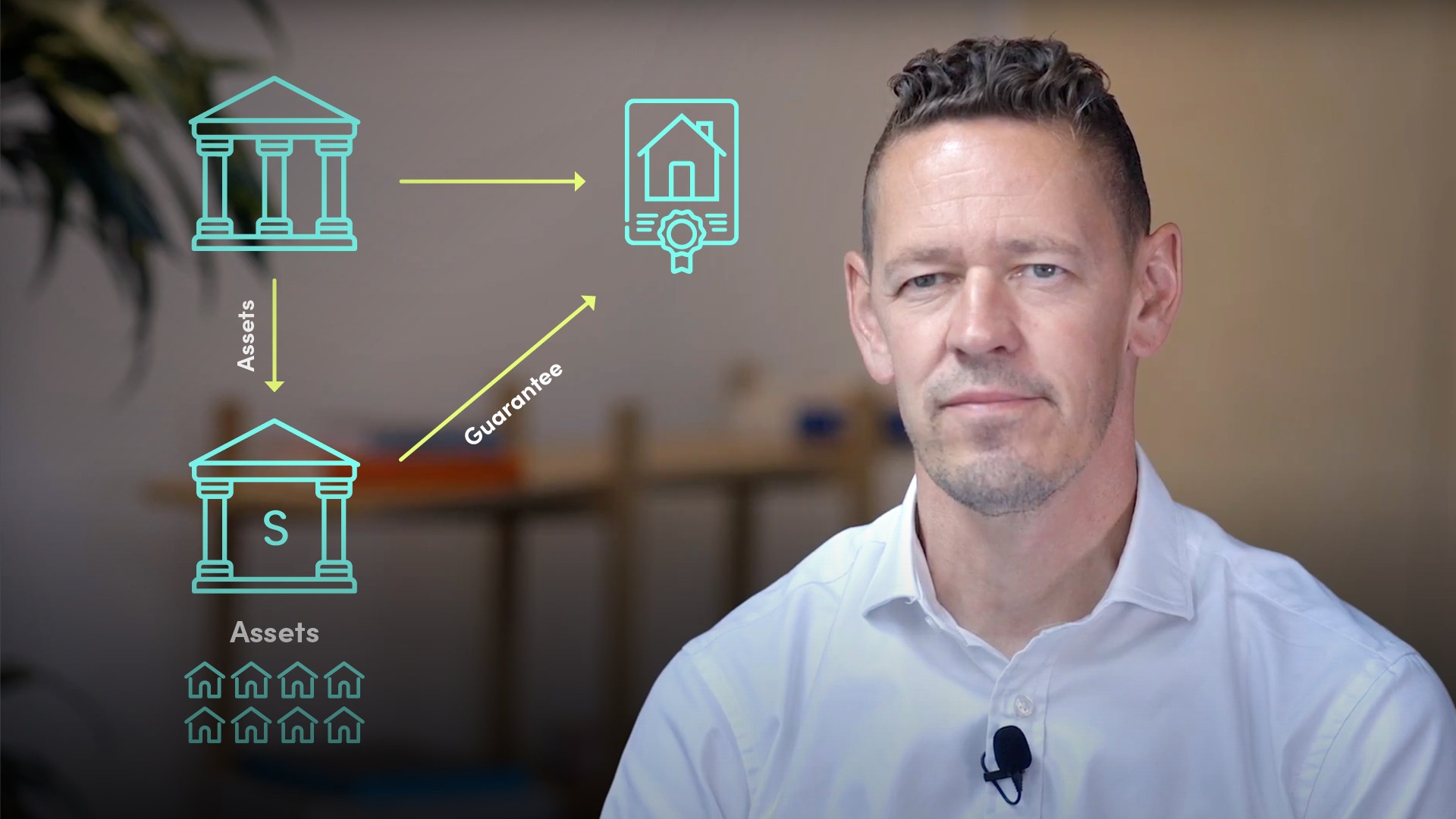

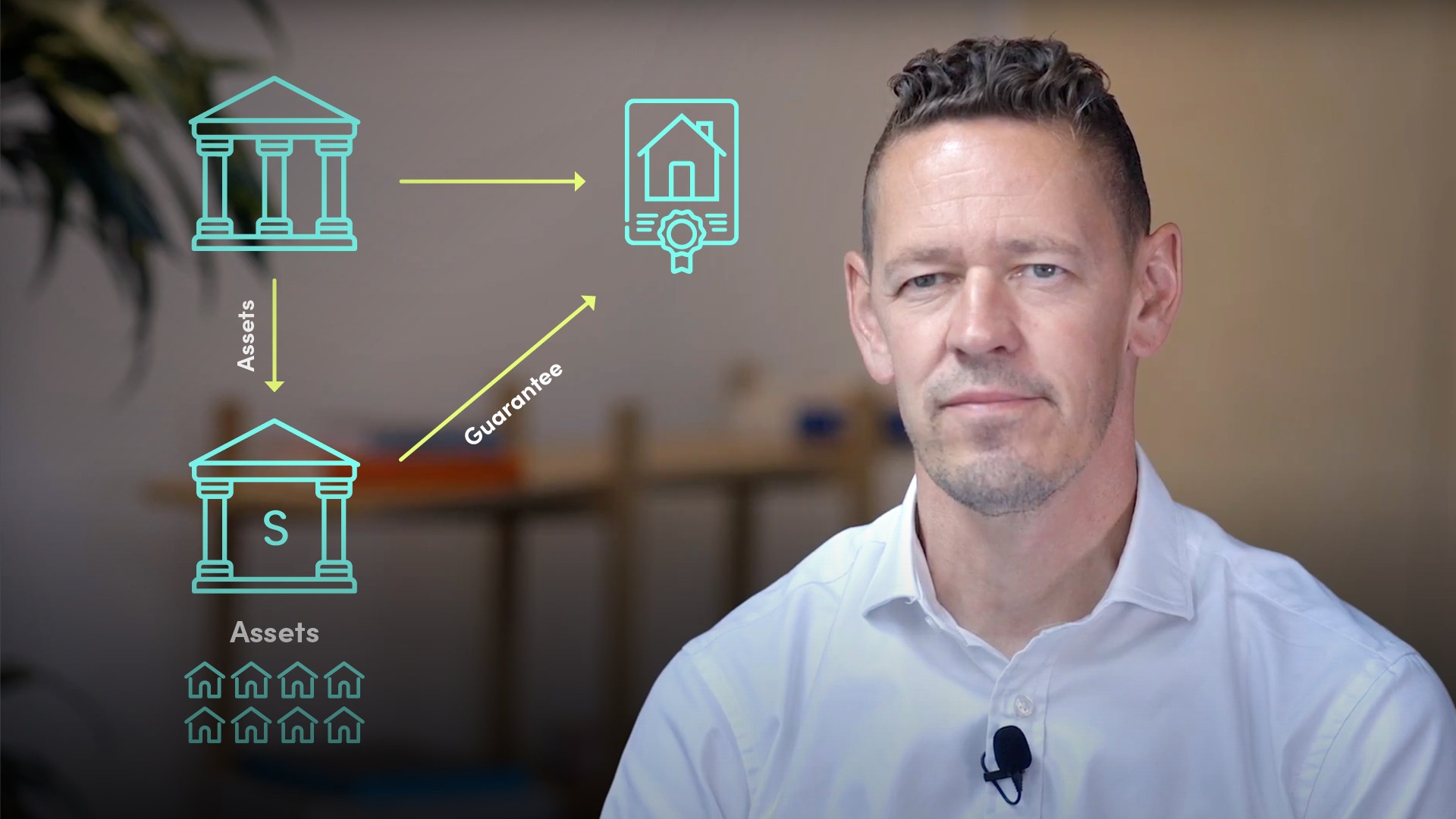

From our definition, we can pull out the following statements about relationships between three key nodes, namely Investment Banks, the Repo Market and Special Purpose Vehicles (SPVs): These are:

- The repo market allowed investment banks to lessen their requirement for longer-term funding and asset-to-term funding

- Investment banks were able to package and partially take off-balance sheet assets which were placed into Special Purpose Vehicles (SPVs)

- The repo market allowed SPVs to roll short-term the finance for long-term assets these SPVs had acquired from Investment Banks’ balance sheets

What was the role of banks?

Banks lended money for long-term projects, such as individuals buying homes, and they themselves borrowed some of this money from a market that only lent short term. Banks were able to take claims relating to the money they had lent for long-term projects and put them into a new pool, allowing the size of these loans to become less visible. As banks used more and more of these new pools, they realised they had to ask the pools to borrow short-term, rather than asking the bank to lend for a longer-term.

How was the repo market linked?

How is it possible that we can take this efficiency, this three-legged stool which provides financing to grow lending in a profitable way and connect one of the nodes, the Repo Market, directly to the Seeds of Doom? Well the link between these two states that the Seeds of Doom partially come from a “huge over-reliance on the Repo Market, causing a funding mis-match”. Put simply, the credit creation process, which has to exist in order for the whole system to make sense, became so super charged by short-term financing and the ability to lend more than was primarily obvious that it became a problem for the whole system.

What are the lessons?

The Repo Market:

The Repo Market is none other than the banks themselves. The evaporation of confidence in banks led to an evaporation of confidence between banks which led to an evaporation of confidence in banks. The control mechanism had become the detonator.

Credit Products:

One of the connections with Investment Banks reads that Investment Banks innovated Credit Products. One artefact of that innovation is that the speed with which sticky, long-term lending such as mortgages could become shaped into a commodity that could very easily be purchased and passed on. The ability to take loans and convert them into securities which could be sold, facilitated a much smoother and quicker transfer of risk. In addition, the tailoring of that product, through tranche technology, allowed a new array of securities to be created which would suit a plethora of investor tastes, which of course encouraged further investor participation and created new waves of demand for this product.

Model Risk:

Another frailty could be summed up as model risk. During the creation of credit products, from very simple examples whose value depended only on a single variable, to more complex structures which depended on financial calculus, models had been developed hand in glove. The purpose of these models was foremost to take observable market variables in order to calculate consistent valuations for products which could not be otherwise observed in the marketplace. In other words, the legal and structural process of converting sticky, long-term loans into securities needed to have a framework which gave confidence that the valuation and therefore liquidity of these products could be upheld during different market conditions.

Interconnectedness and Innovation:

The reliance on the belief in interconnectedness and innovation was the story of the run up to the crisis. Closer analysis of the systemic nature of institutions and their interconnectedness, particularly around the willingness and ability to finance each other proved to be the trigger to the evaporation of confidence in banks and between banks during the crisis. The balancing act around stability and equilibrium could only last as long as the whole believed in the parts.

Richard Boardman

There are no available Videos from "Richard Boardman"