DWS Machine Learning Case Study

Carlos Salas

Portfolio Manager and Data Scientist

So we’ve learned a lot about models. Let’s see how they work in practice. Join Carlos Salas as he explores how data science and machine learning can be used in finance to generate investment signals.

So we’ve learned a lot about models. Let’s see how they work in practice. Join Carlos Salas as he explores how data science and machine learning can be used in finance to generate investment signals.

DWS Machine Learning Case Study

6 mins 54 secs

Key learning objectives:

Understand how DWS Group use machine learning

Overview:

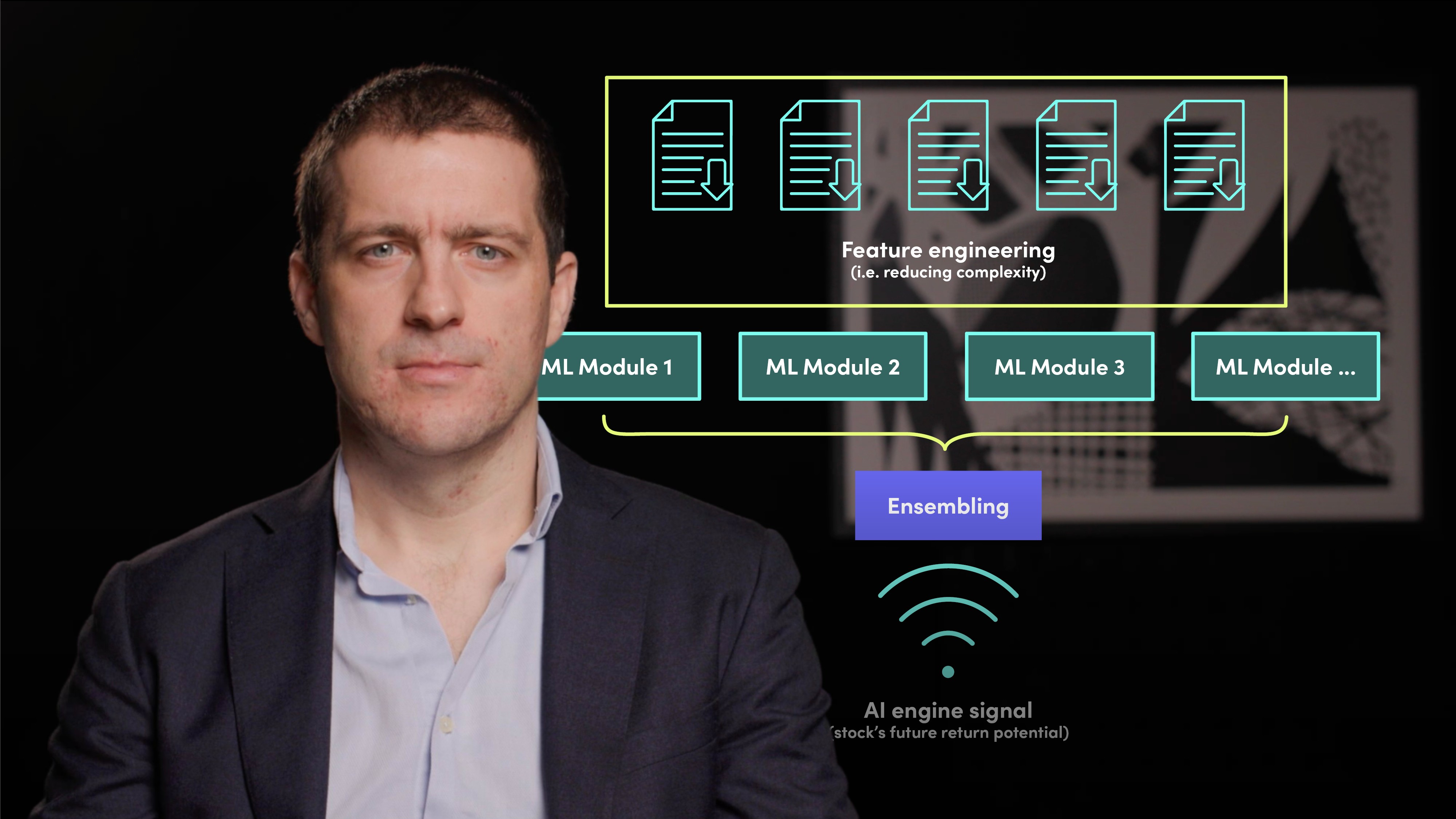

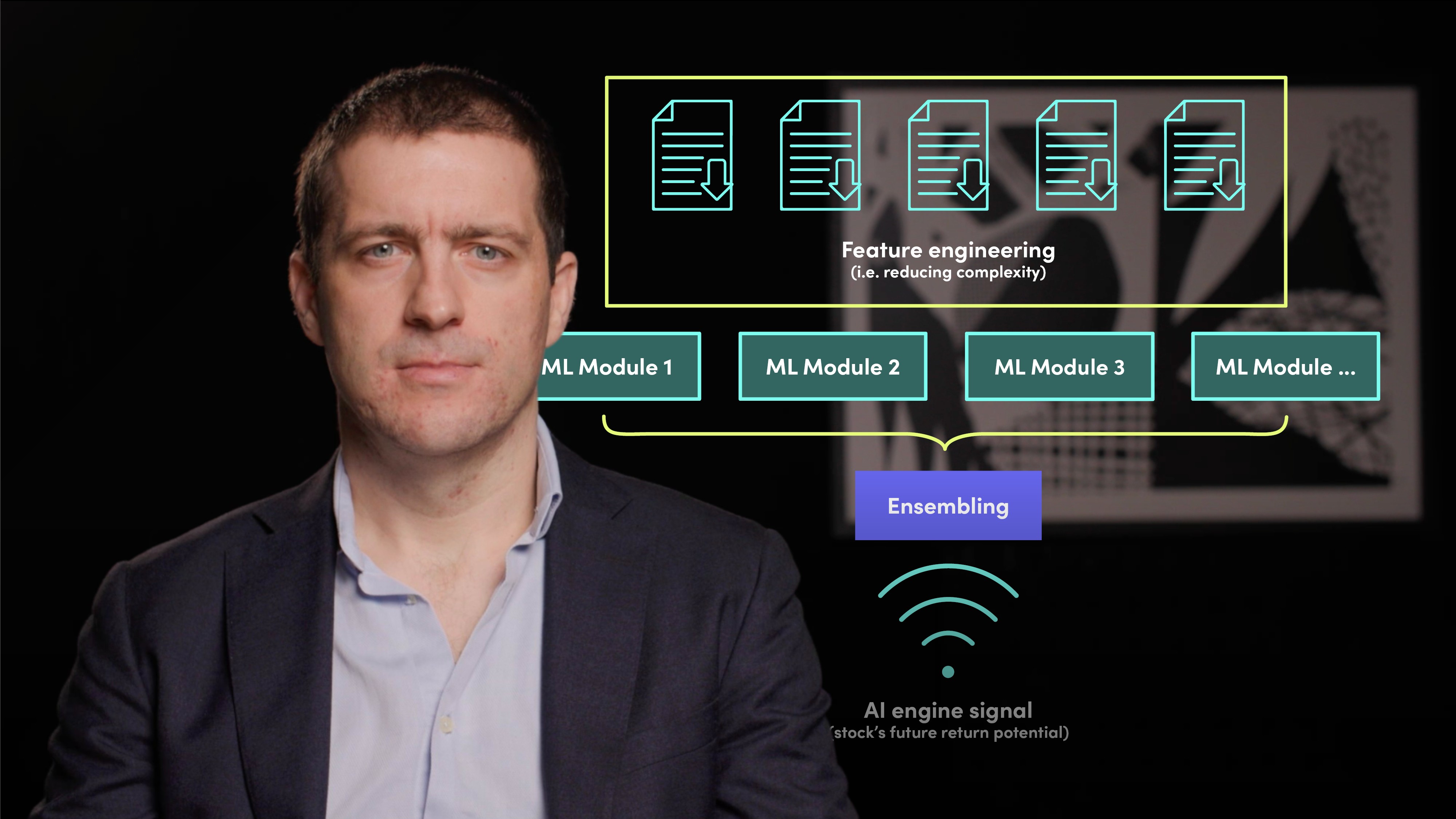

DWS Group has used data science and machine learning to generate investment signals. The process uses 20 years of historical data on approximately 260 different metrics for around 35,000 stocks and goes through three stages: data pre-processing, machine learning model training and ensemble.

How has DWS Group used data science?

DWS Group has used data science and machine learning to generate investment signals. The process uses 20 years of historical data on approximately 260 different metrics for around 35,000 stocks and goes through three stages: data pre-processing, machine learning model training and ensemble.

The ensembled model is then applied to new ingested data to generate expected returns. For every stock in the starting universe, the ensembled model generates independent forecasts about the likelihood of the returns of each stock over a 1-month holding period.

DWS backtested this model for the period 2010-2021 and published very promising performance results with +640 bps per annum outperformance compared to an equally-weighted benchmark of the investment universe. No further information was publicly shared about the backtesting assumption (such as trading fees or slippage) and so there may be downsides to this model that we are unaware of currently.

Carlos Salas

There are no available Videos from "Carlos Salas"