Market Bubbles After 2000

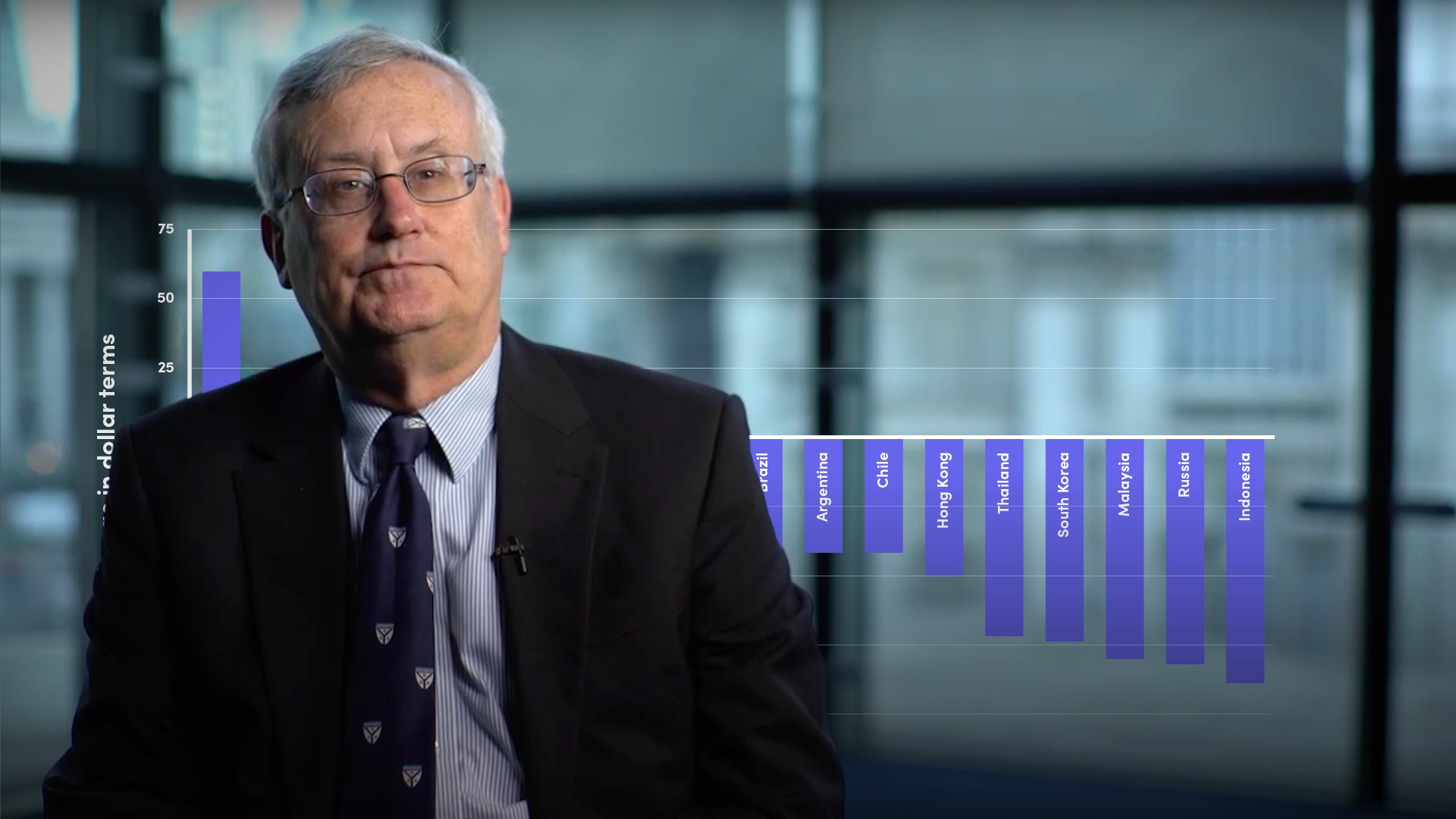

Peter Eisenhardt

30 years: Capital markets & investment banking

Peter continues to discuss prominent market bubbles in history. In this video, he focuses on post-2000 market bubbles including the Dotcom Bubble (2000), the Global Financial Crisis (2008-2009), the Chinese Stock Market Crash (2015/2016) and Bitcoin.

Peter continues to discuss prominent market bubbles in history. In this video, he focuses on post-2000 market bubbles including the Dotcom Bubble (2000), the Global Financial Crisis (2008-2009), the Chinese Stock Market Crash (2015/2016) and Bitcoin.

Market Bubbles After 2000

7 mins 11 secs

Key learning objectives:

Provide an overview of some of the greatest bubbles in history

Overview:

This video is a continuation of the largest bubbles in history including the Dotcom Bubble and the Global Financial Crisis.

What are some of the biggest market bubbles post-2000?

- Dotcom Bubble – 2000

- The creation of the internet represented an enormous technological advance. Its commercialisation led to the greatest expansion of capital ever seen. Powerhouses such as Microsoft, Intel, Cisco, and Oracle led the way, but it was the upstart dotcom companies that fuelled the stock market surge beginning in 1995. Venture capitalists looked to invest in any company with “.com” after its name. Valuations were based on earnings and profits that could only materialise years ahead, if the business model actually worked at all. Companies yet to generate revenue, profits, or even a finished product launched IPOs that gapped up in multiples on the first day of trading.

- Excess liquidity and signs of inflation forced the Fed to tighten. With venture capital no longer freely available, everything changed. Management and investors focused on “burn rate”, which was the rate at which dot.com went through its existing capital. When the capital was gone, so was the company. By October 2002, the Nasdaq fell by 75% and most dot.coms went bust. Famous failures included on-line shopping companies, such as Pets.com, Webvan, and Boo.com, and communication companies, such as Global Crossing. Ultimately, the information technology market stabilised, with companies consolidating and players such as Amazon, eBay, and Google gaining market share and dominating their sectors.

- Global Financial Crisis – 2008

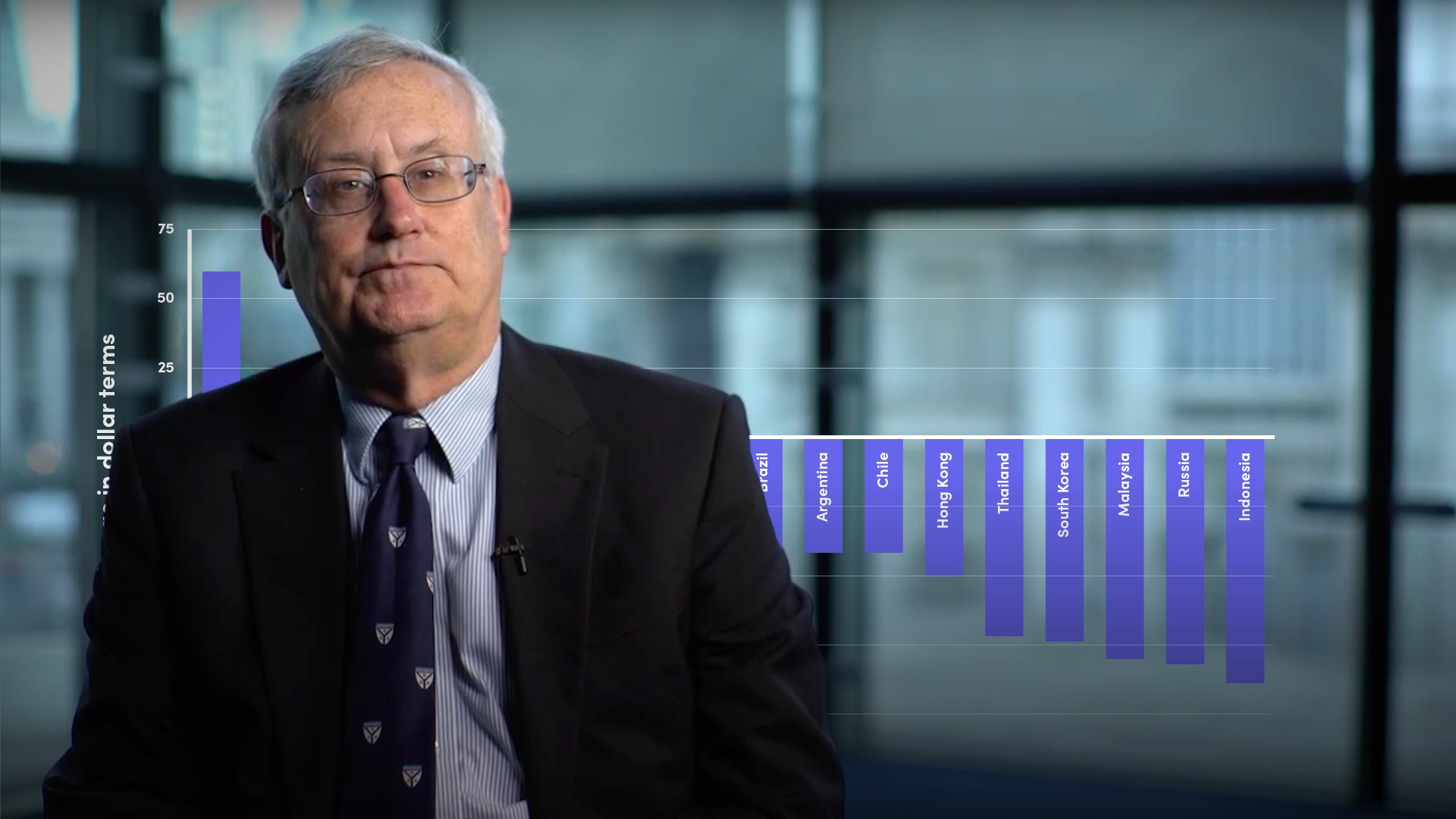

- The Global Financial Crisis (GFC) has been called the greatest economic disaster since the Great Depression. The crisis was caused by excess liquidity in the financial system. The Fed lowered interest rates to unprecedented levels to re-invigorate the economy following the dot.com bust. Money flowed into developed markets from China, other emerging market economies, and oil producing countries, who poured growing trade surpluses into developed markets. Banks, individuals, and hedge funds snapped up easy money to take on unprecedented leverage and drove asset prices to all-time highs.

- The bubble burst when the U.S. mortgage market collapsed. The U.S. government had pursued aggressive policies to increase home ownership, leading to an increase in “subprime” borrowers from 10 to 20% of the market. Securitised bonds backed by pools of up to 5,000 mortgages were wrongly given AAA ratings by the agencies, and eagerly snapped up by investors desperate for yield. Ultimately, borrowers could not keep up with their monthly payments and bonds failed.

- The GFC led to sweeping reforms to ensure that banks would have adequate liquidity and capital in times of crisis. Regulators also cracked down on shadow banking, or lending activity by non-bank entities.

- Chinese Stock Market Crash – 2015/2016

- By 2015, 85% of the Chinese stock market investors were made up by individuals. Encouraged by the government, more than 30 million new accounts were opened in the first five months of that year. This made for an investment boom that was fuelled by further devaluation of the renminbi making China’s exports more competitive. Prices more than doubled.

- In 2016, after years of an extraordinary economic expansion, China’s growth rate finally slowed down. While still positive, growth fell to its slowest rate in twenty-five years. The inflated stock market valuations became unsustainable. Short selling had only become permitted in China several years before and drove down exaggerated market declines. Many retail investors sold at distressed prices as a result. Steep single day declines forced the authorities to halt trading, which led to a rout in global stock markets.

- Bitcoin – Ongoing

- Bitcoin is yet another example of an exciting innovation with enormous growth potential. Bitcoin offers a way to transfer money over the internet through decentralised, distributed ledger technology, and is an alternative to central bank-controlled fiat money. The first public record of Bitcoin dates to October 2008, when Satoshi Nakamoto published a white paper with the technical outlines for a new, decentralised cryptocurrency.

- Whether Bitcoin will succeed in the end is not known. Will it become a widely accepted form of payment for goods? Is it secure? Does the blockchain technology gobble up too much energy? Will governments decide that it facilitates crime, money laundering, and terrorism and ban it? Could Bitcoin be superseded by other cryptocurrencies?

Peter Eisenhardt

There are no available Videos from "Peter Eisenhardt"