What are Negative Interest Rates and what is their Impact?

Trevor Williams

25 years: Macroeconomist in banking

According to economic theory, we should not have persistent negative interest rates. The reason: investors – lenders - want a real return for taking the risk of not getting their money back (defaults) and for deferring spending from today to the future. Join Trevor as he briefs us about the history of Interest rates and what impact it can have on the economy.

According to economic theory, we should not have persistent negative interest rates. The reason: investors – lenders - want a real return for taking the risk of not getting their money back (defaults) and for deferring spending from today to the future. Join Trevor as he briefs us about the history of Interest rates and what impact it can have on the economy.

What are Negative Interest Rates and what is their Impact?

15 mins

Key learning objectives:

Understand why we should not have persistent negative interest rates

Outline how pandemics have affected long-term interest rates

Identify how many population demographics explain some of the recent trends of interest rates

Identify the usefulness of negative rates

Overview:

Interest rates are the return on lending money or, alternatively, it is the price of money. All savers are lenders - assuming that money is placed in a deposit taking institution, such as a bank, or similar that pays a return for holding those savings. In this video, Trevor discusses negative interest rates.

Why should we not have persistent negative interest rates?

The reason: investors – lenders - want a real return for taking the risk of not getting their money back (defaults) and for deferring spending from today to the future, thus allowing others the opportunity to use such funds to generate returns.

How is the rate of interest determined?

For the classical economists, the rate of interest is determined by the interaction between the demand for investment capital (the fisherman making a net) and the supply of savings (the friend's surplus fish). There is some so-called 'natural rate' that emanates from the multitude of interactions in an economy that produce a marginal return on the utility of money that equates to the marginal return on investment.

How does expected rates of inflation affect nominal interest rates?

Lower expected future inflation reduces the nominal interest rate demanded for the risk of lending. Say you had a target return of a 3% real rate for lending money for a year, and inflation was expected to be 2%. The nominal interest rate you would demand is 5% to be persuaded to lend. But if inflation falls to zero or below, you will accept 3%, or lower. So, lower future expected inflation means lower interest rates than would otherwise be the case. The reverse is also true.

What is the intended policy outcome from lowering interest rates?

- From a policy perspective, weak economic growth and low inflation usually prompt central banks to lower interest rates. The idea is that this lowers the return to savers so encouraging them to spend or invest. That increase in spending or investing then boosts the economy, kick-starting a rise in company output, profits, employment, household income, and so a virtuous cycle

- The same should be true for banks. Offering them low or negative rates for depositing money with the central bank, should encourage them to lend to the private sector (households and non-financial companies) to make higher returns

How has pandemics affected long-term interest rates?

- Historically, the effect of a pandemic is to raise savings rates and induce a long period of negative interest rates. Economy's suffer a huge supply-side shock, as human and capital productivity is hit hard, and deflation ensues

- This is because the survivors of these pandemics needed to rebuild the capital stock, and for that to happen, savings needed to rise. For the survivors, real pay increases as skills are in demand

How may population demographics explain some of the recent trends of interest rates?

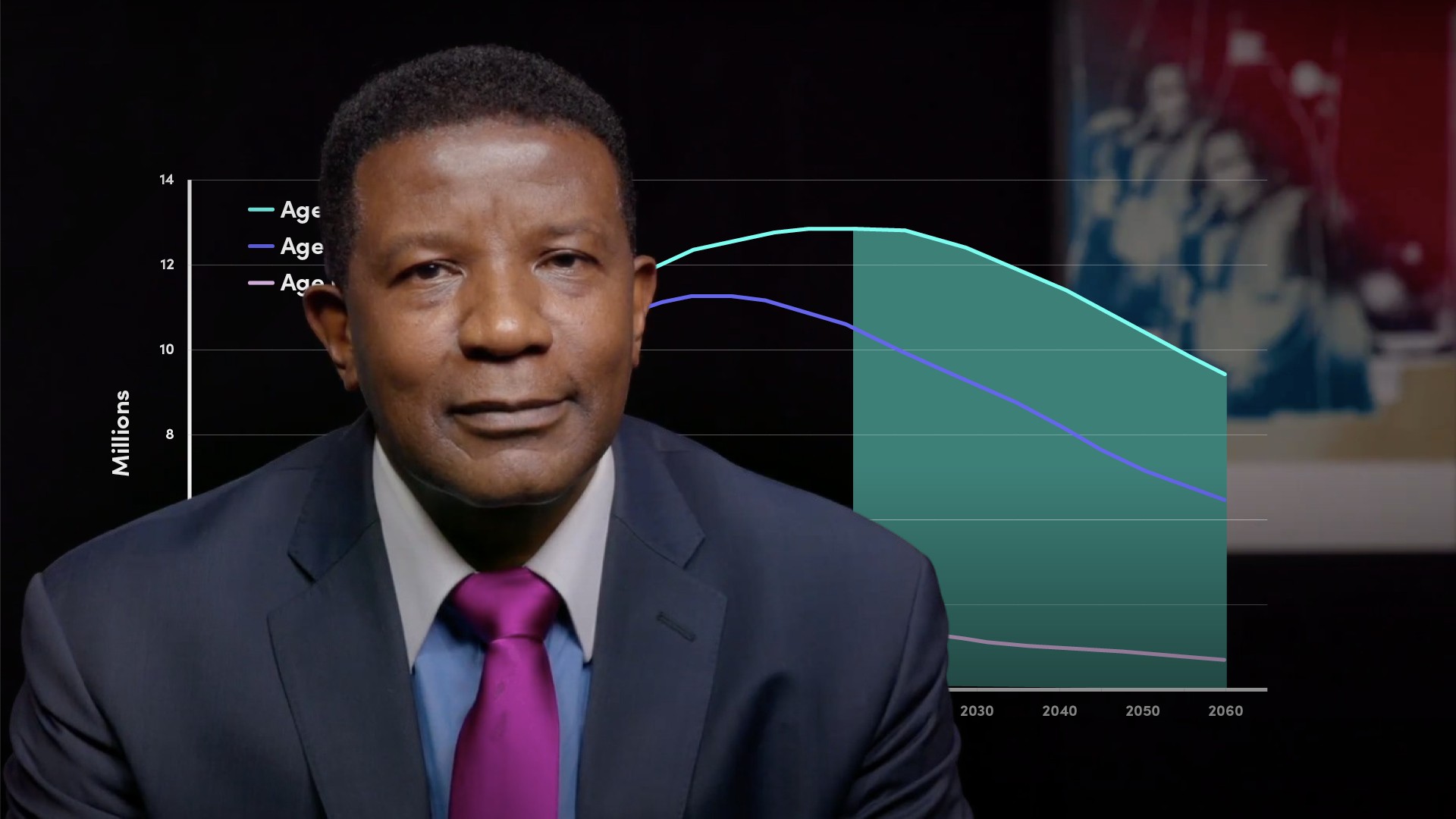

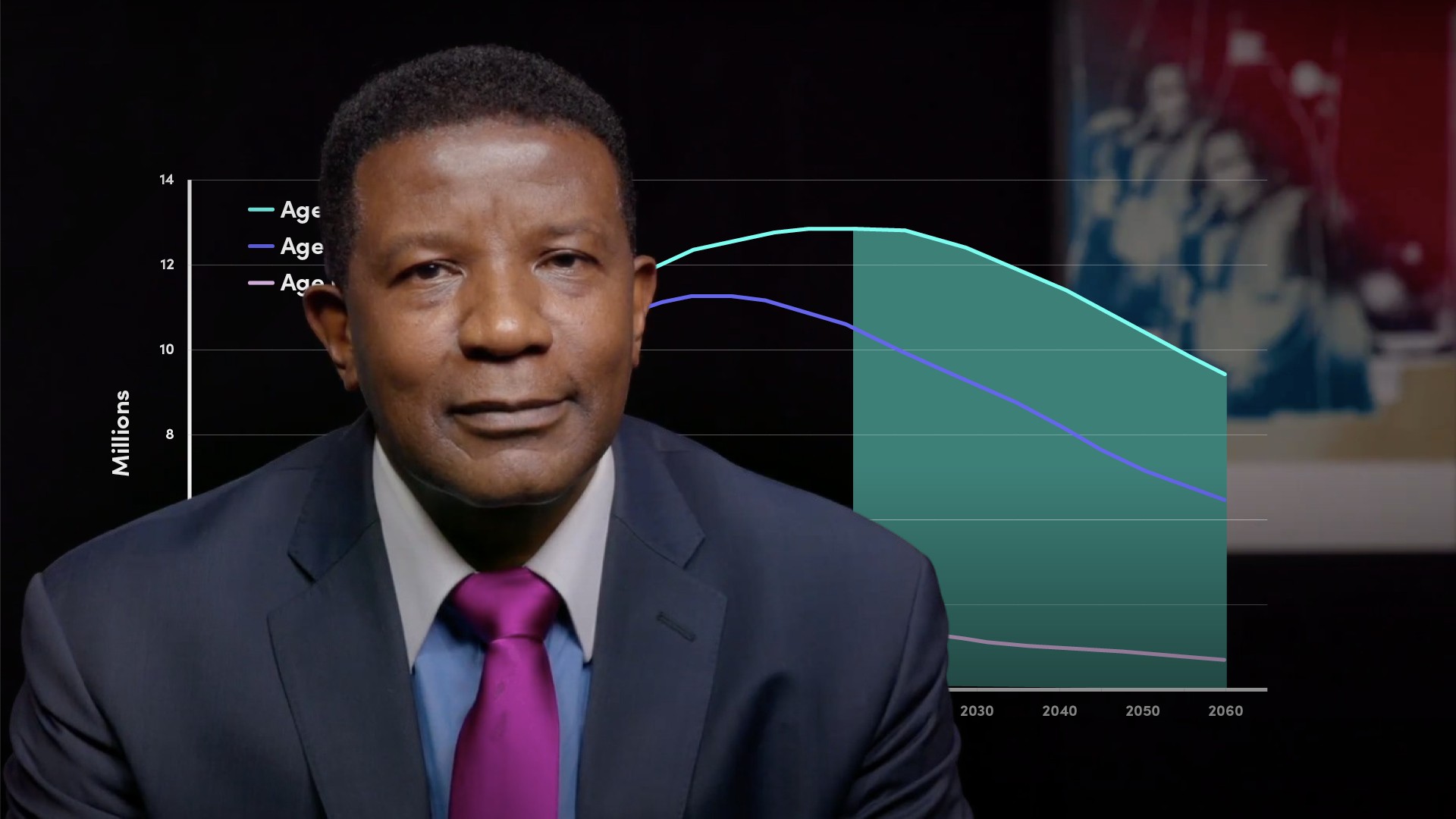

- Demographic trends in the UK and advanced economies support a move towards lower real rates

- An ageing population is predicted to put pressure on savings rates. And Europe is aging, with Germany and Italy seeing actual or imminent population decline. Young people typically borrow, middle-aged and above save, and the retired spend

Low-interest rates have consequences for savers - what are they?

- The combination of an ageing population, increasing life expectancy and low savings rates will mean that people will have to retire later or retire poor

- To keep pension and retirement systems viable in an era of negative or low real interest rates, the government may have to extend the retirement age and increase the amount that people pay in

With record low-interest rates prevalent everywhere, what are savers to do?

- They could take more risk and invest in assets with higher returns but clearly with a higher risk of losing their savings

- They could also save more out of current income

Why may negative rates be bad?

- Zero or negative rates depress bank profits, making them less likely to lend. They allow 'zombie firms' or companies that would fail if interest rates were not exceptionally low to survive and so sap the profitability of more productive firms

- Furthermore, pension funds and insurance companies can struggle to meet their long term liabilities when returns from bonds are low or negative when inflation is taken into account

Why may negative rates be useful?

One silver lining of low long term interest rates at the moment, however, is that it allows government spending to be higher for longer than it would be otherwise.The reason is that the government's cost of funding the deficit is cheaper the lower long term interest rates are. Hence, the government – or more precisely the Debt Management Office - is focused on financing the fiscal deficit at points in the gilt curve that is further out and closest to zero / negative yields.

Trevor Williams

There are no available Videos from "Trevor Williams"