Introduction to Options, Pricing and Use Cases

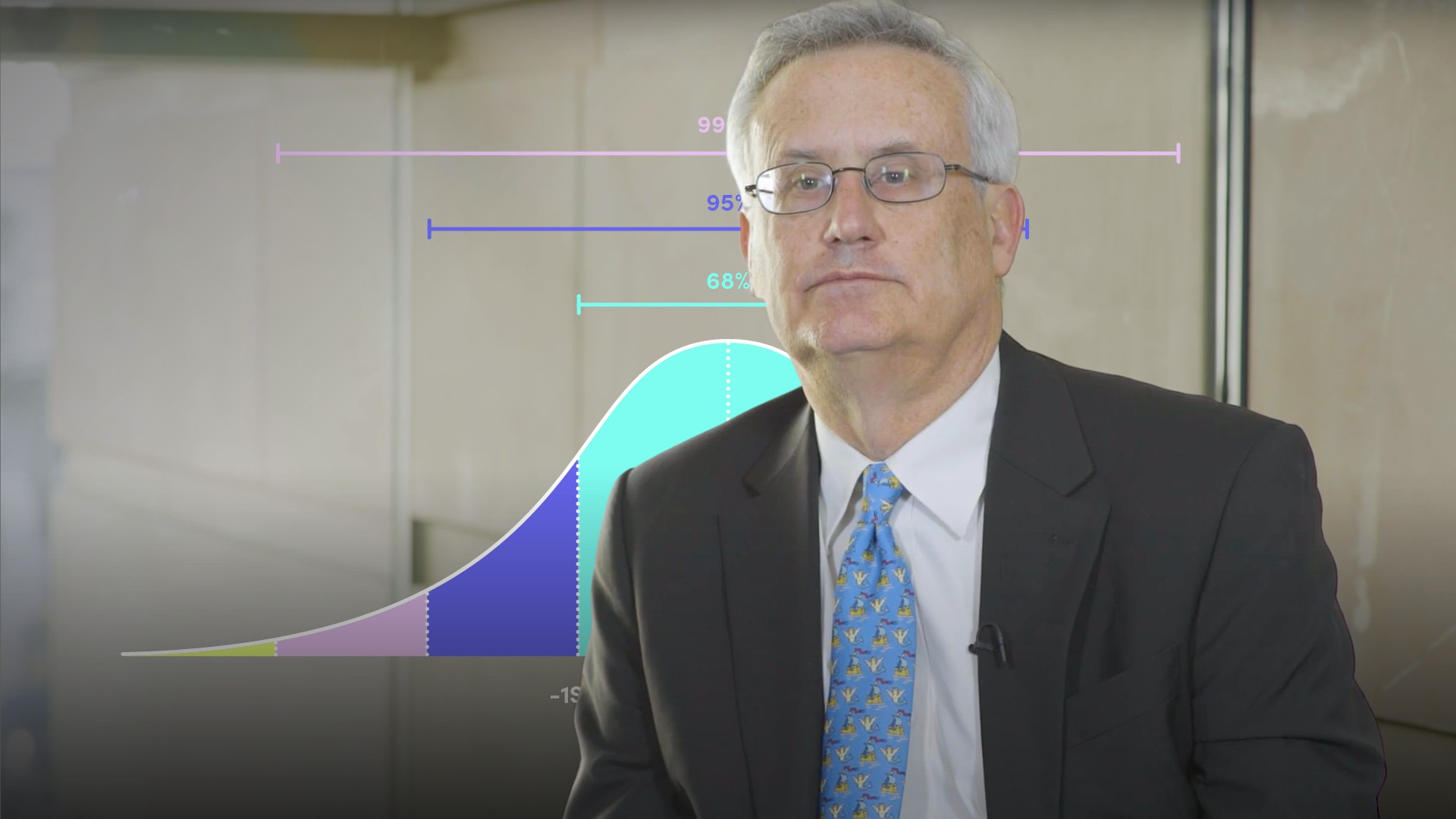

Peter Eisenhardt

30 years: Capital markets & investment banking

Peter provides an overview of the basic methodology behind pricing options.

Peter provides an overview of the basic methodology behind pricing options.

Introduction to Options, Pricing and Use Cases

13 mins 20 secs

Key learning objectives:

Define the basics of options pricing

Describe the basics of the Black-Scholes Model

Define options

Outline the advantages options offer in trading and hedging

Define delta trading

Define historic volatility and implied volatility

Understand how volatility is used to derive an option price

Learn the limitations of pricing models

Overview:

Options are financial instruments that give holders an option, but not an obligation, to buy or sell an underlying asset at an agreed price within the lifetime of the contract. The seller of an option is obliged to buy or sell if and when the buyer chooses to exercise it. Options are available on a wide range of assets, including stocks, bonds, commodities, currencies, futures, market indices, and funds.

What are options?

Options are financial instruments that give holders an option, but not an obligation, to buy or sell an underlying asset at an agreed price within the lifetime of the option contract. The seller of the option is obliged to buy or sell if and when the buyer chooses to exercise the option. Options are available on a plethora of assets, including stocks, bonds, commodities, currencies, futures, market indices, and funds. Options have been trading on exchanges for almost 50 years.What advantages do options offer in trading and hedging?

- Capital efficiency

- Option buyers can take positions knowing losses are limited to the cost of the price of the option (the premium). Participants can take controlled exposure to financial instruments without paying the full cash price.

- Flexibility

- Positions can be tailored around a choice of strike prices. Outright trades and options, as well as puts and calls, can be combined to suit specific risk profiles and tolerances.

- Strategy

- Market participants can hedge using options more effectively than through outright purchases and sales. Option strategies can be tailored to allow for upside while limiting downside.

- Protection

- Options can provide protection against catastrophic events – and are another form of insurance.

Define the basics of options pricing

Five factors determine the price of an option:

- The current price of the underlying instrument

- The strike price: where the option buyer can buy (if it is a call) or sell (if it is a put)

- Maturity: when the option expires

- Interest rates: the cost of financing a long or short position in the underlying instrument in the cash market

- Volatility: how volatile is the price of the underlying instrument? What chance does it have of moving enough to go through the strike price?

What is delta trading?

Traders, believing that a volatile market with high option prices will quieten down, can sell puts and calls at the same strike price in the belief that the premiums received will be greater than any pay-out on the options. A trader, believing volatility will increase, can execute a strategy of buying puts and calls. If options are undervalued and bought cheaply, traders can sell a percentage of the underlying whenever the market goes up and buy whenever it goes down. The goal of delta trading is to earn trading profits that will exceed the cost of the premium.What are historic volatility and implied volatility?

The more volatile an instrument, the greater the chance it has to go through the strike price and have a high intrinsic value. The greater the volatility, the higher the price of an option. Options traders can trade volatility rather than the direction of a market. Historic volatility is calculated by averaging past daily price changes in percentage terms over different time periods; market participants study historic volatility to try and predict the future. Volatility is affected by factors including political events, economic conditions and seasonality, but it is impossible to predict unforeseen circumstances that may make volatility spike. Traders derive implied volatility from current options prices; implied volatility can differ significantly from historical volatility.How is volatility used to derive an option price?

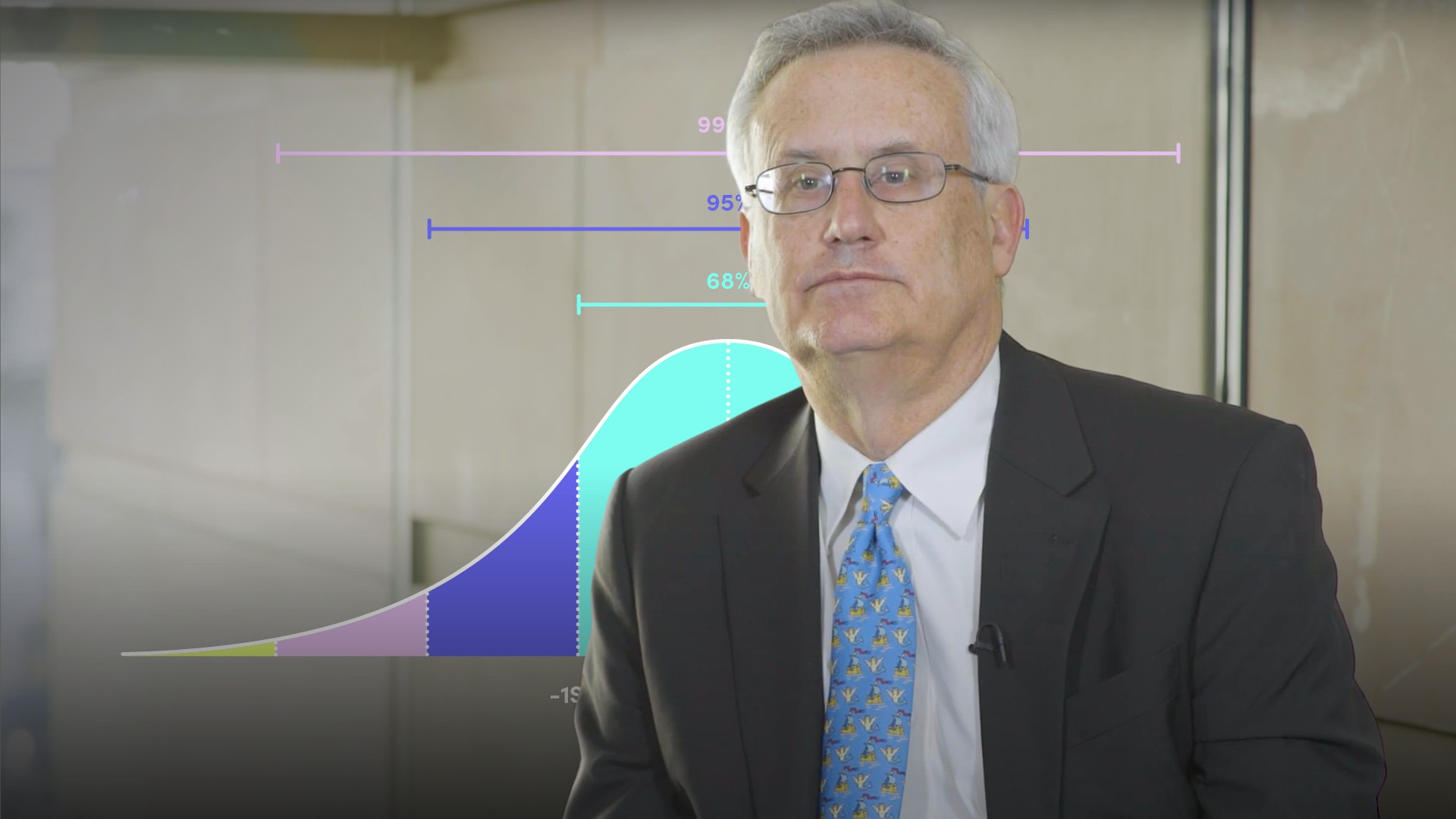

To arrive at an option price, market participants predict the future volatility of the price of the underlying instrument over the life of the option, model a price distribution curve – with probabilities – and analyse the curve against the option pay-out at each price.Describe the basics of the Black-Scholes Model

The key to the market-neutral Black-Scholes options pricing model is standard deviation. Standard deviation measures the dispersion of prices from the mean. Black-Scholes plots a standard deviation curve. For each instrument, it:

- Assigns a probability of the market moving to each price

- Calculates the intrinsic value at each price

- Multiplies probability times intrinsic value at each price

- Sums the expected values, or the options price

An option on an instrument with a tall hump and small standard deviation (e.g. a share trading at $11 with an expected price range of $10-$12; $11 average) would be cheap, especially if the strike price was greater than $12. The price is expected to be between $9 and $11 for 68% of the time i.e. one standard deviation, with a limited price tail, making for a limited options value.

Options on instruments with a flatter curve but large standard deviation with long tails and potential big pay-outs are expensive. This investment is more volatile so one standard deviation has a wider price tail. The price of the option on this instrument would be $1.10 compared to $0.62 for the other instrument.

What are the limitations of pricing models?

Pricing models are only as good as the inputs. No matter what, future volatility is an unknown. Some specific criticisms of option pricing models are:

- They assume normal distribution of prices

- The do not fully consider transaction costs

- They assign a constant rate of financing for the term of the option

- They don’t consider taxes

Peter Eisenhardt

There are no available Videos from "Peter Eisenhardt"