The Put-Call (Options) Parity

Abdulla Javeri

30 years: Financial markets trader

In this video Abdulla outlines the concept of Put-Call Parity and how to formulate it into an expression and get all six combinations (long and short positions). He describes the arbitrage-free relationship between call and put premiums for European options. Perhaps most importantly, Abdulla explains how to take advantage of risk-free profit that arises from arbitrage opportunities

In this video Abdulla outlines the concept of Put-Call Parity and how to formulate it into an expression and get all six combinations (long and short positions). He describes the arbitrage-free relationship between call and put premiums for European options. Perhaps most importantly, Abdulla explains how to take advantage of risk-free profit that arises from arbitrage opportunities

The Put-Call (Options) Parity

6 mins 1 sec

Key learning objectives:

Describe the put-call parity

Understand how to calculate the fiduciary call

Identify one of the keys to understanding the put-call parity

Overview:

Put–Call parity is an important concept in the option world. The original Black Scholes model priced a European call option on a non-dividend-paying stock. The price of the equivalent put option was derived using the concept of Put-Call Parity.

What is the put-call parity?

The put-call parity defines the arbitrage-free relationship that determines the connection between the call premium and the equivalent put premium, under the following conditions:

- European style options

- Same underlying assets

- Same expiry

- Same strike

Given a call premium the put premium must be at a level consistent with Put-Call Parity so that the actual futures price and the synthetic futures price are identical, excluding transaction costs.

How do we calculate the fiduciary call?

Fiduciary call - Protective put. This relationship can also be expressed as;

call premium plus present value of the strike equals put premium plus stock.

What is one of the keys to understanding the Put-Call Parity?

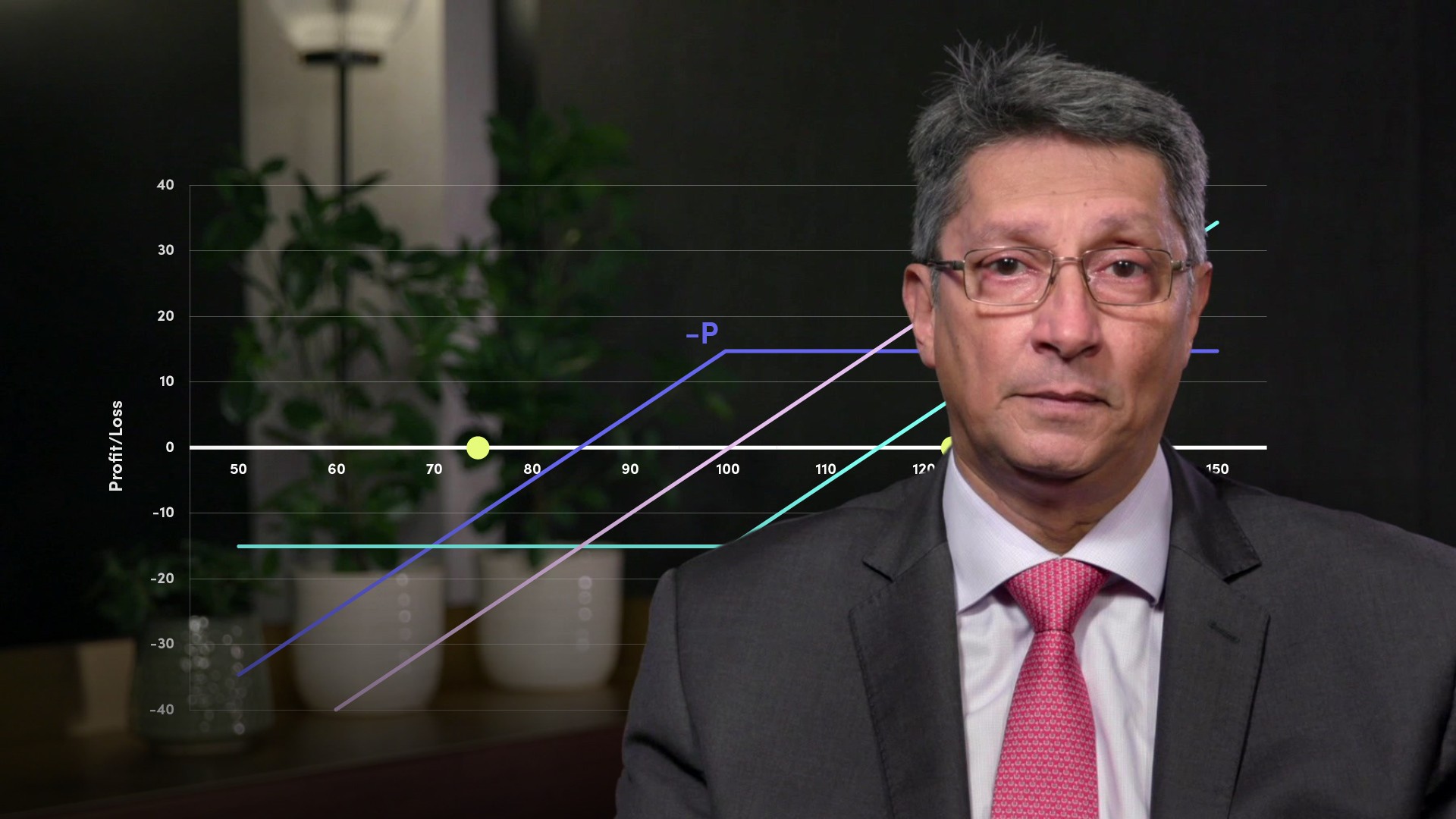

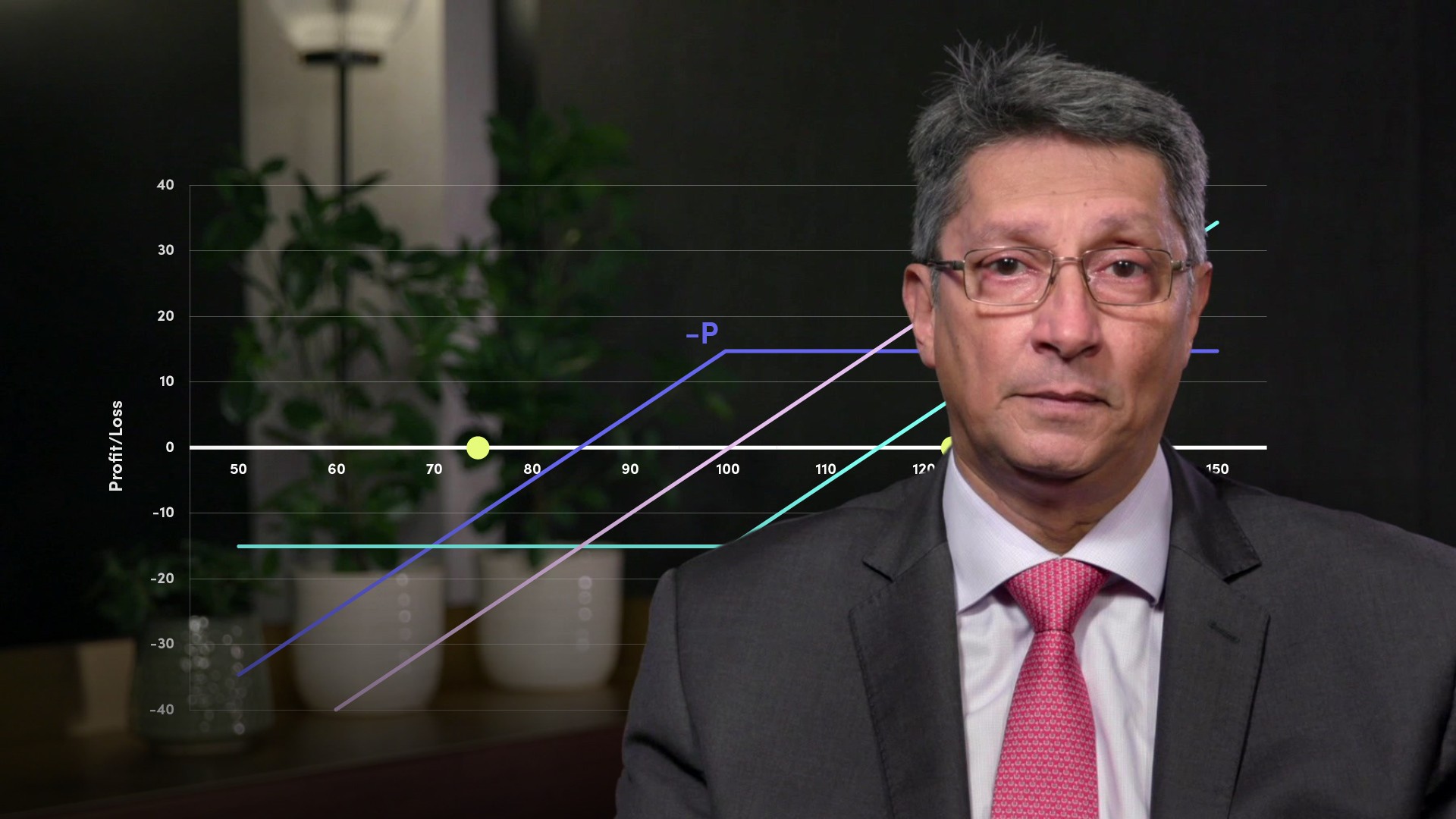

- The understanding that by combining positions in two out of the following three elements Future, call and put, we can synthetically create a position in the third element

- It can be encapsulated in the simple expression, F = C – P. What this says is that a long futures position plus F, can be synthetically created by combining a long call plus C and a short put minus P

- By rearranging the expression we can get all six combinations, reflecting the long and short positions for each. For example, buying a call and selling a future gives us a long put position. Similarly selling a future and selling a put gives us a short call position

Abdulla Javeri

There are no available Videos from "Abdulla Javeri"