Options Valuation Exercises

Lindsey Matthews

30 years: Risk management & derivatives trading

In this video, Lindsey explains the application of the simple valuation model to value 4 options

In this video, Lindsey explains the application of the simple valuation model to value 4 options

Options Valuation Exercises

3 mins 53 secs

Key learning objectives:

Apply the simple valuation model to value 4 options

Overview:

To establish the model distribution you require the forward price and the volatility. The forward price is $1,000 and the 3-month volatility is 5%. What is the value of the $1,000 call? What is the value of the $1,000 put? What is the value of the $1,025 call? What is the value of the $1,025 put?

What is the value of the $1,000 call?

First, calculate the payoff at expiry. Only the $1,050 and $1,100 bars are in the money, with $50 and $100 payoffs respectively.

Second, calculate the value at expiry by multiplying by its probability, which results in a value of $8.33 for both bars in the money, resulting in an overall value of $16.66.

What is the value of the $1,000 put?

First, calculate the payoff at expiry. Only the $900 and $950 bars are in the money, with $100 and $50 payoffs respectively.

Second, calculate the value at expiry by multiplying by its probability, which results in a value of $8.33 for both bars in the money, resulting in an overall value of $16.33.

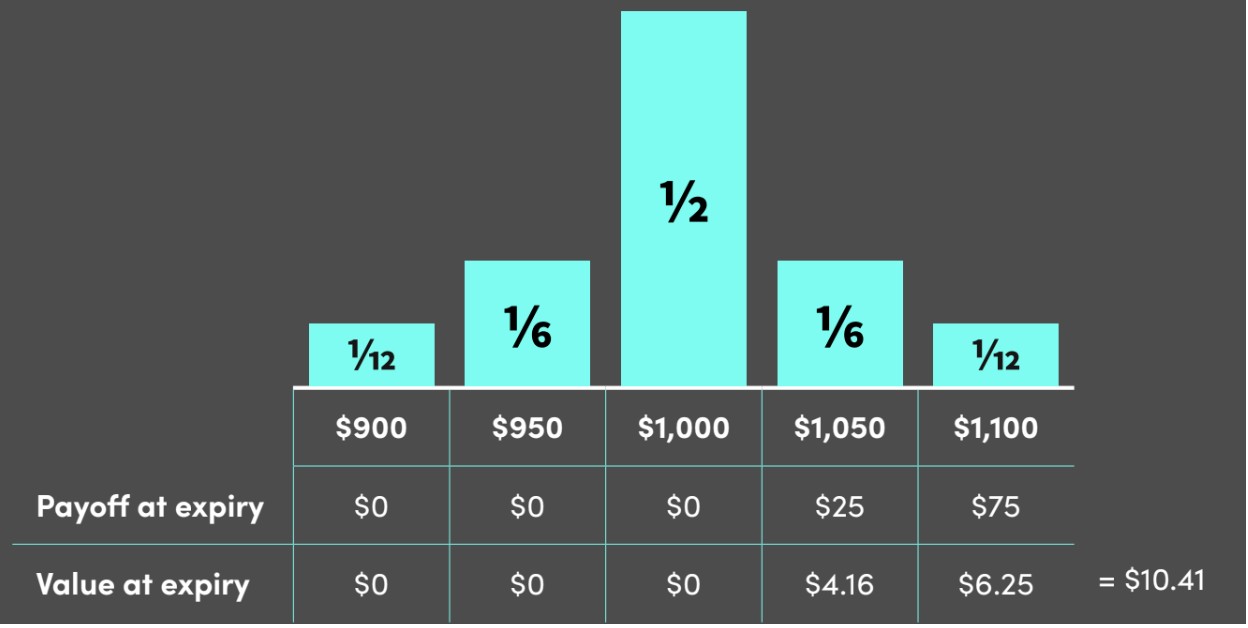

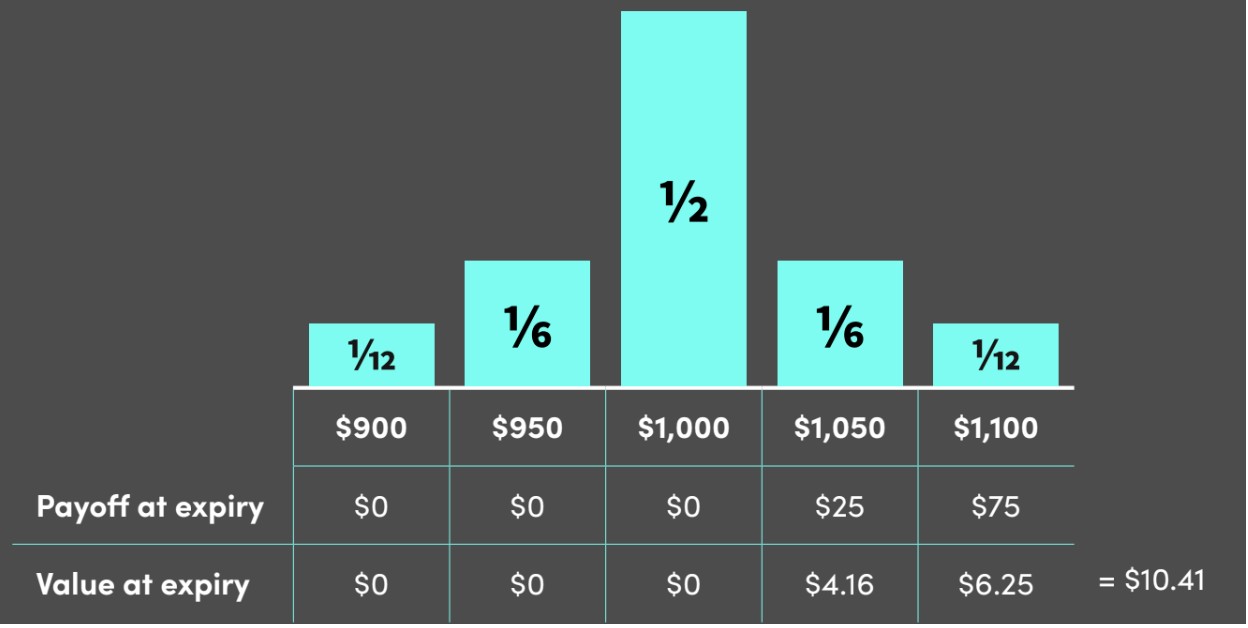

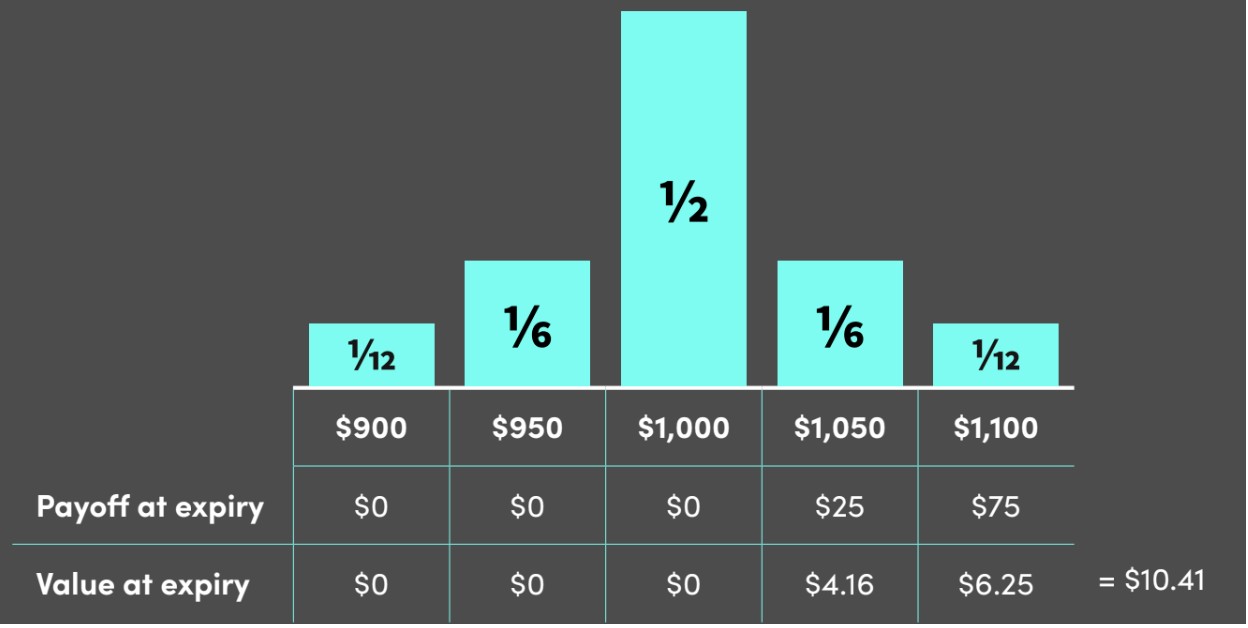

What is the value of the $1,025 call?

First, calculate the payoff at expiry. Both the $1,050 and $1,100 bars are in the money and have a $25 and $75 payoff respectively.

Second, calculate the value at expiry by multiplying by its probability, which results in a value of $4.16 for the $1,050 bar and $6.25 for the $1,100 bar, resulting in an overall value of $10.41.

What is the value of the $1,025 put?

First, calculate the payoff expiry. Both the $900, $950, and the $1,000 bars are in the money, with $125, $75 and $25 payoffs respectively.

Second, calculate the value at expiry by multiplying by its probability, which results in a value of $10.41, $12.50 and $12.50 at each point respectively, resulting in an overall value of $35.41.

Lindsey Matthews

There are no available Videos from "Lindsey Matthews"