The Origins of ESG

Johannes Lenhard

ESG & VC Specialist

Within the venture capital and startup financing space, there is a lack of clarity around ESG and how it is implemented firm-wide. Johannes explores some of the issues that are triggered by misleading reports compiled by different ESG rating and scoring agencies and how these challenges can be overcome.

Within the venture capital and startup financing space, there is a lack of clarity around ESG and how it is implemented firm-wide. Johannes explores some of the issues that are triggered by misleading reports compiled by different ESG rating and scoring agencies and how these challenges can be overcome.

The Origins of ESG

14 mins 58 secs

Key learning objectives:

Understand the historical context around ESG

Learn about issues that can arise from reporting surrounding ESG

Learn how ESG reporting issues can be overcome

Overview:

This video attempts to clear up some of the confusion surrounding the meaning of ESG and provides some context around where ESG emerged from. Johannes will begin with the early 2000s, when measurements in investment decisions started. The meaning of sustainability is also explored, with a focus on what this means to long-lasting businesses. Venture capital and ESG are intricately connected, as venture capital funds the world’s startups. This video analyses how VC funds can embrace ESG and what that means for restructuring their operations and internal practices.

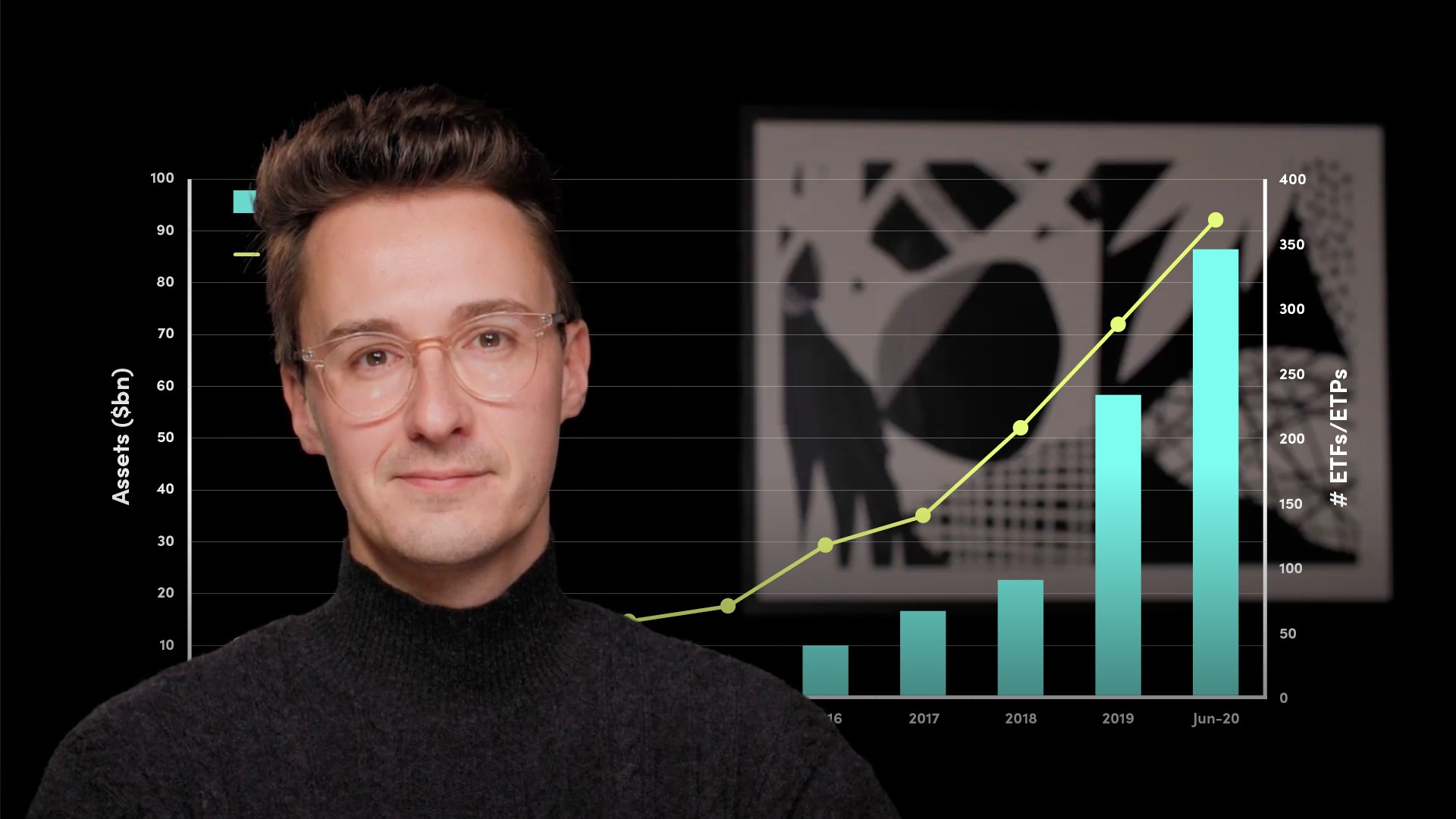

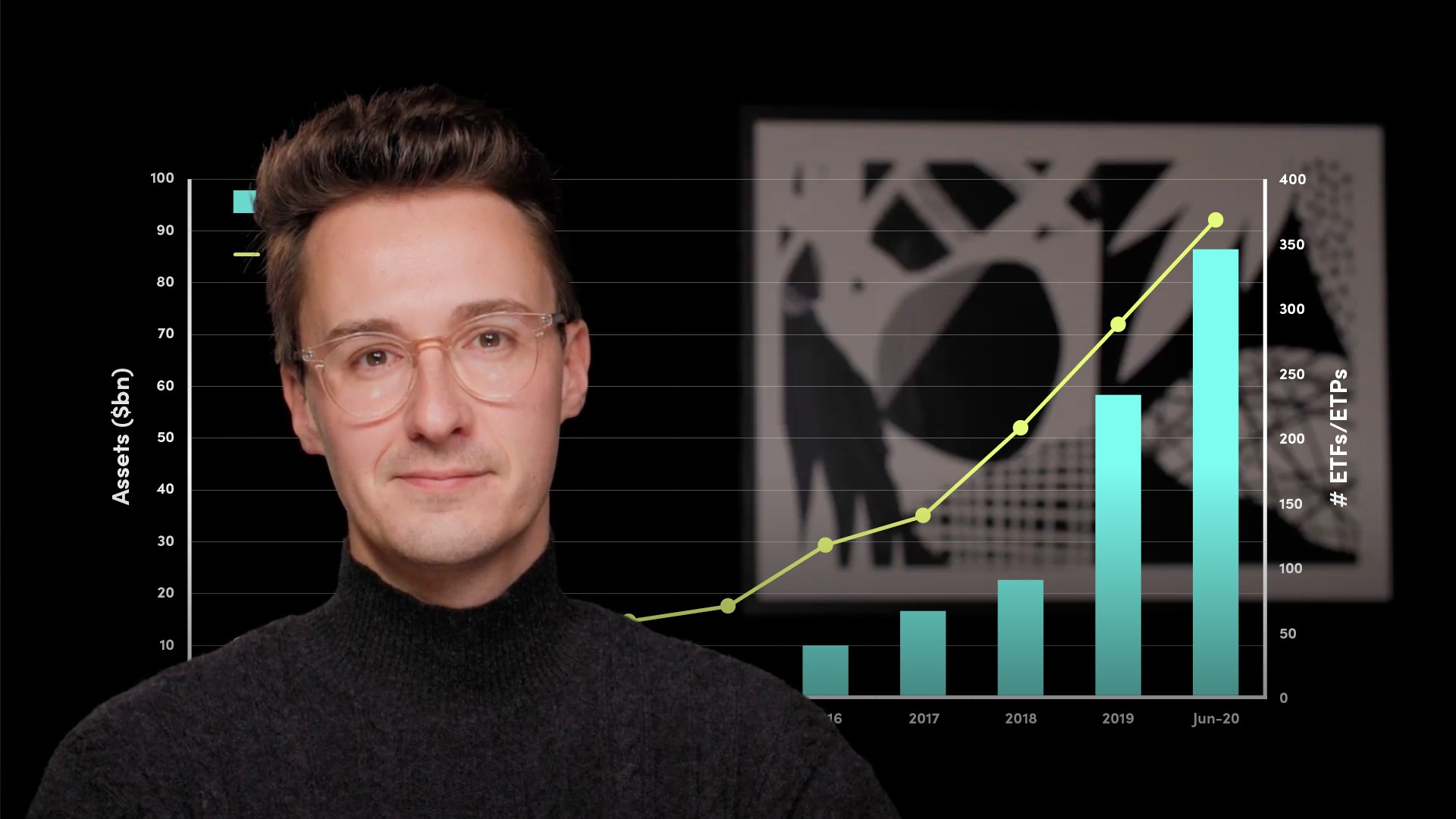

What is the history of ESG?

Historically, the term ESG, as well as the widespread and formalised use of ESG measurements in investment decisions, started in the early 2000s. The term ESG was first developed in a 2004 report by 20 financial institutions in response to a call from the Secretary-General of the United Nations. Between 2015 and 2020, there was a sevenfold increase in cash allocations. ESG is a popular investment topic in public markets.

How does ESG relate to venture capital?

ESG is slowly starting to play a role in the world of venture capital. A recent survey of the European Investment Fund found that 70% of VCs use ESG in the investment decision making process, a number which indicates an interest in the topic. In our day-to-day work with VentureESG, pinning down exactly what it means to “adhere to ESG principles” still seems to cause some trouble for most VCs. Practitioners themselves and commentators talk about sustainable investing, responsible finance, and indeed ESG and impact, often interchangeably. Specifically, for VC, there is a general lack of a universally accepted definition, standard or methodology when it comes to ESG. This, naturally, is something that needs to be rectified.

What are the challenges around measuring ESG?

Although ESG rating and scoring agencies have institutionalised ‘measuring ESG’, they are arriving at vastly different ratings, thereby undermining the credibility of ESG assessments altogether and opening the door for greenwashing or ESG-washing - talking about ESG but not practising it correctly. This is a term which we are seeing used more and more these days and which refers to the deceptive practice of implying, through marketing or other means, that a company’s operations and products are more environmentally or ESG-friendly than they actually are.

Johannes Lenhard

There are no available Videos from "Johannes Lenhard"