Overview of TLAC

Gilles Renaudiere

Corporate Advisor: BNP Paribas

In this video, Gilles covers the global standard, TLAC, as well as looks at why it is so important for deposits to be protected. He then concludes by discussing some of the industry's recent developments.

In this video, Gilles covers the global standard, TLAC, as well as looks at why it is so important for deposits to be protected. He then concludes by discussing some of the industry's recent developments.

Overview of TLAC

12 mins 27 secs

Key learning objectives:

Outline the global version of the bail-in rules, TLAC

Understand the importance of bank deposits

Outline some key developments taking place in the industry

Overview:

The Total Loss Absorbing Capacity (TLAC) is a global standard introduced by the Financial Stability Board in 2015 to absorb losses and recapitalize banks in a crisis. It only applies to Global Systemically Important Banks (G-SIBs) and has been required since January 2019. The TLAC requirement is higher than the Basel capital requirements and requires G-SIBs to hold 18% in terms of risk-weighted assets or 6.75% of leverage exposure. The TLAC requirement requires that the debt instruments be paid in, unsecured, not subject to set-off or netting rights, and not be redeemable by the holder prior to maturity.

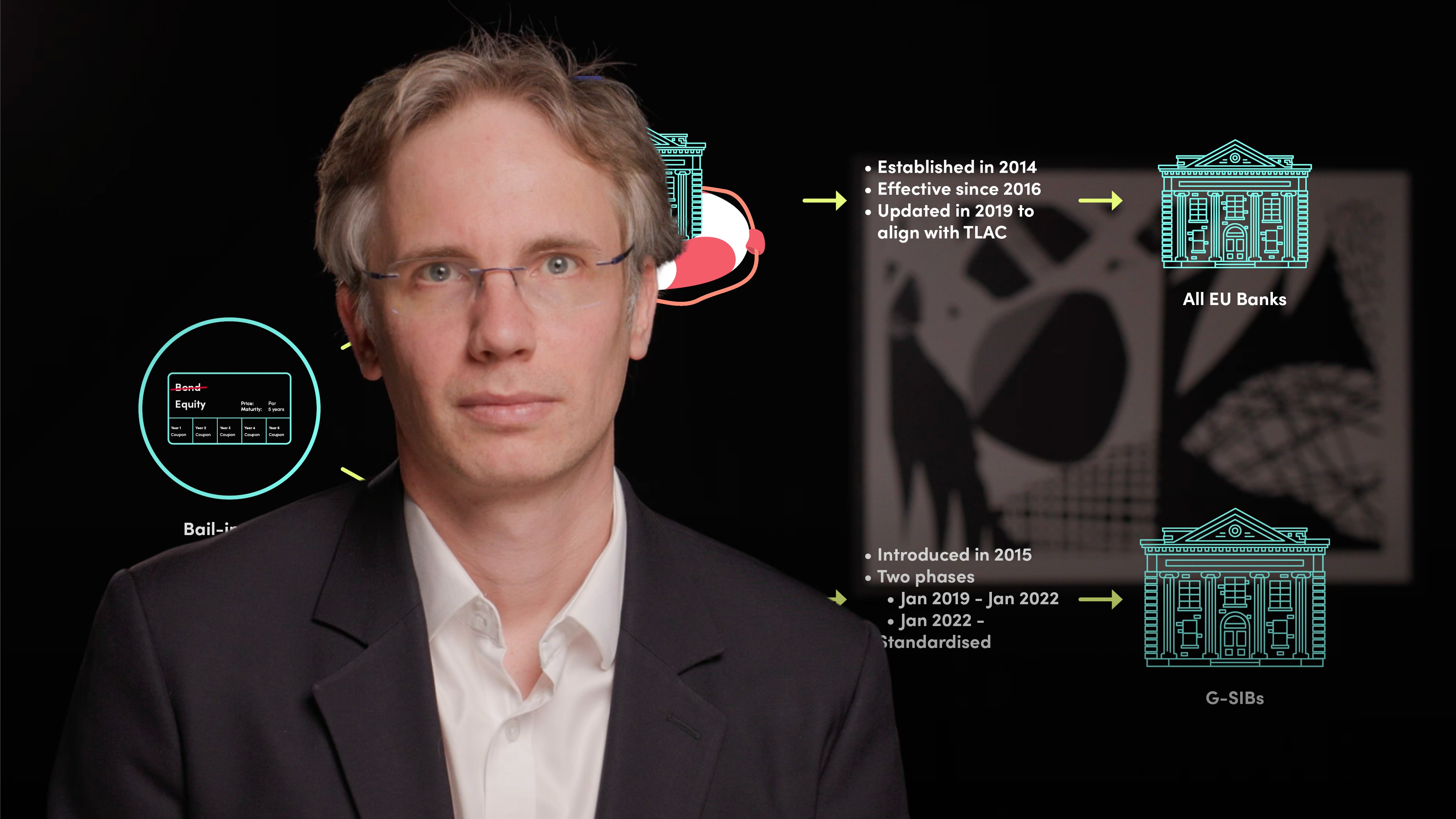

What is TLAC and how does it compare to MREL?

TLAC, or Total Loss Absorbing Capacity, is a global standard introduced by the Financial Stability Board for systemic banks, also known as G-SIBs, to absorb losses and be recapitalised in case of crisis.

It was introduced in two phases with the requirement of holding 16% of risk-weighted assets (RWAs) or 6% of leverage exposure, which was later increased to 18% RWAs or 6.75% leverage exposure.

TLAC eligible instruments must be paid in, unsecured, have a minimum remaining maturity of one year, and not be funded directly by the resolution entity. TLAC does not only apply to the group level but also to material subsidiaries, which can meet the requirement with internal TLAC or internal bail-inable debt.

If banks have cash deposited with them, why is MREL and TLAC necessary?

Banks need MREL and TLAC to ensure the protection of deposits as deposits are critical to a bank's viability and stability. If deposits are at risk, individuals may not trust financial institutions to hold their savings, leading to greater risk of instability and liquidity issues. To prevent this, bank deposits must be protected.

What developments are taking place in the industry?

The banking industry is undergoing various developments and regulatory changes.

The EU introduced the BRRD II in 2019 to align MREL rules with TLAC.

There has been work on harmonising the creditor hierarchy in the EU. The EU Creditor Hierarchy Directive updated the ranking of liabilities in 2017.

A debate is ongoing regarding further harmonisation of the creditor hierarchy and the issue of medium-sized banks that are too big to be unwound through normal insolvency but can't raise MREL at an attractive cost.

Gilles Renaudiere

There are no available Videos from "Gilles Renaudiere"