Managing Credit Ratings During an M&A II

Gurdip Dhami

25 years: Treasury & ratings

Gurdip continues his explanation of steps to take in order to maintain a company's credit rating during an acquisition. This video covers RES/RAS decision, preparing the ratings pack, the rating agency meeting and ultimately the rating agency decision.

Gurdip continues his explanation of steps to take in order to maintain a company's credit rating during an acquisition. This video covers RES/RAS decision, preparing the ratings pack, the rating agency meeting and ultimately the rating agency decision.

Managing Credit Ratings During an M&A II

15 mins 1 sec

Key learning objectives:

Identify steps 4-7 in the credit rating acquisition process

Outline the five sources management can use to help with its rating analysis

Outline the key information that management should get from the rating agency analyst

Overview:

This video outlines the last four steps in the credit rating acquisition process. This includes an initial consideration of the RES/RAS product. Secondly, the relevant parties must prepare a ratings pack, which includes the overall timetable. Upon completion, the next step is the meeting with the agency, before finally receiving a credit rating.

What is Step 4?

The RES/RAS Decision:

In step 4, the company will need to decide whether to use the commonly called ‘RES/RAS’ service provided by the rating agencies. RES/RAS products provide the company with a confidential rating committee decision in writing on the outcome of a proposed acquisition based on information provided to the rating agency.

How much does a RES/RAS cost?

Depends on:

- The complexity of the acquisition

- The number of scenarios to be modelled

- How quickly the company needs the rating agency response

What are some useful RES/RAS considerations?

- Can the RES/RAS product be used for the proposed acquisition? - For example, the agency may not allow its use if the transaction is a hostile acquisition

- Is written permission required from the target company even if it is a friendly takeover?

- How widely among the acquisition team can the result be shared? - For example, can it be disseminated amongst the company’s advisors?

- Under what conditions and what extra cost is the company allowed to present further scenarios?

What are the pros and cons of the RES/RAS product?

Pros:

- Greater certainty on the rating impact

- A range of scenarios can be presented so that the company can decide on the best option to use. For example, different levels of financial leverage

Cons:

- A fee is payable to the agency

- There is more work involved such as reviewing contracts and choosing and providing scenarios the agencies

- Requires the company to notify the agency of the acquisition sooner than if no RES/RAS product was used

When is a RES/RAS service not appropriate?

- For a company that is going ahead with an acquisition using only one transaction structure and which is confident of the rating result

- If a company wants to proceed with the acquisition even if it gets downgraded

What is Step 5?

Prepare the Ratings Pack:

The company should provide comprehensive information to the agency ahead of the public announcement of the acquisition. This should be in the form of a written presentation. It should be provided to the analysts ahead of the meeting, ideally a few days before.

What should be included in the ratings pack?

- Details of the target company

- Strategic rationale for the acquisition

- The benefits of the acquisition

- The management and mitigation of potential risks

- The execution and integration plans

- Financial plans and forecasts (including key ratios)

- The timetable

What are the key areas of focus of the agency analysts?

- Strategic Rationale - For example: Does the acquirer have adequate resources to carry out and integrate the acquisition?; How will staff and customers view the acquisition?

- Combined Business Profile - For example: Will the risk profile of the acquirer be weakened?;How will the risks of increasing complexity be mitigated?

- Combined Financial Profile - For example: What is the rationale for the purchase price?; How will the purchase be funded; How realistic are revenue/cost synergies?

- Execution & Integration Risk - For example: What is the experience of management in executing and integrating acquisitions?; Could the acquisition be blocked by regulators?

What is Step 6?

The Rating Agency Meeting

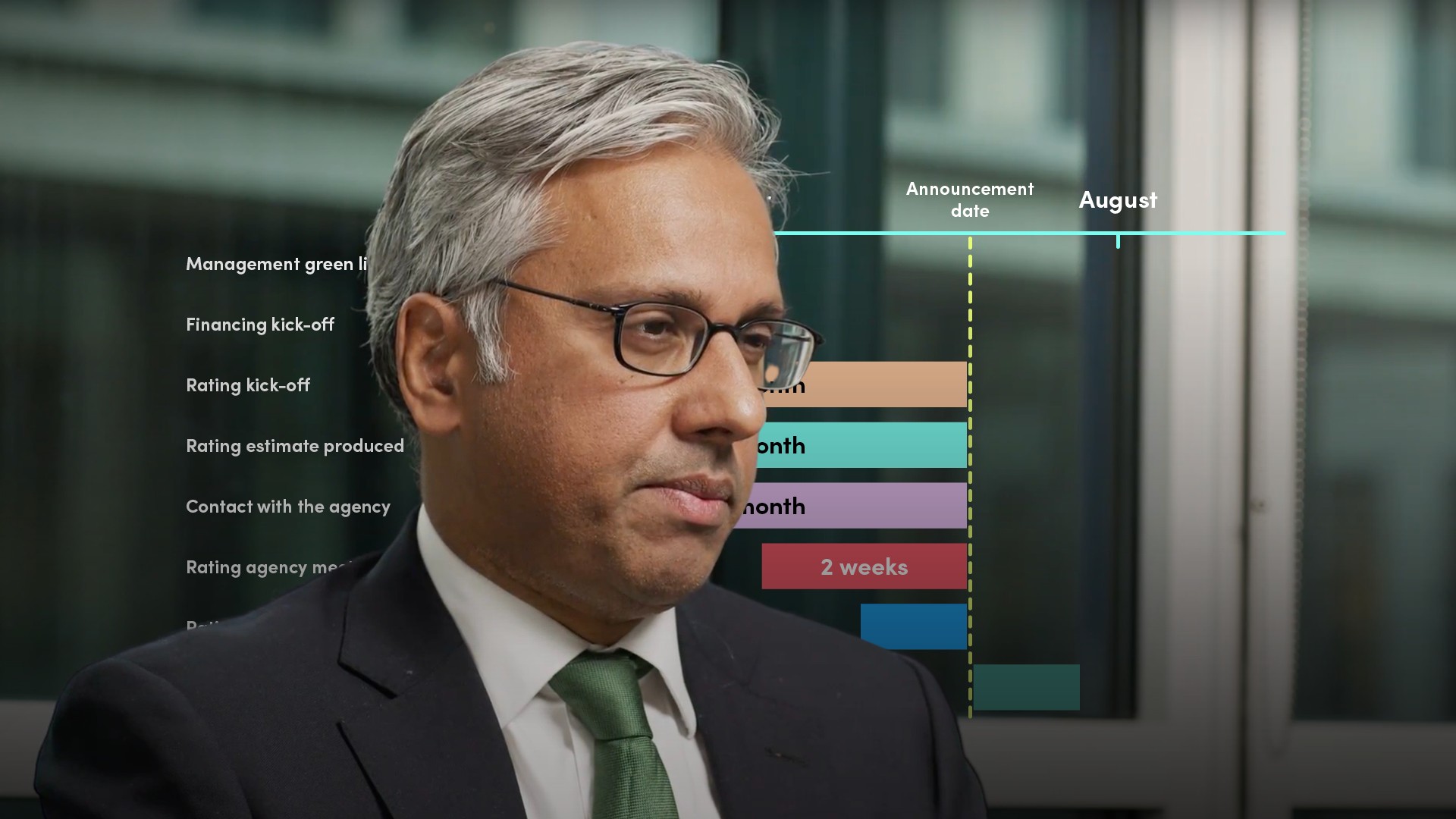

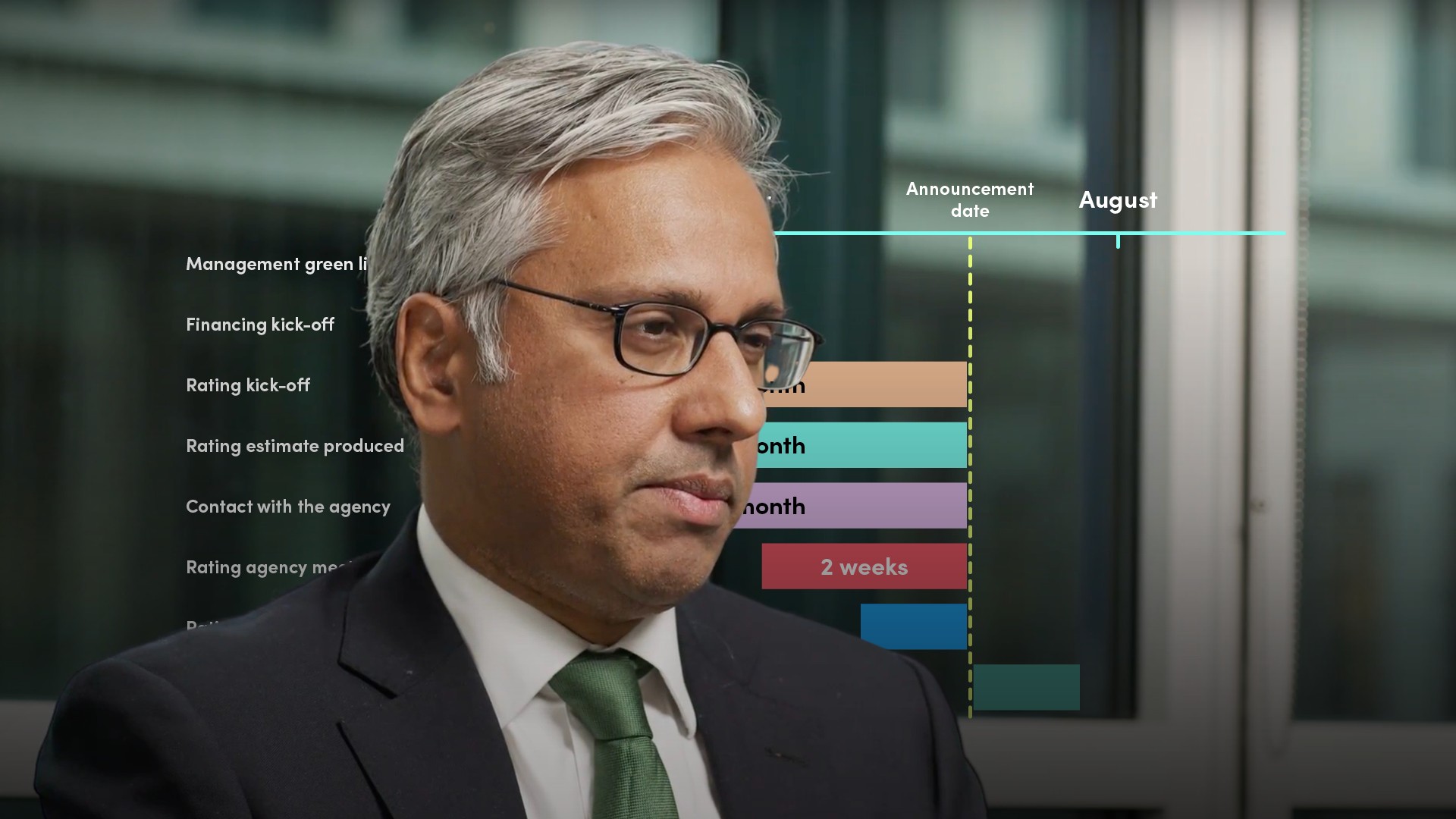

The company should meet, preferably in person, to discuss the transaction including the rationale, the benefits, the risk management, integration plans and so on. The meeting should take place at least two weeks before the public announcement date so the agency has enough time to review the information and make a decision.

What should management consider prior to the rating agency meeting?

- The company’s representatives at the meeting should be chosen such that they can answer all potential questions and present the transaction in the best way

- The company should also use the opportunity to get some feedback from the analysts; for example how their criteria will be applied and what the key areas of focus are

- The analysts should also be asked about the next steps, for example when the rating decision will be made

What is Step 7?

The Rating Agency Decision:

- After the ratings meeting, the rating agency analysts will carry out their analysis and present their results to the rating agency committee

- The rating agency committee will review the information and then decide on the credit rating and outlook post-acquisition

- The result is communicated confidentially to the company, and the agency will also send a draft press release which sets out its rationale for the decision. This should be checked thoroughly by the company

- The company can appeal the decision if it believes the agency has fundamentally misunderstood the transaction

- If the company accepts the ratings decision, the company should coordinate with the agency to ensure that the public announcement is released shortly after

- The actual completion of an acquisition often takes place months after the public announcement of the acquisition

- After the completion, the company should continue to update the agency about the acquisition

What are the possible outcomes of the rating agency decision?

- The rating committee could decide to change the rating - that is either a downgrade or upgrade

- The committee could change the rating outlook - for example from stable to negative or positive

- The agency could put the company on a rating watc - for example, it requires further information before making a decision

What are the main reasons to have a ratings strategy at the start of an acquisition process?

- Senior management is informed about potential changes in the credit rating, so that feedback can be received and potential negatives can be mitigated

- Engaging with the rating agency at an early stage can make the process more efficient

- The rating plan can help optimise the information gathering and production within the company by ensuring internal teams work effectively together

Gurdip Dhami

There are no available Videos from "Gurdip Dhami"