Pricing and Application of Contingent FX Hedges

Selim Toker

30 years: Derivatives & risk management

In this video, we look at the practicalities of prosecuting a DC hedge, as well as some case studies to highlight the robustness of this product. We will also spend some time discussing the different market risks that can be covered by such a derivative technology.

In this video, we look at the practicalities of prosecuting a DC hedge, as well as some case studies to highlight the robustness of this product. We will also spend some time discussing the different market risks that can be covered by such a derivative technology.

Pricing and Application of Contingent FX Hedges

14 mins 42 secs

Key learning objectives:

Grasp how deal contingent transactions are priced and quoted

Understand how a DC deals with the fact that the completion date of an M&A is uncertain

In which other events and for which market risks can the DC product be used?

Understand how a DC trade is executed and the key documentation points

Overview:

This video explores contingent transactions in depth, with a worked example to show pricing and the practical implications of how the transaction works. We examine other situations where this type of transaction may be apt. It also discusses the execution process and key documentation required to implement a transaction. The video concludes with case studies to highlight the robustness of the product.

Pricing the DC contract

Pricing of DCs can be shown as a number of pips to be added to the FX Forward rate (if the M&A transaction closes successfully). It is also usually presented as a percentage of the equivalent ATM forward option. The option will protect you fully if the trade closes, and may have a residual value if the M&A fails, as a result the DC should always be cheaper than the option. Typical FX DCs trade in the 15% - 40% of the ATM option.

Deal completion timeline implications

The bank (DC counterparty) will price a DC to the earliest possible date the M&A could close, and then price another DC to the latest possible date (the long-stop date). If the M&A then closes anywhere in between, the premium will be interpolated between these two prices. This eliminates the risk that you are not hedged to the correct date and also ensures that you do not pay for any protection that you do not need.

Value for Money

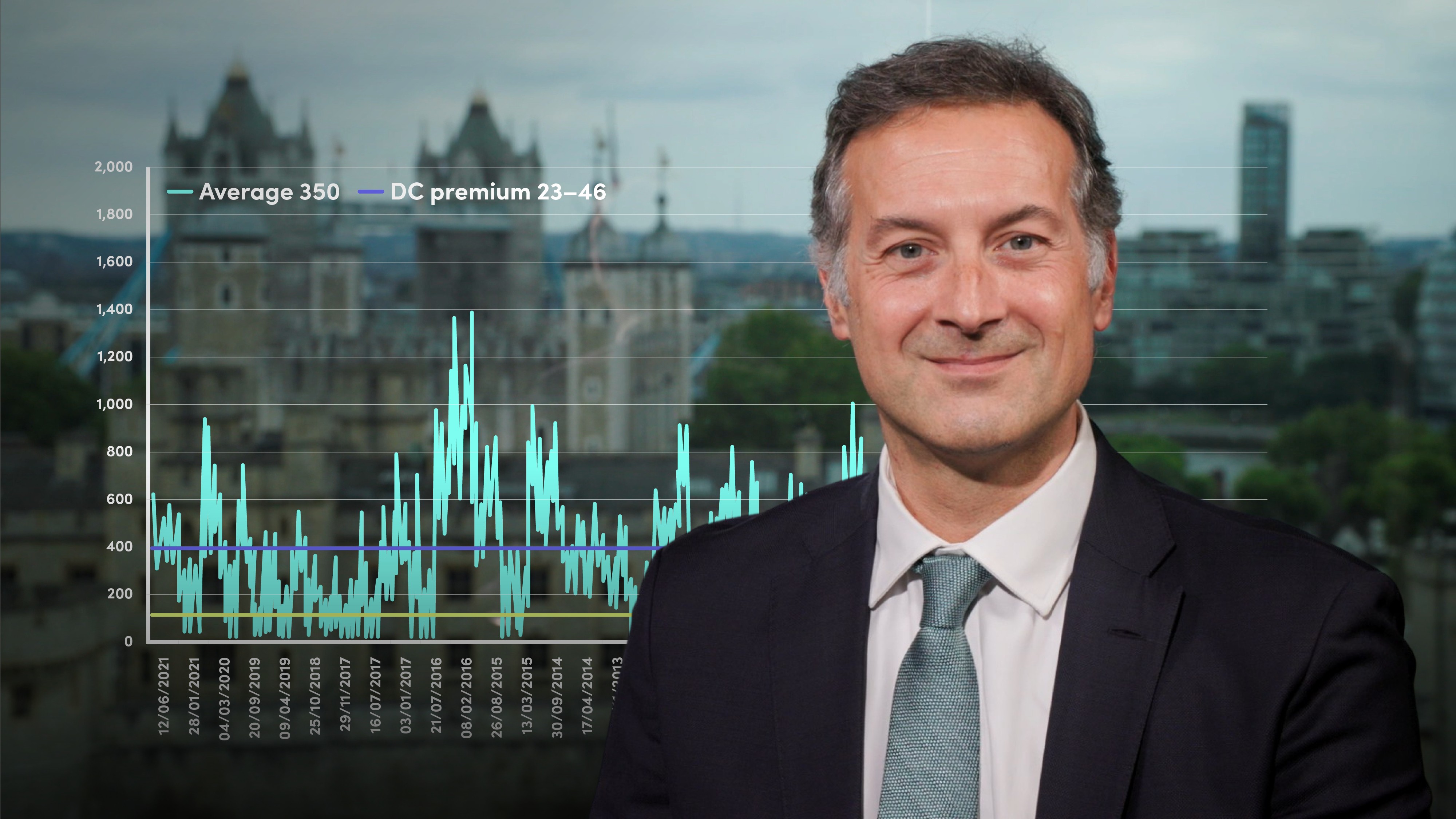

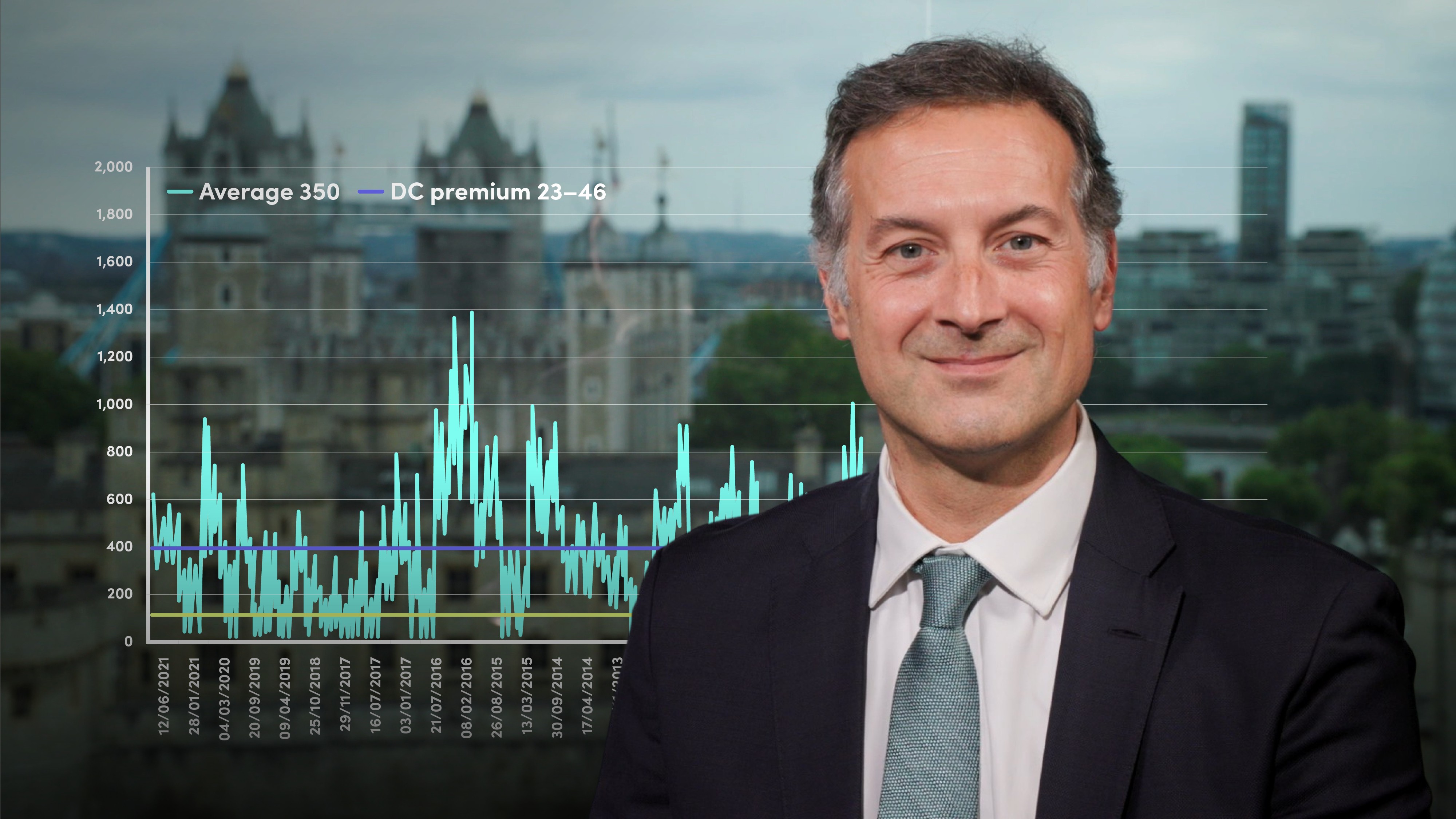

When taking the EUR/GBP currency pair as an example and looking at the absolute amount that the currency moves over a six month period, plotted every day for the last 10 years, we see that this average is around 350 pips. A 6-month, 20% premium DC would cost around 23 pips, only a fraction of the historical move.

Other situations where DCs can be used

DCs can also be used to hedge other market risks, such as interest rates, Credit risks, cross-currency risks etc. Other events can also be hedged with DC such as IPOs in a foreign currency, infrastructure deals and public tender offers.

Execution and key documentation points

M&A transactions are highly confidential and so the DC execution process will be treated with the utmost care by the DC counterparty who have to manage the information flow internally. If the conditions are not met, the forward terminates at zero cost to the buyer or seller. There is often an additional clause in the confirmation known as a “lookback” or “phoenix” clause. This clause allows the buyer a grace period of a few months post the long stop date to complete the trade.

Case studies

Recently, there have been a handful of M&As that were hedged with DCs and that subsequently failed to close. In all cases the documentation worked as planned and the DC hedge was terminated at no cost to the buyer. In the large majority of cases, the transaction completes successfully and the consideration for the M&A flows through the Deal contingent confirmation. Over the last 10 years, and for developed market transactions, the success rate of M&A is around 90% for private equity, and around 80% for corporate M&A

Selim Toker

There are no available Videos from "Selim Toker"