Private Equity Impact Investing

Gavin Ryan

25 years: Private equity & banking

In this video, Gavin explores the viability of impact investing, i.e. achieving both financial and social returns on investment, and outlines where this concept relates to private equity.

In this video, Gavin explores the viability of impact investing, i.e. achieving both financial and social returns on investment, and outlines where this concept relates to private equity.

Private Equity Impact Investing

12 mins 38 secs

Key learning objectives:

Understand how impact investments are structured

Understand the context of and players in impact investment

Understand the intersection between private equity and impact investment

Overview:

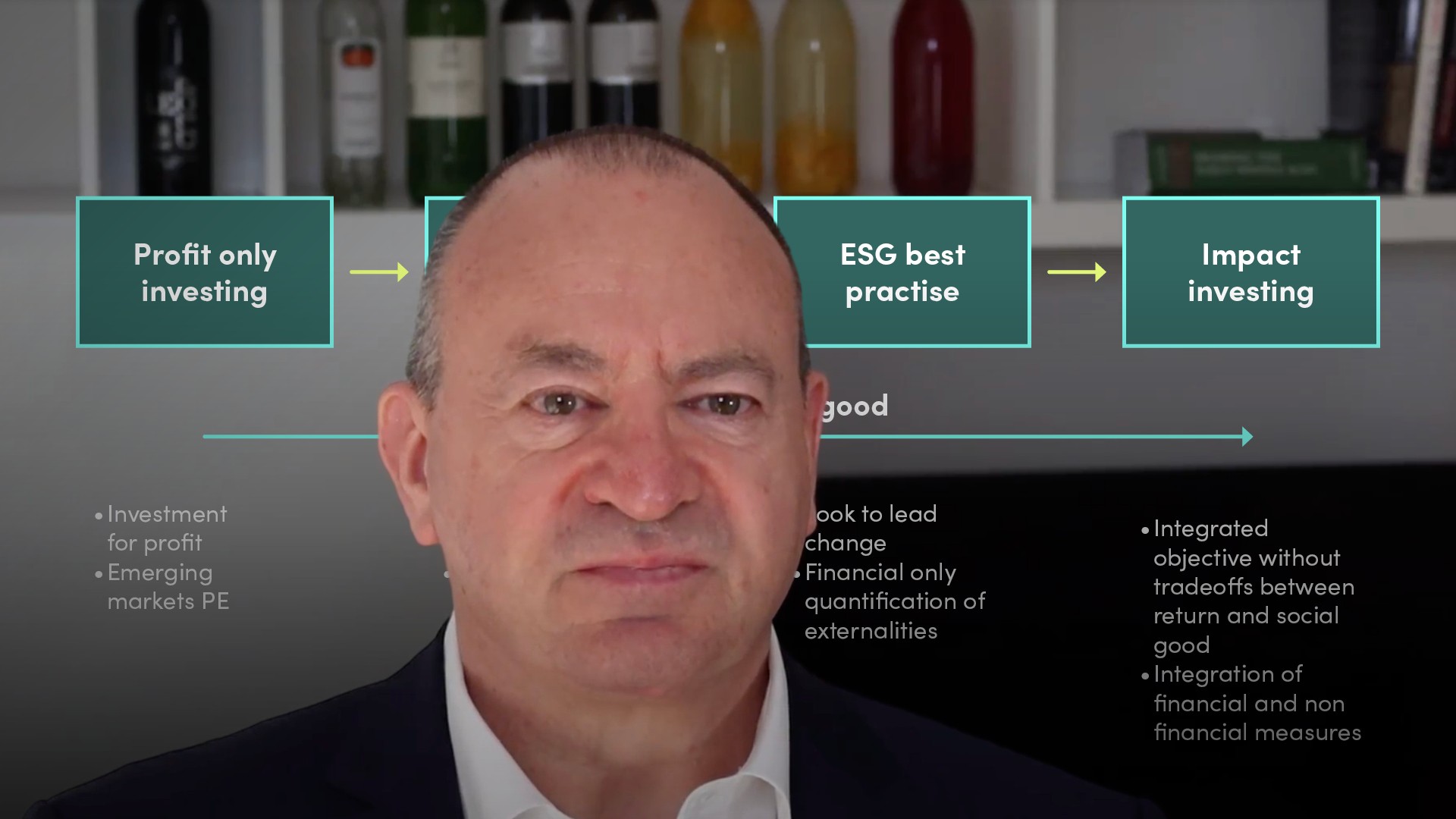

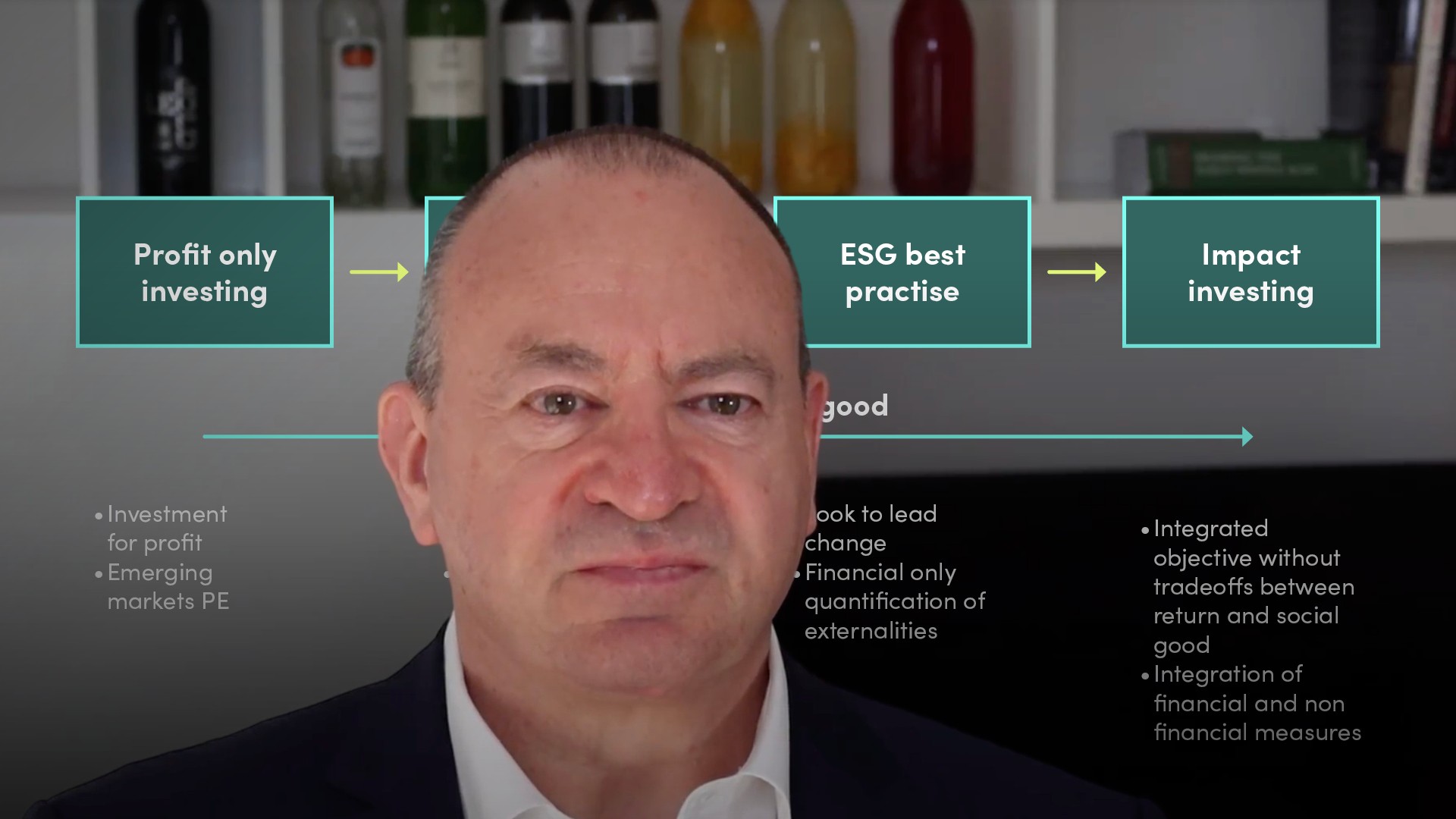

Impact investment is an investment strategy which explicitly combines the dual objectives of financial returns as well as social good, with the underlying idea that there need not be trade offs between the two. Dedicated impact funds still represent a small minority of total private equity investors today. The still open questions in impact investment are firstly, how to measure social returns; and secondly, whether it is really possible to achieve dual returns without trade offs.

How does impact investment work?

Impact investing is part of Socially Responsible Investing, but represents the part of it which gives the most importance to social factors, because these are now an explicit investment objective, unlike in other forms of Socially Responsible Investing. In addition, the social part of impact investment is measured with a tailored non-financial metric, unlike with the method of quantifying externalities.How did impact investment develop?

The main impetus for the development of impact investing as an asset class came from a combination of charitable foundations, developmental finance institutions and some pioneering impact fund managers. Impact investing was resulting from a desire for new approaches by:

- Philanthropists

- From a new generation of social entrepreneurs launching ventures with both a social and business objective

- Government seeking to partner up with the private sector

- The rise of online social networking platforms

One of the selling points of impact investment to the not for profit sector, is the concept that the capital deployed will be returned and can thus be redeployed again.

How does impact investment relate to private equity?

Impact investment is not a new sub asset class of private equity; but rather a number of private equity funds are describing themselves as impact funds. Dedicated impact funds still represent a small minority of total private equity investors. It is in the area of mid cap private equity, that we see the most funds that incorporate a social impact into their investment strategy; and for the majority in Emerging Market countries. A debated question in impact funds in private equity concerns the profile of the fund manager. The best way to look at impact investment for now, might be as an approach which can be implemented in different contexts, rather than as a distinct private equity sub asset class.

Gavin Ryan

There are no available Videos from "Gavin Ryan"